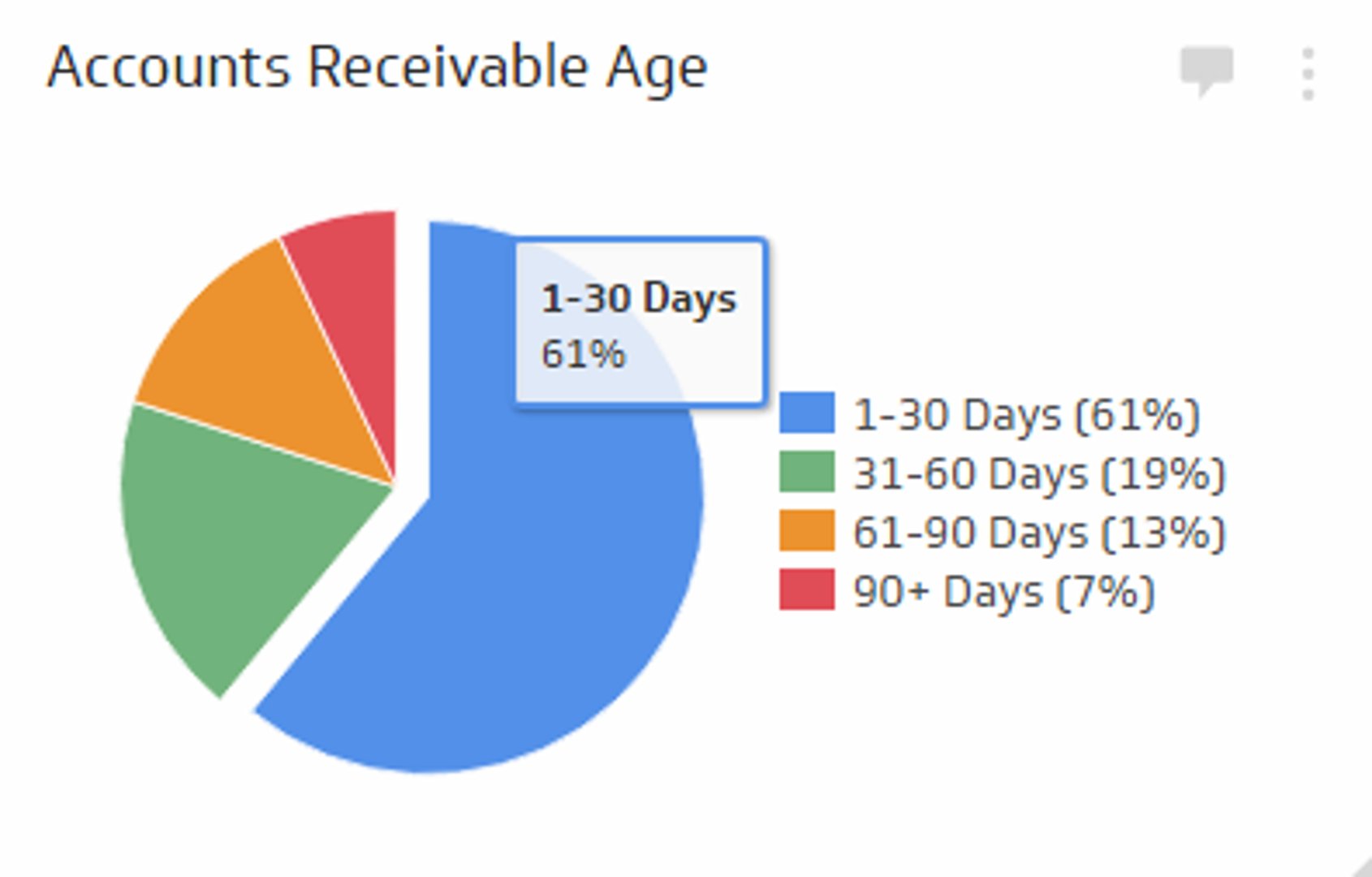

Accounts Receivable Turnover Ratio Metric

Measures the rate at which you collect on outstanding accounts.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

The Accounts Receivable Turnover is a KPI that measures the rate at which your company collects on outstanding receivable accounts. This indicator measures the amount of times that your account receivable has been converted to cash during a certain period of time (month, quarter, year). Monitoring this metric is essential to ensure that accounts receivable is collecting from customers in a timely manner. It is an essential piece of understanding the efficiency of your organization's cash flow process. Overall, a high ratio indicates that your business is efficient at collecting and has extended credit to quality customers that pay their bills.

Formula

Accounts Receivable Turnover Ratio = (Net Credit Sales / Average Accounts Receivable)

Note: Net credit sales is reflected on the Income Statement, and Accounts Receivable is on the Balance Sheet.

Example of Accounts Receivable Turnover Ratio

XYZ Company sold $2,000 of good by credit in 2021. Its accounts receivable at the end of 2020 and 2021 is 1,000 and 1,500 respectively.

Account Receivable Turnover Ratio = [2,000 / (1,000+1,500) / 2] = 1.6

This means that on average company XYZ collected its average accounts receivable 1.6 times during 2021.

Related Metrics & KPIs