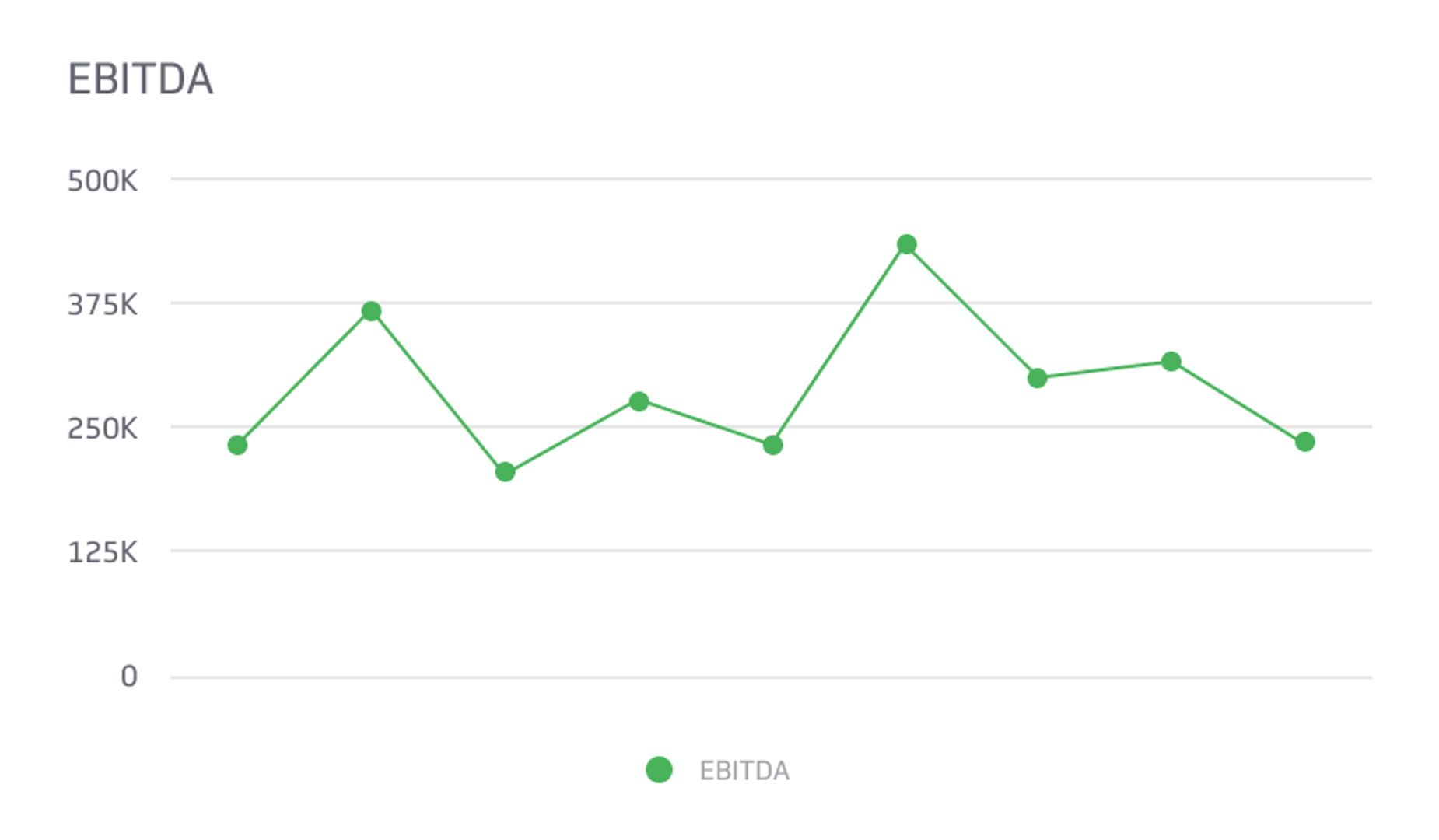

EBITDA vs. Net Income

Instead of relying solely on net income, which includes non-cash expenses like depreciation and amortization, EBITDA aims to capture the cash profits generated by the company's operations.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

For those in the business world, financial insights can be incredibly powerful. Delving deeper into the numbers gives invaluable insight into a company's profitability, health, and overall financial performance.

