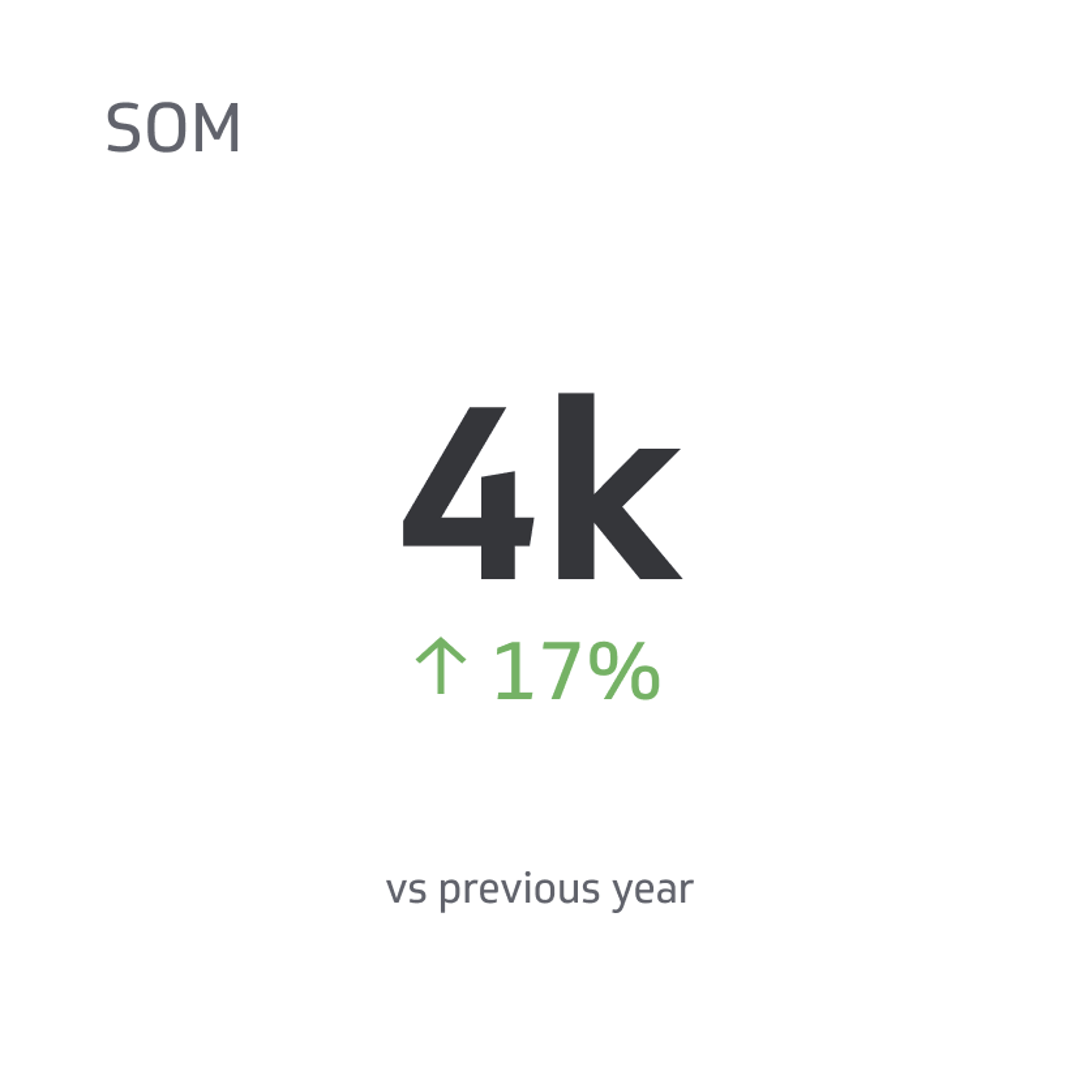

Serviceable Obtainable Market (SOM)

Serviceable obtainable market (SOM) is a fundamental metric in market analysis, providing clear, realistic insights into your potential for brand penetration.

Track all your SaaS KPIs in one place

Sign up for free and start making decisions for your business with confidence.

As a business leader or entrepreneur, you likely understand how often success hinges on market segmentation and how you use the data to drive your strategic planning. Serviceable obtainable market (SOM) is a fundamental metric in market analysis, providing clear, realistic insights into your potential for brand penetration.

