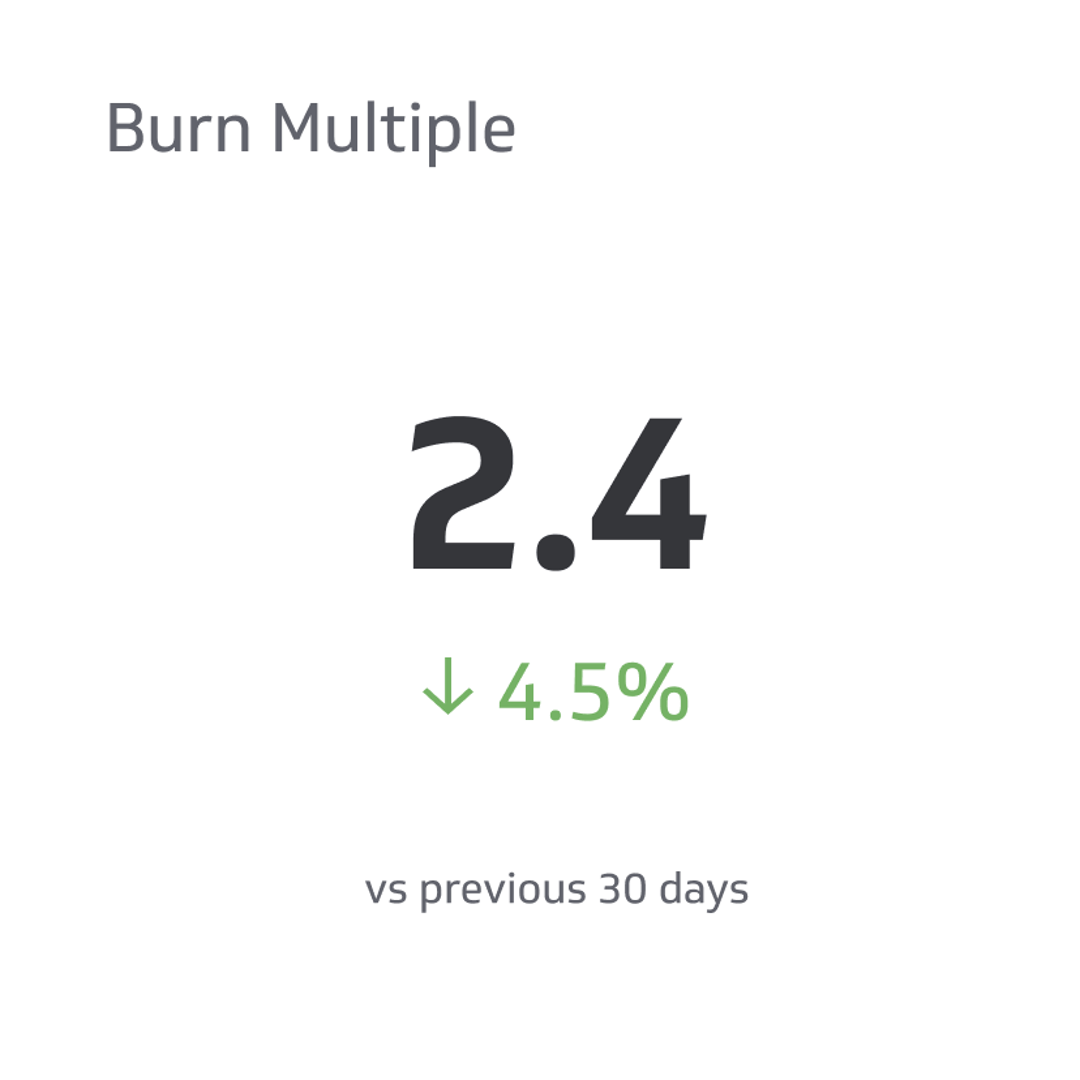

Burn Multiple

Burn multiple is the amount of funds a business burns before becoming profitable.

Track all your SaaS KPIs in one place

Sign up for free and start making decisions for your business with confidence.

In the venture capital and startup world, you must understand a company's financial health. One key metric you can use to evaluate your company’s financial robustness is burn multiple. Burn multiple helps entrepreneurs comprehend the amount of money that a business burns before becoming profitable.

Moreover, it helps investors know the money a company burns through before reaching a viable cash flow. When the burn multiple is high, it means that the startup or company is burning so much to accomplish each growth unit.

What is Burn Multiple?

Burn multiple is the amount of funds a business burns before becoming profitable. You can calculate the burn multiple by dividing up the total money your company has made by the total money it will burn through to reach profitability. If you’re an investor, burning multiple can help you know how much money you’ll have to spend in your company before you see any profit.

Why is Burn Multiple Important?

Burn multiple is essential if you want to know your company’s financial health. If your company has a high burn multiple, it means that you’re spending a lot of money without generating enough revenue. And if this is the case, it is a huge red flag for you as an investor or entrepreneur. It’s a red flag because your company or business might quickly burn its cash reserves.

Alternatively, if your company has a low burn multiple, it’s a positive sign for you as an investor. This is because it means your company is yielding revenue and on the right path to becoming lucrative.

Here are a few reasons why burn multiple is important:

- It helps in giving insight into a company’s capacity to handle its credit obligations.

