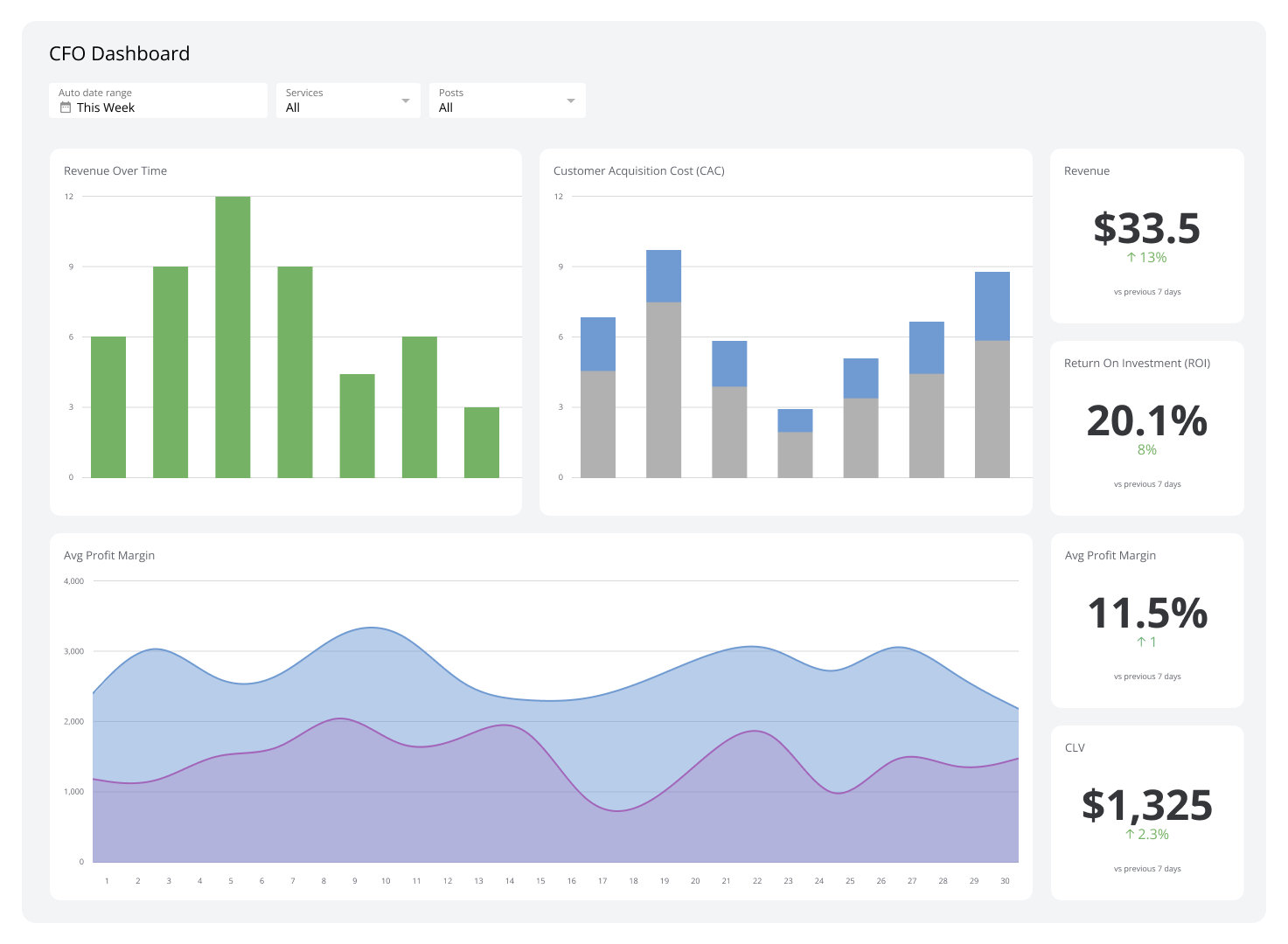

CFO Dashboard

CFO dashboards offer strategic insights beyond raw data, enabling finance leaders to anticipate issues and drive proactive, value-adding decisions.

