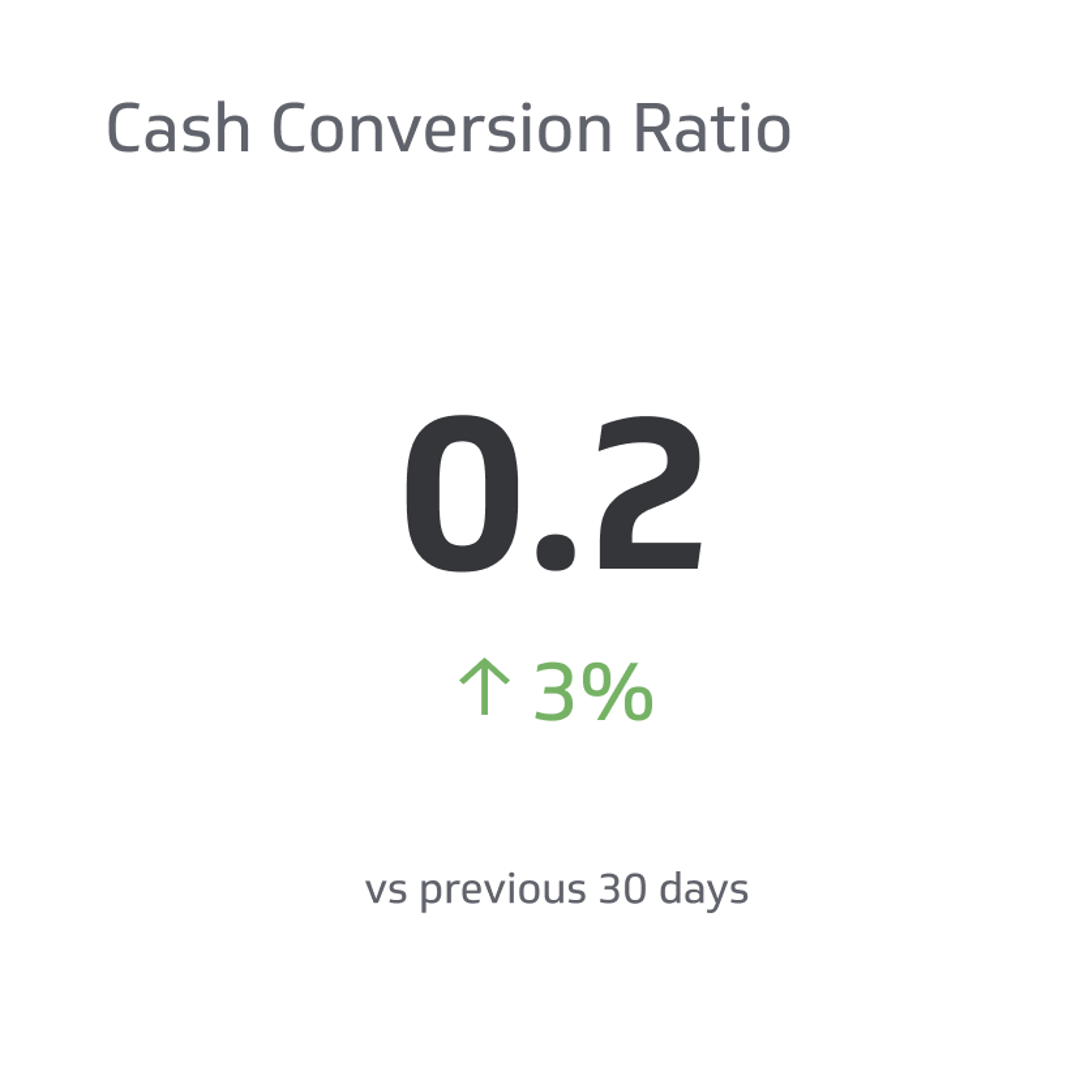

Cash Conversion Ratio

The cash conversion ratio is a metric that determines the proportion of a business's earnings before interest, taxes, depreciation, and amortization that is converted into operating cash flow for meeting various financial obligations, such as paying off debts or funding investments.

