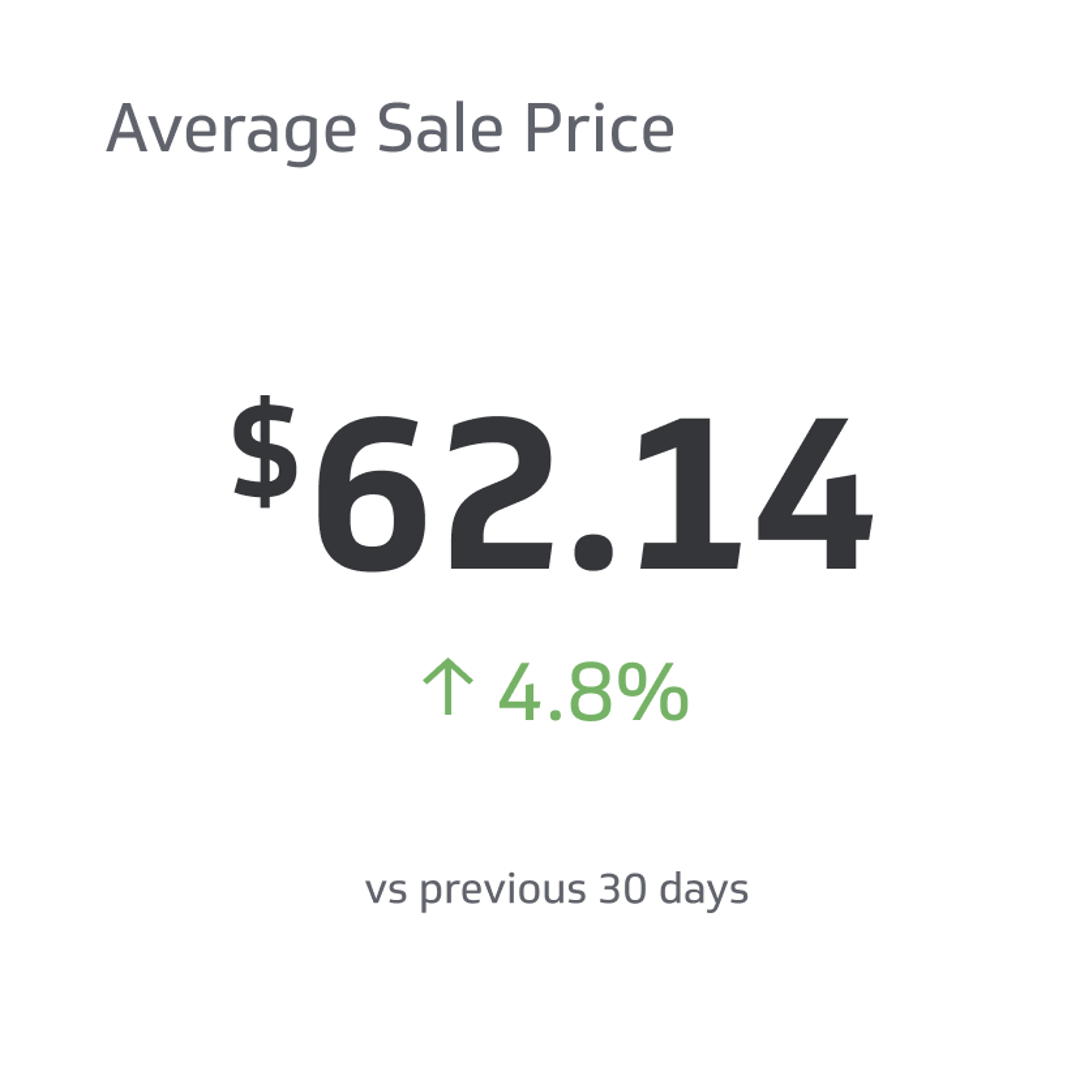

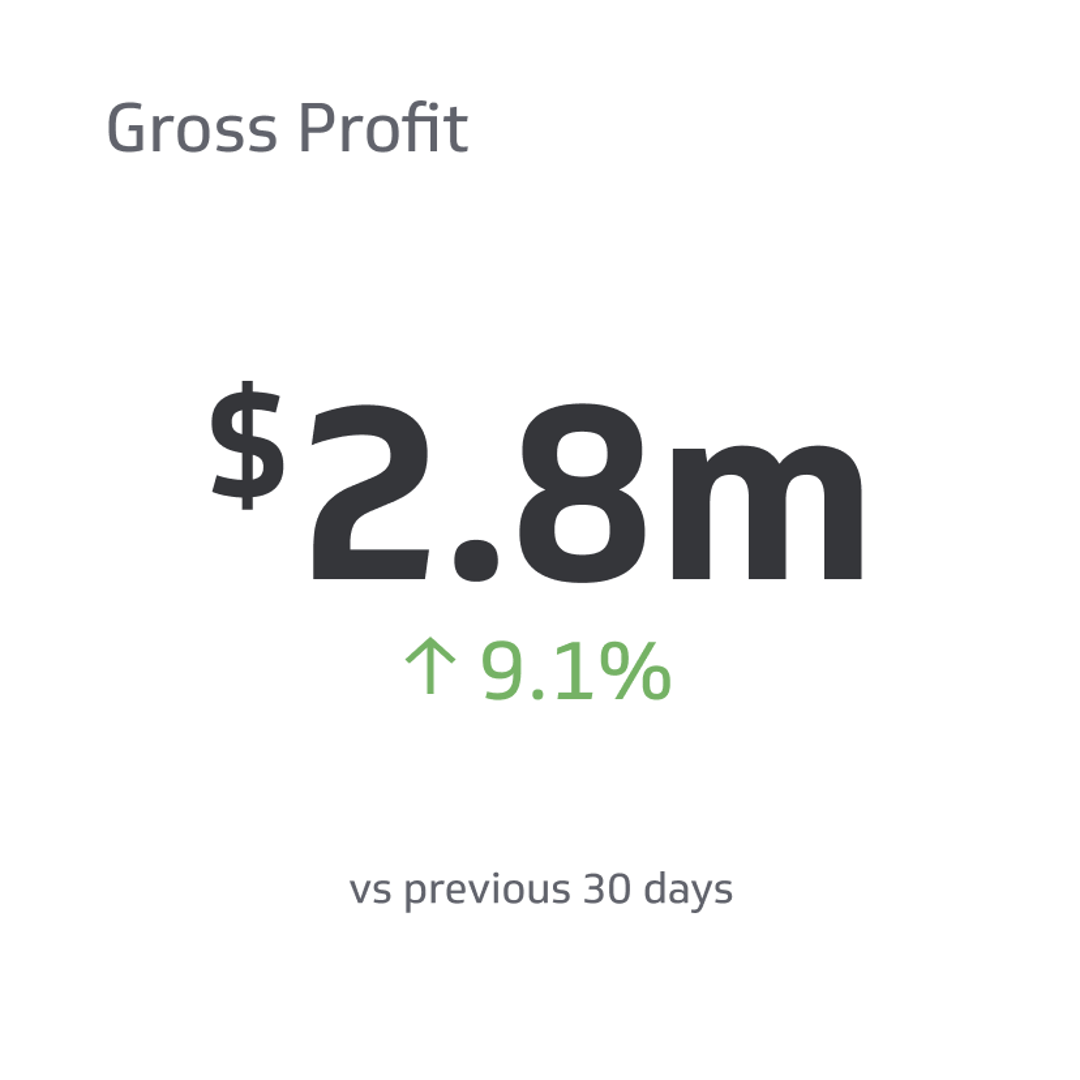

Gross Profit

It's a financial indicator highlighting the difference between a company's total revenue and the cost of goods sold (COGS).

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

As a business owner, investor, or stakeholder, you've likely encountered the term gross profit. This financial measure is one of many cornerstones for sizing up a company's economic well-being and operational prowess.

This guide will decipher gross profit, dive into its significance, and provide a step-by-step recipe for calculating and analyzing it, empowering you to make well-informed decisions regarding your business's financial performance.

What Is Gross Profit?

So, what exactly is gross profit?

It's a financial indicator highlighting the difference between a company's total revenue and the cost of goods sold (COGS). This valuable number shows how skillfully your company employs direct costs to generate income.

These direct costs differ based on the business, but examples include:

- Raw materials

- Direct labor (e.g., production workers' wages) and subcontractors

- Manufacturing supplies

- Inventory

- Freight and shipping charges

- Packaging materials

- Direct production equipment costs (e.g., machine maintenance)

- Utilities for production facilities

- License or royalty fees for production-related software or patents

However, it does this without considering overhead costs or other indirect expenses, making it a valuable tool for assessing your company's financial efficiency.

Why Is Gross Profit Important?

Gross profit is a linchpin of any business, determining a company's ultimate success or failure. It's the difference between just scraping by and soaring to new heights.

A substantial gross profit margin shows a company's ability to manage its costs effectively, maintain prices, and generate revenue.