What is a CFO Dashboard?

A CFO dashboard provides a look into an organization's financial health, showcasing critical metrics like ROI and profit margins, enabling swift, informed decisions on resource allocation and investment strategies

Effective CFO dashboards visualize market trends, efficiency metrics, and competitive pressures, helping CFOs identify issues early and address challenges proactively. These tools enable timely adjustments to cash flow, profit margins, and customer acquisition costs, letting CFOs navigate their organizations toward financial success with precision and foresight.

Examples of CFO Dashboards

Revenue Dashboard

Revenue dashboards offer CFOs a real-time view of income streams, enabling quick identification of top-performing products or services. These visualizations allow for precise revenue forecasting and help pinpoint areas for potential upselling or cross-selling opportunities.

With this data, CFOs can make targeted decisions on pricing strategies, resource allocation for high-growth segments, and adjustments to sales structures to maximize overall revenue growth.

Who’s it for | Chief financial officers (CFOs), company leadership, financial analysts, business owners, executive management teams |

How often it's needed | Daily, weekly, monthly, quarterly, yearly |

Covered KPIs | Sales growth, average profit margin, cash flow, customer acquisition cost (CAC), customer lifetime value (CLV), sales pipeline, accounts receivable turnover, operating expenses, return on investment (ROI), revenue per employee |

Expense Management Dashboard

An expense management dashboard provides real-time visibility into your company's spending patterns across various categories. This tool helps organizations enhance their financial management strategies by providing insights into current expenditures and future projections.

Who’s it for | CFOs, accounting teams, business owners, department heads, project managers |

How often it's needed | Daily, weekly, monthly, quarterly, yearly |

Covered KPIs | Total expenses by category, payroll-to-revenue ratio, budget variance, expense growth rate, cost per employee, travel and entertainment expenses, overhead costs, expense approval time, compliance rate with expense policies, return on expense (ROE) |

Forecast Dashboard

A forecast dashboard provides CFOs with a view of revenue performance against budgeted projections for various teams and locations. It highlights individual and team achievements, identifies potential risks, and shows how close they are to meeting their yearly revenue goals.

Who’s it for | CFOs, senior financial executives, revenue leaders, department heads, business unit managers |

How often it's needed | Daily, weekly, monthly, quarterly, yearly |

Covered KPIs | Total revenue generated, revenue performance against annual targets, progress against quarterly forecasts, team performance metrics, individual performance metrics, risk indicators, year-to-date (YTD) revenue, revenue by location or business unit, variance analysis (actual vs. budgeted), sales pipeline metrics, profit margins |

Sales Dashboard

A sales dashboard displays live data on individual and team progress toward sales targets, including metrics like revenue, conversion rates, and pipeline status. CFOs can use these dashboards to accurately forecast cash flow, allocate resources efficiently, and align sales strategies with overall financial objectives.

Who’s it for | CFOs, sales representatives, chief sales officers (CSOs), sales managers, sales operations teams, marketing teams, chief revenue officers (CROs) |

How often it's needed | Daily, weekly, monthly, quarterly, yearly |

Covered KPIs | Revenue, conversion rates, pipeline status and value, sales quota attainment, average deal size, win rate, sales cycle length, CAC, CLV, lead response time, number of new opportunities, sales activity metrics (calls, emails, meetings), sales forecast accuracy, customer churn rate, upsell and cross-sell rates |

