Financial Dashboard

A financial dashboard helps you analyze your business’s financial health, uncover fiscal trends, and make informed, data-driven decisions to catapult your finances forward using important financial data.

What is a Financial Dashboard?

A financial dashboard is a tool that provides a clear overview of your company's financial health in real time. It brings together data from various sources into a single visual interface, making it easier to understand complex financial information quickly.

You can use a financial dashboard to monitor revenue, expenses, profits, and other important financial data. They reduce the time spent on manual data analysis, allowing you to focus on strategic planning.

These dashboards are also highly customizable, allowing you to focus on the metrics that are most relevant to your financial goals.

Financial Dashboard Examples

Below are some financial dashboard examples to help you get started on yours.

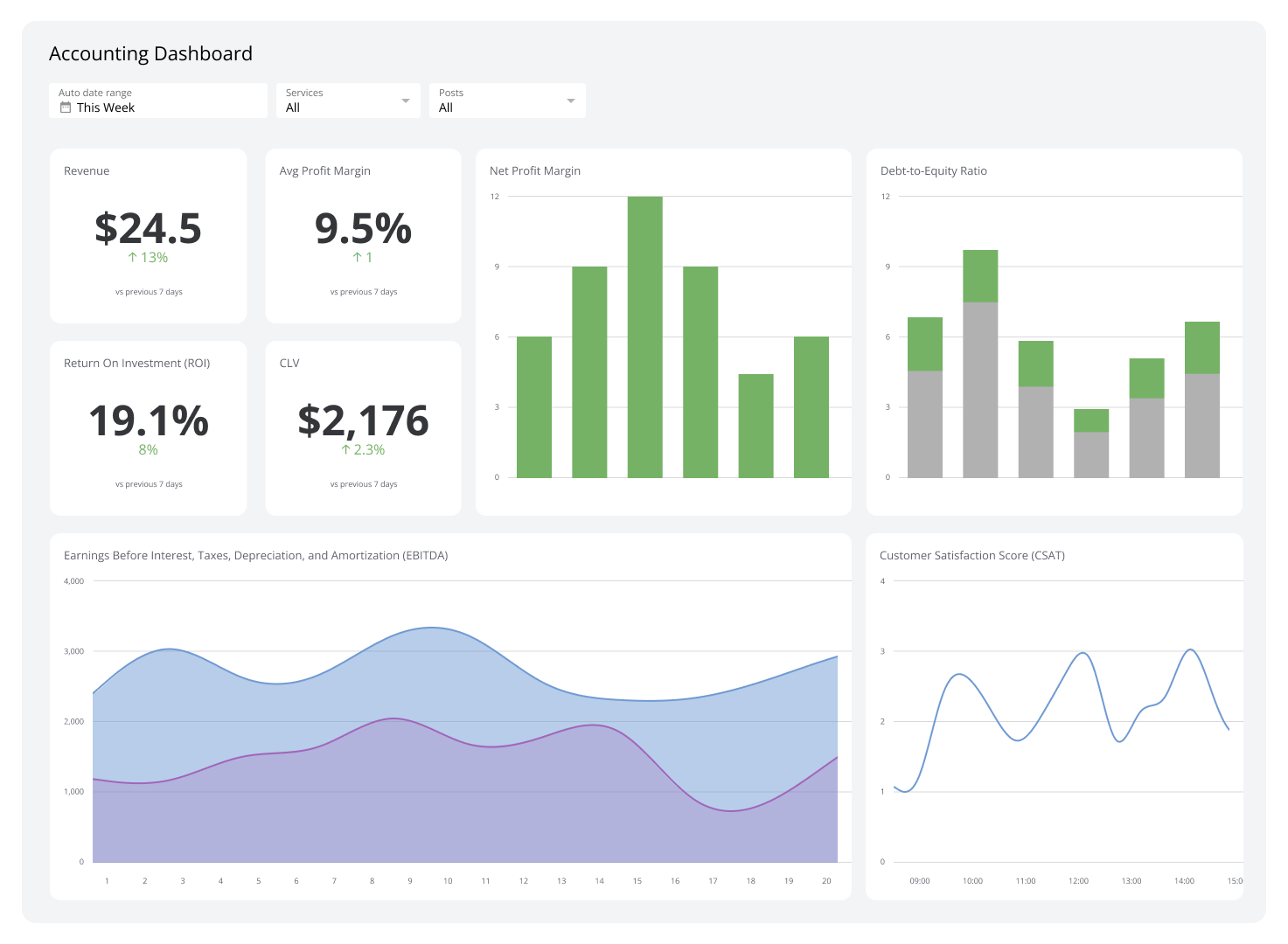

CFO Dashboard

A CFO dashboard is designed to give you a comprehensive view of your company’s financial standing and health. It focuses on delivering live financial data, allowing you to quickly respond to issues such as rapid declines in revenue.

