The KPIs of personal finance: How to measure your personal financial success

Published 2023-03-21

Summary - Tracking your personal financial success is an important means of reaching your financial goals. Use these KPIs of personal finance to stay on track.

For most of us, managing our finances is tough.

We need to figure out where we want to prioritize our spending, set a budget and identify goals.

And that’s to say nothing of actually having to curb your spending and resist that shiny new bobble you’ve been coveting.

Enter personal finance KPIs.

By setting KPI targets for your personal finances you can:

- Identify the goals towards which you’re working

- Offer insight into how well you are progressing toward your goals

They might just be the key to ending the month with a low credit card balance and more money in the bank.

The importance of measuring your personal financial success

A lot of people don’t pay attention to their finances.

They can get away with not setting a budget or tracking their spending and paying off their credit card balance when they feel like it.

For the rest of us, though, it’s not that easy.

If we don’t pay attention to what we’re spending our money on, our bank accounts quickly spin out of control and our credit card balances skyrocket.

It also can help you identify areas where you are spending too much.

Take subscriptions as an example.

You have subscriptions, right? Of course you do. Nearly everyone does.

By tracking your spending you can uncover that music service or magazine subscription you originally signed up for as a free trial and now, despite having never been used since, continues to drain your bank account.

Tracking your spending is also an integral part of planning for your long-term goals.

What are the KPIs of personal finance

The KPIs of personal finance are the metrics that matter most for measuring your personal financial success.

They are goals you set for yourself that you regularly check in on so you can see how you are progressing against reaching your underlying objectives.

Your personal finance KPIs are:

- Unique

- Quantifiable

This helps to take the goals that are most important to your financial situation and express them in a format that leaves no doubt about whether you achieved them or not.

Why use KPIs to measure personal financial success?

KPIs are best-known for helping us to measure – and accomplish – our goals in the professional world.

But they also can play an important role in our personal lives as well.

In the world of personal finance, KPIs help make up for a shortcoming endemic even to many who do budget on a regular basis: Reaching our long-term goals.

Here's why:

- They identify what’s important: Everyone’s personal financial goals are different. Some of us want to pay down debt. Others want to save for vacation or a major purchase. And for many people, building up a nest egg around savings or investment is key. By setting KPIs you can identify what matters most to you. This, in turn, helps ensure you stay on track.

- They keep track of your progress: Setting goals is one thing. Seeing how you’re progressing against them is another. KPIs, because they’re quantifiable, tell you what you need to measure so you can check in on them on a regular basis. That way you have a clear sense of whether you’re meeting – or missing – your financial goals.

- They help to get on the same page: It likely won’t come as much of a surprise that money is one of the top source of acrimony between couples. Setting KPIs forces you to at least sit down and get on the same page about your priorities. This can play a big part in smoothing out any potential sources of conflict about where you want your finances to go. Who knows – it might even save your relationship.

Now... let's dive into the top personal finance KPIs!

The best KPIs for personal financial success

How do you measure personal financial success?

Everyone’s personal financial goals are, of course, different.

So not all of these are going to apply to your situation.

Nor is this intended to be a comprehensive list.

Instead the idea is that this will help to give you ideas of the KPIs you want to set for yourself.

We’ve divided these KPIs into “traditional” and “creative”.

Traditional KPIs are the ones that have been in use for years.

Creative KPIs are, for the most part, interesting combinations of metrics that offer creative ways of measuring your personal financial success.

The traditional KPIs of personal finance

1. Credit score

I know what you’re saying.

Personal finance KPIs are supposed to be a measure of the most integral metrics for personal financial success.

So what is credit score – a metric that primarily measures your ability to access other financial instruments such as loans – doing on this list?

Well, hear me out.

First of all: Yes, a good credit score is important when applying for loans or credit cards as well as helpful for reducing other regular payments you’ll need to make.

But it also has another utility as a means of measuring personal financial success.

Your credit score gets downgraded for stuff like missed credit card payments and defaults on loans – the sorts of financial activity all of us want to avoid.

That allows us to use our credit score as one of the few independent metrics we can use to measure financial success.

2. Savings rate

Saving is an essential part of any financial plan.

If you don’t save you can’t make any major purchases, enjoy retirement or reap the benefits of investing.

It’s as simple as that.

3. Discretionary spending

We don’t have direct control over how much income we make (to a degree).

Nor can we control having to spend money on the bare necessities like a place to live or meals to eat.

What we can control, though, is how much we spend on the stuff we don’t need: meals out, fancy clothes, vacations.

That’s what we mean when we talk about discretionary spending.

Tracking it can help keep a lid on unnecessary expenses, leaving a greater amount left over for more important goals.

4. Net worth

Net worth is one of the most popular personal finance KPIs.

Why?

Because it helps measure your financial health in a way that just isn’t possible when you’re looking at liquid assets like the cash you have in the bank.

You can calculate net worth by taking all of your assets (the money you have in the bank, the value of your house, how much your car is worth etc.) and subtracting your liabilities (the amount left on your mortgage, any debts you have from loans and credit cards).

The end result?

