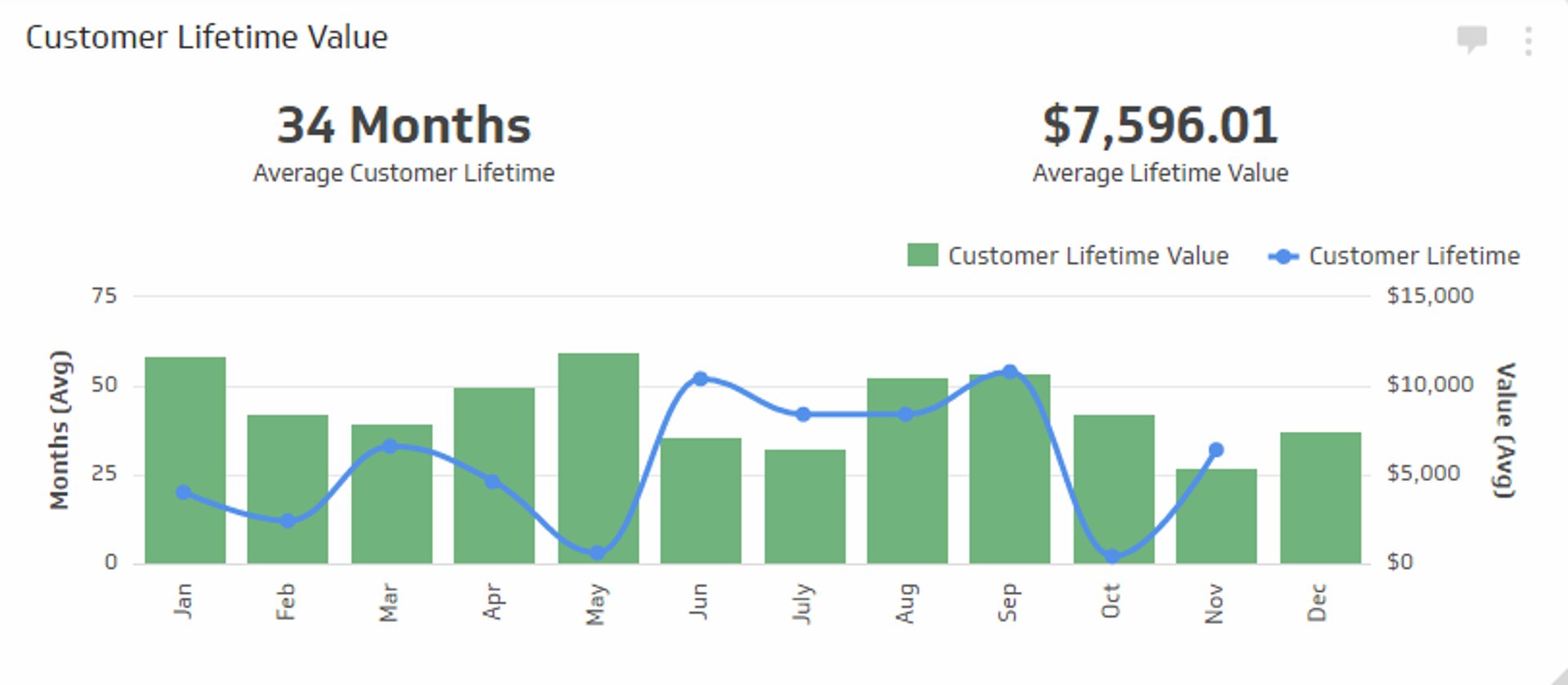

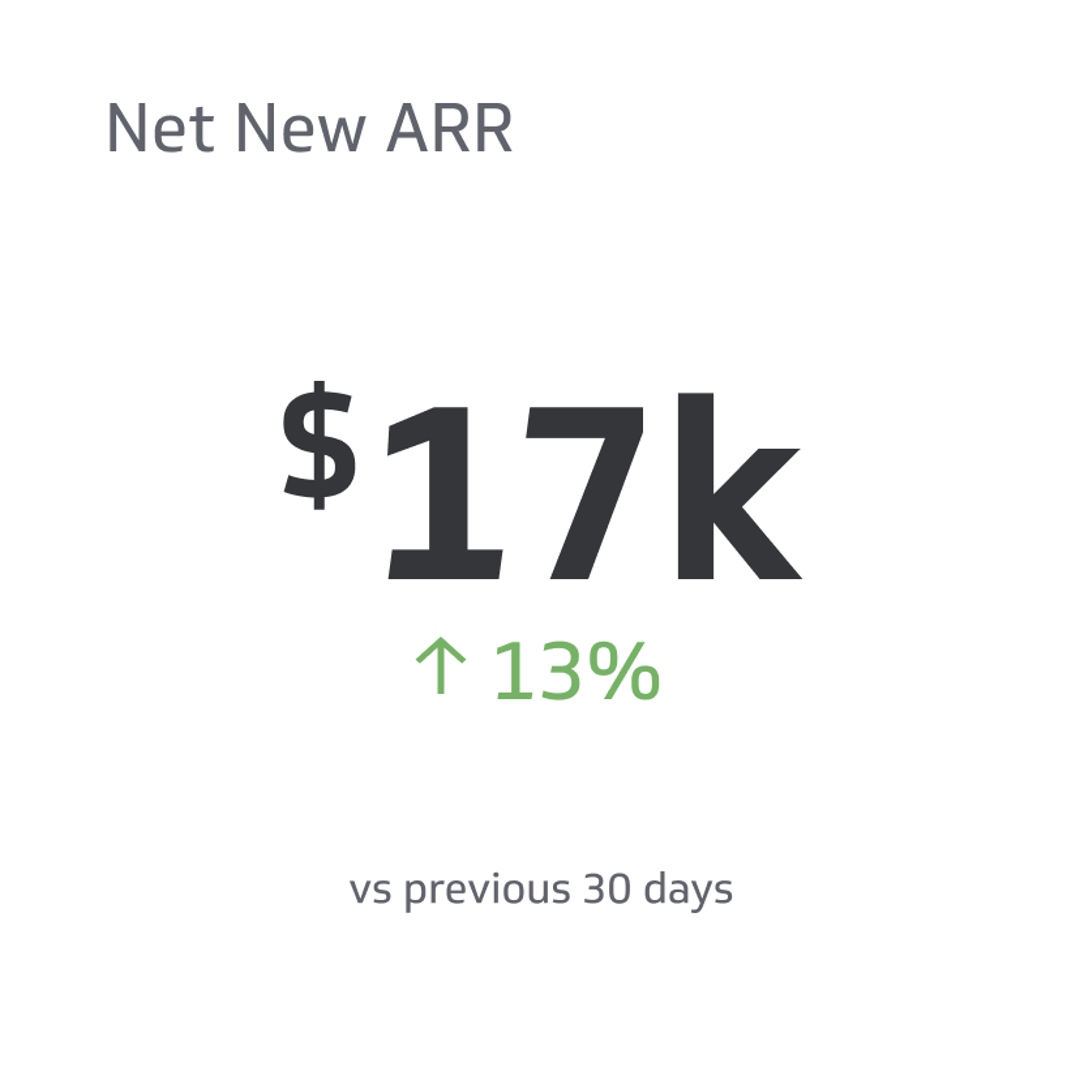

Net New ARR

Net New ARR gives a business owner a snapshot of the organization's health annually and allows for more accurate sales forecasting, budget formulation, and work volume.

Track all your SaaS KPIs in one place

Sign up for free and start making decisions for your business with confidence.

One very important business metric is New Net Annualized Recurring Revenue (ARR) (or Net New ARR.) More than most standard benchmarks, the New Net ARR gives a business owner a snapshot of the organization's health annually and allows for more accurate sales forecasting, budget formulation, and work volume.

Here is all you need to know about New Net ARR, what it is, why it matters, and how managers use it to identify growth areas, challenges, and ways to improve a business's longevity and financial health.

What New Net ARR Is and Does

As a business metric, New Net ARR is pretty simple. In the most basic terms, New Net ARR is the total annual recurring revenue a business takes in over one year. The revenue differs from one-time revenue and from revenue sources that cease to produce. New Net ARR revenue includes, but is not limited to:

- Subscription fees

- Client fees

- Annual contracted sales (license agreements, etc.)

