Average Profit Margin Metric

Measures the average profit generated from the sale of a specific service, product or product/service category.

Track all your Sales KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Finance is one of the most important aspects of running a successful business. One key financial metric that business owners should pay close attention to is the average profit margin.

Let’s explore what the average profit margin is and why it is important for businesses.

What is Average Profit Margin?

Average profit margin is a financial metric that measures the efficiency of a business in converting sales into revenue. It represents the percentage of revenue that remains as company profit after accounting for all expenses and additional production costs.

Typically, your average profit margin is the average net profit margin, which measures the profitability of a business after accounting for all expenses.

How to calculate your average profit margin

To calculate your profit margins, you need to divide your net profit by your total revenue and multiply the result by 100 to get a percentage. The exact formula is:

Average Profit Margin = (Net Profit / Total Revenue) * 100

For example, let's say your net profit, minus costs of goods, is $50,000, and your total revenue is $500,000. To calculate your average profit margin, you would divide $50,000 by $500,000, which equals 0.1. Multiply 0.1 by 100, and you get an average of 10%, which is equal to 10%.

Interpreting your average profit margin

Once you have calculated your average profit margin, it’s time to interpret its result.

A high profit margin (ranging from 10% or higher) indicates that you are generating a significant amount of profit from sales. This suggests that your business is efficient in converting revenue into profits and may be financially healthy.

On the other hand, a low profit margin (which is below 5%) may indicate that your business is struggling to generate sufficient profits. This could be due to high costs, low pricing, or inefficiencies in your operations. It's important to identify the underlying causes and take steps to improve profitability.

Net Profit Margin vs. Gross Profit Margin

Net profit margin and gross profit margin are two important metrics used to assess a company's financial performance. While both metrics measure profitability, they focus on different aspects of the business.

Gross profit margin

Gross profit margin evaluates the profitability of a company's core operations by comparing the gross profit (revenue minus cost of goods sold) to revenue. It indicates how efficiently a company is generating profit from its direct production or service costs.

While gross margins are useful for analyzing the profitability of individual products or services, they’re not as comprehensive as net profit margin since it doesn't take into account other operating expenses, such as overhead costs.

Net profit margin

Net profit margin, on the other hand, provides a more comprehensive picture of a company's profitability by considering all operating expenses. This includes taxes and interest. It measures the percentage of revenue that a business owner brings home after deducting all expenses.

While both metrics are important, the net profit margin is often considered a more accurate measure of a company's overall financial health and profitability. Nonetheless, you should still check your company’s gross profit margin and compare it with your net profit margin. Sometimes, there’s a huge difference between the two.

How to Use Average Profit Margin as a Business Tool

Now that you understand how to calculate your profit margins, it’s time to explore how you can use it as a valuable tool for your business. Below are some ways to effectively leverage this metric:

Use it to set financial goals

Use your profit margin as a starting point to set financial goals for your business. Increase your profit margin over time by implementing strategies to improve efficiency, reduce costs, and increase revenue, such as optimizing pricing strategies and expanding your customer base.

