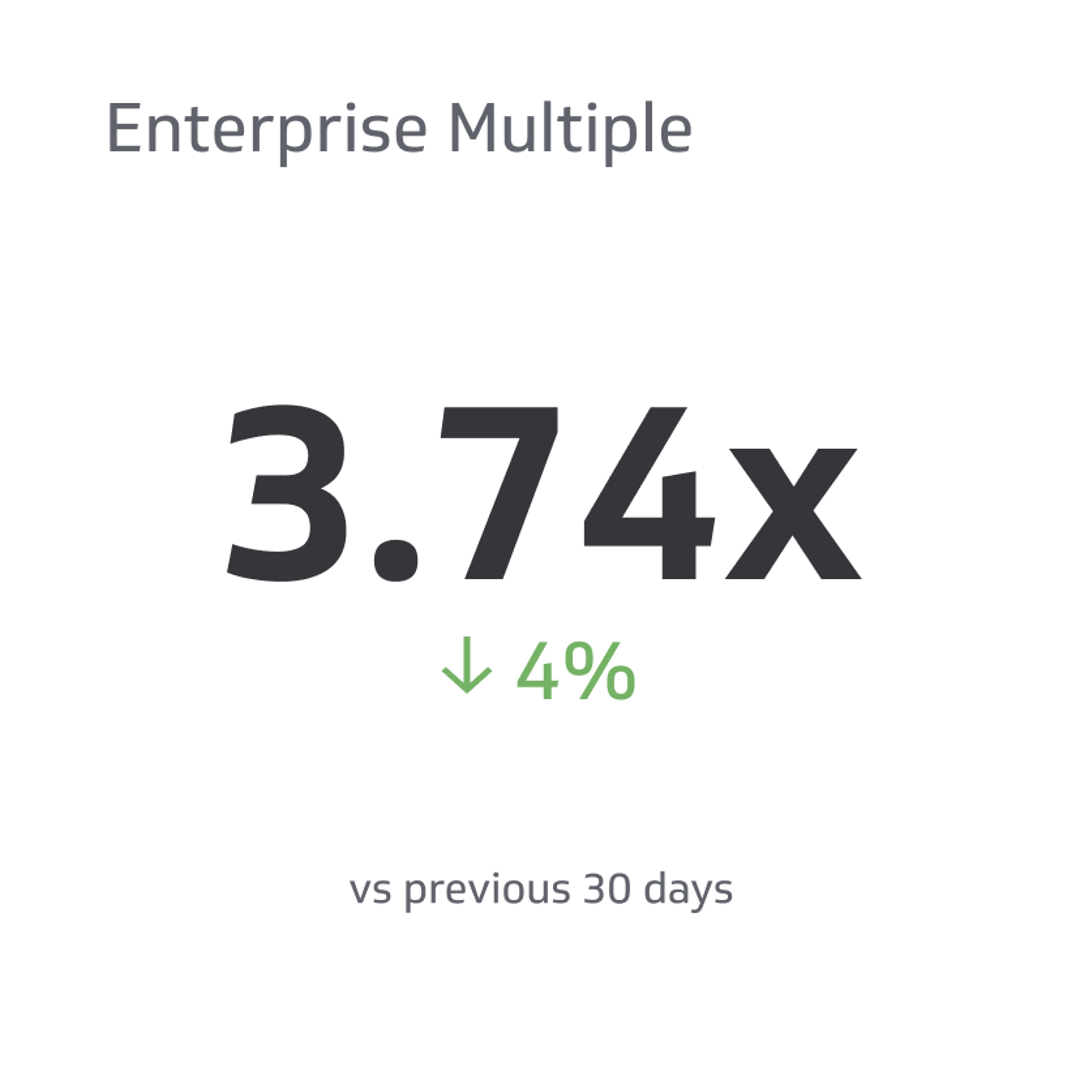

Enterprise Multiple (EV/EBITDA)

EV/EBITDA provides valuable insights into a company's valuation and operational performance.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Companies of all sizes and industries strive for financial success and long-term growth. Enterprises continuously evaluate their operations and financial metrics, from startups to multinational corporations, to remain competitive and achieve their objectives.

In this regard, investors and analysts use an important financial ratio to measure a company's performance: the enterprise multiple or EV/EBITDA. This ratio holds a key position in the arsenal of investors and analysts, enabling them to assess businesses' financial health and profitability.

