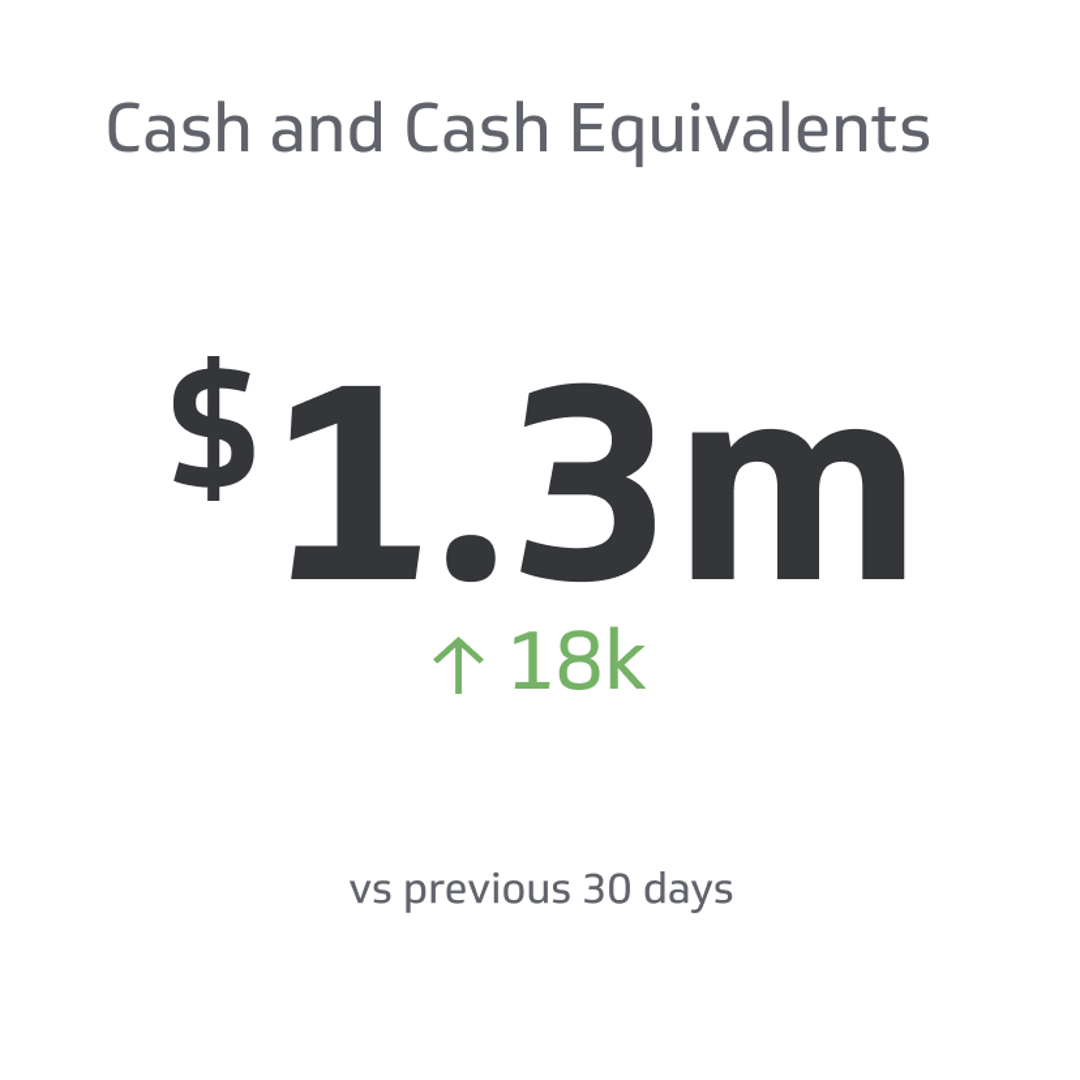

Cash and Cash Equivalents

Cash and cash equivalents are balance sheet details that summarize the worth of a company's assets that are cash or may be converted into cash instantly.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Cash and cash equivalents are balance sheet details that summarize the worth of a company's assets that are cash or may be converted into cash instantly.

The balance sheet categorizes any possessions that meet this description as current assets.

The two basic conditions for classifying an asset as a cash equivalent are that it is easily converted into an established amount of cash and that it's too close to maturity to have a negligible risk of fluctuations in value arising from shifts in interest rates by when the maturity date arrives.

In short, cash and cash equivalents are a firm's most liquid short-term assets.

Types of Cash and Cash Equivalents

Cash and cash equivalents assist businesses with working capital requirements as you can use these liquid assets to pay down current liabilities, which are short-term loans and payments.

Here is the list of items that make the cash and cash equivalents on a business's balance sheet.

Cash

Cash is money in the form of currency that a firm holds in possession or its bank account at a given time. It includes currency notes, coins, and bills.