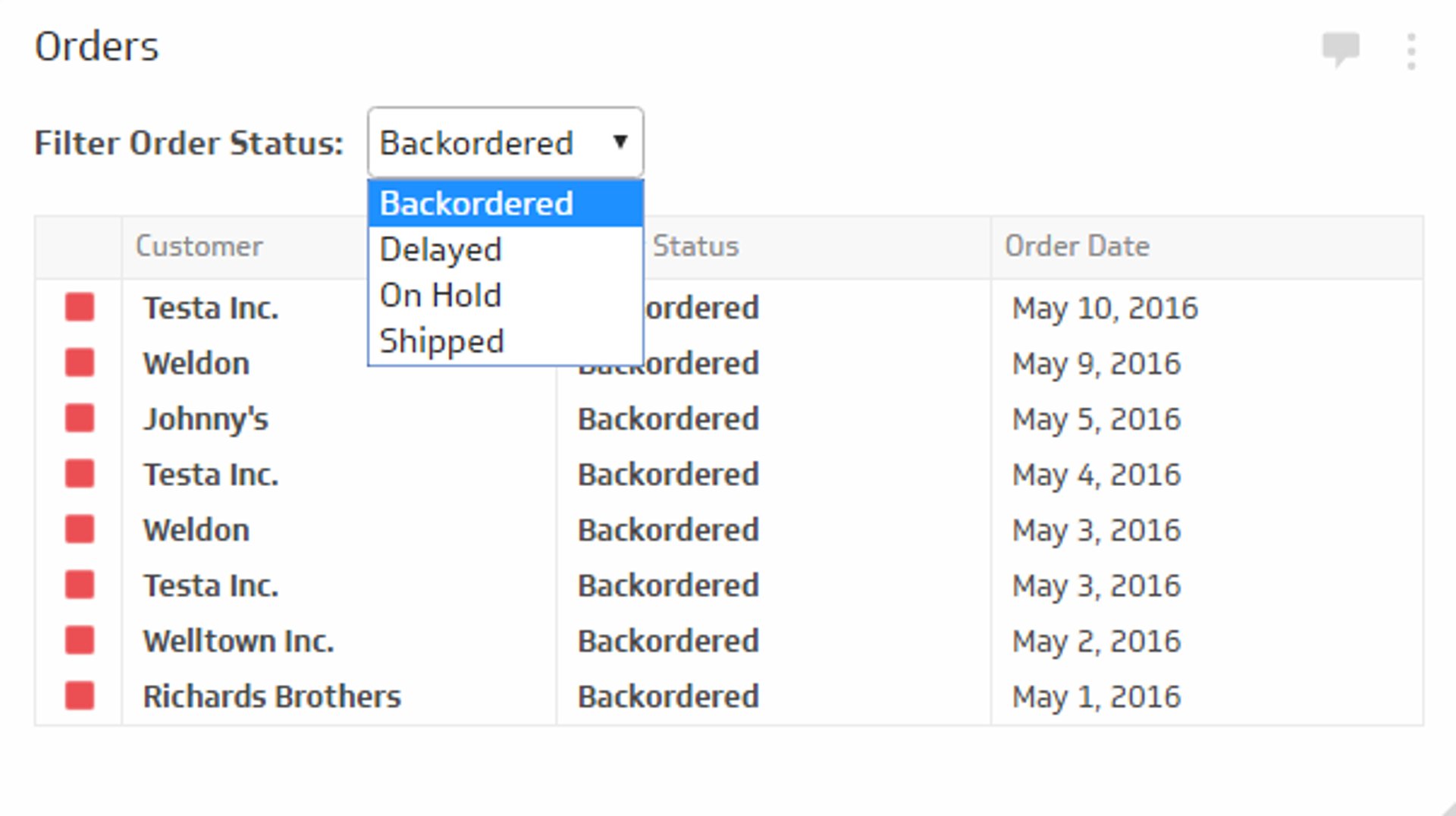

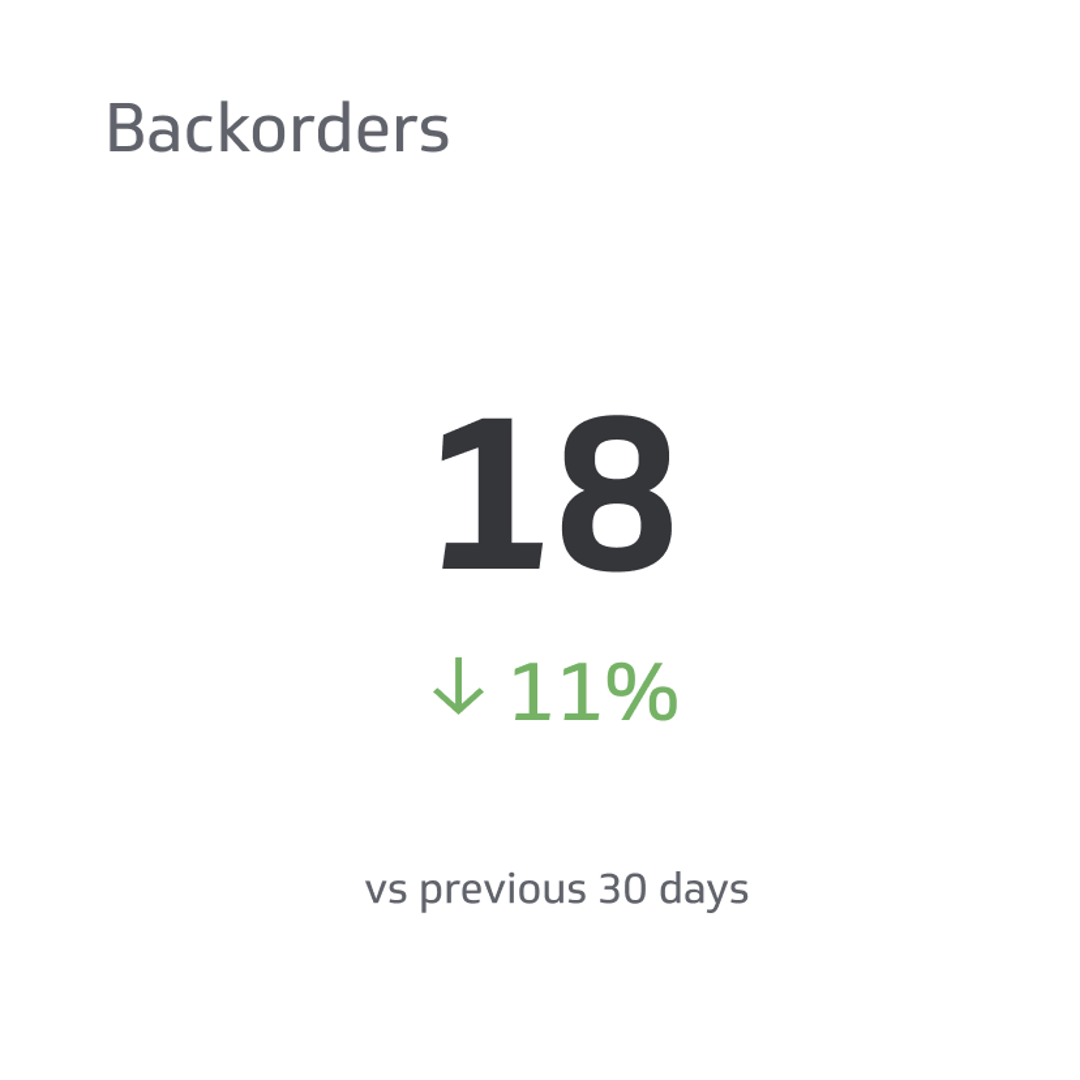

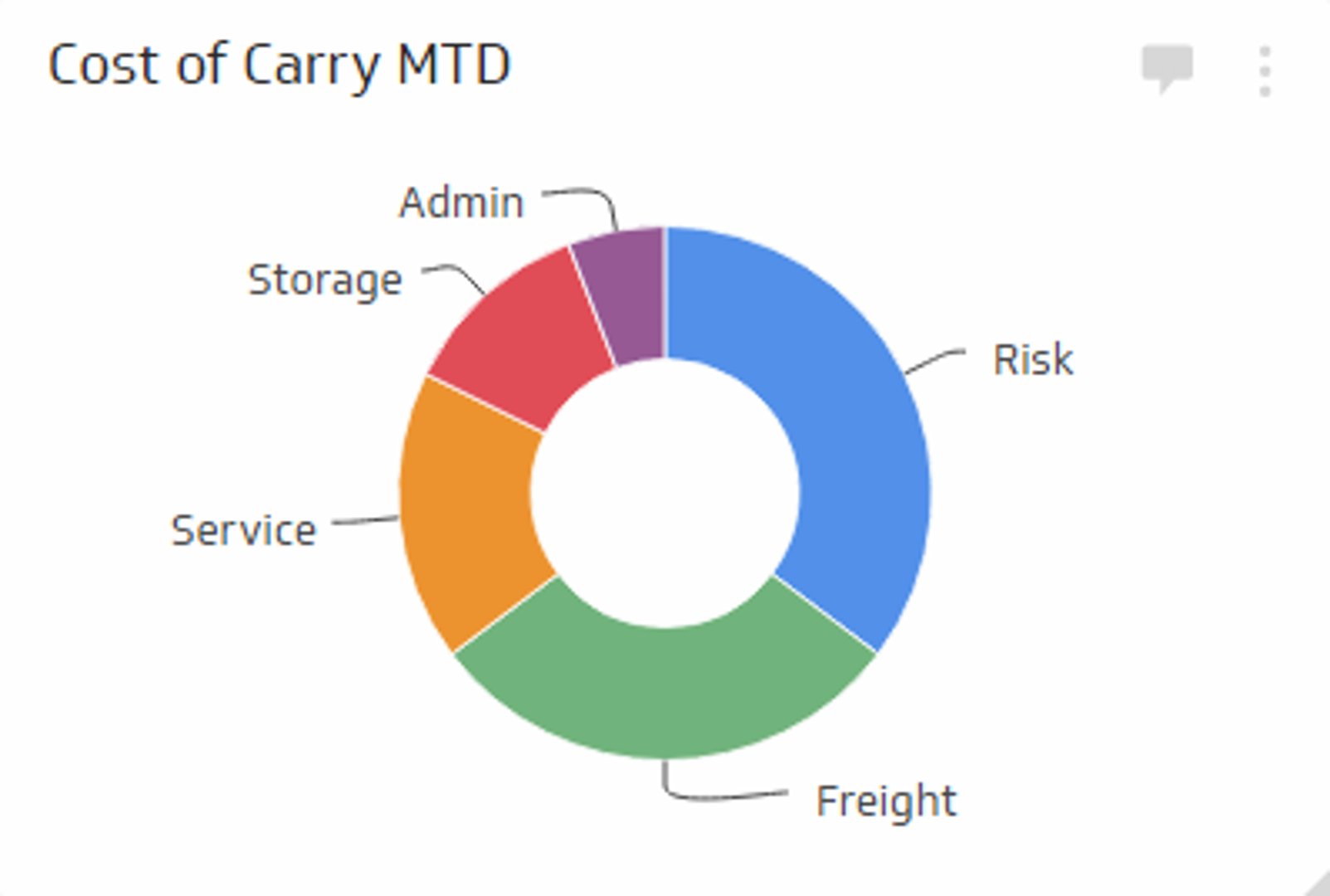

Track all your Supply Chain KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Key performance indicators (KPIs) help enterprises maintain rigorous standards to build sustainable, successful companies. One important KPI in business performance and decision-making is the Cash Conversion Ratio (CCR), which assesses a company's ability to convert profits into cash.

Let's look at the calculation, interpretation, and application of the Cash Conversion Ratio as part of the larger financial picture of a business.

What Is the Cash Conversion Ratio?

Cash conversion ratio is a financial metric that measures the percentage of a business’s EBITDA converted into operating cash flow for paying debts or funding investments.

Because it measures how efficient an enterprise is at managing its cash and expenses, it provides invaluable insights into the overall financial performance, including:

- How able a business is to meet short-term financial obligations.

- How a business's performance stacks up to other companies in the same industry.

- Areas in a business that require strategies to improve cash management practices.