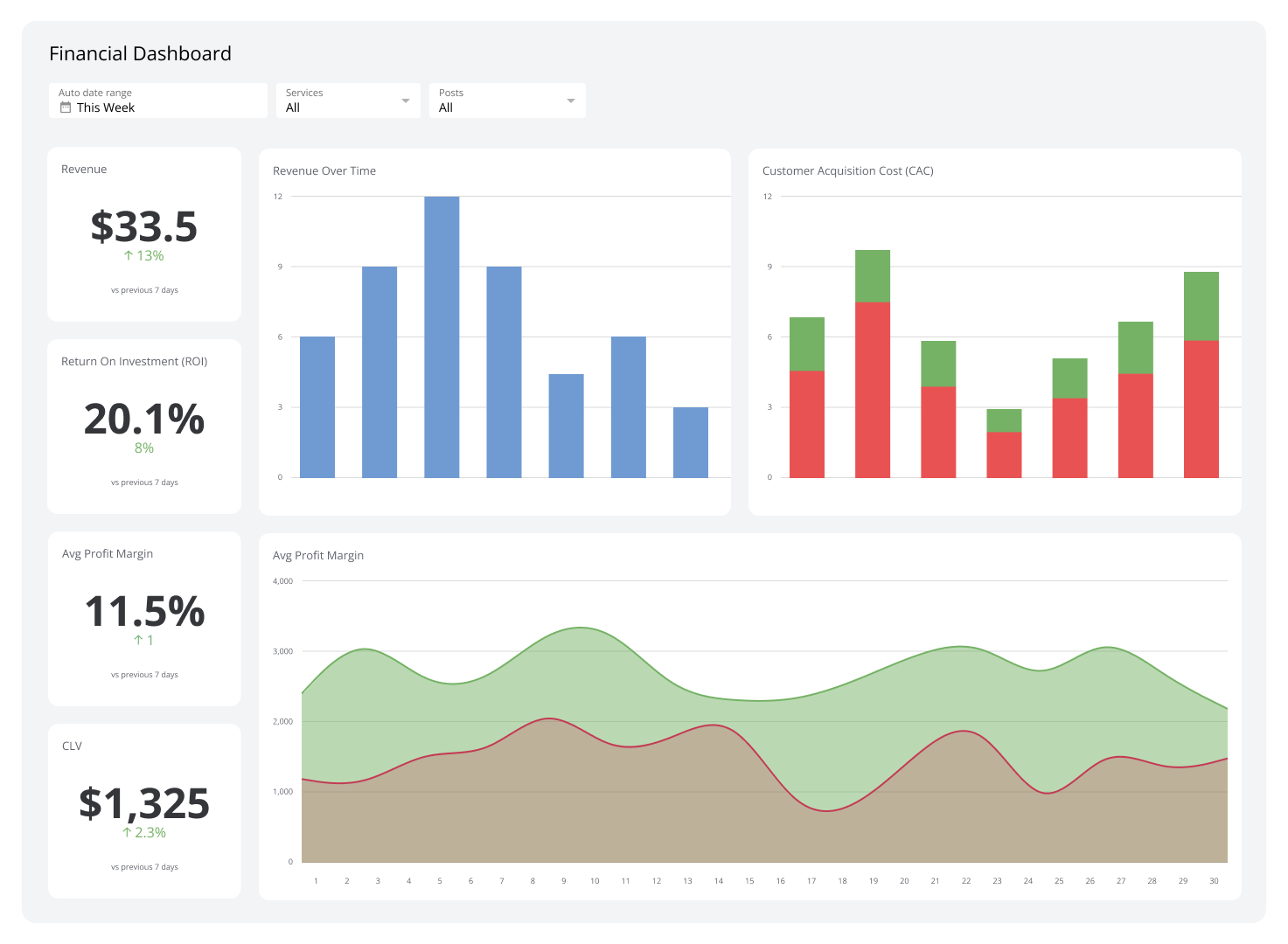

Profit and Loss Dashboard

A profit and loss dashboard presents a sweeping outline of a company's financial performance, highlighting revenues, expenses, and costs over a fiscal year. CFOs can use this tool to identify areas of cost reduction and profit maximization. In addition, the dashboard's live data allows CFOs to spot emerging financial trends quickly, enabling them to make planned decisions on resource allocation, pricing strategies, and cost management before issues escalate.

