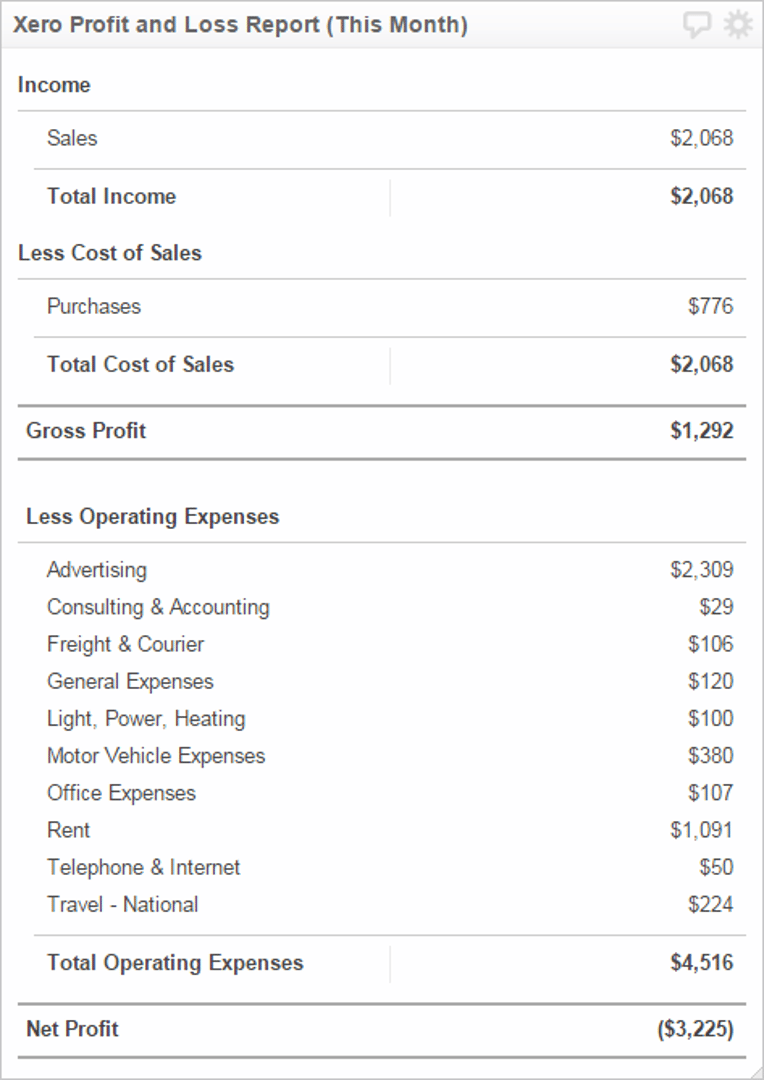

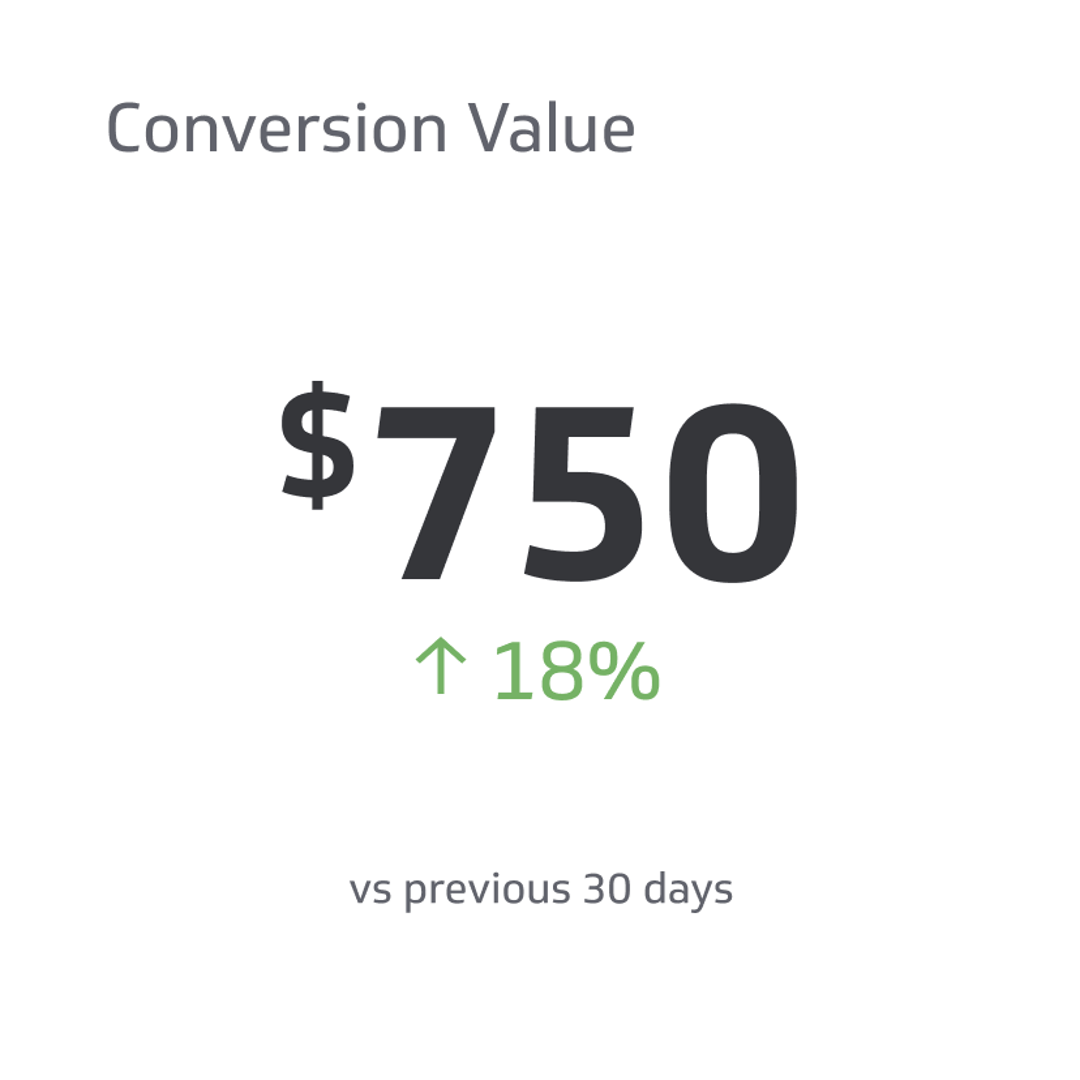

Conversion Value

Conversion value refers directly to the value of convertible securities.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Believe it or not, not all shareholders know the stock market's technical aspects. Within the stock market, various financial metrics and ratios help determine the value or worth of certain stocks. One of these ratios is conversion value, but what is conversion value?

The conversion value is an extremely interesting ratio that helps determine the value of preferred shares and other securities. It can get confusing and complex, so it's important to break it down into pieces to understand what conversion value is and why it's important.

What Is Conversion Value?

It's important to note that conversion value refers directly to the value of convertible securities. That leads to another question, what are convertible securities? Convertible securities are investments that can change into different forms.

The two common types of convertible securities are convertible bonds and convertible preferred shares. Both of these can convert into common stock. For those who don't know, common stock is a tradable asset representing ownership of a specific business entity.

What Determines Conversion Value?

The conversion value focuses on finding the current value of a bond if you were to convert them into common stock. That means two pieces of information determine the conversion value of a stock. The first piece of information you need is the common stock market price.

You can find the common stock market price by looking at a company's price per share. That dollar amount is important for getting the conversion value of the bond. Next, you'll need the conversion ratio of the bond.

If you don't know, the bond's conversion ratio is how many stocks that bond can convert into. For example, if a bond can convert into 30 stocks, it has a conversion ratio of 30. Now that you have that conversion ratio, you can multiply it by the stock's current share price.

That number you get is the conversion value. It's simpler if you imagine it as a formula. Here's what your conversion value formula will look like.

Common stock price x conversion ratio = conversion value of the bond

Conversion Value Examples

Now that you have a formula and a process, it's important to see how it works. Here are a few key examples to give you a better idea of the conversion value of a bond and its purpose.

Say that you buy a bond with a par value of $1,500, which can convert into 50 stocks at any point. If you want to know the conversion value of that bond, you'll need one more piece of information, the current market price per share.