Conversely, a low gross profit margin can be a red flag for investors and stakeholders, signaling potential problems with operations or pricing.

Assessing Efficiency

One of the most valuable aspects of gross profit is its knack for revealing a company's skill in managing its production and operational costs.

Over time, a business can use the gross profit to uncover positive or negative cost management trends, empowering companies to pinpoint areas for improvement or capitalize on their strengths.

Pricing Strategy

Gross profit also plays a big part in shaping a company's pricing strategy. By understanding the relationship between costs and revenue, a business can determine the proper pricing to cover expenses and generate profits.

Together with sales volume and other financial metrics, a thorough gross profit analysis can help fine-tune pricing strategies to maximize profitability.

Cost-Structure Analysis

A close look at gross profit can help businesses identify inefficiencies in their cost structures. By breaking down the components of the cost of goods sold (COGS), companies can spot areas where cost reductions are possible.

This process might involve negotiating better deals with suppliers, streamlining production processes, or cutting down on waste and inefficiencies.

Comparisons

In today's dog-eat-dog business world, companies must stay ahead of the pack to survive and thrive. One of the most crucial metrics for this is gross profit.

By comparing gross profits among industry rivals, companies can gain a valuable edge by identifying competitive advantages and areas for improvement.

Tracking gross profit margins over time can also help companies understand market shifts and make well-informed decisions.

Investment Decisions

Investors often see gross profit as a critical factor when making investment decisions. When companies prioritize raising their gross profits, they can attract and keep investors, secure funding, and chase new opportunities.

On the other hand, neglecting gross profit can lead to missed opportunities, reduced competitiveness, and, ultimately, business failure.

Financial Forecasting

In financial forecasting and planning, gross profit provides priceless insights. Businesses use historical gross profit trends to shape future revenue and expense projections.

Performance Evaluation

Lastly, gross profit can serve as a benchmark to evaluate the performance of different departments or product lines within a company.

Comparing gross profit across various segments can help identify areas that need attention or high-performing elements that enterprises can leverage for growth.

How To Calculate Gross Profit

Calculating gross profit is a straightforward process that subtracts the cost of goods sold (COGS) from the revenue generated during a specific period:

Gross Profit = Revenue - Cost of Goods Sold

Step-by-Step Calculation

1. Determine Your Revenue

Kick off your gross profit calculation by pinpointing your revenue. Consider the amount of money you've brought in from sales or services during a specific period, such as a month or a year.

2. Determine Your COGS

Next up, figure out your COGs, which include the cost of producing or purchasing the products or services you sold during the same period as your revenue calculation. Account for raw materials, labor, and other expenses directly related to producing or delivering the goods or services.

3. Subtract the COGS From the Revenue

You can now calculate your gross profit by subtracting your COGS from your revenue.

4. Interpret the Results

After calculating your gross profit, it's time to dig in and interpret the figure to comprehend your business's financial health.

Example #1

Retro Rides is not just any car dealership; it's a haven for vintage car enthusiasts, a treasure trove of rare finds and classic beauties.

But for owner John, the dream of expanding his inventory and reaching more customers hinges on a crucial metric: gross profit.

With careful analysis of Retro Rides' revenue and cost of goods sold, John can determine whether the business is generating enough profit to fuel his ambitious plans. The stakes are high, but the rewards of success are even higher.

In 2022, Retro Rides generated $2,500,000 in revenue, and the COGS, which included purchasing and restoring cars, was $3,000,000.

Gross profit = Revenue - COGS

Gross profit = $2,500,00 - $3,000,000

Gross profit = -$1,500,000

Therefore, the dealership experienced a loss of $500,000 for the year.

The stark reality hits John like a wrecking ball: his beloved Retro Rides is bleeding money. The loss of $500,000 is a bitter pill to swallow, but John knows that he must confront the harsh truth and take decisive action. He cannot afford to let his passion for vintage cars blind him to the urgent need for profitability.

Example #2

Green Pastures Farmstead is a community staple thanks to its commitment to sustainability and compassionate husbandry. For the farm's investors, it's also a business that requires a shrewd eye for profitability.

With the potential for growth and expansion on the horizon, they know that calculating gross profit is the first step towards unlocking the farm's full potential.

The farm generated $300,000 in revenue, while the COGS, which included the cost of seedlings, fertilizer, animal feed, and other farm-related expenses, was also $300,000.