Monitor profitability over time

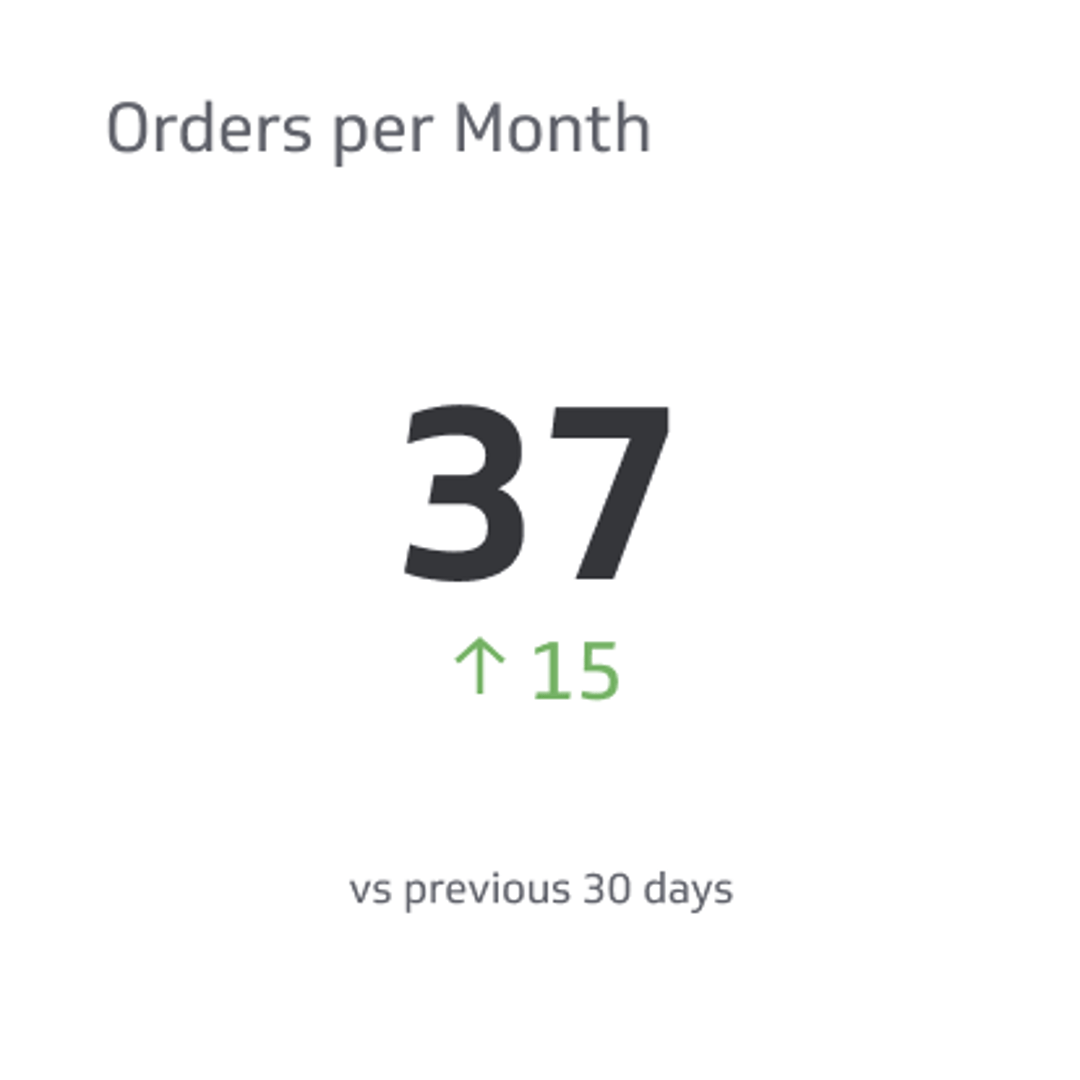

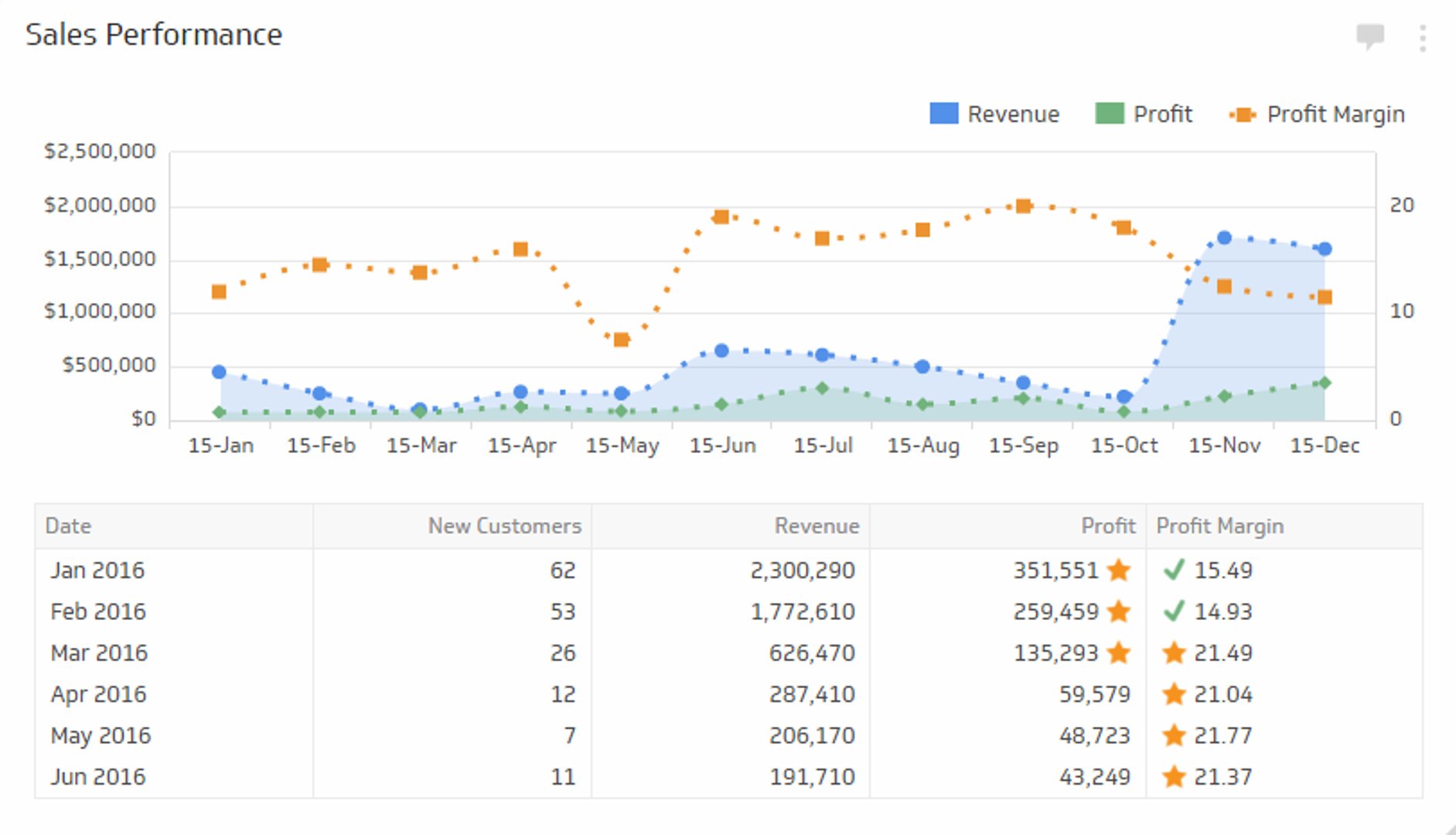

Calculate your profit margin regularly to track how it changes over different periods. This will help you identify trends and potential issues in your business's financial performance.

It also helps you determine which specific products or services are the most profitable. This information can guide you in making decisions about product offering costs, marketing strategies, and goods allocation.

Compare against industry benchmarks

Another way this metric can help is by researching industry averages for profit margins and comparing them to your own. By doing so, you get an idea of how well your business is performing relative to others in your industry.

Identify areas for improvement

If your average profit margin is lower than industry benchmarks, it may indicate areas where you can make adjustments to increase profitability. Analyze your expenses, pricing strategies, and operational efficiency to identify opportunities for improvement.

Profit Margin Analysis Tools and Software

Checking your financial performance and analyzing your profit margins can be made easier with the help of various tools and software. Here are some options to consider:

Accounting software

Accounting software such as QuickBooks or Xero lets you track your revenue, expenses, and calculate your profit margins automatically. They also provide financial reports that can give you insights into your business’ financial performance.

Profit margin calculators

Online profit margin calculators can help you calculate your profit margins based on your revenue and expenses. Simply input the necessary data, and the calculator will provide you with the results.

Omni Calculator and Calculator Soup are online resources that offer profit margin calculators.

Financial analysis software

Financial analysis software, such as Bloomberg Terminal or FactSet, can provide in-depth analysis of your profit margins and compare them to industry benchmarks. These tools offer advanced features and data integration capabilities to help you make strategic business decisions based on your profit margin analysis.