Amongst these metrics is EBITDA vs. net income – two crucial concepts that any savvy marketer, business operator, analyst, or SAAS team should understand how to navigate.

In this post, we explore EBITDA vs. net income, understanding why each metric is important and what kind of information it provides– helping you get an overview of where your company stands financially.

What Is EBITDA?

EBITDA, an acronym for earnings before interest, taxes, depreciation, and amortization, is a financial metric that provides an alternative approach to measuring profitability.

Instead of relying solely on net income, which includes non-cash expenses like depreciation and amortization, EBITDA aims to capture the cash profits generated by the company's operations.

By eliminating these non-cash expenses, taxes, and debt charges, EBITDA provides investors with a clearer understanding of a company's ability to generate cash flow.

Despite not being recognized under GAAP, some publicly traded corporations include adjusted EBITDA figures in their quarterly reports to understand their financial performance better.

How To Calculate EBITDA

EBITDA is a frequently used financial metric that assesses a company's profitability and overall financial health. In order to calculate EBITDA, you will need to begin with operating profit, commonly known as EBIT, and then add back depreciation and amortization.

This simple formula offers critical insights into a company's operations and management capability, making it a crucial tool for investors and business owners. There are two different methods to calculate EBITDA, depending on whether you use operational income or net income.

EBITDA = Operating Income + Depreciation & Amortization

and

EBITDA = Net Income + Taxes + Interest Expense + Depreciation & Amortization

Understanding these formulas and how to calculate EBITDA can help you make informed decisions about your investments and business strategies.

Example of EBITDA

To better understand EBITDA, let's take this example of a corporation that generates $100 million in revenue, spends $20 million on overhead, and $40 million on product costs.

After considering the depreciation and amortization costs of $10 million, the corporation makes an operational profit of $30 million. The interest expense is $5 million, leaving $25 million in revenues before taxes.

After taxes, net income amounts to $21 million, assuming a 20% tax rate and tax-deductible interest expenses. If we subtract depreciation, amortization, interest, and taxes from net income, we get EBITDA, which is $40 million.

EBITDA is a valuable tool for investors and analysts to evaluate a company's financial health and profitability.

What Is Amortization in EBITDA?

Amortization is a crucial concept in business, especially concerning EBITDA. It is a process by which a company's intangible assets' book value is gradually reduced over time, considering their impact on EBITDA. This practice gets reflected in an organization's income statement, where you can see the effect of amortization on the company's financials.

Intangible assets such as patents, trademarks, and goodwill are prime examples of assets subject to amortization. As a professional or a business owner, it is vital to understand how amortization works and how it can impact your company's financial performance over time.

Disadvantages of EBITDA

EBITDA gets widely used as a financial metric for analyzing a company's performance. However, this non-GAAP statistic comes with its fair share of disadvantages.

No Uniform Way of Calculation

First, since there is no uniform way of calculating EBITDA, each company may have different methods, making it challenging to perform cross-company comparisons.

Companies often prioritize EBITDA over net income, as it paints a more flattering picture of the company's profitability. Thus, investors must be vigilant if a company abruptly starts to focus on EBITDA, especially if there are crucial issues like rising debt or escalating capital costs.

In such circumstances, companies might try to divert attention away from these problems using EBITDA. As a result, investors must carefully scrutinize EBITDA and examine it alongside other financial indicators to gain insight into the company's actual financial status.

Disregards Asset Costs

EBITDA, a standard financial metric, is often considered an indicator of cash earnings. However, in contrast to free cash flow, it does not consider the cost of assets.