Gross profit = Revenue - COGS

Gross profit = $300,000 - $300,000

Gross profit = $0

Despite not generating a profit, Green Pastures Farmstead's stability is a testament to the owners' commitment to sustainability, resilience, and hard work. However, to achieve their vision of growth and impact, they must be strategic in their approach to profitability without compromising their standards.

Example #3

The Furry Friends Pet Store is a paradise for pet enthusiasts, where they can find everything necessary to ensure their furry pals stay joyful and healthy.

For Lisa and Mike, the store's owners, success isn't only about wagging tails. They recognize their employees as the backbone of their business and want to reward them generously with bonuses.

Last year, the store raked in $1,500,000 in revenue. Their COGS, covering expenses like buying pet products from manufacturers, shipping fees, and other costs tied to purchasing and stocking items, totaled $800,000.

To calculate gross profit:

Gross profit = Revenue - COGS

Gross profit = $1,500,000 - $800,000

Gross profit = $700,000

The store earned a profit of $700,000 for the year.

With the financial wind at their backs, Lisa and Mike are eager to explore new horizons, invest in their business, and reward their employees for their invaluable contributions. With a profitable business and a passionate team, they are well-positioned to weather any storm and achieve their business goals.

Limitations of Gross Profit and Complementary Metrics

While gross profit is undeniably vital for assessing a company's financial health, it's crucial to acknowledge its limitations for making well-rounded decisions. Gross profit alone paints only a partial picture of a company's profitability since it omits operating expenses, taxes, and interest expenses.

For a more comprehensive understanding of a business's financial performance, it's wise to consider gross profit alongside other financial metrics like operating profit, net profit, and break-even analysis.

By delving into various financial metrics, businesses can unveil trends and fine-tune their operations, paving the way for long-term financial stability and success.

Complementary Metrics

Analyzing gross profit in isolation may lead to misleading conclusions about your business's financial health.

Instead, using complementary metrics alongside gross profit will provide a more comprehensive understanding of your company's performance.

Here are some complementary metrics to consider:

Operating Profit

Operating profit accounts for all costs involved in running the business. In addition to the cost of goods sold (COGS), operating expenses include salaries, rent, utilities, marketing, and other costs related to daily operations.

By subtracting COGS and operating expenses from revenue, operating profit considers all costs of producing and delivering goods and services, providing a more accurate picture of a company's true profitability.

In turn, this metric enables businesses to evaluate their financial performance holistically, identifying areas for improvement and making informed decisions about pricing, product offerings, and cost management.

Net Profit

Net profit, also known as net income, represents the money that a company retains after accounting for all expenses, including taxes and interest.

When it comes to measuring a company's financial performance and profitability, net profit reigns supreme. It is the ultimate measure of a company's financial health and sustainability, providing critical insights into its operations, management, and strategy effectiveness.

Gross Profit Margin

The gross profit margin is calculated by dividing gross profit by revenue and expressing the result as a percentage. Comparing gross profit margins across different time frames, products, or competitors can reveal trends and potential areas for improvement.

Contribution Margin

The contribution margin represents the difference between sales revenue and variable costs associated with producing or delivering a product or service. It reveals how much each unit sold contributes to covering fixed costs and generating revenue so businesses can prioritize their most profitable offerings.

Break-even Analysis

In business, it's not just about making money; it's about making intelligent, informed decisions that drive sustainable growth and success. That's where break-even analysis comes in.

Break-even analysis is a potent tool that empowers businesses to pinpoint the sales volume necessary to cover all their fixed and variable expenses. By grasping the number of sales needed to break even, companies can strategically plan their growth, foresee upcoming costs, and sidestep potential financial hurdles.

Operating Expense Ratio (OER)

The Operating Expense Ratio (OER) is another crucial metric to consider when handling operational costs, as it offers valuable insight into a company's cost management efficiency. Financial analysts reach the OER by dividing operating expenses by total revenue.

A low OER signifies operational excellence, meaning a more significant portion of income remains after covering operating expenses. Consequently, this boosts overall profitability, making the company more appealing to investors and stakeholders.

Final Thoughts

Gross profit is a fundamental financial metric for every business to track. By understanding how to calculate and analyze gross profit, companies can gain valuable insights into their financial performance and identify areas for improvement.

Comparing gross profit margins across different time frames, products, or competitors can reveal trends and potential areas for optimization.

Moreover, investors look to gross profit before investing, as it demonstrates a company's efficient cost management and growth potential.

By prioritizing maximizing gross profit, businesses can optimize their financial performance, make informed strategic decisions, and achieve sustainable success in today's dynamic and competitive business environment.

Related Metrics & KPIs