Understanding this ratio can help business leaders make informed decisions and optimize their operations to drive profitability.

What Is EV/EBITDA?

EV/EBITDA is a financial metric widely used in the business and investment community. It provides valuable insights into a company's valuation and operational performance.

Its focus on a company's operating performance sets EV/EBITDA apart from other valuation metrics. It considers both debt and equity when calculating its value, making it a more comprehensive measure of its worth.

To fully grasp the significance of EV/EBITDA, let's break down its components.

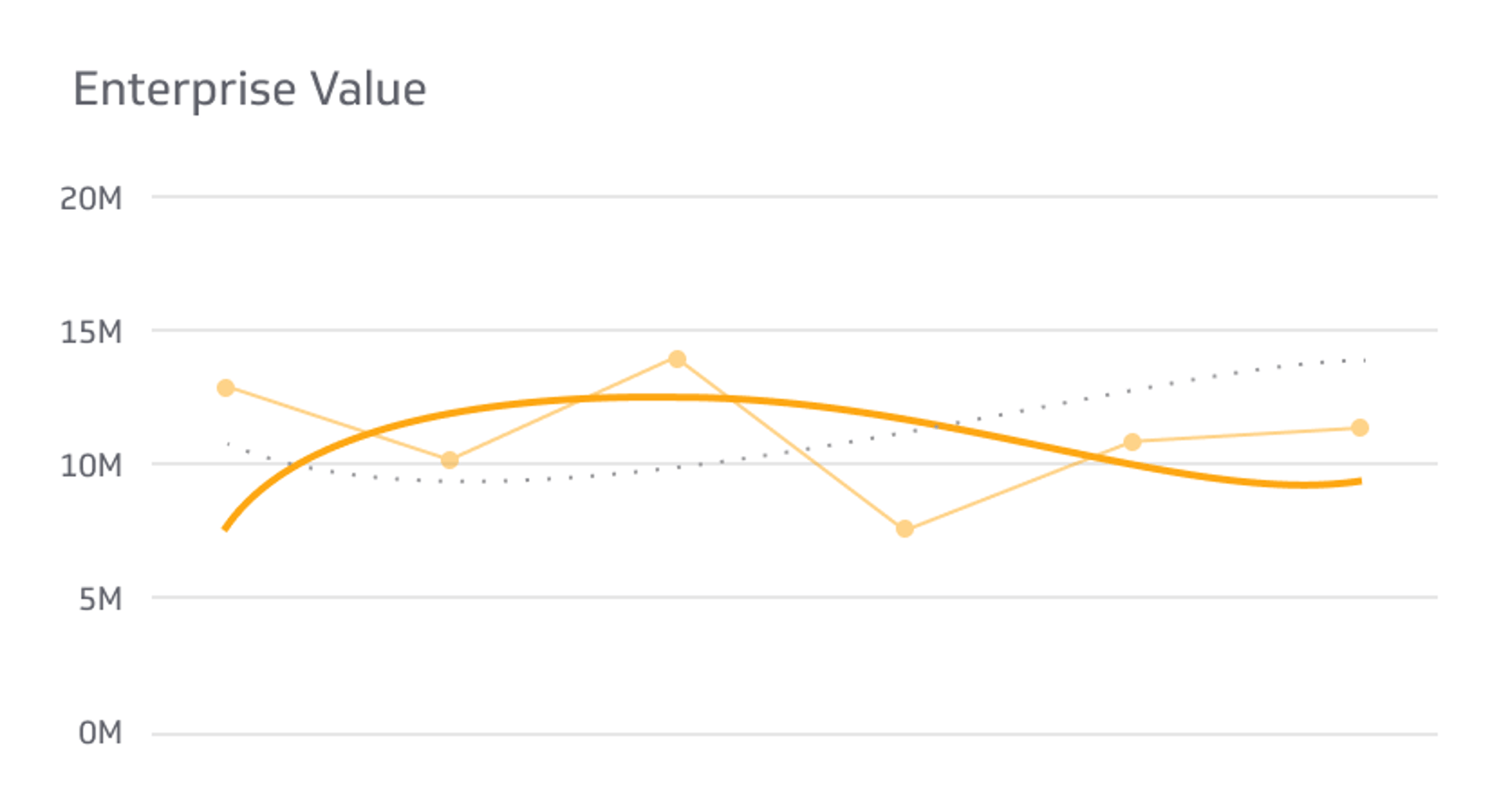

EV

EV, or Enterprise Value, is a fundamental financial measure used to determine the total value of a company. It considers equity and debt components and represents the theoretical price an investor must pay to acquire the entire business.