For this example, the current market price per share is $20. Now, here's how you'll find the conversion value of this bond.

20 x 50 = $1,000

So, what does this mean? This example demonstrates that if you converted your current bond into stocks, you would get $1,000 worth of stock in that company. The bond's original value is $1,500, meaning you'd lose $500 if you were to convert your bond into shares.

Here's another example. Say you have a bond from a company with a par value of $1,200. You can cover that into 20 stocks at any point in time. Currently, that company's stock is $65 per share. Here's the bond's conversion value.

20 x 65 = $1,300

Unlike the other example, in this example, if you were to convert your current bond into stock, you would make $100 in profit.

Importance of Conversion Value

So now that you understand the conversion value and how to calculate it, why does it matter? Well, if you follow the previous examples, you can see what matters. A bond's conversion value helps determine the profitability or security of a bond.

Say there's a surge of interest in the company that has issued you a bond. There's a drastic increase in that company's stock price, and you're holding onto one of their bonds. If you want to make a profit, you may want to convert that bond into stocks.

You'd only know that if you understand how to determine the value of your bond beyond its par value. Bonds mature, and once they mature, you get a guaranteed return from them, but stock prices change daily and can be unpredictable at times.

The benefits of a bond are why it's important to understand its conversion value. During hard times, the company's stock may heavily decrease in value. For someone with a bond, that doesn't have an immediate impact unless they convert that bond into stocks.

You need to know when or if converting your bond into stocks is okay. Understanding the conversion value helps you make that decision and ensure that no matter what, you come out even or with a profit.

Conversion Value vs. Conversion Premium

Similar to conversion value, conversion premium helps determine the worth of a bond, but in a different way. Conversion premium helps determine whether or not a bond is currently worth purchasing at its full cost by comparing the price of the bond and the bond's value.

Typically, most bonds are attractive because they provide security and profit, but for those looking for profit over security, you would look at the conversion premium. Sometimes bonds sell at a lower par value than their conversion value.

To determine this, an investor will look at the conversion premium by determining the conversion value and comparing it to the bond market price. If the conversion value is lower than the bond market price, buying that bond might be less attractive than buying common shares.

In this case, you might wonder why someone would be willing to overpay for a bond. For example, say the current value of a bond is $1,300, but its conversion value is only $900. That would mean you would be losing money if you were to convert that bond into stocks.

Some people find the bond's security worth the investment and don't plan to sell their bond for the stock value anyways. Instead, they want to wait for the bond to mature and reap the rewards that the bond comes with.

Regardless, the conversion premium helps investors decide whether they can profit from a bond through its conversion value, making it a valuable formula to remember when looking at bonds.

Conversion Value vs. Conversion Price

Unlike conversion value and premium, the conversion price is extremely simple. Essentially, the conversion price is the current value of the convertible bond. Unlike the conversion value, the conversion price doesn't change.

The conversion price only considers the current par value of the bond when calculating its price. For example, if the bond's par value is $1,500 and its conversion ratio is 50, its conversion price will be $30. It will never change from $30 because that's the bond's par value.

The way you get the conversion price is also simple, you take the current par value of the bond and divide it by how many shares it can convert into. So, in the example above, you would take $1,500 divided by 50 to get $30.

The main purpose of the conversion price is to give you an idea of the value of the bond in its current state. Since the conversion price is static, you can compare your bond to current and past stock prices, giving insight into how you want to proceed with your bond.

Frequently Asked Questions

These topics can get complex, so here are answers to people's questions about conversion value and its importance.

Is the conversion value more important than the conversion premium?

Depending on your needs, the conversion value may be more helpful than the conversion premium. Most people who look at the conversion premium only do it to make a quicker profit, but most who buy bonds do it for security and future investments.