We'll explain the nuts and bolts of SOM, distinguishing it from other related SaaS metrics and exploring its application across various industries. You'll also learn growth strategies to optimize your SOM as your resources and budget allow.

What Is Serviceable Obtainable Market?

Serviceable obtainable market refers to the market portion your business can realistically serve.

It's more specific than your total or serviceable market because it considers current demand and competition for your particular product or service.

Distinguishing Between TAM, SAM, and SOM

Total addressable market (TAM), serviceable addressable market (SAM), and serviceable obtainable market (SOM) are interconnected, but each provides a different level of insight into the market.

Total Addressable Market

TAM accounts for the total market demand for a product or service. It's the maximum revenue a business could make if it achieved 100% market share.

However, achieving 100% market share is often impossible due to factors like differing customer preferences and the presence of competitors.

Serviceable Available Market

SAM is the segment of the TAM targeted by your products and services, which is within your geographical reach in terms of distribution capabilities.

It's still a somewhat optimistic view as it assumes you can reach the entire market while ignoring competition and brand-specific features that might not appeal to some consumers.

Serviceable Obtainable Market

Finally, SOM is the portion of the SAM that you can realistically achieve while considering any limiting factors. It provides the most realistic view of the market for your business.

To illustrate the differences between these three metrics, suppose you are a startup launching a new, eco-friendly smartphone brand.

- The TAM is the entire worldwide smartphone market.

- The SAM is the segment of the TAM that your product or service can reach geographically or logistically.

- The SOM represents the parts of this SAM that you can practically reach and serve with limited startup resources and the intense competition of established brands.

While TAM and SAM help in assessing market potential, it's your SOM that you should focus on for operational planning and execution.

Understanding your SOM allows you to focus your resources on reachable customers, enhancing the efficiency of your marketing efforts and reducing wastage. It also helps you estimate revenue potential more accurately, supporting better budgeting and financial planning.

Lastly, it provides valuable insights into your competitive standing in the market. If your SOM is significantly smaller than your SAM, it might indicate fierce competition or gaps in your capabilities, nudging you towards strategic improvements before attempting to launch.

Calculating the Serviceable Obtainable Market

Let's break down the process of calculating SOM into manageable steps:

1. Determine Your TAM

The first step is to calculate the potential revenue based on the number of customers in the market. There are two approaches to finding your TAM.

The less accurate top-down approach involves reviewing existing third-party research, such as market reports, to estimate the percentage of overall industry revenue you manage.

The more accurate bottoms-up approach is multiplying the market size by your product or service's annual contract value (ACV) or retail price.

2. Identify the SAM

Next, you must consider the geographic and logistic constraints determining your SAM.

If you are selling a physical product, your SAM would consist of the TAM within your distribution area. This factor applies to both online and brick-and-mortar retailers.

For digital products, the available market is much larger. Still, you would need to take into account software language settings or whether your website is accessible in countries that have more stringent online regulations.

3. Consider Your Company’s Capabilities

Internal factors such as your enterprise's resource allocation and budget will constrain the available market you can reach.

Part of leveraging SOM effectively requires realistically assessing what you can dedicate to brand penetration regarding the following factors:

- Production limits

- Marketing and sales budget

- Pricing model

- Available human resources

You must avoid being overly generous in this phase of calculating your business's SOM.

Misjudging your capabilities can quickly lead to pitfalls like overbuying inventory or unsustainable marketing expenses, which means significant losses without the sales to make up for it.

4. Analyze the Competitive Landscape

Competitors are still a mitigating factor even if a particular market segment is within your geographic reach and you can serve it.

While understanding the competitive landscape and realistically estimating your potential market share can help refine your SOM, overestimating your ability to outpace competitors can leave you with unrealistic expectations.

Do the necessary research into their offerings and current brand penetration to make a more informed estimate of how much of the market you can expect to capture.

5. Estimate Your SOM

Finally, you can estimate your SOM by taking the percentage of the SAM you can realistically capture when considering your company's capacity to serve the market and the current competitive landscape.

Drawing on the eco-friendly smartphone example, you would start with data on the global smartphone market (TAM), then narrow it down to vendors within your geographic reach (SAM).

After considering your startup's production and distribution capabilities and your competitors, you determine that you can capture 1% of the SAM in your first post-launch year. This 1% is your SOM.