Who’s it for | CFOs, financial controllers, accountants, business unit managers, chief executive officers (CEOs), board members, investors |

How often it's needed | Daily, weekly, monthly, quarterly, yearly |

Covered KPIs | Total revenue, gross profit, net profit, operating expenses, cost of goods sold (COGS), profit margins (gross and net), revenue growth rate, expense ratios, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), break-even point, operating cash flow, accounts receivable turnover, inventory turnover, debt-to-equity ratio, ROI |

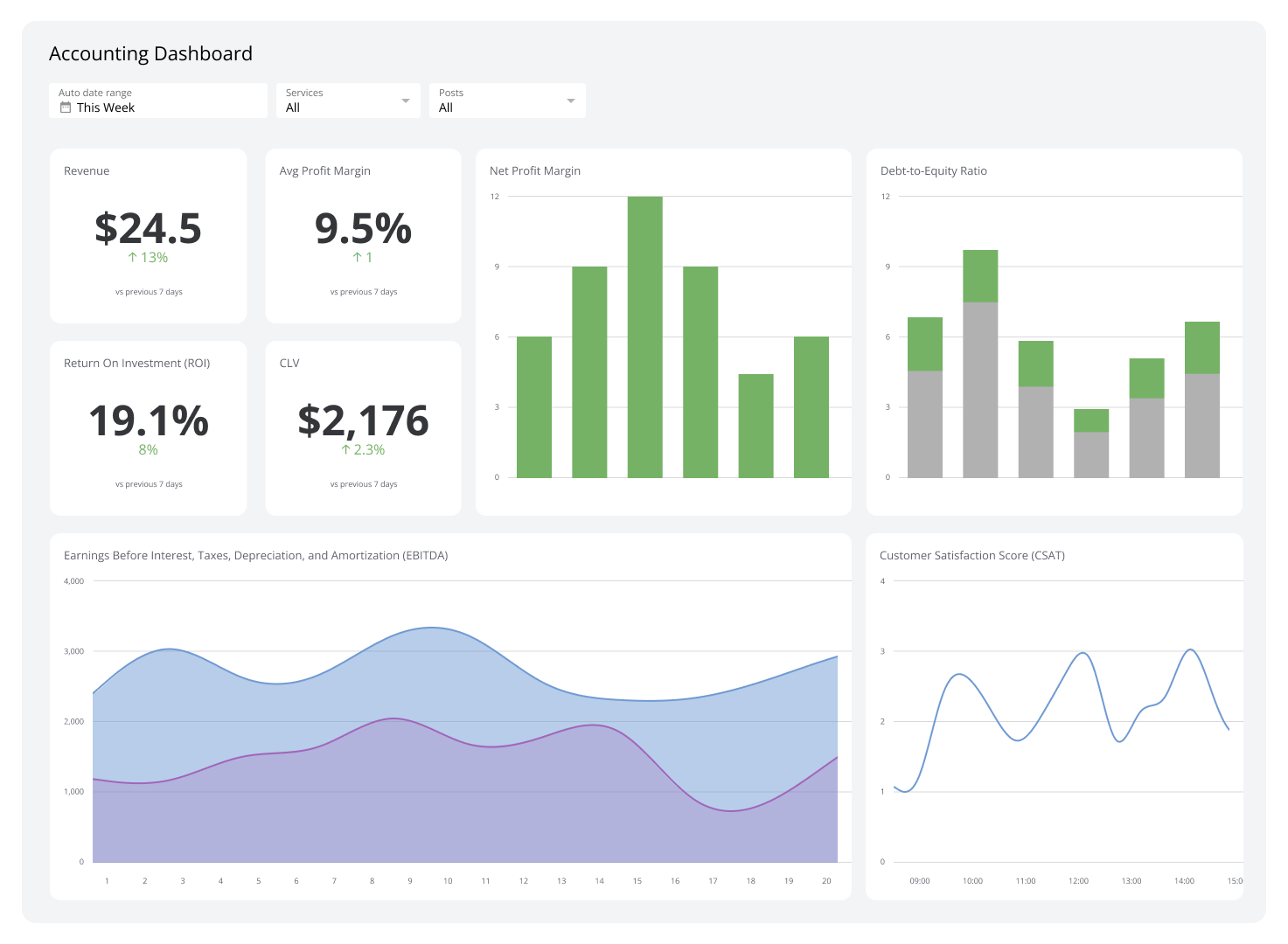

Balance Dashboard

Balance sheet dashboards present up-to-date overviews of assets, liabilities, and equity, benchmarked against budgets and historical data. This enables CFOs to swiftly evaluate organizational health, refine capital allocation, and make informed choices on working capital management and debt restructuring.

Who’s it for | CFOs, CEOs, financial controllers, accountants, board members, investors, auditors, credit analysts |

How often it's needed | Monthly, quarterly, yearly |

Covered KPIs | Current ratio, quick ratio, debt-to-equity ratio, return on assets (ROA), return on equity (ROE), asset turnover ratio, inventory turnover ratio, accounts receivable turnover, days sales outstanding (DSO), cash conversion cycle (CCC), net asset value, debt service coverage ratio, equity multiplier, book value per share |

Cash Flow Dashboard

Cash flow dashboards offer insights into an organization's liquid assets and spending capacity, helping businesses address timing discrepancies and conduct scenario planning. By visualizing cash movements across different time horizons, CFOs can optimize working capital, refine credit policies, and strategically time significant expenditures to maintain healthy liquidity levels.

Who’s it for | CFOs, financial controllers, treasures, business owners, investors, shareholders |

How often it's needed | Daily, weekly, monthly, quarterly |