A depiction of how your financial situation is evolving over the long-term, not just on a month-by-month basis.

Ideally, this number will be positive.

If not, you’ll want to look at ways to reduce your liabilities (such as by paying off debts) and increasing the value of your assets (such as by investing).

The creative KPIs of personal finance

There are a ton of creative personal finance KPIs out there (in particular, on the personal finance subreddit).

Here we’ll give you a taste of how getting creative can help you achieve your financial goals.

1. Financial Health Index

Bassam Salem of the Mindshare Ventures blog has an example of a metric that I love as a means of creatively measuring financial success.

His Financial Health Index – a metric he created – combines several other custom metrics to provide a complete picture of financial health.

The best part?

His Life Happiness Index.

The LHI, as he calls it, is useful because it isn’t purely financial.

In fact, it isn’t financial at all.

Instead, it provides a picture of how much time you spend working on the outside-of-work pursuits you really enjoy.

It’s calculated by dividing the number of daily hours you spend doing what you want into the non-required sleep hours per day.

The higher the score, the more time you are spending doing what you want. The lower the score, the greater the indication you are sacrificing lifestyle to cover your budget.

“One can always work two jobs to make more money, but at what cost?” writes Salem. “One can have no car but spend three hours getting to work; is that a worthwhile trade-off?”

It’s a great example of how a non-traditional, creative KPI can help you track your financial success.

2. Financial independence number

MoneyMow offers a succinct overview of what the financial independence number, a creative way of measuring what you’ll need to accomplish to become financially independent, means:

“The financial independence number is the amount of money you need to be able to live off the returns on your net worth without depleting your net worth. Once you have money in the bank equivalent to your financial independence number, you can call yourself financially independent for life because it does not deplete your net worth.”

You can calculate your financial independence number by dividing your yearly spending into your withdrawal rate.

For more information, check out MoneyMow.

Conclusion

KPIs have utility outside of the work world.

Adopting some KPIs for your personal finance goals can help to keep you on track and on budget.

Who knows – it might even save your relationship.