Serviceable Obtainable Market Across Industries

While the basic principles of SOM apply across all industries, the specific implications and calculation favors can vary depending on the sector.

We’ll look at examples from several industries, focusing on mitigating factors and how they impact SOM calculations.

Retail

For retailers, SOM calculations differ based on whether the enterprise has physical locations, e-commerce platforms, or both.

For instance, a clothing retailer planning to open new physical stores would need to calculate the SOM in different potential locations. The TAM would include all consumers in those geographic areas, while the SAM would refine this number to the brand's target demographics.

The SOM would then consider factors like property rental prices and competitors within a particular radius to determine the area with the most potential for successful brand penetration.

An e-commerce retailer, on the other hand, has a virtually global reach, so the TAM is enormous. The SAM would temper this massive market to the geographic areas to which the retailer can deliver.

The brand's SOM would further narrow the penetration based on digital marketing reach, website traffic, e-commerce platform access, warehouse space, and competing online retailers.

SaaS

In the software as a service (SaaS) sector, businesses face similar limitations to e-commerce retailers regarding digital reach but don't have to consider storing or shipping physical products.

Thus, a company offering project management tools can consider the TAM to be all businesses that manage projects. The SAM would be other enterprises that are large enough to require dedicated project management software and operate in regions where the SaaS provider can deliver their service.

The SOM would account for the company's server capacity, digital marketing reach, pricing model, and the robustness of its customer service. They would also need to research competitors like Basecamp and Asana to develop a strategy that positions them as a more worthy option.

Healthcare

Regulatory considerations play a more significant role in healthcare SOM than most other sectors, making it quite complex to constrict the TAM of all patients who would benefit from a particular treatment or medication into the SAM of only those living in areas where your product has market approval.

From there, factors such as how long a medication has patent protection and competing treatments would go into the SOM calculation.

Strategic Considerations for Optimizing Your SOM

Understanding the concept of your serviceable obtainable market is just the first step. The challenge lies in devising strategies to optimize your market penetration.

Remember, SOM is not static; It can contract or expand based on an ever-evolving market and your strategic decisions to grow your business.

Expanding Company Capabilities

Expanding capabilities is about increasing your internal capacity to tap into your identified market.

By investing in and developing your company's capabilities - production, distribution, marketing, and more - you can serve more of your SAM, effectively increasing your SOM:

- Amplifying production capacity could enable you to meet increased demand.

- Enhancing your distribution network could put your brand’s offerings within reach of more potential customers.

- Bolstering your marketing prowess can raise brand awareness and draw more of your SAM into your customer base.

Competitive Advantages

Competition plays a pivotal role in defining your SOM, so your ability to capture a larger market share within your SAM by developing unique selling propositions (USPs) is crucial to overall growth potential.

You can give yourself a competitive advantage through multiple avenues:

- Superior product features

- Unparalleled customer service

- Competitive pricing

- Strong brand positioning

- Innovative marketing strategies

By offering something uniquely attractive to your target market, you could increase your market share within your SAM, thereby expanding your SOM.

Market Development

Another route to expanding your SOM is through deliberate market development. Keep an eye on organic changes in the market, such as emerging customer segments, shifts in consumer behavior, or technological advances that you can leverage to your advantage.

Alternatively, you can take your market development fate into your own hands by deliberately implementing strategies that change the minds of consumers or building those new advances yourself, should your resources allow for it.

One common method companies use to spur market development is positioning their product as the ideal solution for a particular pain point, educating consumers on what makes it superior to competitors, or the long-term effects of letting the problem go unchecked.

A good example is the emergence of online mattress retailers using specialty materials like cooling gels or memory foam to offer customers a better night's sleep.

The ads explain extensively how hot spots and pressure points affect work productivity because they prevent restful sleep. Their product, they claim, can negate the issue through innovative construction and data-driven design.

Collaborative Partnerships

Strategic partnerships involve aligning with other businesses to access new customer segments and enhance your product or service offerings to broaden your market reach.

These alliances have numerous benefits depending on the goals and resources each business brings to the table, some of which include the following:

- Bundled services or products, adding value for your existing customers and attracting new customers looking for comprehensive solutions

- Shared marketing initiatives, where costs are split between both parties

- Access to your partner's distribution networks, placing your products or services within reach of customers who were previously inaccessible

Remaining Nimble in a Changing Market

Your enterprise has to be agile in the face of factors like a new competitor coming onto the scene or a sudden change in regulations.