Covered KPIs | Operating cash flow, free cash flow, DSO, days payable outstanding (DPO), burn rate, cash flow to debt ratio, working capital ratio, cash flow forecasts, cash flow from financing activities, CCC, cash flow from investing activities |

Customer Ledger Dashboard

Customer ledger dashboards give finance professionals a clear view of all transactions, helping them keep accurate records and make smart decisions about credit and customer relations. CFOs can use this information to study payment patterns, optimize cash flow, and implement targeted strategies to improve the company's financial health.

Who’s it for | CFOs, accounts receivable managers, credit controllers, financial analysts, sales managers, customer service representatives |

How often it's needed | Daily, weekly, monthly, quarterly |

Covered KPIs | DSO, average collection period, accounts receivable turnover ratio, bad debt to sales ratio, customer credit utilization, on-time payment rate, CLV, customer profitability, invoice accuracy rate, time to resolve complaints, customer retention rate |

Supplier Ledger Dashboard

Supplier ledger dashboards aggregate vendor financial data to offer a vivid look at company payables and transaction history. These tools help CFOs follow payment due dates, identify early payment discount opportunities, and analyze spending patterns across suppliers and categories.

Who’s it for | CFOs, accounts payable managers, supply chain managers, financial controllers, procurement managers |

How often it's needed | Daily, weekly, monthly, quarterly |

Covered KPIs | DPO, supplier payment accuracy, early payment discounts captured, accounts payable turnover ratio, supplier concentration ratio, average payment terms, invoice processing time, supplier delivery performance, cost savings from negotiations, supplier defect rate, contract compliance rate |

Investor Relations Dashboard

An investor relations dashboard brings together key financial data and market trends, allowing CFOs to monitor stock performance, earnings, and investor opinions. Using its insights, CFOs can enhance transparency and build stronger relationships with investors.

