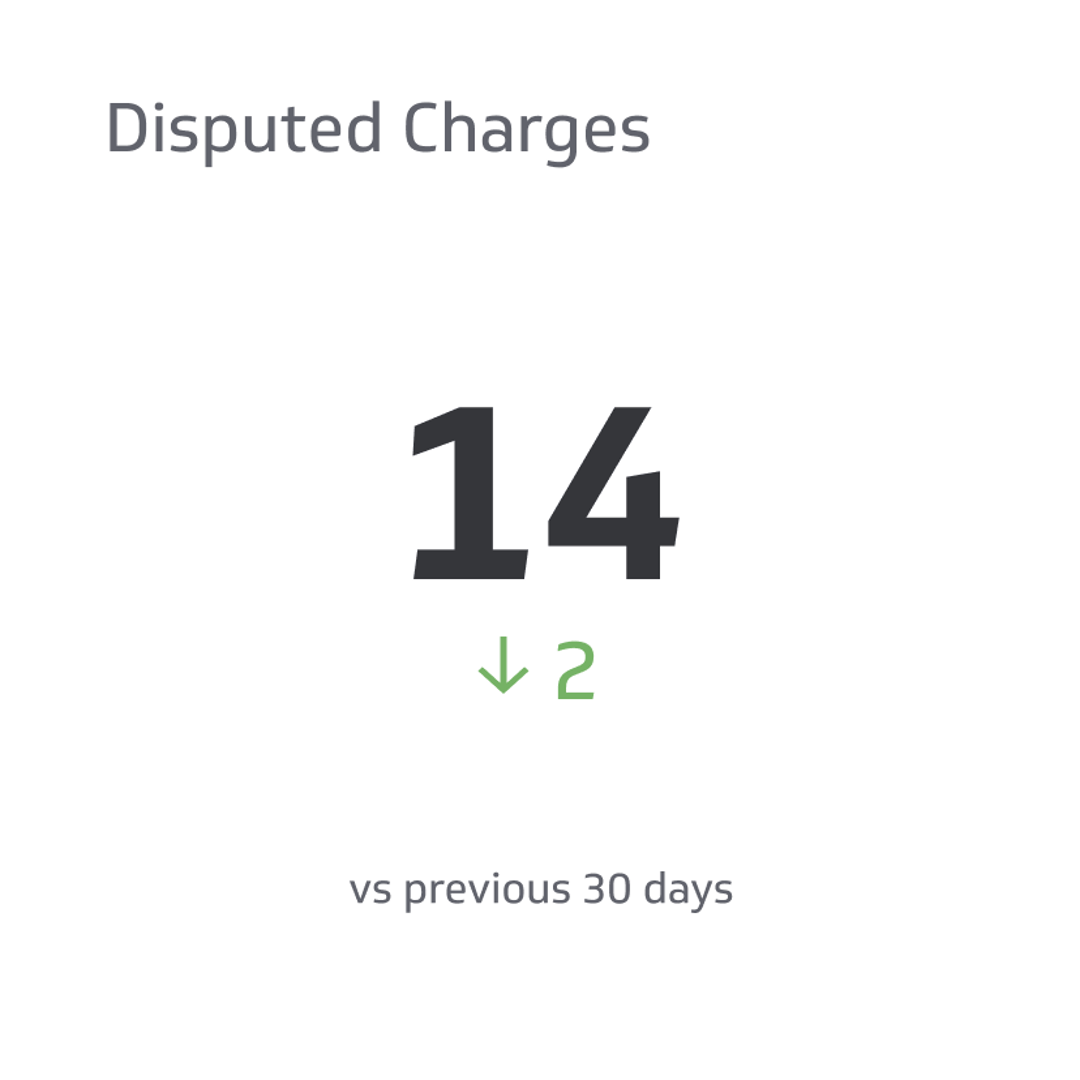

Disputed Charge

Disputed Charges represent the total of payments that have been contested and may result in chargebacks, which occur when your account is charged a fee to cover a contested amount.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Disputed charges have become an increasingly common issue in the credit card industry. Whether it's a result of fraudulent activity, unexpected fees, or mistakes made by customers and businesses alike, disputing charges on your statement is becoming more prevalent.

While consumers may view this as a helpful way to protect themselves from inaccurate billing practices, for businesses and marketers, understanding what constitutes a disputed charge - and how best to manage them - is key to running a successful enterprise.

In this post, we'll break down exactly what comprises a disputed charge and explore some of the best strategies for effectively managing any that come up on your account.

What Is a Disputed Charge?

Disputed Charges represent the total of payments that have been contested and may result in chargebacks, which occur when your account is charged a fee to cover a contested amount.