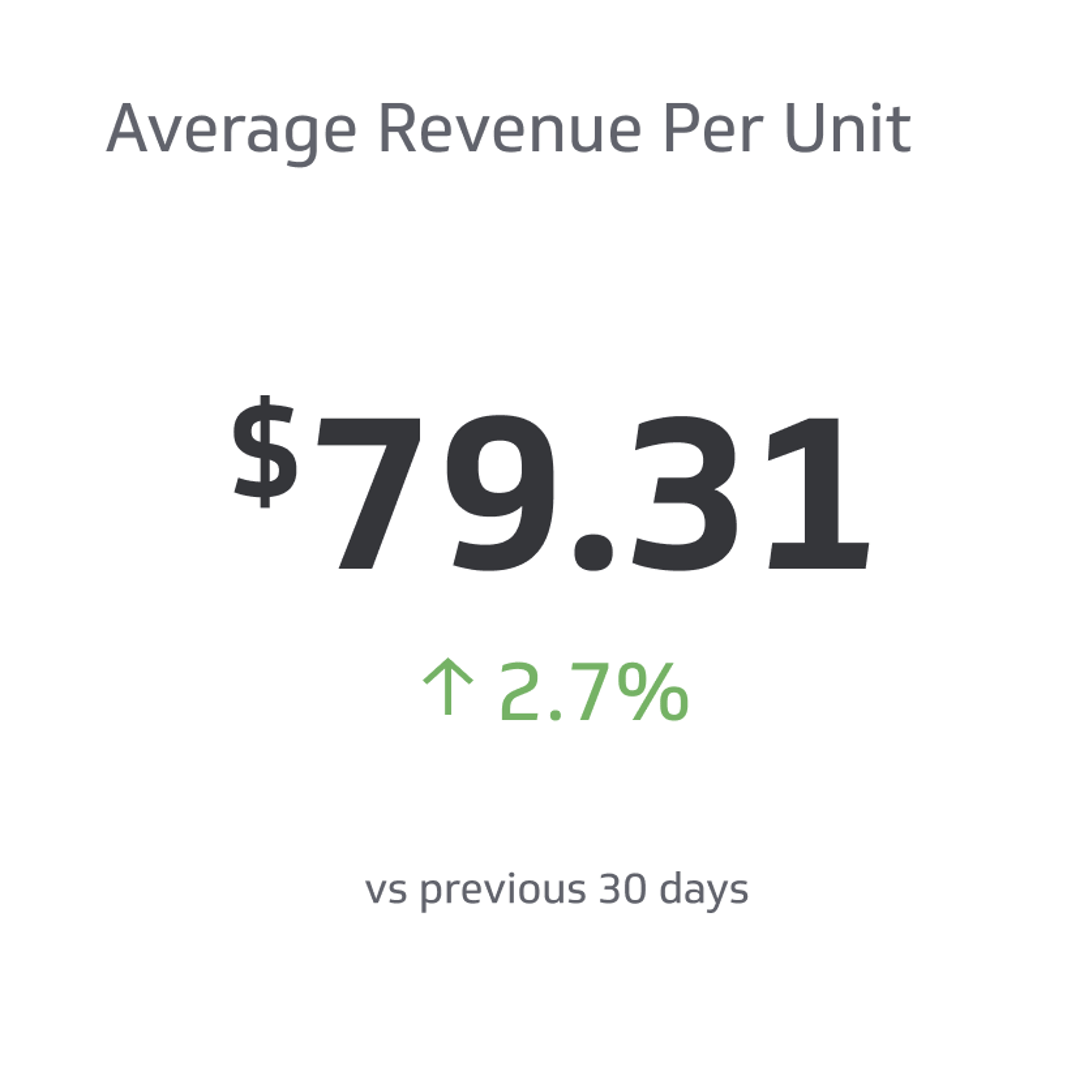

Is conversion value the same as revenue?

The conversion value isn't the same as a company's revenue. Revenue is what the business generates through its products and services. Conversion value focuses on the value of bonds.

What happens when convertible bonds are converted?

When you convert a company's convertible bond, you'll convert it won't always convert into the par value of the bond. Instead, the bond will convert into a predetermined number of stocks that match the current market price of that company's common stock.

Bottom Line

The conversion value of your bond is important to understand, and understanding the difference between your conversion value, premium, and price gives you an extra edge when looking at the stock market and bonds.

Now that you understand conversion value, put it to use. Practice your calculations and see if your bonds are worth converting into shares. Regardless, keep an eye on your conversion value, and best of luck in your future bond investments.

Related Metrics & KPIs