Enterprise Value takes into account various factors that influence a company's valuation. It includes the market capitalization, which is the value of all the company's outstanding shares multiplied by its share price. Additionally, EV incorporates the company's debt and other liabilities while considering its cash and cash equivalents.

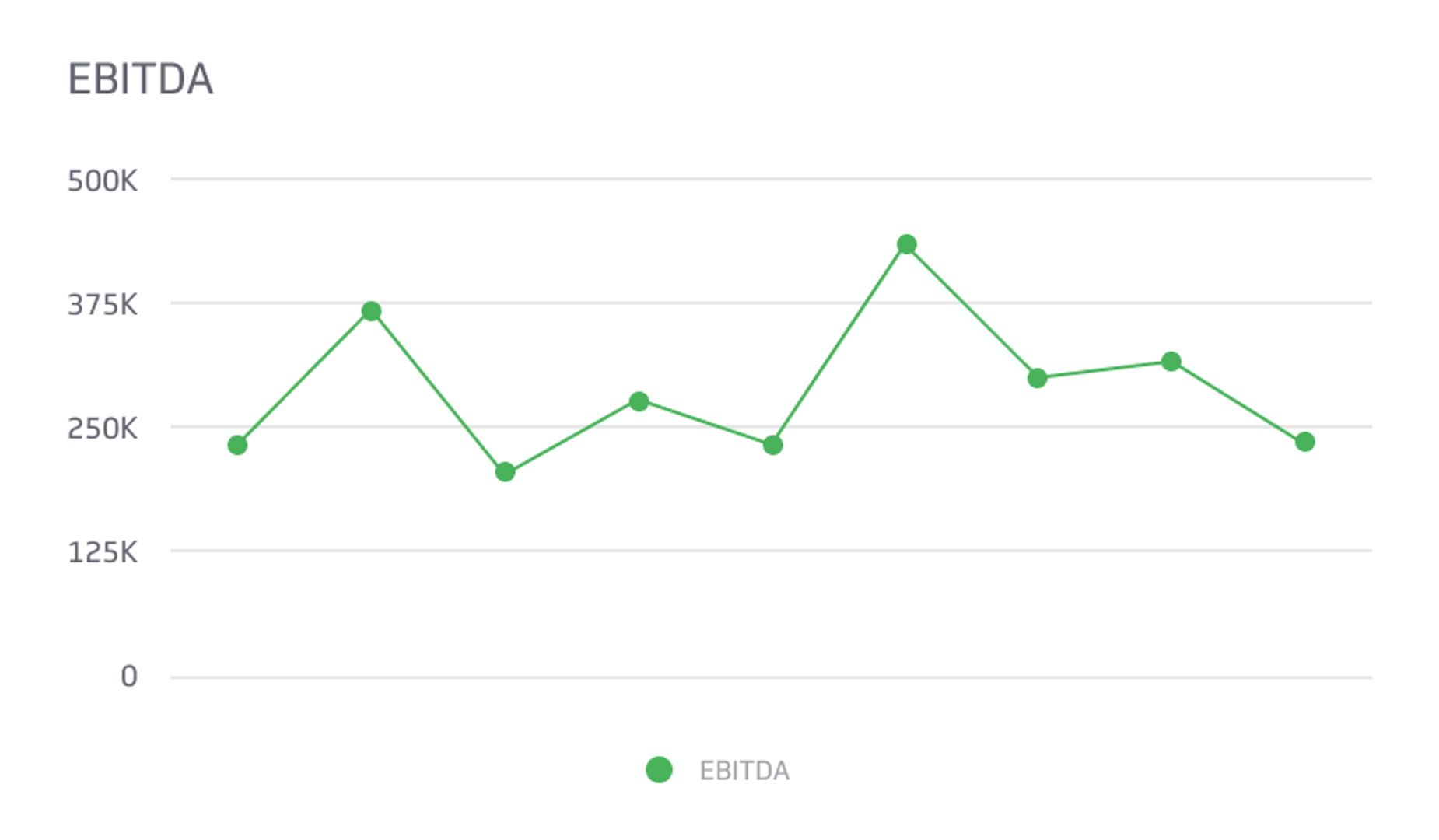

EBITDA

EBITDA, which stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, is a financial indicator used to assess a company's operational earnings. It represents the earnings a business generates before considering non-operational expenses such as interest payments, taxes, depreciation of assets, and amortization of intangible assets.