Businesses with these types of fees count on that revenue year in and year out. The New Net ARR formula is Annual Recurring Revenue that exists in the current year minus the ARR from the previous years.

So, if a company had an ARR of $1M last year and a current year ARR of $1.5M, its New Net ARR would be $500,000.00. If that business had a current ARR of less than $1M, the New Net ARR would be in the red for the difference between the two ARR calculations.

How New Net ARR is Used

Business leaders and decision-makers use New Net ARR to monitor performance from one year to the next. The ARR also gives those same leaders a hard-set number to rely on when deriving financial forecasts.

Because the definition of recurring revenue is subjective, the ARR and the New Net ARR cannot be used for accounting or taxes. It can be used as a forecasting tool when talking to investors or presenting financial predictions to secure a loan.

It is great, however, in the following two areas:

- Assessing the overall health of a business

- Forecasting revenue growth overall by unit and department

On a macro level, a business can use New Net ARR as one tool to get a snapshot of the overall health trend of a business. An owner or CEO can use this figure to compare to competitors to get a sense of how healthy the company is compared to the competition.

On a micro level, individual departmental managers can use the New Net ARR to help predict sales growth, increases in revenue, resource needs, and employee work projections.

In between the micro and the macro, business managers can formulate departmental budgets based on the growth of New Net ARR, particularly if the growth is maintained year over year.

How Net New ARR Is Used

Apart from being used as one of a slate of forecasting tools, there are several other reasons keeping track of the New Net ARR is important.

Cash Flow Management

Since a healthy business' recurring revenue is usually reliable annually, knowing the New Net ARR allows financial managers to forecast cash flow. Equally as important, the metric allows managers to foresee and plan for cash crunches.

A business that knows the ebb and flow of its ARR can set aside funds for tight times and know when it can invest in the business. That business can also use its cash flow projections to plan improvement projects and capital expenditures without worrying about sudden cash crunches.

Business Model Analysis

A growing business should have an annual and growing ARR. Not producing new ARR, or worse, losing ARR, are indicators the business model needs help. Understanding the state of the New Net ARR lets business managers look at cost centers and areas a business is growing when other areas are not.

Additionally, the New Net ARR lets businesses assess the health and relevance of their products and services concerning customer perceptions. Robust growth in ARR is a good indicator that customers are happy with the products, services, and business. Stagnant ARR or declining numbers are a good indicator that something is amiss with one or more of the following:

- Products

- Services

- Customer Service

- Quality of the product

A manager armed with that information can develop a method to collect customer feedback and find out why something that once worked is no longer producing as it did. Depending on where the issue or issues lie, the business can modify to meet the needs and desires of its customers.

Informed Investor Decisions

From the business perspective, New Net ARR can be used to formulate revenue projections when talking to investors. From the investors' perspective, knowing a business' ARR and New Net ARR can help them decide whether to invest in the business. If the business managers do not have a good reason for stagnant or declining ARR, investors can be forewarned.

Prospects

New Net ARR is a tool to help predict growth projections as well as the overall direction of a company. ARR does not usually suddenly disappear, which means over time, it can help establish a growth trend that can then be used to extrapolate future growth. Further, if a company has a bad New Net ARR, it can identify areas that need help.

Tracking Customer Behavior

New Net ARR presents a clear picture of how much a business has grown, stagnated, or shrunk revenue-wise over the previous year. In cases where there is no growth or growth is stagnant, a business can assess its customer behavior and determine if there is a specific area revenue has shrunk or a particular product or service customers have stopped using.

Lessons Learned

Understanding why a customer has stopped using a product or service can help a business reposition itself to get its old customers back and how to position itself for new customers. Very few businesses have ARR growth in areas a market is moving away from. If customers are not using a product or service, it stands to reason potential customers will not as well.

New Net ARR Is An Essential Business Tool

Very few SaaS business metrics are as simple as New Net ARR. Likewise, very few metrics are useful in as many ways as a New Net ARR. From forecasting to diagnosing to deciding what resources are needed to grow or handle incoming business, the New Net ARR is one tool no business can ignore.