A financial institution holds cash in a demand deposit account – a type of account in which you can withdraw money at any time without notifying the institution. Demand deposits include checking, savings accounts, and money market accounts.

Cash totals contain the balances of all demand accounts as of the date of the financial statements. The balance sheet's current assets section includes these totals or all assets scheduled to be converted into cash within a year or the length of the company's operating cycle.

Below are other examples of cash:

Petty Cash

Petty cash is a small sum of money a business keeps on hand to cover small, everyday expenses. An employee who keeps track of expenditures and refills the fund as needed usually maintains this account.

Typically, businesses use petty cash to pay for expenses like office supplies, mail, and small repairs. Petty cash generally gets set up as an imprest system. Businesses restore the fund to its initial amount after a specific time, typically monthly or quarterly.

Bank Draft

A bank draft is a type of payment instrument that a bank issues that ensures payment to a third party. Akin to a cashier's check, it is a form of payment supported by the issuing bank and regarded as equally valid as cash.

When a business offers a bank draft for payment, the money typically flows out of the issuer's account, and the receiver can deposit or cash the draft right away.

For a business to fulfill its immediate responsibilities, such as making payroll or paying suppliers, it is critical to maintain a sufficient cash balance.

Cash Equivalents

Cash equivalents are low-risk, highly liquid investments that can be easily converted into cash. These investments must be short-term, typically three months or less. Should the investment mature after three months, it's recorded as "other investments" on the balance sheet.

Businesses record cash equivalents on the balance sheet at their market value. They know the value and it doesn’t fluctuate. There must be no reasonable expectation that the cash equivalents' value will change considerably before redemption or maturity.

Here are some examples of cash equivalents.

Commercial Paper

A commercial paper is an unsecured promissory note issued by a firm with a high credit rating. Typically, commercial paper matures in less than nine months (270 days), which makes it a short-term investment.

Commercial paper is also very liquid since it can be traded on a secondary market and is quickly converted into cash. The interest rate on commercial paper varies depending on the creditworthiness of the issuing firm.

Money Market Account

A money market account is an interest-bearing deposit account, like a savings account.

Financial institutions that often pay a greater interest rate than standard savings accounts while still providing fast access to cash offer money market accounts.

In addition, a money market account features a minimal minimum balance requirement and no or low fees.

Short-Term Government Bonds

Short-term government bonds are bonds issued by national governments, considered one of the safest types of investment because of the government's capacity to tax and mint money.

Short-term government bonds can be categorized as a cash equivalent on a firm's balance sheet if they fulfill the requirement of high liquidity and easy conversion into cash within 90 days or less.

Treasury Bills

Treasury bills are short-term debt instruments with maturities of one year or less that the U.S. Department of the Treasury issues.

T-bills are very liquid since they are often traded on the secondary market and are easily converted into cash by selling them before maturity.

Certificates of Deposits

Depending on the maturity date, certificates of deposits (CDs) can be recorded as cash equivalents on the firm's balance sheet.

CDs that mature in 90 days or less and can be redeemed without penalty qualify to be recorded as cash equivalents on the balance sheet. Conversely, CDs with longer maturity or penalties for early withdrawals don't qualify as cash equivalents.

Foreign Currency

Foreign currency can impact the value of cash and cash equivalents recorded on the balance sheet. Variations in exchange rates may affect the reported value of cash or cash equivalents held by a business denominated in foreign currency.

Firms must convert their assets into their functional currency at the balance sheet date when they present their financial statements in a functional currency different from the one in which their cash and cash equivalents are recorded.

Suppose the functional currency rises against the foreign currency in which the cash and cash equivalents are denominated. In that case, the reported value of the assets in the functional currency will go up.

However, if the functional currency falls in value relative to the foreign currency, the reported value of such assets will fall in the functional currency of the firm.

Exchange rate variations can influence a company's reported cash balances, liquidity, and capacity to satisfy short-term financial demands.

Companies with large cash holdings in foreign currencies can utilize hedging measures to manage currency risk and limit the impact of exchange rate variations on their cash and cash equivalents.

Exclusions from Cash and Cash Equivalents

The "Cash and Cash Equivalents" line item on a company's balance sheet excludes several things that could seem to be cash or cash equivalents. Here are a few examples.

Credit Collateral

Credit collateral, like bank guarantees, standby letters of credit, and letters of credit, is generally excluded from cash or cash equivalents on a business's balance sheet. It's because it does not reflect a cash asset but a contingent liability.

Credit collateral is often used as a type of security or guarantee for the repayment of a debt or other financial obligation.

For instance, a financial institution can issue a letter of credit on a buyer's account to guarantee payment to the seller. Consequently, the seller can produce a letter of credit to the financial institution and get the payment even if the buyer fails to pay.