What Is Considered a "Good" Cash Conversion Ratio?

Depending on the particular industry your enterprise is in, a good CCR will differ.

In general, however, a CCR of 1 indicates that a business efficiently converts every dollar of net income to cash.

A CCR above 1 means that you have high liquidity that you can then use to invest in business growth strategies like marketing, product development, or hiring.

A CCR below 1 indicates that invoices are delayed or that your expenses in a particular period are eclipsing your profits.

Calculating CCR

Before calculating CCR, you'll need to familiarize yourself with its two main components: Operating Cash Flow (OCF) and Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA).

While these two numbers are valuable as standalone metrics, the cash conversion ratio gives them synergy that lends invaluable insights into the fiscal health of an enterprise.

Calculate Operating Cash Flow

Operating Cash Flow, or OCF, represents the cash generated by a company's regular business operations, including inflows and outflows from the company's primary revenue-generating activities.

It's a key indicator of how well a company can generate the liquid assets necessary to cover day-to-day costs, grow its operation, and pay off debt.

The calculation for OCF is as follows:

OCF = Net Income + Depreciation + Changes in Working Capital

In this formula:

- Net Income refers to how much money a company makes after accounting for all expenses.

- Depreciation is how much an asset's value decreases over time.

- Changes in Working Capital are the differences in asset and liability value from one fiscal period to another.

A positive OCF signifies a company has sufficient cash flow to cover operational expenses, while a negative OCF indicates potential cash flow issues.

Calculate EBITDA

The EBITDA measures an enterprise's earnings before deducting the amount spent on interest, taxes, depreciation, and amortization expenses to represent a business's total profit.

Typically, it's used to express the potential value of a company to a buyer or investor, but it is also an integral component when calculating internal performance metrics, including CCR.

The calculation for EBITDA is as follows:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

In this formula:

- Net Income is the money the enterprise makes in a predetermined time frame.

- Interest is all debt-related interest costs and does not include the principal payment.

