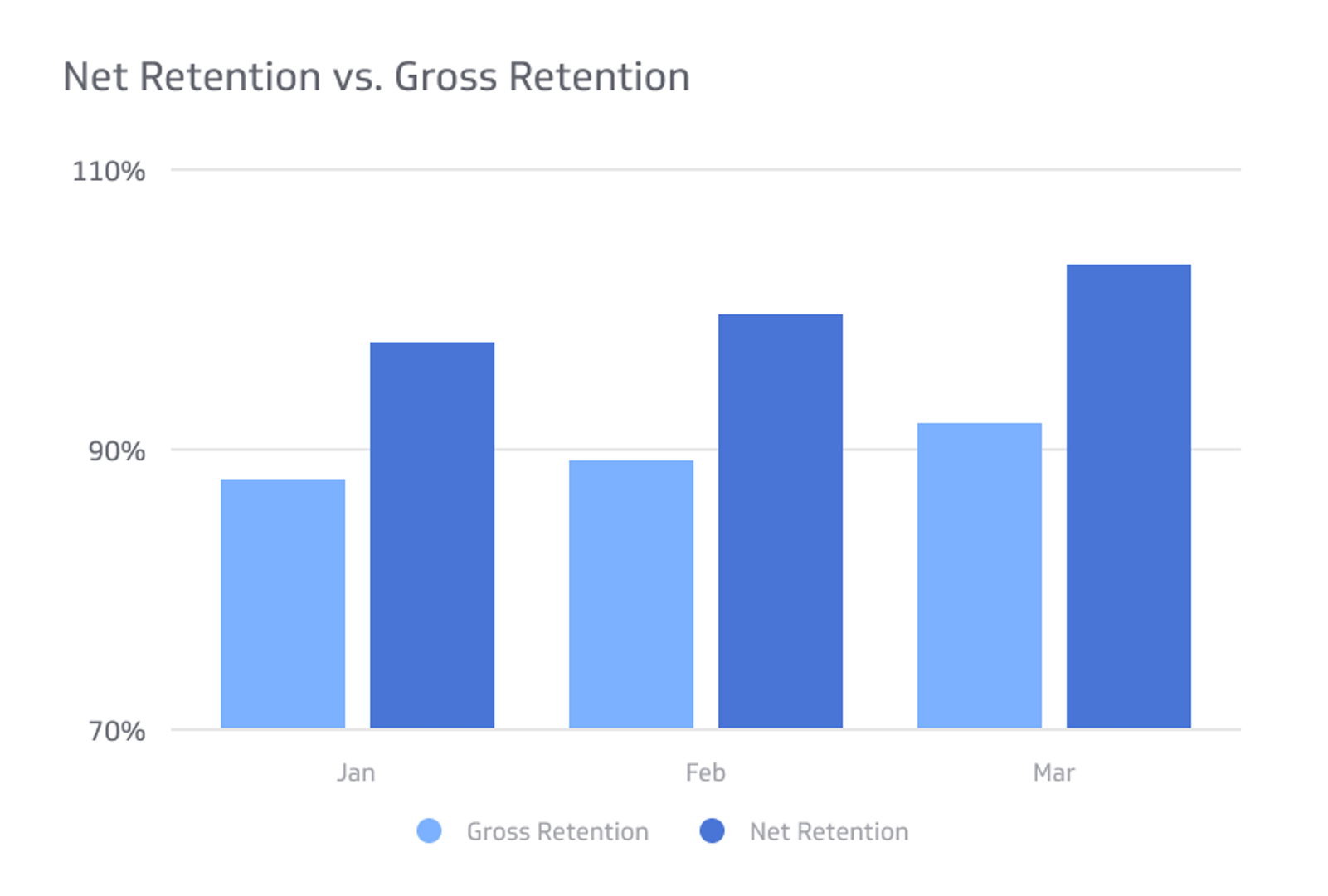

Net Retention vs. Gross Retention

Net retention and gross retention are crucial for maintaining success and growing a business.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Net retention and gross retention are crucial for maintaining success and growing a business. However, it’s easy to confuse these two metrics. This article will articulate the differences and explain why both metrics are essential.

Keep reading for all the information related to gross retention vs. net retention.

Definition of Net Retention

Net retention or net retention revenue shows your company’s ability to retain customers and expand your customer base. So, net revenue will include all revenue collected from existing and new customers. It also subtracts revenue churn, meaning lost clients or downgrades. Below is the equation for net revenue retention (NRR):

- NRR = (MRR + Expansion - Churn and Contractions) / MRR

MRR stands for Monthly Recurring Revenue, meaning the repeat and existing customers. As mentioned, churn refers to lost customers that were recurring before. So, churn includes canceled subscriptions, expired contracts, and membership downgrades. Contractions are typically a tiny aspect of this equation but refer to economic downturns that affect your company.