Although credit collateral can offer a certain amount of security, it cannot be quickly turned into cash within 90 days or less. Additionally, some default risk is associated with credit collateral, and market movements may impact the collateral's value, disqualifying it from cash and cash equivalents.

Unbreakable Certificate of Deposits

Unbreakable CDs are a type of CD that can't be redeemed before the maturity date without facing a substantial penalty. Unbreakable CDs are often not included in the "Cash and Cash Equivalents" line item on the balance sheet, even though CDs generally may be regarded as cash equivalents.

The exclusion is because unbreakable CDs aren't particularly liquid and can't be quickly converted into cash within 90 days or less.

Also, unbreakable CDs may feature a lower market value than their face value as they can't be redeemed before their maturity date and are therefore exposed to interest rate risk.

Therefore, unbreakable CDs are typically categorized as investments rather than cash equivalents on the balance sheet.

Inventory

Inventory is a type of current asset that represents items that a business has purchased for sale or that are being manufactured.

Because inventory is not a highly liquid asset that can be easily turned into cash within 90 days or fewer, it is not regarded as cash or a cash equivalent.

Also, inventory reflects products that a business plans to sell or employ in its operations. Its value is susceptible to adjustments due to changes in consumer demand and production cost.

So, the inventory value is not guaranteed, which means there is no assurance of the amount derived for liquidating the inventory.

Prepaid Assets

Since prepaid assets do not reflect readily available cash, they are not regarded as cash and cash equivalents. Prepaid assets are types of assets that have been paid for in advance but provide benefits over time.

While prepaid assets may be refundable, the risk that the refund may not be processed on time or settled partially disqualifies them from being considered cash or cash equivalents.

Accounts Receivable

Accounts receivable are payments due by customers to a business for products sold or services supplied. While these funds can be expected to be collected soon, they do not count as cash or cash equivalents until they are received.

The exclusion is due to the ambiguity surrounding the client's creditworthiness. Even if a debt is available for collection, there is no guarantee that the client will pay. Furthermore, the business may not be given priority in bankruptcy or liquidation procedures.

Cash vs. Cash Equivalents

Although the balance sheet categorizes cash and cash equivalents together, there are notable differences between the two entries. Cash is the ownership of money, whereas cash equivalents are the ownership of financial instruments easily converted into cash.

Also, cash is regarded as the safest and most readily liquid asset, but cash equivalents feature some risks owing to fluctuations in the market. While cash equivalents are often seen as low-risk investments, they are nonetheless vulnerable to market fluctuations and may lose value.

Despite the fairly low risk, cash equivalents can receive favorable yields. Furthermore, some money market funds may be tax-exempt or kept in tax-favorable accounts. Conversely, cash earns little to no yield, with lower interest rates in deposit accounts. But it's essential to remember that the relatively higher yield isn't the primary motive for holding cash equivalents.

Maturity is another contrasting factor between cash and cash equivalents. Cash is available for use immediately, while cash equivalents have a maturity date, generally three months or less.

Therefore, cash equivalents aren't readily available and require redeeming or selling before they can be used as cash.

Why Do Firms Hold Cash and Cash Equivalents?

Firms hold cash and cash equivalents for various business reasons. Below are some reasons why companies may hold cash and cash equivalents.

Transactional Purposes

Companies carry cash and cash equivalents for transactional needs, including day-to-day expenses like rent, payroll, and utilities. Holding cash and cash equivalents helps businesses to pay for such expenses on time, ensuring smooth business organization.

Also, having cash and cash equivalents provides a buffer against unexpected expenses or changes in cash flow.

For instance, if a company experiences an unexpected expense increase or a delay in collecting accounts receivable, holding cash will help the company endure the storm without incurring debt or making other financial adjustments.

To Pay Debts

Cash and cash equivalents are generally used by businesses to settle invoices and current portions of long-term debts when they are due. Such obligations are usually due within a short timeframe and require immediate payment.

Cash and cash equivalents offer businesses the liquidity they need to meet debt obligations without borrowing or selling assets.

Moreover, holding sufficient cash and cash equivalents can help firms negotiate more favorable terms with suppliers and lenders.

Suppliers and lenders are more inclined to offer favorable terms to businesses with a healthy cash position since it suggests that the firm is financially sound and capable of meeting its obligations.

Plan for Emergencies

Another reason why companies keep cash and cash equivalents is to plan for emergencies. Emergencies can take various forms, including unforeseen spending, economic downturns, natural disasters, or other events that could impair the business's operations.

Holding cash and cash equivalents helps the company in case of an emergency.

Meet Financial Covenants

Companies may hold cash and cash equivalents to fulfill financial covenants with their lenders and other stakeholders.

Financial covenants are constraints or requirements in loans and other financial contracts that define certain financial performance metrics that a firm must maintain. These measurements include a minimum level of cash flow, debt-to-equity ratio, and net worth.