Related Articles

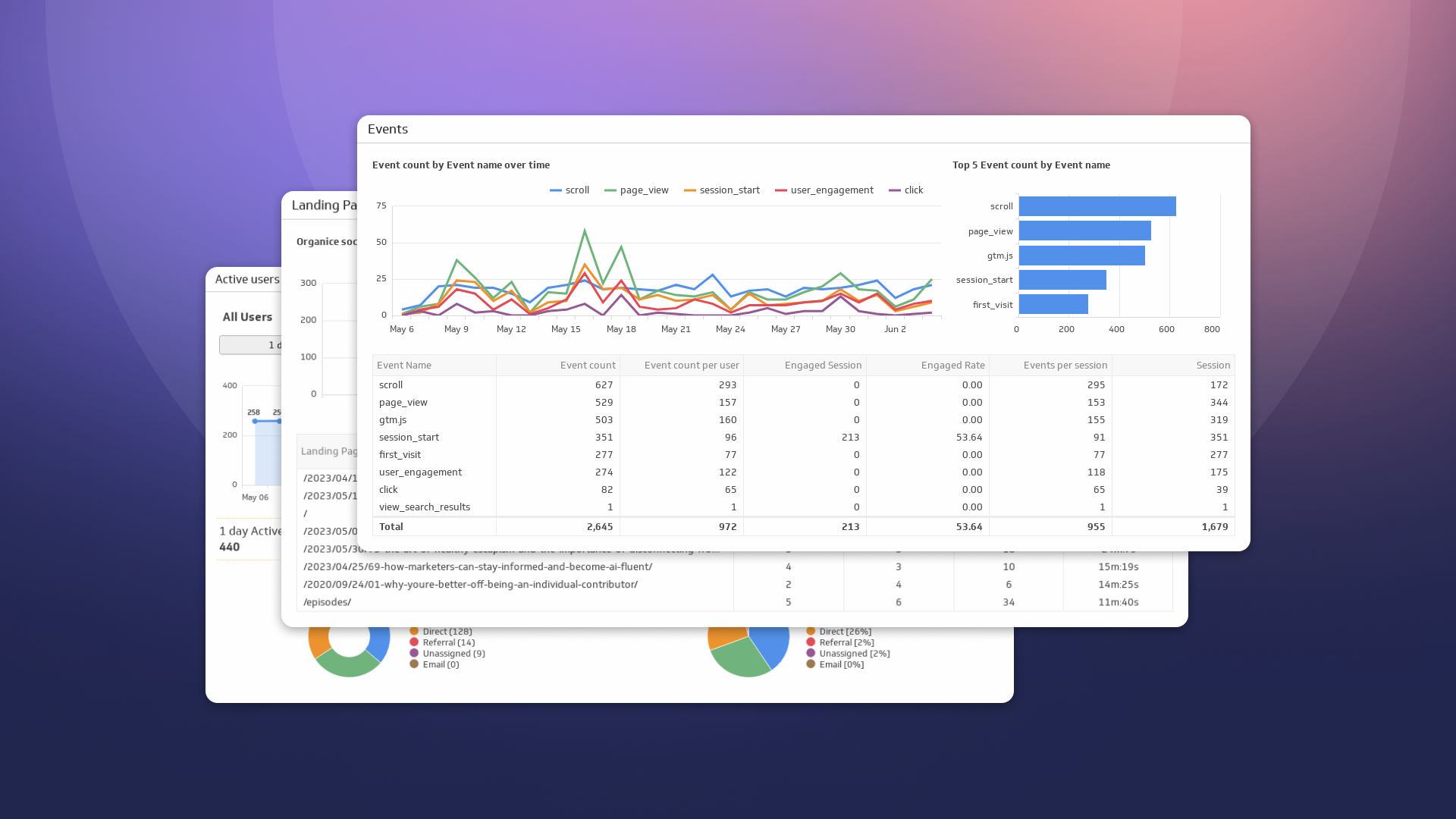

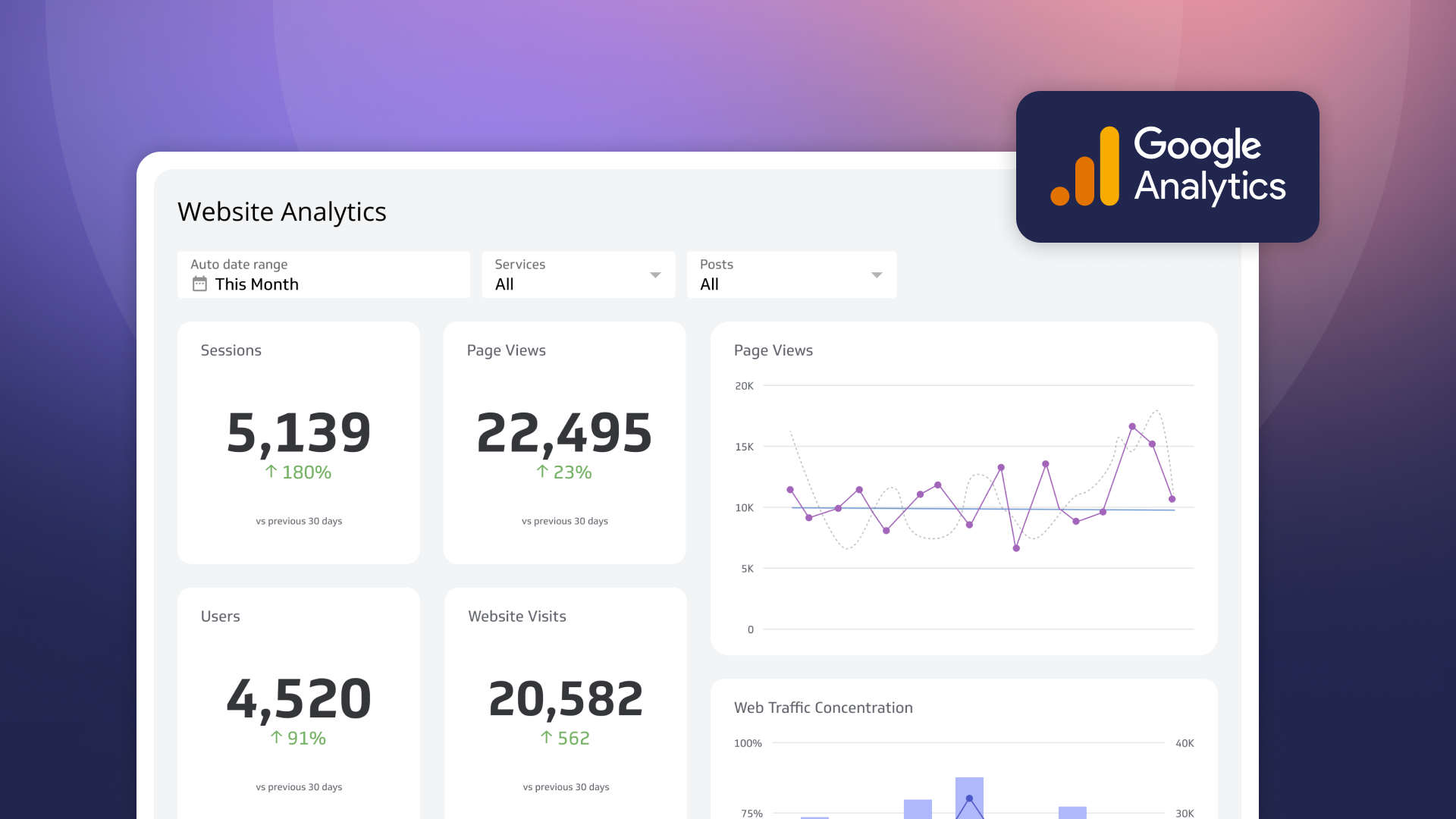

How to Build Google Analytics 4 Dashboards in Klips

By Jonathan Taylor — June 6th, 2023

How to use the Google Analytics 4 Query Explorer to export data

By Jonathan Taylor — June 1st, 2023

Unlock Data-Driven Decisions with ChatGPT & MetricHQ

By Nicolas Venne — April 3rd, 2023