Moreover, EBITDA has been criticized for its assumption that profitability is solely a result of a company's sales and operations. This neglects the contribution of assets and debt financing.

EBITDA Is Susceptible to the Earnings Accounting Games

Different businesses use different methods to arrive at their earnings figure, which becomes the starting point for EBITDA. As a result, even after deducting interest expenses, taxes, depreciation, and amortization, the earnings figure may still need to be revised.

That can have significant implications for investors and businesses alike, as a distorted earnings figure can create a false sense of financial health or undermine accurate valuation. Therefore, it is essential to exercise caution when relying on EBITDA and to look at it in conjunction with other economic measures.

What Is Net Income?

Net income is a crucial metric in evaluating the financial performance of a business. The company's bottom line represents the earnings left after deducting all expenses, taxes, and liabilities. The meticulous calculation of net income gets reflected in carefully examining a company's revenue and each expense.

In addition, it includes tricky expenses such as depreciation, which requires assessing the cost of long-term assets getting worn down over time. As a key indicator of financial success, net income is an essential metric for company owners, shareholders, and stakeholders.

In addition, its calculation provides valuable insights into a business's profitability and ability to sustain future growth.

Understanding Net Income

As a key business metric, net income plays a prominent role in determining their financial health. It represents the profit or loss the company has made over a specific period, considering all revenues and expenses.

It's no wonder that analysts place such importance on this metric, given that it's the number that ultimately paints a picture of how well a company is performing.

Commonly referred to as the bottom line, net income is a barometer for businesses to assess their profitability and is used to calculate earnings per share. Understanding net income is critical for investors to evaluate a company's viability and potential for growth.

How To Calculate Net Income

Calculating net income is a crucial aspect of any business operation, as it accurately represents how much money the company generates after all expenses have gotten accounted for. To calculate net income, you must begin by tallying up the company's total revenue.

Following this, you must deduct operational and spending costs to find the earnings before taxes. The final calculation involves subtracting tax from the sum to determine the NI.

It is essential to understand that NI can get manipulated by using accounting techniques such as revenue recognition or expenditure concealment.

As a result, investors must delve deeper into the accuracy of the figures used to calculate NI before making any investment decisions.

Example of Net Income

When evaluating a company's performance, one key metric is its net income. To illustrate this point, let's look closely at Coca-Cola's financial report. This iconic brand posted revenue of $9.02 billion in the first quarter of 2021, supplemented by $417 million from equity and other income and $66 million from interest.

However, after deducting various expenses - including the cost of goods sold, general and administrative fees, additional operating costs, interest payments, and taxes - Coca-Cola's net income was $2.255 billion.

This figure indicates how much profit the company made after all expenses have been accounted for and is a crucial indicator of a company's financial health.

EBITDA vs. Net Income: What's the Difference

When analyzing a company's financial health, investors often come across two popular metrics: EBITDA and net income. While both provide insights into a company's profitability, they differ significantly.

1. EBITDA stands for earnings before interest, taxes, depreciation, and amortization, making it an estimate of a company's operating revenues. It shows how much cash a company generates from its core business activities.

On the other hand, net income is a more conservative calculation that considers all expenses, including taxes and interest. It represents the profit a company has earned in a given period.

2. EBITDA, provides a clearer picture of a company's operating performance by factoring out non-operating expenses. This metric can get calculated in two ways: by adding EBIT with depreciation and amortization or by adding net profits with interest, taxes, depreciation, and amortization.

On the other hand, net income gets determined by subtracting a company's total operating expenses from its revenues.

3. EBITDA is often used to gauge a company's earning potential. One of the benefits of using EBITDA is that it's relatively easy to calculate since it ignores non-cash expenses like depreciation and amortization.

Conversely, net income is the bottom line on a company's income statement once all costs have been accounted for. It's important to note that net income considers depreciation and amortization, while EBITDA doesn't.