- Depreciation is how much a tangible asset costs, such as machinery or buildings, over the asset's use within the enterprise minus the estimated resale value.

- Amortization is the cost of an intangible asset, such as franchise contracts or trademarks, spread over the asset's entire useful life.

Usually, companies take their EBITDA one step further by calculating the EBITDA margin, or the EBITDA ÷ total revenue, to figure out the percentage of total revenue spent on operating expenses.

A higher EBITDA margin is a good sign, as it means a business successfully balances operating expenses to maintain profitability.

Calculate the Cash Conversion Ratio

Once you've calculated the OCF and EBITDA, you can plug those numbers into the Cash Conversion Ratio formula:

CCR = OCF ÷ EBITDA

Cash Conversion Ratio in Action

Let's consider the hypothetical ABC Corp, a manufacturing company that produces widgets for a particular piece of machinery.

Using ABC Corp's financial statements, we have the following data:

- Net Income: $500,000

- Depreciation & Amortization: $100,000

- Changes in Working Capital: $50,000

- Interest: $30,000

- Taxes: $120,000

Using this data, we can calculate the Operating Cash Flow and Earnings Before Interest, Taxes, Depreciation, and Amortization as follows:

OCF = Net Income + Depreciation + Changes in Working Capital

OCF = $500,000 + $10,000 + $50,000

OCF= $650,000

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

EBITDA = $500,000 + $30,000 + $120,000 + $100,000

EBITDA = $750,000

Now that we have the values for OCF and EBITDA, we can calculate the CCR:

CCR = OCF ÷ EBITDA

CCR = $650,000 ÷ $750,000

CCR = 0.87

Interpreting CCR Results

A Cash Conversion Ratio of 0.87 means that ABC Corp converts 87% of its EBITDA into operating cash flow, below the ideal "perfectly efficient" Cash Conversion Ratio of 1.

At this point, they should analyze the underlying reasons behind their lower CCR and implement strategies to improve their efficiency.

Otherwise, they may face challenges generating enough cash to cover their financial obligations and hurt their chances of convincing investors to put capital into their business.

Limitations of Cash Conversion Ratio

While the Cash Conversion Ratio has its role in assessing a company's cash management efficiency, it has certain limitations that you should consider:

- The CCR does not account for non-cash expenses like stock-based compensation and deferred income taxes.

- Different industries and business models have varying cash flow patterns and working capital requirements. Comparing CCR values across companies with business models that differ from yours won't give you a fair comparison.

- A high CCR during this financial period does not guarantee sustained economic efficiency over the long term. This limitation is particularly relevant in industries that experience seasonality, such as construction.

So long as you keep these limitations in mind, the cash conversion ratio is still valuable in developing a comprehensive overview of your business's financial health.

Strategies for Improving Cash Conversion Ratio

Once you've identified the inefficiencies in your cash flow management, the next step is addressing the issue by implementing smart business strategies that help close the gap.

Optimizing Invoices

Late invoices are among the most prevalent reasons enterprises fall behind in their cash conversion cycle.

Encourage your clients to pay early by offering a small discount or consider hiring someone to act on behalf of accounts receivable to remind clients who still need to pay persistently.

Consider implementing a more user-friendly payment process.

For example, a real estate manager who requires in-office payments adds an extra step to the process. In contrast, an online payment portal would make it far easier for their tenants to pay without requiring an unnecessary trip.

Focusing on the Most Profitable Projects

At least in the short term, prioritize taking on projects and clients that yield the highest returns, thus generating more cash flow.

By allocating your resources and workforce only to the most profitable ventures, you can provide stellar results, thus improving your relationships with the customers and bringing more money to your business long-term.

Once you've improved your CCR and overall financial outputs, you can shift your focus to incorporating smaller clients and diversifying your customer base.

Monitoring Consistently

Make financial checkups part of your routine. It will help you identify minor problems before they escalate into more significant issues and give you timely feedback on which of your strategies are working.

While it's tempting to throw every strategy you can think of at the problem to fix it as quickly as possible, doing so will affect your ability to parse out what's effective and what's a waste of your resources.

Instead, use real-time analytics to evaluate one variable at a time, then reassess and implement only the most valuable strategies at the end of the predetermined monitoring period.

Final Thoughts

Although the Cash Conversion Ratio has limitations, it is still a valuable metric to keep in your toolbox. It allows you to identify potential cash management issues and implement strategies to improve them, particularly when paired with ongoing, consistent analytics.

By combining CCR with other supply chain metrics, you can better understand your business's financial health and make more informed decisions to ensure long-term stability.

Related Metrics & KPIs