Who’s it for | CFOs, investor relations managers, CEOs, board of directors, institutional investors, individual shareholders |

How often it's needed | Daily, weekly, monthly, quarterly, yearly |

Covered KPIs | ROE, ROA, earnings per share (EPS), price-to-earnings ratio, dividend yield, working capital ratio, debt-to-equity ratio, share price and volume, market capitalization, EBITA margin, free cash flow, analyst ratings and recommendations |

Cost Per Customer Dashboard

A cost per customer dashboard provides detailed insights into client-specific cloud expenditures, allowing businesses to track operational expenses and resource usage through unit cost analysis. CFOs use this data to identify high-cost customers, analyze utilization trends, and optimize pricing strategies.

Who’s it for | CFOs, finance executives, cloud cost management teams, customer success managers, sales teams, product managers |

How often it's needed | Monthly, quarterly, yearly |

Covered KPIs | Cost per customer, cost per tenant in multi-tenant environments, resource utilization per customer, customer profitability, feature usage metrics, cloud expenditure trends, customer-specific operational expenses, unit cost analysis, CLV, contract efficiency, discount impact analysis, resource allocation efficiency |

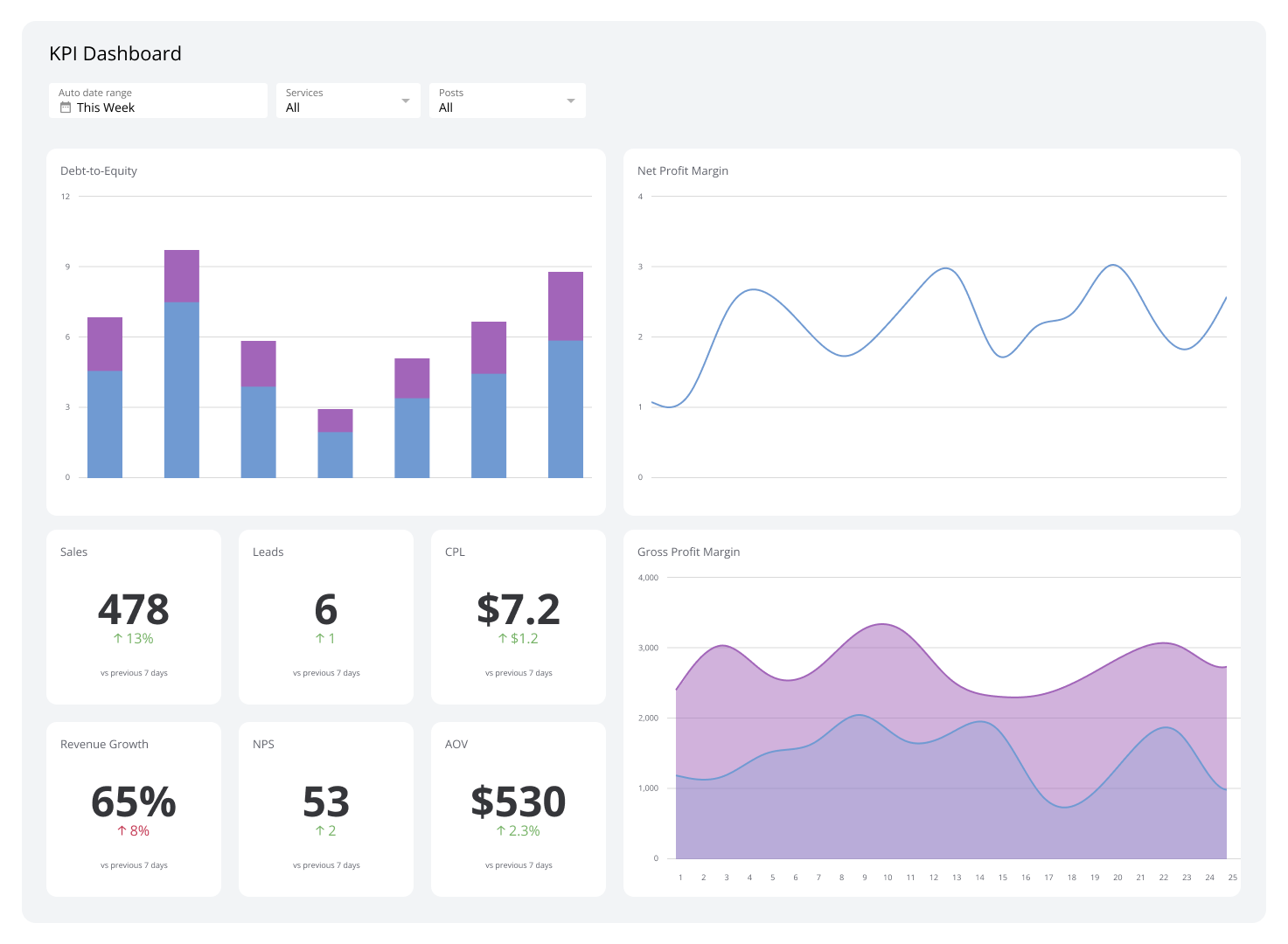

Budget vs. Actual Dashboard

A budget vs. actual dashboard compares projected figures with real-time data, offering CFOs a bird’s eye view of their company's fiscal health. It highlights variances in revenue and expenses, helping track progress toward key financial targets like revenue projections, profit margins, and EBITDA goals. This tool empowers CFOs to promptly address budget overruns, capitalize on unexpected revenue streams, and reallocate resources to high-performing business units.

Who’s it for | CFOs, department managers, business owners, financial analysts |

How often it's needed | Monthly, quarterly, yearly |

Covered KPIs | Revenue variance, expense variance, profit margins, cash flow, budget utilization rate, forecast accuracy, operating expenses ratio, net income |

Income Statement Analysis Dashboard

An income statement analysis dashboard shows revenue, expense, and profit trends across multiple periods. CFOs can employ these insights to pinpoint underperforming product lines, streamline cost structures in specific departments, and implement targeted pricing strategies to boost overall profit margins.