Plus, the dashboard helps you spot opportunities like social media trends that can be capitalized upon to boost sales. A CFO dashboard also makes it possible to immediately evaluate the impact of various cost-cutting initiatives and measure the effectiveness of ongoing financial strategies.

Who’s it for | Chief financial officers (CFOs), financial controllers, finance managers, accounting teams, budget analysts, investment analysts |

How often it's needed | Daily, weekly, monthly, quarterly, yearly |

Covered KPIs | Revenue, net profit margin, gross profit margin, operating income, cash flow, accounts receivable turnover, accounts payable turnover, working capital, debt-to-equity ratio, return on assets (ROA), return on equity (ROE), current ratio, quick ratio, cost of goods sold (COGS), earnings before interest, taxes, depreciation, and amortization (EBITDA), operating expenses, capital expenditures (CapEx), budget variances, financial forecasting accuracy, investment performance, liquidity ratios, credit risk exposure, key performance trends over time |

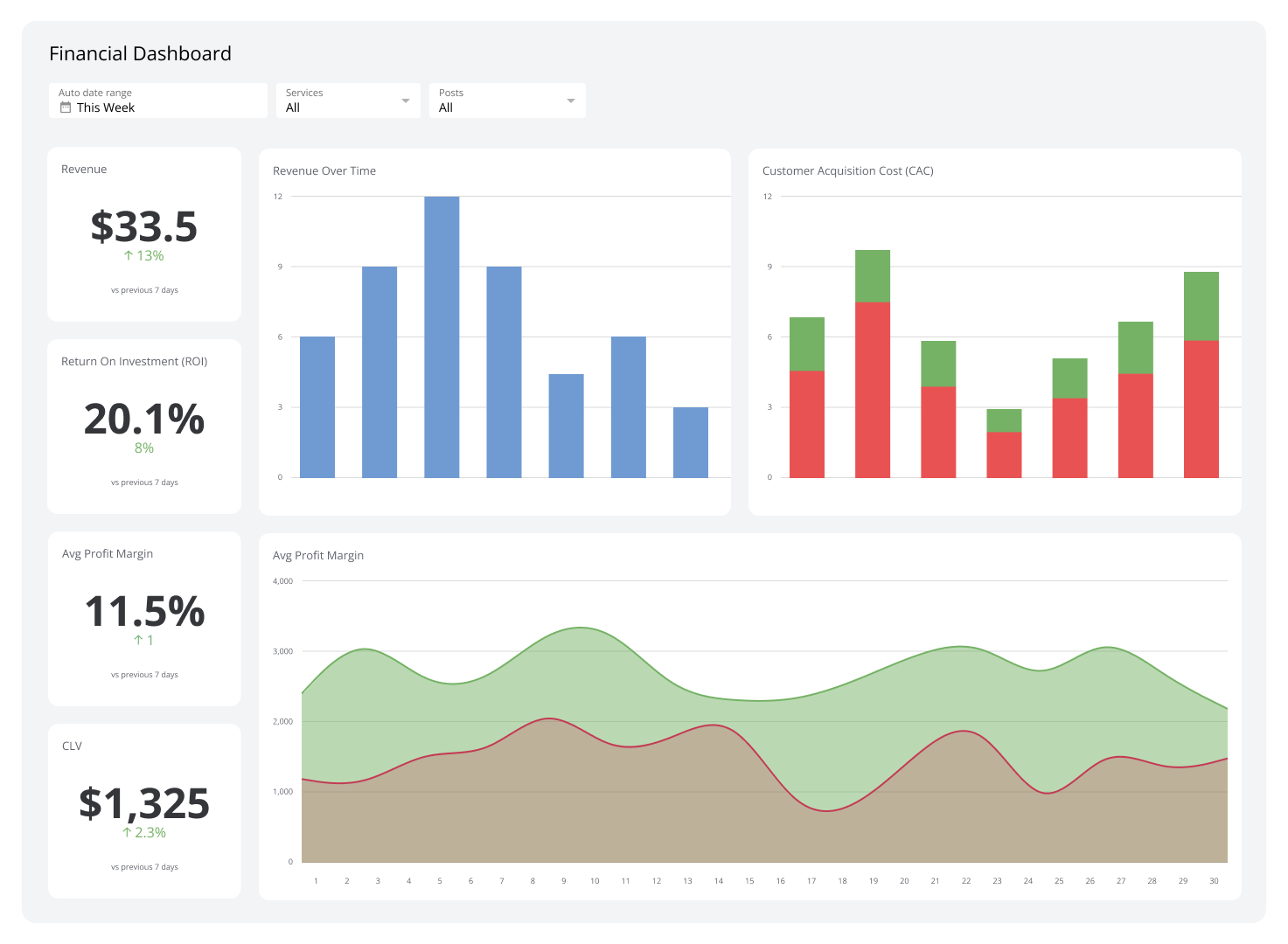

Revenue Metrics Dashboard

A revenue dashboard is a financial dashboard that delivers a clear overview of your company’s income generation performance. By visualizing revenue growth against targets, it helps you analyze the effectiveness of pricing strategies and sales tactics. Revenue dashboards can also uncover trends in customer behavior, product performance, and market opportunities to boost revenue.

Who’s it for | Chief revenue officers (CROs), CFOs, sales managers, marketing managers, business development teams, revenue analysts |

How often it's needed | Daily, weekly, monthly, quarterly, yearly |

Covered KPIs | Revenue growth rate, recurring revenue (monthly recurring revenue or annual recurring revenue), revenue by product or service, revenue by region, total revenue, customer acquisition cost (CAC), customer lifetime value (CLV), average revenue per user (ARPU), churn rate, upsell and cross-sell revenue, gross profit margin, net profit margin, revenue forecast accuracy, sales pipeline value, conversion rates, deal size, contract renewal rates, revenue per employee, revenue from new versus existing customers |

Cash Flow Dashboard

A cash flow dashboard tracks the movement of money in and out of your business, giving you live visibility into its liquidity. It can help you monitor cash inflows from sales and cash outflows for expenses, payroll, and debt repayments. This way, you’ll gain the insight you need to accurately forecast future cash needs and prevent shortfalls by making sure you have enough liquidity to cover your operational costs.