This can result in additional costs, including dispute fees and currency conversion fees, which can hurt your bottom line.

Staying aware of Disputed Charges and taking steps to minimize them can help you to maintain healthy financial practices and avoid costly disputes.

Why Do Customers Dispute Charges?

Generally, three categories can explain a customer's motivation to file a chargeback. The first is merchant error, which accounts for about 20% of chargeback situations. This can occur when a merchant fails to comply with a customer's request to stop a recurring transaction.

However, more than 70% of chargebacks are classified as "friendly fraud." This refers to situations where a customer knowingly makes a purchase but later rejects the credit card charge.

Fraud is the third leading cause of chargebacks, which occurs when a customer's credit card information is stolen and used for unauthorized purchases. This can be a frustrating experience for the victim, who must then dispute the charges through a chargeback request.

How to Calculate Disputed Charges

Disputing charges is often a headache-inducing process for businesses of all sizes. Not only does it take valuable time away from managing day-to-day operations, but it can also lead to financial losses. However, there is a straightforward formula that marketers, business operators, analysts, and SaaS teams can use to calculate disputed charges accurately.

Using the formula ƒ Sum (Disputed Charges), businesses can quickly calculate the sum of disputed charges and determine their impact on the bottom line.

For example, if a business has $1,000 in disputed costs from a vendor and $500 in disputed charges from a customer, the total disputed charges would be $1,500.

How Long Can a Charge Be Disputed?

While chargebacks can be incredibly frustrating, understanding the rules and regulations surrounding them is crucial in minimizing their impact on your business. One common question that arises is how long a charge can be disputed.

Unfortunately, there is no universal answer to this question. Instead, each card network and issuing bank sets its deadline for submitting a chargeback. However, it is essential to note that U.S. law mandates a minimum of 60 days. Therefore, most cardholders will have 120 days to contest a charge with their bank.

How Will Disputed Charges Affect Your Business?

As a business operator, chargebacks are not something you can afford to ignore. In contrast, they may seem like a minor inconvenience, but the financial impact of chargebacks can be devastating for any company.

Apart from lost revenue, chargebacks incur additional fees, product losses, and increased processing expenses. In some cases, chargebacks may even result in the cancellation of your merchant account, further adding to your financial troubles.

Therefore, as a savvy marketer, analyst, or SaaS team member, it's essential to understand the impact of chargebacks on your company and take proactive steps to mitigate these effects.

What Costs and Consequences Do Merchants Face With Disputed Charges?

Chargebacks can be a costly affair for merchants who face disputed charges. Not only do they result in immediate financial loss, but the merchant also loses the product or service sold to the consumer.

A chargeback dispute requires a significant amount of time and effort from the merchant's end, as they must present supporting documentation to the payment provider.

Apart from the financial loss, chargebacks can lead to increased bank fees and, in the worst-case scenario, even suspension of the ability to accept credit cards.

Therefore, it becomes imperative for merchants to have robust systems in place to mitigate chargebacks and minimize their impact on the business's bottom line.

How To Shield Your Business From Disputed Charges

One of the most effective ways to do this is by using a prominent business name for any transaction. This minimizes the chances of a customer assuming fraud simply because they don't recognize the name on their statement.

Another vital aspect of managing disputed charges is to make the refund process clear and straightforward for clients. Not only are refunds less expensive than chargebacks, but they can also help maintain customer satisfaction and build trust for future transactions.

Ensure you provide clear refund guidelines in-person and online while including a phone number for customers to contact if they need further assistance.

In addition to setting up reliable fraud detection systems, it is crucial to adhere to best practices for payment processing, such as dipping EMV cards instead of swiping them. By doing so, you will reduce your risk of fraudulent activity significantly.

However, don't forget that the client's experience is equally important. By delivering top-notch customer service and ensuring a seamless shopping experience, you'll build a strong relationship with consumers and increase their chances of contacting you to resolve any issues before turning to their bank for chargeback assistance.

Remember, prevention is always better than cure, and by implementing these strategies, you're taking proactive steps to shield your business from disputed charges.

Conclusion

As such, it is wise for businesses to stay vigilant and proactive about monitoring their disputed charges.

Having a system that monitors customer disputes, responds promptly with clear explanations of charges, and acts swiftly upon notification from the customers' bank can help minimize any negative financial implications associated with chargebacks due to disputed charges.

Additionally, having the ability to quickly comprehend the financial impact of these disputes with the ƒ Sum (Disputed Charges) formula can allow businesses to make more informed decisions regarding potential customer transactions.

To sum it all up, understanding your business dealings with cardholders is key when it comes to upholding trust and integrity between yourself and your customers.

Related Metrics & KPIs