Who’s it for | CFOs, financial analysts, department managers, investors, stakeholders |

How often it's needed | Monthly, quarterly, yearly |

Covered KPIs | Revenue growth rate, gross profit margin, operating profit margin, net profit margin, EPS, ROE, COGS ratio, operating expense ratio, interest coverage ratio, EBITA margin |

Operational Efficiency Dashboard

An operational efficiency dashboard gives CFOs a clear view of important metrics across different business units, such as how well capital and resources are used and overall productivity. It helps spot areas where resources are limited or operations are not running smoothly.

Who’s it for | CFOs, operations managers, department heads, business unit leaders |

How often it's needed | Daily, weekly, monthly, quarterly |

Covered KPIs | Return on invested capital (ROIC), asset turnover ratio, inventory turnover, DSO, operating expense ratio, labor productivity, capacity utilization, cash conversion cycle, overall equipment effectiveness (OEE), employee turnover rate |

Financial Position Analysis Dashboard

The financial position analysis dashboard gives CFOs a clear view of key financial ratios, such as liquidity, solvency, and profitability. It shows how assets and debts are structured, helping CFOs evaluate the company’s ability to meet its obligations and make a profit. With it, CFOs can spot financial risks, adjust the capital structure, and improve strategies for better performance and long-term company stability.

Who’s it for | CFOs, sales managers, marketing leaders, product managers, customer success managers, investors, board members |

How often it's needed | Daily, weekly, monthly, quarterly |

Covered KPIs | Current ratio, quick ratio, debt-to-equity ratio, interest coverage ratio, gross profit margin, net profit margin, asset turnover, inventory turnover, total debt, debt-to-assets ratio, long-term debt-to-equity ratio, operating cash flow, free cash flow, ROA, ROE |

Sales Manager Dashboard

A sales manager dashboard displays pipeline health and sales velocity, allowing CFOs to quickly identify issues like stagnant pipelines or opportunities like high-potential leads. This clear view improves forecasting accuracy and boosts sales results by highlighting both challenges and growth potential in the sales process.