EBITDA offers a more accurate representation of a company's operational effectiveness by excluding certain financial factors that can vary significantly between companies or distort the true profitability of a business. By removing these items, EBITDA allows for better comparability across companies and industries, making it a widely used metric for evaluating profitability.

What is the Enterprise Multiple Used For?

Now that we’ve explored the components of EV/EBITDA, let’s delve into its practical applications. The enterprise multiple is a versatile financial metric with various uses in the business and investment world.

Understanding these applications can empower investors, analysts, and business leaders to make informed decisions.

Determining a Company's Current Trading Multiple

Analyzing the current multiple at which a company is trading provides a reference point for understanding how the market perceives its financial performance. It also provides insights into the relative valuation of the company and growth prospects.

Stakeholders can assess whether the market sentiment aligns with their valuation or investment strategies. This information can be handy when considering buying or selling shares or making investment decisions.

Comparing Valuations of Multiple Companies

Comparing the enterprise multiple allows for a relative assessment of companies' valuation levels. It helps identify outliers, potential investment opportunities, or areas of overvaluation.

Companies with higher EV/EBITDA multiples may indicate higher growth expectations, stronger market positions, or unique competitive advantages. Conversely, companies with lower multiples may suggest potential undervaluation or less favorable market sentiment.

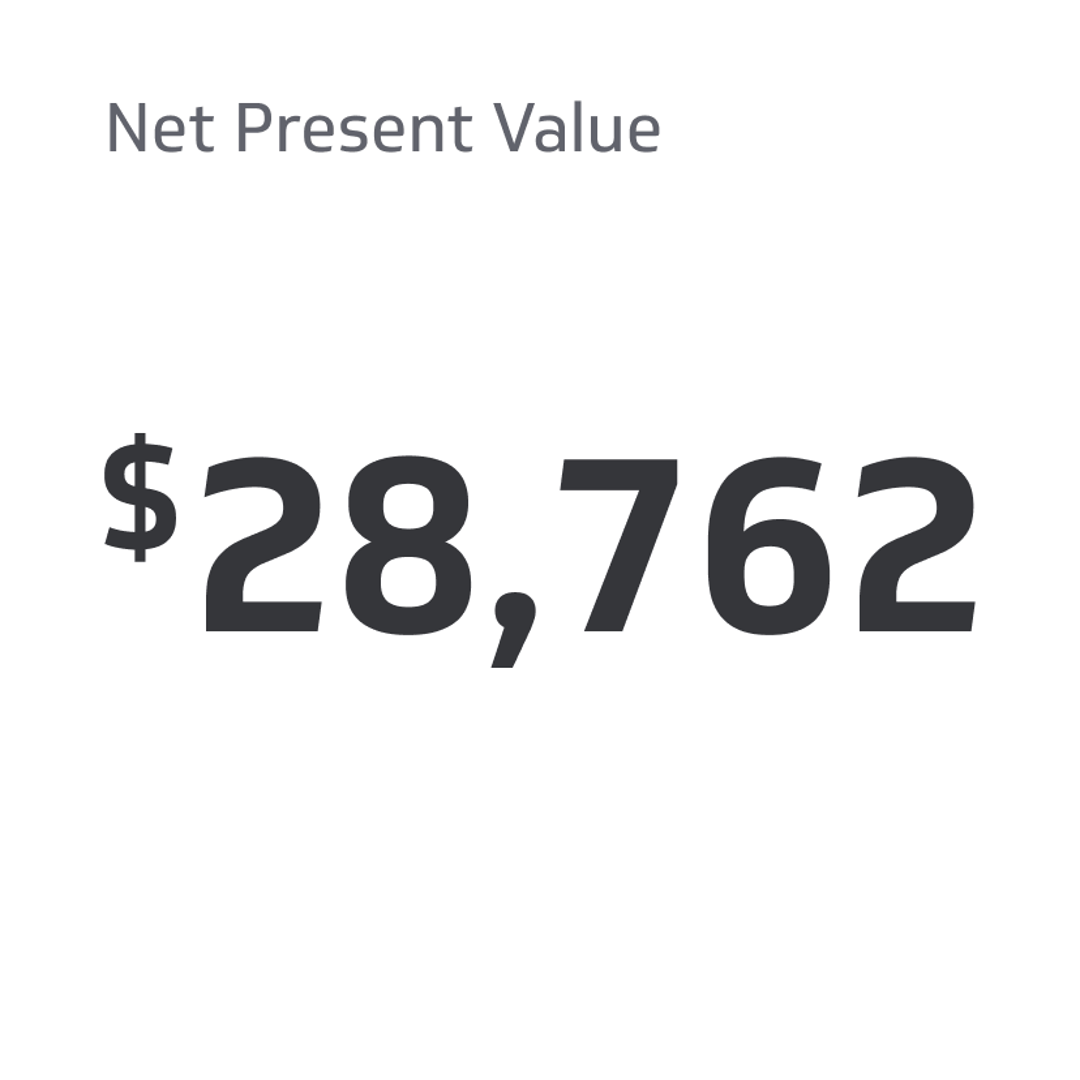

Calculating the Terminal Value in a Discounted Cash Flow (DCF) Model

The EV/EBITDA ratio also finds its application in estimating the terminal value component of a Discounted Cash Flow (DCF) model. In DCF analysis, the terminal value represents the value of a company's expected cash flows beyond the explicit forecast period. It’s a crucial consideration when assessing the long-term value of an investment.

In this context, the projected EBITDA for the final year of the explicit forecast period is multiplied by the estimated enterprise multiple. The multiplication yields the terminal value, which is then discounted to the present value using an appropriate discount rate.

This approach enables a more comprehensive and holistic assessment of the company's long-term value and facilitates better-informed investment decisions.

Negotiating the Acquisition of a Private Business