To stay on top, put the time and effort into monitoring the market and being willing to adapt your strategy accordingly. Your ability to remain vigilant and flexible is an invaluable advantage over other companies that try to bend the market to their will rather than simply paying attention to the market.

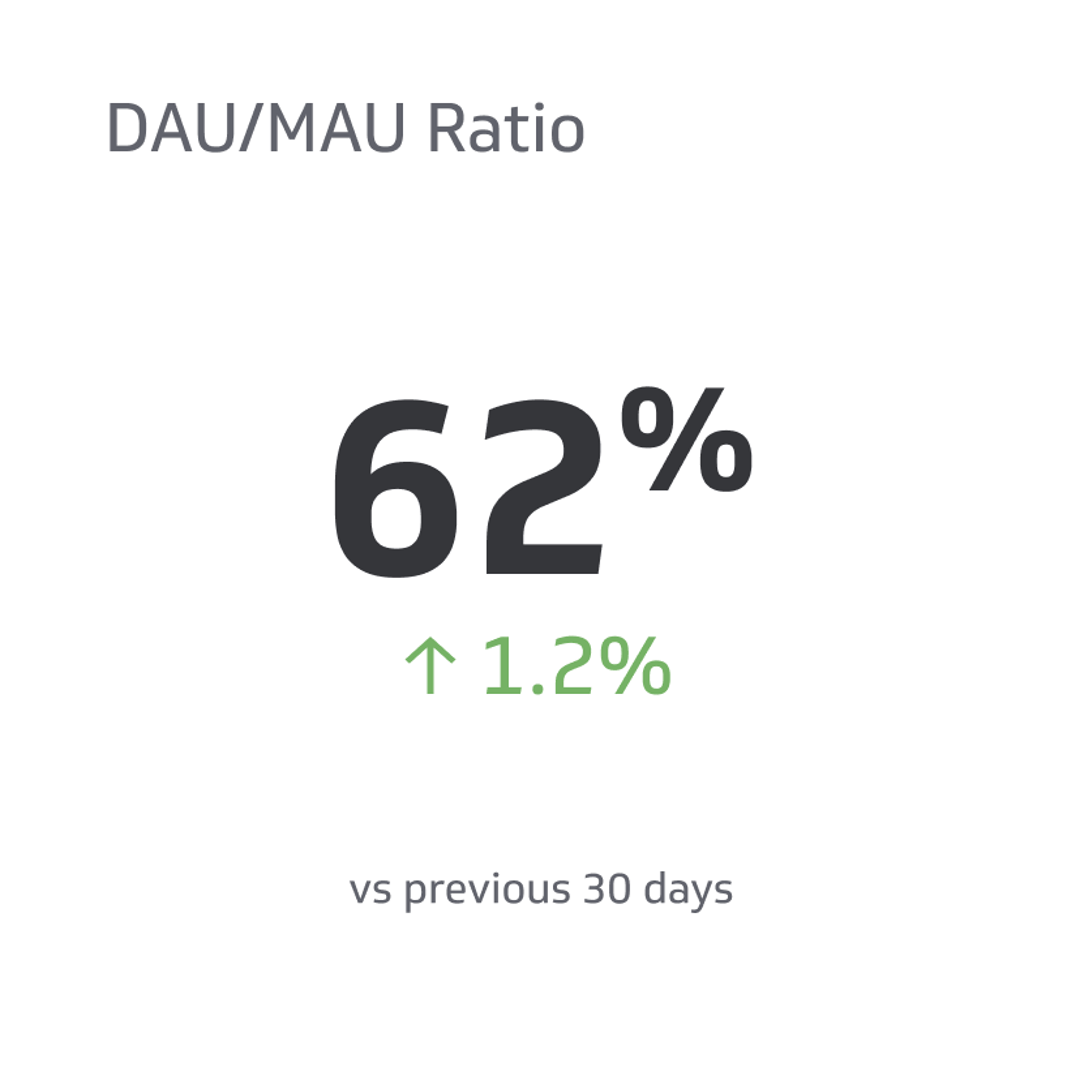

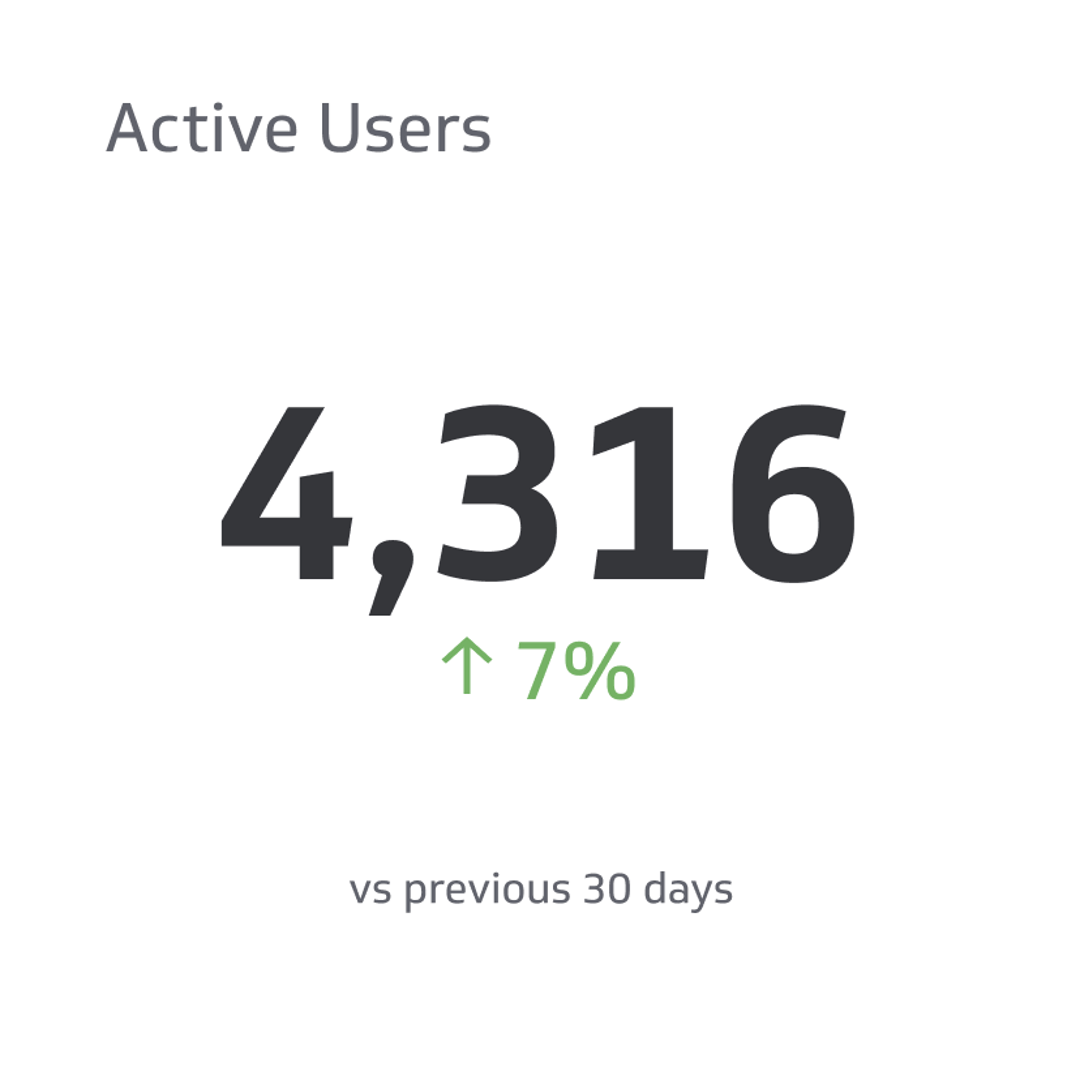

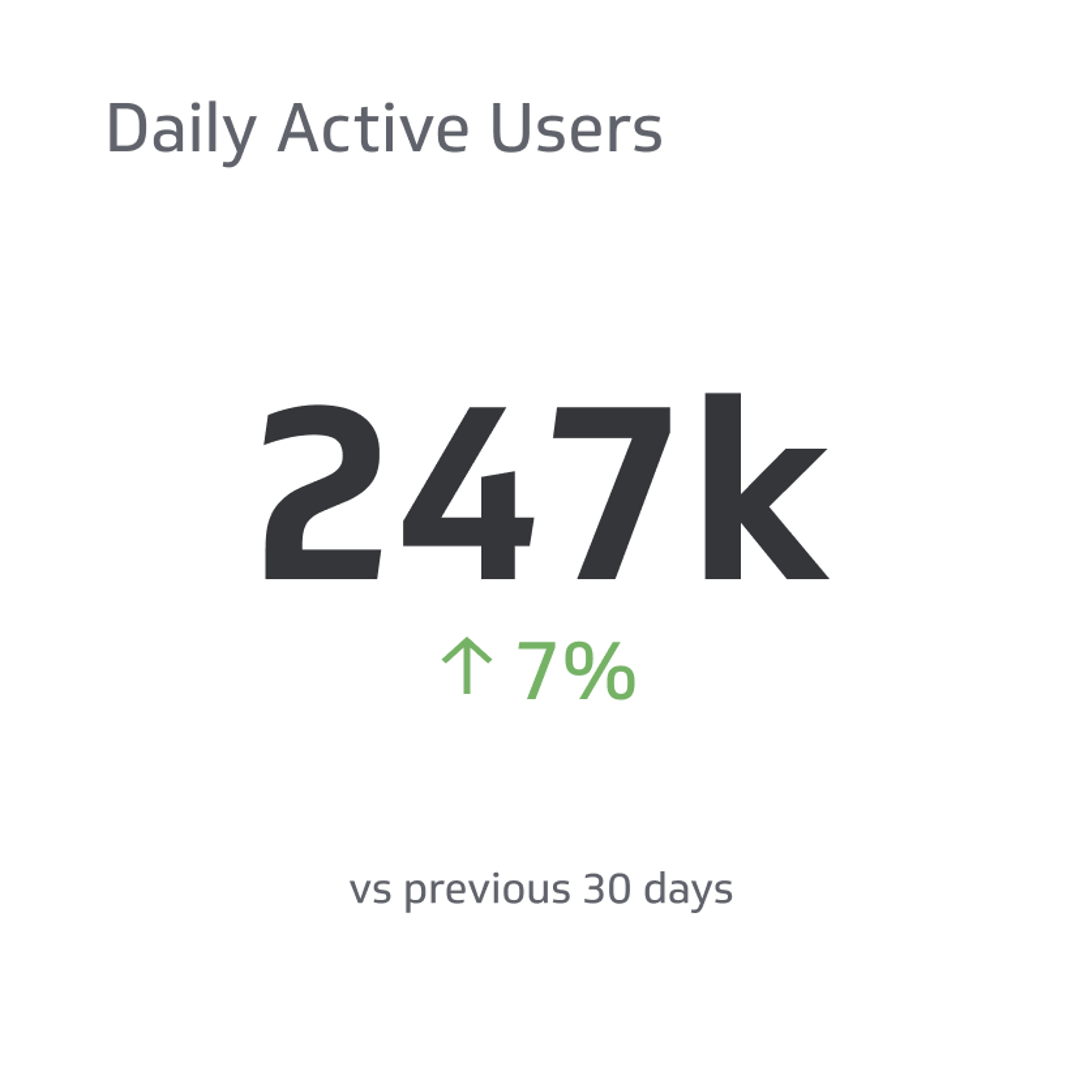

Leveraging SOM With Other KPIs

SOM's realistic market perspective can help businesses set achievable targets and measure performance effectively, thus significantly shaping your enterprise's strategic use of KPIs.

A few of these interlinked metrics include:

- Sales forecasts: SOM offers a realistic view of your potential customer base, helping to create more precise sales forecasts.

- Revenue projections: By understanding the market portion you can realistically capture, you can make more accurate revenue predictions.

- Market share: Your company's market share is the portion of your SOM you've captured.

- Customer acquisition cost (CAC): Knowing your SOM helps better target your marketing efforts, potentially lowering CAC by focusing resources on a reachable audience.

- Customer growth rate: SOM defines the upper limit of your customer growth rate, at least in the short to medium term.

- Revenue growth rate: Revenue growth is directly tied to your ability to capture more of your SOM over time. The more revenue you have, the more you can invest in growing your market penetration.

Final Thoughts

Companies that balance their growth ambitions with a clear understanding of their serviceable obtainable market are more likely to achieve long-term success because it empowers them to set realistic targets and allocate resources efficiently.

Whether launching a startup, introducing a new product, or exploring new markets, your SOM is a reality check that helps ground your business strategy. Leverage it accordingly, and watch your market growth flourish.

Related Metrics & KPIs