Beyond that, you can also more effectively manage budgets, make informed financial decisions, and optimize operations.

Who’s it for | CFOs, financial controllers, accountants, finance managers, treasury teams, cash flow analysts, business owners |

How often it's needed | Weekly, monthly, quarterly, yearly |

Covered KPIs | Total cash inflows, total cash outflows, net cash flow, operating cash flow, investing cash flow, financing cash flow, cash flow forecast, free cash flow, cash burn rate, days sales outstanding (DSO), days payable outstanding (DPO), days inventory outstanding (DIO), cash conversion cycle, working capital, accounts receivable turnover, accounts payable turnover, liquidity ratios (current ratio, quick ratio), debt repayment schedules, CapEx, ending cash balance by period |

Fundraising Insights Dashboard

Fundraising dashboards observe the performance of your organization’s fundraising campaigns and donor contributions. They generate and then display the figures behind funds raised, average donation size, fundraising goal progress, and donor engagement.

With one, you can acquire the data needed to grow a better relationship with your donors and track donation trends to predict future fundraising outcomes, which is imperative for long-term financial planning.

Who’s it for | Nonprofit executives, finance managers, budget analysts, financial controllers, development directors, fundraising managers, donor relations teams, grant managers, finance departments, event coordinators, board members |

How often it's needed | Daily, weekly, monthly, quarterly, yearly |

Covered KPIs | Fundraising goal progress, number of active donors, donor retention rate, average donation amount, donor acquisition cost, donor lifetime value, top donors by contribution, campaign-specific funds raised, grant funding received, total funds raised, online donation performance, recurring donation metrics, event fundraising totals, pledge fulfillment rates, donor segmentation breakdowns, email open and click-through rates, social media engagement for campaigns, cost per dollar raised, peer-to-peer fundraising activity. |

Expense Analysis Dashboard

An expense analysis dashboard provides a detailed view of your company’s spending patterns to help you track and manage costs effectively. It lets you determine where costs can be reduced without compromising efficiency.