- Another thing that makes burn multiple important is its ability to measure how many times businesses run income to cover their return expenses.

- It helps lenders and investors in the evaluation of the financial health and creditworthiness of a company.

- It’s beneficial in helping businesses determine their interest charges on loans and borrowing capacity.

How to Calculate the Burn Multiple

Calculating the burn multiple is a very straightforward process. If you’re stuck about how you can calculate your company’s burn multiple, worry no more.

Here is a guide on calculating your company’s burn multiple:

Ascertain the Total Amount of Money Raised by the Business or Company

To calculate a company’s burn multiple, you first have to find out the total money the company raised. The total amount of money includes all the funds that the company or startup has raised from sources of funding such as:

- Grants

- Equity financing

- Debt financing

Grants are sources of funding provided by foundations, government agencies, and other institutions to support or help initiatives and projects. On the other hand, equity financing is selling a part of a company’s ownership to investors in exchange for funds. Debt financing entails borrowing money from private investors or banks, and then you pay it back with interest.

To determine the money raised, consider every source of funding. Moreover, among the sources of financing, you should consider the money that the management team or founders have invested in the company. After knowing the total funds the company raised, you can go to the next step of calculating burn multiple.

Determine the Money the Company Plans to Burn

This is the next crucial step of calculating burn multiple. To ascertain how much money the company plans to burn, you have to analyze the company’s business plan and financial statements.

These documents are crucial since they clearly show the business's operating expenses. Some of the company's operating expenses include

- Rent

- Salaries and wages

- Utilities

- Marketing expenses

You should consider the current burn rate and the anticipated burn rate when you’re calculating the burn multiple. For instance, a business may have a low burn rate. However, it may be planning to spend more in the future to help the growth initiative.

In this scenario, in the burn multiple calculations, you should factor in the anticipated future burn rate. It’s important since it helps in getting a clear view of the financial health of the company.

Moreover, in this step, determine the timeline that the company can reach a good cash flow or profitability. This varies depending on the company’s business model. Some businesses or companies can reach profitability faster than others.

Divide the Total Money Raised by the Amount of Money the Company Wants to Burn

After you’ve found out how much money the company has raised and the amount it wants to burn, it’s now time to divide. You just have to divide the funds raised by the amount the company plans to burn.

Let's use an example of a company that has contributed $15 million in funding and plans to spend $3 million to reach profitability. In this instance, to calculate the burn multiple, you’re to divide the $15 million by $3 million.

It will give you a burn multiple of 5x. This burn multiple of 5x means the company will have burned five times the money it raised before it reached profitability.

Interpret the Burn Multiple

After you’ve divided the total money raised by the money the company plans to burn, it’s now time to interpret the burn multiple. This step entails the assessment of the results number of whether it’s low or high. The resulting number indicates the financial situation of the company.

When your company’s burn multiple is high, it means that the company is spending more than it’s receiving. Therefore, if this is the case, you can run out of cash because your company is not generating enough revenue. If it’s a low burn multiple, it’s a good thing for the company and will henceforth experience profitability.

Burn multiple is a SaaS metric you must consider alongside other non-financial and financial metrics. This is because it helps comprehend your company’s financial bloom and potential success.

The financial metrics include the revenue growth rate, gross profit margin, and acquisition cost. Non-financial metrics, on the other hand, include market trends, customer satisfaction, and employee engagement.

Benefits of Calculating Burn Multiple

Financial Health Assessment

Burn multiple is helpful if you want to assess or evaluate your company’s sustainability and its financial bloom. It can measure the number of times your company will or can burn through its cash reserves. If you calculate your company’s burn multiple, you’ll be aware if you’re running out of funds or if you can cover interest payments on debts.

Business Planning

Burn multiple is very advantageous when it comes to business budgeting and planning. It’s beneficial because you’ll know the total money you have at hand. You’ll also be aware if the funds you have at hand can sustain your company’s operations.

If you know the funds you have and how long they can sustain the operations in a company, you’ll make logical decisions regarding expenses. You’ll also develop informed strategies to adjust your company’s operations based on the funds at hand.

For instance, if your company has a low burn multiple, and there is a possibility of running out of money to run the company, you can cut costs. You can also think of some revenue-generating activities. Moreover, it will help you stay on the right track to profitability.

Investor Decision Making

Burn multiple is an essential metric for investors. It helps investors in assessing investment opportunities. If you’re an investor, you can use burn multiple to compare companies within similar industries and stages of development.

When you compare the burn multiples of different companies, you will gain knowledge of the businesses’ financial sustainability. You’ll also be able to recognize investment choices that align with the company you want to invest in investment objectives. Burn multiple will also make you know if a company will experience growth and profitability in the future. You will therefore make logical decisions about the company you want to invest in.

Benchmarking

With burn multiple, you can benchmark from other companies and compare their financial bloom with your company’s bloom. You can gain insight into how other companies stack up against others in the same stage through benchmarking. You’ll then be able to identify some of the areas you can improve or the risks that your company faces.

Take Away

Burn multiple is essential for evaluating a company's financial sustainability and health. If you’re an entrepreneur, it’s essential to calculate your company’s burn multiple. It will help you with business planning and budgeting. Moreover, it will help you make logical decisions and have insight into increasing your company’s profitability.