Firms can guarantee compliance with these financial covenants while avoiding defaulting on their obligations by keeping cash and cash equivalents.

For example, suppose a company's debt-to-equity ratio falls below a specific threshold. In that case, it may be obliged to return some of its debt to bring the ratio back into compliance.

Save for Investment Opportunities

Holding cash and cash equivalents presents companies with the finances they need to make strategic investments or acquisitions to help them develop and boost shareholder value.

For instance, if a company discovers a great investment opportunity or acquisition target, having cash on hand allows the company to move fast and capitalize on the opportunity.

If the company was dependent on borrowing or other forms of finance to fund the investment, it would not be able to respond as fast or might lose out on the chance entirely.

Furthermore, maintaining cash and cash equivalents can give a company more flexibility and bargaining power when negotiating with possible partners or takeover targets.

Holding cash and cash equivalents can demonstrate to prospective partners that the company is financially sound and can follow through on its obligations.

Regulatory Requirements

Regulatory agencies may also obligate firms to have specific cash and cash equivalents. For instance, banks and other financial institutions may be mandated to maintain a specific amount of reserves in the form of cash and other liquid assets to guarantee that they have adequate funds to satisfy their customer commitments.

Furthermore, as a regulatory requirement, maintaining cash and cash equivalents can assist in limiting systemic risks in the financial system.

If all enterprises are obliged to maintain a specific level of reserves, it can help prevent a domino effect of defaults that could spread across the financial system.

How To Calculate Cash and Cash Equivalents

Calculating cash and cash equivalents on a balance sheet is a simple process. The balance sheet provides a snapshot of the firm's financial position at a particular time. All you need is to add up all cash balances and the business's short-term investments.

The following are the steps for calculating cash and cash equivalents:

- Locate the current assets section: On the balance sheet, cash, and cash equivalents are categorized under the current assets section, which are assets that can be converted into cash within a year or less. Look for this section, typically near the balance sheet's top bit.

- Identify cash and cash equivalents: Look for the items on the balance sheet that qualify as cash and cash equivalents. These may include items like cash on hand, cash in checking or savings accounts, and short-term investments, including market funds or Treasury bills.

- Add up the cash and cash equivalents: Once you've determined which line items reflect cash and cash equivalents, sum them all together to obtain the total cash and cash equivalents. This statistic shows the amount of cash and liquid assets available for immediate use by the firm.

It is vital to remember that the definition of cash and cash equivalents might change based on the accounting standards employed and the company's circumstances. Some short-term investments might not be regarded as cash equivalents in some instances.

As a result, it's necessary to examine the company's accounting procedures to determine what items are reflected in cash and cash equivalents.

Frequently Asked Questions

Now that you've known the nitty-gritty of cash and cash equivalents, let us look at the frequently asked questions.

What makes a financial instrument a cash equivalent?

A financial instrument is considered a cash equivalent if it is readily liquid with a short-term maturity of three months or less.

Also, the financial instrument must have a low credit risk to meet the company's short-term cash needs. A firm should be able to quickly liquidate the cash equivalent without concerns about a significant material loss to the product.

Are cash equivalents better than cash?

Cash equivalents aren't necessarily better than cash, but they typically serve a different purpose in a firm. Cash equivalents feature some perks that some investors prefer.

Cash equivalents are often utilized as a short-term investment option for cash that may not be required for a short period but must still be readily accessible. Nevertheless, both categories of financial instruments are relatively comparable and have low yields.

How are cash and cash equivalents reported in a company's financial statements?

Cash and cash equivalents are reported as a separate line item on a company's balance sheet. This line item is usually towards the top of the balance sheet's current assets section. Also, firms can report information about their cash and cash equivalents in the notes to the financial statements.

What are the risks associated with holding cash and cash equivalents?

Various risks are associated with holding cash and cash equivalents, including inflation risk, currency exchange rate risk, credit risk, interest rate risk, and opportunity cost.

Cash and cash equivalents may not keep up with inflation, and exchange rate shifts may influence their value. Cash held in financial institutions carries credit risk, while fixed-income instruments involve interest rate risk.

What does a negative cash and cash equivalents balance indicate?

A negative cash and cash equivalents balance shows that a company's cash outflows exceed its cash inflows and lacks enough cash reserves to pay its short-term commitments and obligations.

Essentially, it indicates that the firm has a financial shortfall and may need to take remedial measures such as increasing capital or cutting costs to prevent insolvency.

Final Thoughts

Cash and cash equivalents are stapled entries on every company's balance sheet. They represent the firm's most liquid assets, with three months or less maturities.

Also, they don't feature any restrictions on their liquidity. Companies frequently hold cash and cash equivalents to facilitate smooth business operations.

Related Metrics & KPIs