Aside from monitoring expenses, this financial dashboard can also help uncover patterns that might go unnoticed, such as recurring overspending and underutilized budgets. It can even segment data by category, department, or timeframe to supply you with a more granular view of your organization’s spending habits.

Who’s it for | CFOs, finance managers, accountants, department heads, budget analysts, procurement teams, finance departments, operational managers |

How often it's needed | Daily, weekly, monthly, quarterly, yearly |

Covered KPIs | Expense-to-revenue ratio, budget utilization rate, departmental spending breakdown, expense category distribution (travel, marketing, payroll), total expenses, cost per employee, variance between actual and budgeted expenses, recurring expense trends, vendor payments, overdue payments, procurement cycle time, operating cost ratio, cost savings from negotiated contracts, capital expenditure tracking, indirect cost allocation, month-over-month expense changes |

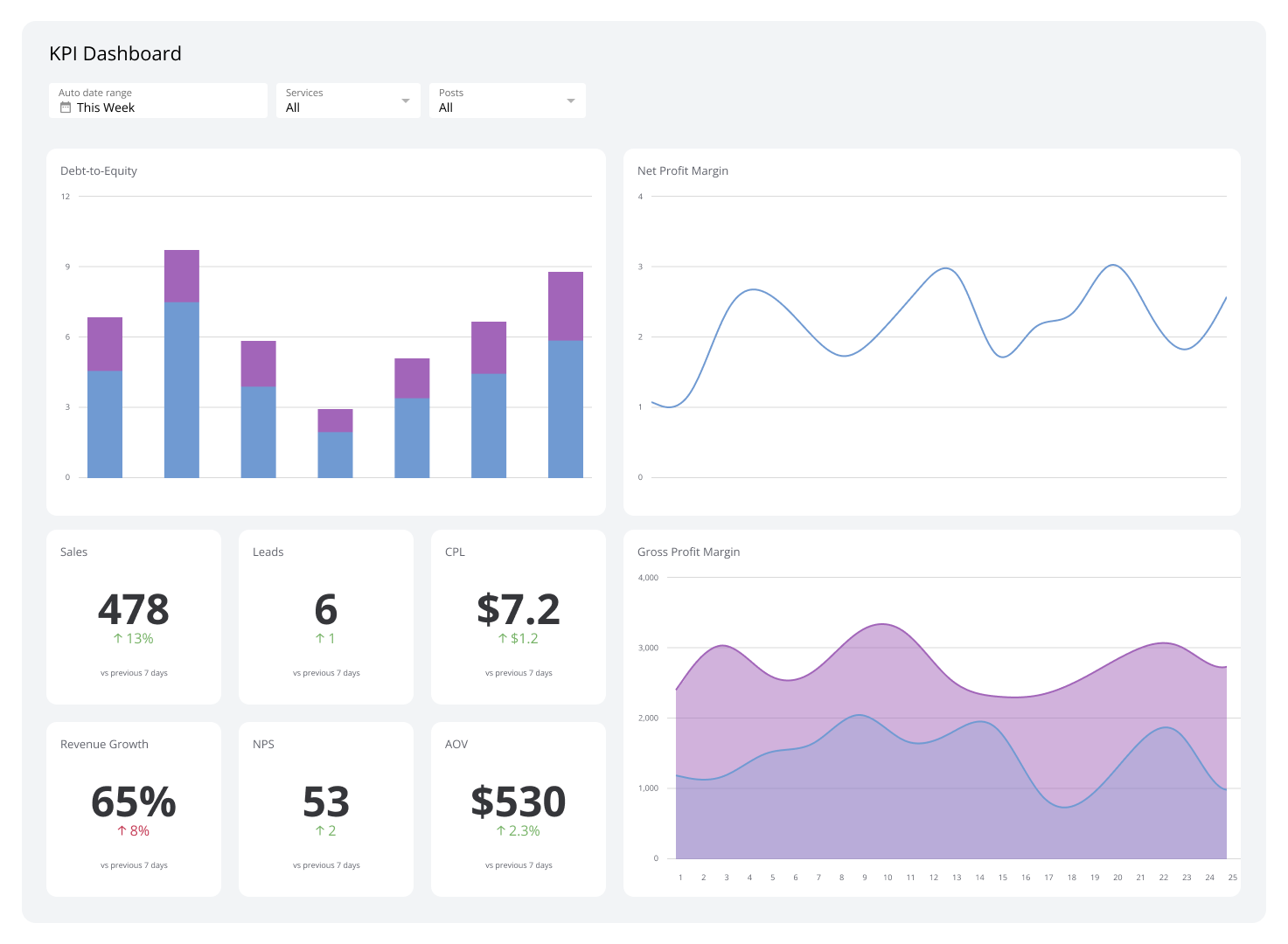

Sales & Product Dashboard

A sales dashboard is a business analytics platform that helps your company monitor and evaluate its sales performance using clear, real-time insights from key sales metrics like revenue, deal conversion rates, and customer acquisition costs.

This dashboard provides sales teams and finance departments with a view of sales performance, making it easier to track progression. This financial dashboard also showcases sales trends, uncovers bottlenecks in the sales pipeline, and supports the creation of informed decisions that will drive your company sales forward.

Who’s it for | Sales managers, account executives, business development representatives, regional sales directors, chief sales officers (CSOs), marketing and sales alignment teams, strategic planning teams |

How often it's needed | Daily, weekly, monthly, quarterly, yearly |

Covered KPIs | Total sales revenue, sales growth rate, revenue by product or service, regional sales performance, sales by channel, average deal size, sales cycle length, customer acquisition cost, customer lifetime value, lead-to-close conversion rate, sales forecast accuracy, pipeline value by stage, win rate, opportunity-to-lead ratio, salesperson performance rankings, churn rate, upsell and cross-sell rates, quota attainment, sales activity metrics, discount utilization rate |