4. EBITDA measures a company's earnings before deductions for taxes, costs, depreciation, and amortization. It provides a more accurate picture of a company's cash flow and profitability. Net income, on the other hand, is determined by subtracting all expenses, taxes, depreciation, and amortization from a company's revenue.

While EBITDA is a good indicator of operating performance, net income is a more comprehensive metric that reflects the total profitability of a business.

5. Startups and investors often use EBITDA to determine a company's profitability by looking at the company's cash flow. While net income, which represents the profit a company has made after all expenses have gotten paid, is more commonly used by established companies to show how well it is performing financially.

EBITDA Is More Accurate in Measuring Profitability

When measuring profitability, EBITDA is a more accurate and reliable indicator. It considers a company's capital structure and tax situation to clarify its actual earning ability.

We can demonstrate this by comparing two companies: Company X with a $10 million EBITDA and a $5 million net profit, and Company Y with a $5 million EBITDA but a $10 million net income.

Despite Company Y's higher net income, Company X is more lucrative due to its higher EBITDA. By eliminating the impact of capital structure and taxes, EBITDA provides a more precise measure of a company's profitability - a vital metric in the business world.

EBITDA vs. Net Income: Why EBITDA Is Used Instead of Net Income

EBITDA is a popular financial metric that investors and businesses use to evaluate a company's profitability.

While net income is a widely recognized metric, EBITDA is preferable in industries where capital-intensive investments are the norm. EBITDA provides a clearer picture of a company's earning potential without being distorted by factors like tax policies or capital structures.

Additionally, EBITDA allows investors to compare companies across different industries, making it a helpful tool for analyzing potential investments. Finally, EBITDA's simplicity and ability to accurately assess a company's financial performance make it an attractive alternative to net income.

FAQ

Here are frequently asked questions about EBITDA vs net income.

Why is EBITDA higher than operating income?

EBITDA is a financial metric commonly used in business. It often gets mentioned in the same breath as operating income, another financial metric reflecting a company's profitability from its primary operations.

While the two terms may seem interchangeable, EBITDA is typically higher than operating income. This discrepancy exists because EBITDA includes non-operating incomes such as interest and other income not factored into operating income.

Therefore, when comparing a company's EBITDA and operating income, it's essential to understand the components contributing to each metric.

Are net income and EBIT the same thing?

While these terms may seem interchangeable, they represent very different aspects of a company's financial performance. For example, EBIT, or earnings before interest and taxes, clearly shows a company's ability to generate profits before factoring in financial obligations.

At the same time, net income reveals a company's true profitability after all expenses have gotten deducted. By recognizing the distinction between these two measurements, individuals can make more informed decisions about investing in or managing a business.

Why do people prefer EBITDA?

When evaluating a company's performance and value, EBITDA is a powerful tool that business owners should not overlook.

EBITDA, which stands for earnings before interest, taxes, depreciation, and amortization, provides a clearer picture of a company's financial health by excluding certain expenses that may not accurately reflect its underlying profitability.

Furthermore, EBITDA can highlight a company's growth potential and attractiveness to investors and buyers. By understanding EBITDA calculation and analysis, business owners are better equipped to make informed decisions about their company's future and maximize its value.

Conclusion

In conclusion, the decision to use EBITDA versus net income for evaluating financial performance boils down to understanding the dynamics of a particular business.

For example, companies in highly capital-intensive industries, such as manufacturing and energy, rely heavily on depreciation and amortization expenses to demonstrate their true profitability. Similarly, investors assess a company's standing by looking beyond net income to measure how much cash flows into operations.

If a business operates with minimal capital expenditures, then net income can be used as an effective indicator of the financial health of that particular organization.

Thus, depending on the circumstances and the type of industry you are dealing with, either form of measurement can support your strategies and conclusions regarding a company's present position and future growth potential.

Related Metrics & KPIs