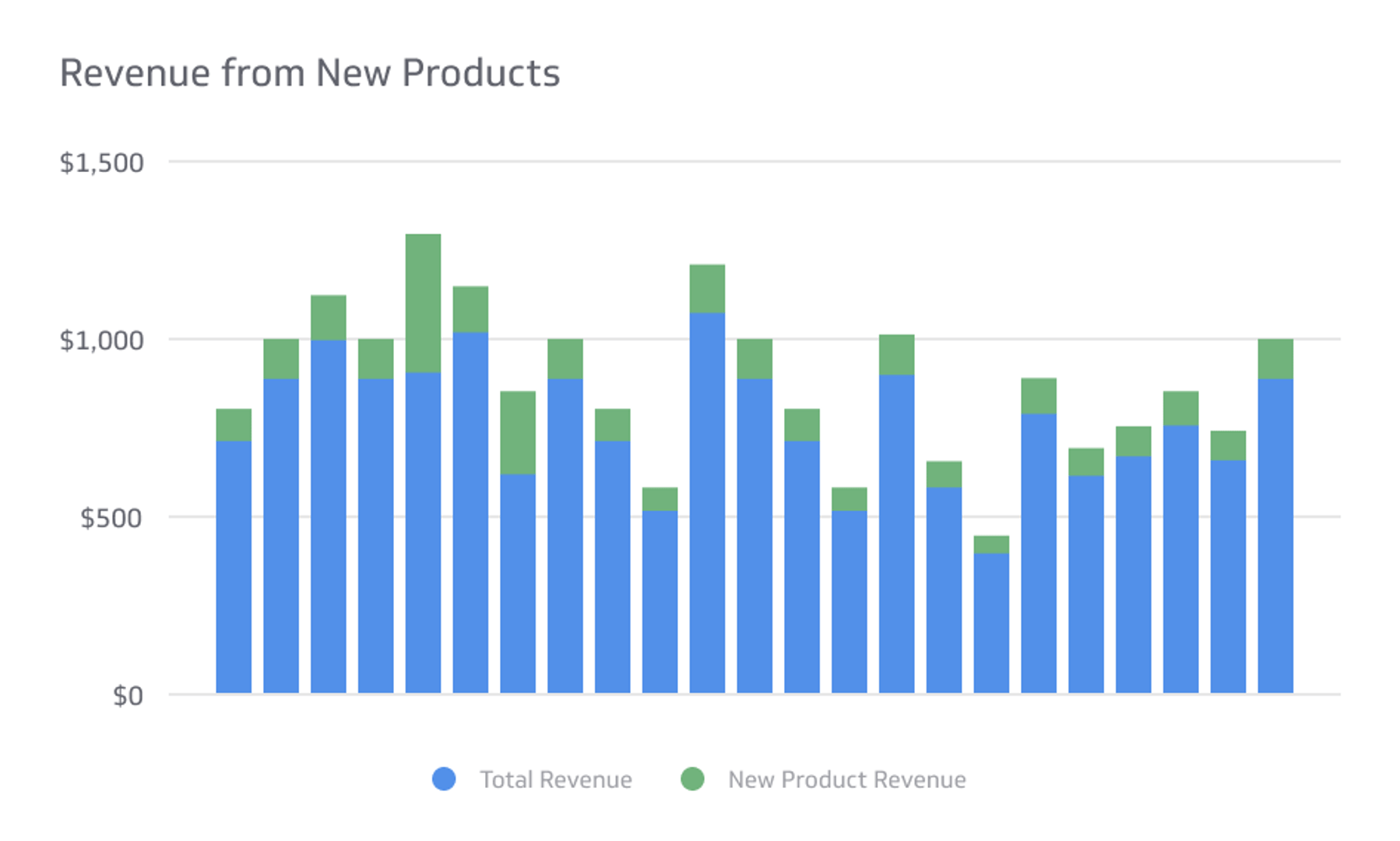

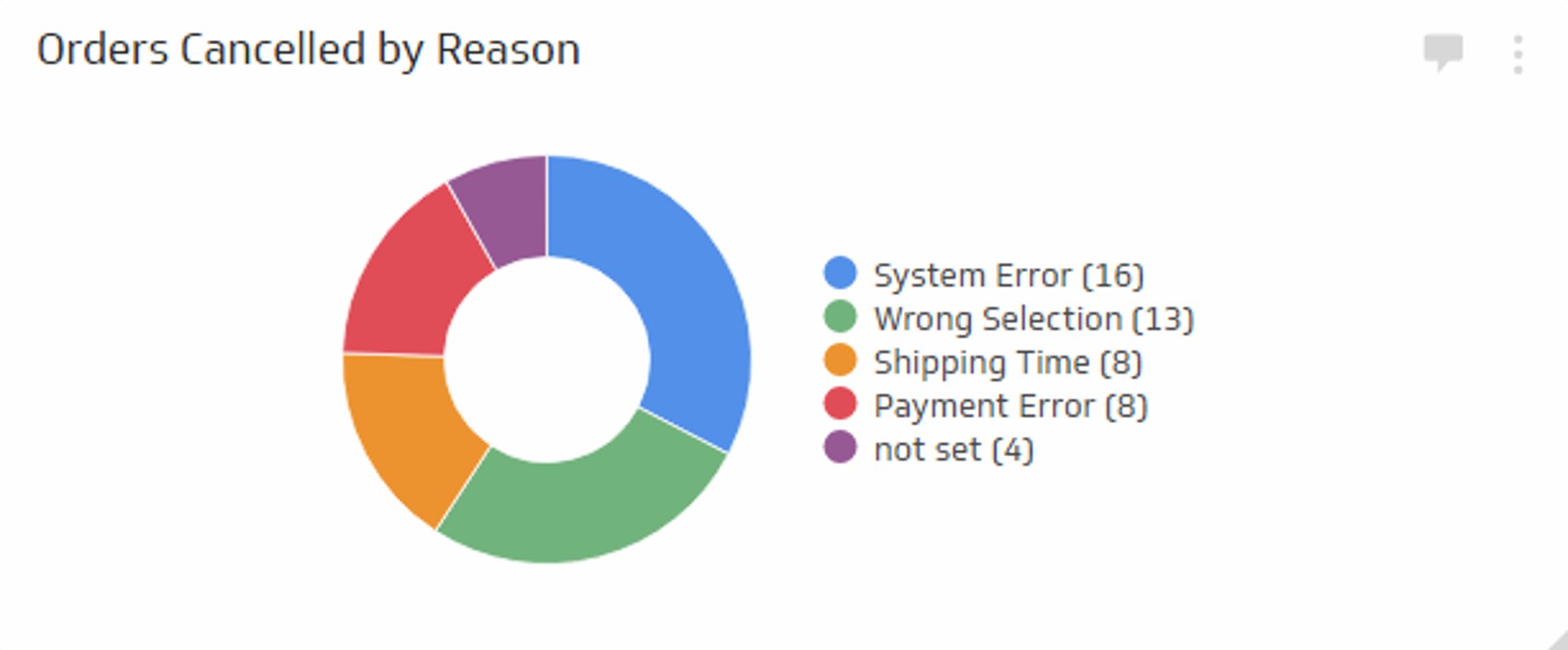

Data visualization tools

Aside from accounting, calculating, and analysis tools, you also need a data visualization tool to present your profit margin analysis in a clear and visually appealing way.

Tools like Klipfolio allow you to create interactive charts, graphs, and dashboards to showcase your financial data effectively. This way, you can easily communicate your profit margin analysis to stakeholders and make informed business decisions based on the visual representation of your data.

How to Increase Your Average Profit Margins

To increase your business’s average profit margins, consider these strategies:

Optimize your pricing strategies

Review your pricing regularly to make sure it aligns with market demand, production costs, and competitor pricing. Don’t be afraid to adjust your prices if necessary to maintain profitability. As long as you do market research to understand your customers' willingness to pay, you can adjust your pricing strategically.

Expand your market

Look for opportunities to reach new markets and expand your customer base. You can target different demographics, enter new geographic regions, or offer your products and services on more platforms to reach a wider audience.

Reduce costs

Identify and eliminate unnecessary expenses. For instance, you can negotiate better deals with suppliers and cut back on non-essential expenses. This way, you can improve your profit margins without affecting the quality of your products or services.

Another way to reduce costs is by streamlining your operations and improving efficiency. Look for ways to automate processes, eliminate bottlenecks, and optimize resource allocation. This can help you reduce wastage and minimize downtime, which, ultimately, lowers your expenses and increases profit margins.

Focus on high-margin products or services

Analyze your product or service offerings and identify the ones with the highest profit margins. Focus on selling them to maximize profitability. You can cut back or even discontinue low-margin offerings since they don’t contribute that much to your bottom line.