Net retention revenue metrics show your company’s capacity to keep customers and source new ones.

Definition of Gross Retention

Gross retention or gross revenue retention shows your company’s ability to keep customers, meaning recurring subscriptions or memberships. However, new customers are not in this metric. This financial metric helps you understand your company’s ability to keep customers long-term. The equation for gross revenue retention (GRR) is below:

- GRR = (MRR - Churn and Contractions) / MRR

The only difference between the GRR and NRR equation is the inclusion of revenue from expansion, meaning new customers. Gross retention vs. net retention boils down to new customers and expanding revenue. A similar way to understand gross revenue retention is to calculate customer retention, which is much simpler. Below is the equation for customer retention rate (CRR):

- CRR = 1 - (Customers Lost in a Period / Customers at the Start of a Period)

So if you begin January with 100 customers, but three (3) customers cancel memberships before the end of January, you divide three (3) by 100, equalling 0.02, and subtract that number from one (1). This leaves you with a customer retention rate of 97%.

While helpful, the customer retention rate does not factor in the monetary aspect of keeping and losing customers, which is why the GRR is beneficial in other ways.

Why Net Retention and Gross Retention are Important

So, why does gross retention vs. net retention matter? As mentioned, NRR reflects recurring and expanding revenue, while GRR shows only recurring revenue. These metrics are invaluable for companies when assessing their performance and projected revenue. The sections below will explain how and why both these metrics are essential in their own right.

The Importance of Net Revenue Retention

Your NRR offers a clear picture of your growth. Even companies with the most loyal customers should focus on expanding their member base and finding new clients to serve. Recurring customers are excellent. But, with new clients, companies can grow.

The number shows how many customers are standing by your company and how many new clients are coming in. Most companies strive for a healthy balance of new customers and existing customers. NRR can help business owners understand how well they balance these two aspects of retention and expansion.

The Importance of Gross Revenue Retention

GRR insights can help companies understand their customer retention rate. Recurring, long-term customers are substantially more likely to upgrade their membership, meaning higher profits. If your company struggles to retain members for over a few months, this is a sign that something could be improved, causing customers to leave.

Businesses may seem promising and successful if they sign hundreds or thousands of new members. However, the hype around these kinds of companies will eventually fade, and with loyal, recurring customers, they will succeed and fold.

If this is the case, revenue and profits may not show this negative trend until it’s too late, but GRR can show business owners problems with retention.

Why You Need Both Metrics

Now you know why these metrics are essential on their own. But, to fully understand your revenue and retention performance, you need both. The sections below detail the downfalls of focusing on one over the other.

Downfalls of Only Focusing on Net Revenue Retention

Unfortunately, many new companies place too much emphasis on NRR while ignoring GRR. Avoid this common business mistake by weighing both metrics equally. Below are the problems that can occur when you focus too much on NRR over GRR to help you understand why both metrics are essential.

Marketing Over Service

Subscription or membership-based companies should save significant labor and capital to keep existing customers happy. Only assessing your NRR can cause you to misuse funds and pivot too hard toward marketing and away from attentive service or quality products.

This mistake means the company neglects existing customers to put energy toward pulling in new clients.

Low Customer Satisfaction

Ignoring GRR and prioritizing NRR often means neglecting existing customers. Low customer satisfaction means canceled memberships and lower NRR and GRR. But it can also cause negative reviews and hurt your brand reputation, lowering your sales potential and, eventually, your NRR.

Unnatural Behavior

If you focus too much on NRR and ignore GRR, your company may begin to behave unnaturally, doing custom work and one-off products to try and grow the net revenue retention rate.

This behavior needs to be more sustainable and completely ignores the value of loyal customers. It also compromises the product or service roadmap of the company.

Uneven Customer Experience

With NRR, companies may let lower-tiered memberships fall by the wayside, causing more customers to cancel. NRR insights value bigger customers more than smaller ones, which can lead to an uneven customer experience.

While it can be beneficial to treat higher-tiered members better, mistreating or wholly neglecting lower-tier members can cause problems.

Downfalls of Only Focusing on Gross Revenue Retention

The sections below explain the downfalls of exclusively focusing on the information you can deduce from GRR. The core problem with neglecting NRR in favor of GRR is that it can prevent companies from stagnating. When assessing GRR, try to avoid the following pitfalls.