Who’s it for | CFOs, sales managers, CROs, sales directors, VP of sales |

How often it's needed | Daily, weekly, monthly, quarterly |

Covered KPIs | Revenue, conversion rate, sales velocity, pipeline health, individual rep performance, average deal size, CAC, win rate, sales cycle length, CLV |

Fundraising Dashboard

A fundraising dashboard helps CFOs understand donor behavior, track how campaigns are doing, and assess overall fundraising success. By looking at donation trends, retention rates, and gift amounts from different channels, CFOs can better allocate resources and improve outreach strategies.

Who’s it for | CFOs, fundraising managers, development teams, executive leadership |

How often it's needed | Daily, weekly, monthly, quarterly, yearly |

Covered KPIs | Total funds raised, progress toward goals, donor acquisition rate, donor retention rate, average gift size, campaign effectiveness by channel, giving trends over time, cost per donor acquired, ROI for fundraising activities |

Account Manager Dashboard

Account manager dashboards offer CFOs a clear view of client relationship health through key metrics like account value and engagement. By analyzing these data points alongside client interaction frequency and revenue trends, CFOs can identify risks, seize growth opportunities, and optimize strategies. This approach enables them to maximize customer lifetime value and strengthen the company's portfolio.

Who’s it for | CFOs, account managers, sales team leaders, customer success managers |

How often it's needed | Daily, weekly, monthly, quarterly |

Covered KPIs | Account value, customer engagement levels, upselling prospects, retention rates, at-risk account indicators, growth opportunities, customer health score, revenue per account, customer satisfaction scores, account activity frequency, product usage metrics, customer renewal rate, contract renewal rates, average response time to client requests, cross-sell success rate, client lifetime value |

Subscription Management Dashboard

A subscription management dashboard presents subscription-based metrics such as customer accounts, subscription status, and financial health KPIs. CFOs operate this tool to analyze churn rates, assess recurring revenue streams, and identify at-risk accounts.

The dashboard's predictive analytics also helps CFOs forecast future revenue and develop targeted retention strategies.

Who’s it for | CFOs, finance teams, sales executives, subscription managers, customer success managers |

How often it's needed | Daily, weekly, monthly, quarterly |

Covered KPIs | Recurring revenue, churn rate, CLV, average revenue per user ARPU, CAC, subscription growth rate, retention rate, conversion rate, renewal rate, monthly recurring revenue (MRR), annual recurring revenue (ARR), net revenue retention, payment success rate, DSO, at-risk account indicators |

HR Dashboard

An HR dashboard showcases employee-related metrics to guide workforce decisions and strategies, tracking employee satisfaction, performance, productivity, and turnover rates. HR professionals and CFOs can use this data to refine recruitment efforts, develop targeted employee programs, and enhance overall workforce management for improved organizational performance.

Who’s it for | CFOs, financial managers, treasury teams, business owners, controllers, accounts receivable/payable managers |

How often it's needed | Daily, weekly, monthly, quarterly |

Covered KPIs | Employee turnover rate, time to hire, cost per hire, employee satisfaction score, absenteeism rate, revenue per employee, training costs per employee, overtime hours, performance rating distribution, diversity metrics, employee engagement score, retention rate, time to productivity for new hires, internal promotion rate, payroll to revenue ratio |

Drive better financial outcomes with Klipfolio

A CFO dashboard acts as a financial command center, transforming raw fiscal data into a strategic roadmap for organizational success. Klipfolio offers dashboard software that helps you create tools to display and track financial metrics and ratios in real time.

Reveal the story behind your figures, seize opportunities, and craft agile responses to ever-changing market dynamics.

Ready to turn information into action? Take Klipfolio for a spin and start your free trial today!

Related Dashboards

View all dashboards