When discussing acquiring a company, the buyer and seller often evaluate the business's worth based on its financial performance and future prospects. The EV/EBITDA multiple serves as a benchmark for determining a fair valuation and establishing the terms of the deal.

Calculating a Target Price for a Company in an Equity Research Report

Equity research analysts often use the EV/EBITDA ratio to determine a target price for a company in their research reports. The target price reflects the analyst's assessment of a company's fair value and is often used by investors to determine whether the current market price represents a buying opportunity.

To calculate the target price using the EV/EBITDA ratio, the analyst first estimates the company's future EBITDA based on its financial projections. They then select an appropriate enterprise multiple based on industry comparables, growth prospects, and market conditions.

Formula and Calculation of Enterprise Multiple

To fully understand the enterprise multiple and its significance in assessing a company's valuation, you need to understand the calculation. To calculate the enterprise value, add a company's market capitalization, total debt, minority interest, and preferred shares. Then, subtract cash and cash equivalents.

The formula is as follows:

Enterprise Value = Market Capitalization + Total Debt + Minority Interest + Preferred Shares - Cash and Cash Equivalents

EBITDA is calculated starting with a company's net income and then adding back the amounts for interest, taxes, depreciation, and amortization.

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

Once you have calculated the Enterprise Value and EBITDA, divide the Enterprise Value by EBITDA to obtain the Enterprise Multiple.

Example (PepsiCo)

To illustrate the calculation of the enterprise multiple, let's examine PepsiCo (PEP), a well-known multinational beverage company. We have the necessary information to calculate PepsiCo's EV/EBITDA ratio.

PepsiCo's EBITDA for the trailing 12 months (TTM) is $14.82 billion. As of May 2023, PepsiCo has a market capitalization of $269.11 billion. PepsiCo holds cash and cash equivalents amounting to $5.2 billion, and the total debt is $41.77 billion.

PepsiCo's enterprise multiple based on this data is approximately 20.62 ($269.11B - $5.2B + $41.77B)/ $14.82B.

8 Steps to Calculate EV/EBITDA and Value a Company

Here are eight steps to follow for a comprehensive valuation analysis using the EV/EBITDA ratio. They can give you a valuable perspective on the target company's worth and its positioning within the industry.

Step 1: Select an Industry

Choosing an industry is the first step in valuing a company using the EV/EBITDA ratio. Identify the industry in which the target company operates to ensure relevant comparisons with similar businesses.