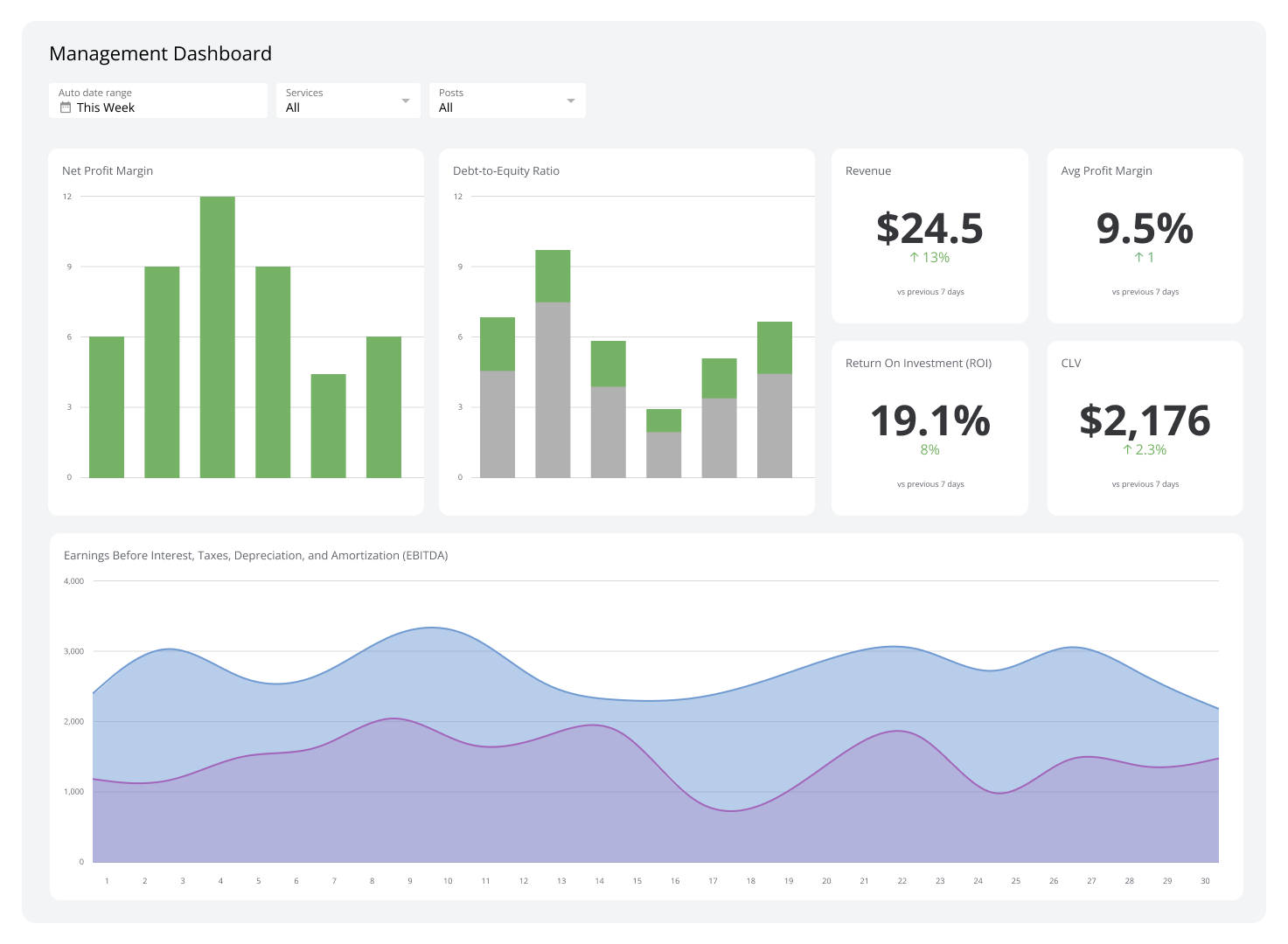

Profit and Loss Finance Dashboard

A profit and loss dashboard offers a detailed, real-time view of your company's financial health by breaking down revenue, expenses, and net profit. It goes beyond simple tracking to identify cost drivers, revenue growth opportunities, and profitability bottlenecks.

With its insights, this dashboard encourages you to optimize pricing strategies, streamline operations, and align financial outcomes with strategic profit goals, making it a critical resource for sustainable growth.

Who’s it for | CFOs, financial controllers, accountants, business unit managers, chief executive officers (CEOs), board members, investors |

How often it's needed | Daily, weekly, monthly, quarterly, yearly |

Covered KPIs | Cost of goods sold (COGS), gross profit, gross margin percentage, operating expenses, net operating income, net profit, net profit margin percentage, revenue by product or service, revenue by region or channel, expense breakdown by category, EBIT, EBITDA, year-over-year profit growth, operating cash flow, income-to-expense ratio, budget variance, tax liabilities |

Analyze Important Finance Data Using Financial Dashboards

A financial dashboard provides insights into your company’s financial health by consolidating data into key metrics like revenue, expenses, and cash flow. This type of dashboard helps you evaluate the profitability of your products, monitor trends, and identify areas for improvement.

Klipfolio’s financial dashboards are customizable to fit your needs. Try them out today!

Frequently Asked Questions

Below are answers to common questions to help you make the most of your financial dashboard:

How do I create a finance dashboard?

To create a finance dashboard:

- Start by identifying the financial metrics you want to track (revenue, expenses, or profit margins).

- Connect your data sources, such as QuickBooks, Excel, or Google Sheets, to Klipfolio.