Marketing Neglect

Coca-Cola is the number one soft drink on earth and has been for decades. Nevertheless, they spend billions of dollars every year on marketing. Why do they do this? Because advertising and marketing are everything. It keeps customers coming back and also entices new ones.

No matter how successful your business is and impressive your profits are, marketing should always be a priority. Still, a tight focus on GRR can lead you to neglect your marketing strategy.

Less Focus on Expansion

As mentioned, even companies with wonderfully loyal customers should still work to grow their business. Satisfied customers may cancel memberships for different reasons, such as financial struggles or relocation. You can’t expect your loyal customers to be around forever, so always look for new customers to help grow your business.

No Customer Segmentation

With customer segmentation, your business strategy values big and small customers but accounts for various membership tiers. When you pay attention to GRR, you need more insight to create effective customer segmentation so customers receive service according to their tier. This can make higher membership tiers less appealing to customers, resulting in fewer upgrades.

Industry Benchmarks to Consider

When assessing your net and gross revenue numbers, you need something to compare them to to make informed business decisions moving forward. Below is a brief overview of the NRR and GRR industry benchmarks that you can use to determine your company’s performance.

Several factors determine GRR and NRR averages, including company size, whether it's a public or private company, and your type of business. This article will focus on GRR and NRR industry benchmarks for SaaS (Software as a Service) companies because they use memberships and subscriptions. Keep in mind GRR can never be over 100%.

Benchmarks according to public versus private companies:

- For public companies, the median NRR is 114%

- For private companies, the median NRR is 104%

- For public companies, the median GRR is 90%

- For private companies, the median GRR is 89%

Benchmarks according to company size:

- For companies worth up to $25 million, the median NRR is 148%

- For companies worth $25 to $50 million, the median NRR is 95%

- For companies worth $50 to $100 million, the median NRR is 60%

- For companies worth up to $25 million, the median GRR is 90%

- For companies worth $25 to $50 million, the median GRR is 90%

- For companies worth $50 to $100 million, the median GRR is 88%

You can keep these numbers in mind when assessing your metrics. Ideally, NRR should be over 100%, and GRR should be 100% or at least 90%.

How to Improve These Metrics

If you read the industry benchmarks above and feel that your company metrics fall short, you can work to improve your GRR and NRR. The sections below will offer tips for improving your GRR and NRR, depending on what metrics need work.

Improving Net Revenue Retention

NRR rates can range wildly from 80% to 150%. Even if your NRR is already above 100%, there is always room for improvement. Check out tips for improving NRR below.

Entice Free Users

One of the best ways to increase your NRR is to entice your freemium users, meaning users who don’t pay for your service, to upgrade to a paid plan. You can entice them by offering limited-time subscription discounts or simply prompt them to upgrade with app pop-ups frequently.

In-App Obstacles

In-app obstacles sound bad, but it’s pretty standard. You can put obstacles in front of free users that may convince them to sign up for a paid membership. It can also work to encourage paying members to upgrade to the next tier. Obstacles include commercials they cannot skip or close, limited access to top features, or restricted feature use.

Invest in User Data

Lastly, invest in user data to help you understand your service's successful aspects and areas that need work. User data gives you insight so you can capitalize on expansion opportunities and give users more of what they want and less of what they don’t.

Improving Gross Revenue Retention

GRR is an easy metric to assess because the goal is 100%. If your GRR is substantially below 90%, try following the tips below to improve it.

Improve Navigation and Accessibility

If your app or platform could be more comfortable and navigate, it will likely lead to canceled memberships. People want simple and intuitive layouts.

Focus on UX and UI to improve customer retention and offer a thorough onboarding process with guided tours so people fully understand the platform and don’t get frustrated.

Utilize Behavior Analytics

Like with NRR, analyzing user data can help you improve GRR. Instead of focusing on how freemium users behave, consider how existing users behave, like what pages they close the most, friction points, and other behavioral information.

Prioritize Customer Support

Above all, if you want to improve your GRR, you must provide existing clients with exceptional customer service. This means having a top-notch customer support team, but it also helps to implement self-service support features, so users can help themselves with minor problems and don’t need to wait for a human to respond.

Final Thoughts on Net Retention Vs. Gross Retention

It’s easy to get wrapped in one metric and neglect the other. Hopefully, this article has shown you how both metrics are valuable in their ways.

To build a successful SaaS business, net revenue retention and gross revenue retention should be priorities, as keeping customers is just as crucial as bringing in new customers.

Related Metrics & KPIs