Prioritize customer experience

A satisfied customer base can lead to repeat business and referrals. Make sure to prioritize customer experience by addressing customer needs and concerns and seeking feedback to continuously improve. Happy customers are more likely to become loyal customers, which can lead to increased sales and higher profit margins over time.

Diversify revenue streams

Finally, explore opportunities to diversify your revenue streams by offering complementary products or services. This can help reduce risks associated with relying heavily on a single product or market.

The Best Profit Margins by Industry

Different industries have different margins due to varying business models, cost structures, and market dynamics. Here’s a list of the top 30 industries with good average net profit margins:

Industry | Average Net Profit Margin |

Aerospace & Defense | 5.7% |

Agricultural Inputs | 3.9% |

Asset Management | 22.9% |

Auto & Truck Dealerships | 5.4% |

Banks - Regional | 27.7% |

Beverages - Wineries & Distilleries | 8.7% |

Building Materials | 15% |

Building Products & Equipment | 8.8% |

Capital Markets | 11% |

Chemicals | 5.5% |

Credit Services | 22.4% |

Drug Manufacturers - General | 17.3% |

Financial Data & Stock Exchanges | 27.8% |

Furnishings, Fixtures & Appliances | 2.9% |

Gold | -0.9% |

Insurance - Specialty | 18.5% |

Oil & Gas E&P | 23.4% |

Oil & Gas Integrated | 10.9% |

Oil & Gas Midstream | 19.1% |

Packaging & Containers | 3.3% |

Personal Services | 6.4% |

Pharmaceutical Retailers | -25.2% |

Pollution & Treatment Controls | 5.2% |

REIT - Industrial | 25.7% |

REIT - Mortgage | 20.3% |

REIT - Residential | 15.5% |

REIT - Retail | 22.1% |

Rental & Leasing Services | 11.8% |

Residential Construction | 11% |

Utilities - Regulated Water | 16.4% |

Source: https://fullratio.com/profit-margin-by-industry

The Key to Financial Health and Growth

Knowing your company’s average profit margin can help you evaluate your financial health and identify areas for improvement. For example, having a high gross profit margin but low net profit margin can indicate that the company is experiencing high overhead costs or other operating expenses that are impacting its profitability.

On the other hand, if the gross profit margin is low but the net profit margin is high, your business may be experiencing low production costs or effective cost management strategies. Be sure you’re implementing the right strategies to make your business more profitable and sustainable.

FAQs

How can a business improve its average profit margin while managing labor and other expenses?

To enhance profit margins, businesses need to optimize labor management and control other expenses. This involves analyzing labor costs as a part of total expenses and finding ways to increase efficiency.

Regularly reviewing and adjusting operational processes can lead to more effective expense management, contributing to improved profit margins.

What role do revenue and costs play in determining a company's profit margin?

Revenue and costs are crucial elements in calculating a company's profit margin. The profit margin is derived by subtracting total costs, including labor and goods, from revenue, and then dividing this figure by the revenue. Understanding this relationship helps businesses make informed decisions to maximize profit, such as adjusting pricing strategies or reducing unnecessary costs.

In what ways can analyzing profit margins help a restaurant business?

For a restaurant, analyzing profit margins is vital for financial health. By examining the gross profit margin and net profit margin, restaurant owners can understand how effectively they are converting sales into profits. This involves managing food costs, labor, and other operating expenses. Restaurants can use this data to adjust menu pricing, control costs, and improve overall profitability.

How does the average profit margin vary across different industries?

Margins can vary significantly across industries due to differences in cost structures, pricing strategies, and market dynamics. For example, industries like technology and finance might have higher margins compared to more labor-intensive industries like restaurants or retail. Businesses should compare their profit margins with industry benchmarks to gauge their performance.

What metrics should businesses track alongside profit margins for a comprehensive financial analysis?

Alongside profit margins, businesses should track metrics such as gross margin, net margin, operating profit margin, sales growth, and expense breakdown. These metrics provide a more complete picture of financial health and operational efficiency.

For instance, a high gross profit margin with a low net profit margin might indicate high operating costs, signaling areas for potential improvement.

Related Metrics & KPIs