- Use pre-built templates or customize your own dashboard with visualizations like bar charts, line graphs, and pie charts.

- Share your dashboard with your team for real-time insights and updates.

You can also use an intuitive platform like Klipfolio that can walk you through the steps and save certain metrics so you don’t have to rebuild anything from scratch.

Can I create a financial dashboard in Excel?

Yes, you can create a financial dashboard in Excel using pivot tables, charts, and slicers. However, dashboard platforms like Klipfolio offer automation, integrations, and a user-friendly interface, making it easier to update and share dashboards without manual work.

What is the best chart to use for financial dashboards?

The best chart for a finance dashboard depends on the type of data you’re analyzing:

- Use line charts to track trends over time, like monthly revenue.

- Opt for bar charts to compare categories, such as expenses by department.

- Try pie charts to show proportions, like expense distribution.

Can I share my financial dashboard with others?

Yes! Klipfolio allows you to securely share finance dashboards via email links, embedded views, or live presentations. Your team can access real-time data updates without requiring additional downloads.

Why should I use a dashboard platform for financial analysis?

Dashboard platforms like Klipfolio can significantly simplify financial analysis by automating data updates from multiple sources. They offer a centralized view of all key financial metrics, allowing users to easily monitor and assess their financial health in one place.

Moreover, they provide customizable visualizations, which can be tailored to better suit the specific insights needed, enhancing the overall understanding of financial data. This not only improves efficiency but also saves a considerable amount of time compared to the traditional method of manually updating Excel spreadsheets.

Related Dashboards

View all dashboards