Step 2: Identify Comparable Companies

Identify a group of companies within the chosen industry comparable to the target company. These companies should share similar characteristics such as size, product mix, geographic focus, and market positioning.

Step 3: Conduct a Comparative Analysis

Thoroughly research each comparable company to ensure they are suitable for comparison. Eliminate companies that differ significantly from the target in size, product offering, market reach, or other critical factors that could distort the valuation analysis.

Step 4: Gather Historical Financial Information

Collect three years of historical financial data for each selected company. Obtain vital financial figures such as revenue, gross profit, and EBITDA.

Step 5: Obtain Current Market Data

Obtain the current market data for each company, including their share price, the number of shares outstanding, and net debt. This information is crucial for calculating the enterprise value accurately.

Step 6: Calculate Enterprise Value (EV)

The Enterprise Value for each company can be determined by adding the market capitalization (the share price times the total outstanding shares) and the net debt (the total debt subtracted by cash and cash equivalents).

Step 7: Compute EV/EBITDA Ratio

Divide the EV by the EBITDA figure for each historical year for all the companies in the analysis. This step helps calculate the enterprise multiple for different periods and companies.

Step 8: Compare EV/EBITDA Multiples

Compare the EV/EBITDA multiples calculated in the previous step across the selected companies. Analyze the variations in multiples to gain insights into relative valuations and identify potential outliers or discrepancies.

What Is a Good Enterprise Multiple? Low or High?

Determining what constitutes a good or favorable EV/EBITDA ratio depends on various factors, including the industry in which the target company operates. A lower EV/EBITDA ratio suggests a company may be more attractive as a potential investment.

A low EV/EBITDA ratio indicates that the company's enterprise value (EV) is relatively low compared to its EBITDA. This suggests that the market potentially undervalues the company.

Investors often interpret a lower ratio as an opportunity to acquire the company's shares at a relatively favorable price, potentially offering the potential for future growth.

Conversely, a high EV/EBITDA ratio implies that the market values the company at a higher multiple of its earnings. This could indicate that the company is potentially overvalued, as investors are willing to pay a premium for the company's expected future earnings or growth prospects.

A higher ratio may indicate market optimism but also raises the risk of a potential downturn or the need for sustained high performance to justify the valuation.

It is important to note that no fixed rules or universally applicable thresholds exist for determining what constitutes a low or high EV/EBITDA valuation multiple. The evaluation of an appropriate EV/EBITDA ratio depends on the specific industry dynamics, growth potential, and competitive landscape.

Pros and Cons of Using Enterprise Multiple

Using the enterprise multiple as a valuation metric offers advantages and limitations. Let’s explore the benefits and drawbacks of employing this method to assess a company's worth.

Advantages

The enterprise multiple offers several advantages when valuing a company:

Easy calculation using publicly available information

Calculating the EV/EBITDA ratio is relatively straightforward and can be done using publicly available financial information. This accessibility allows analysts and investors to apply this metric in their valuation analysis.

Commonly utilized and referenced metric in the financial community

The EV/EBITDA ratio is widely recognized and commonly used in the financial community. It is a well-established metric frequently referenced and discussed in economic research, investment reports, and industry analyses.

Effective valuation method for stable, mature businesses

The EV/EBITDA ratio is particularly effective when valuing stable and mature businesses. It comprehensively assesses a company's operating performance by considering its earnings and debt structure.

An effective approach for comparing different businesses

The EV/EBITDA ratio allows for a standardized measure considering the company's market value and operational performance. This makes it easier to evaluate and compare companies with varying sizes, capital structures, or levels of profitability.

Limitations

While the EV/EBITDA ratio has its advantages, it also has certain limitations to be mindful of:

Beware of value traps

Companies with low EV/EBITDA multiples may appear undervalued. In some cases, low multiples may indicate fundamental issues with the company or its industry, suggesting the potential for negative returns. Carefully evaluate industry trends and company-specific factors to avoid value traps.

Challenging to adjust for different growth rates

Companies with different growth trajectories may have different risk profiles and warrant different valuation approaches. Supplement the analysis with other metrics and consider qualitative factors when evaluating companies with varying growth rates.

Bottomline

EV/EBITDA is a valuable tool for assessing a company's valuation and comparing it to its peers within the same industry. However, it is essential to be aware of its limitations and use it with other financial metrics when making investment decisions.

Related Metrics & KPIs