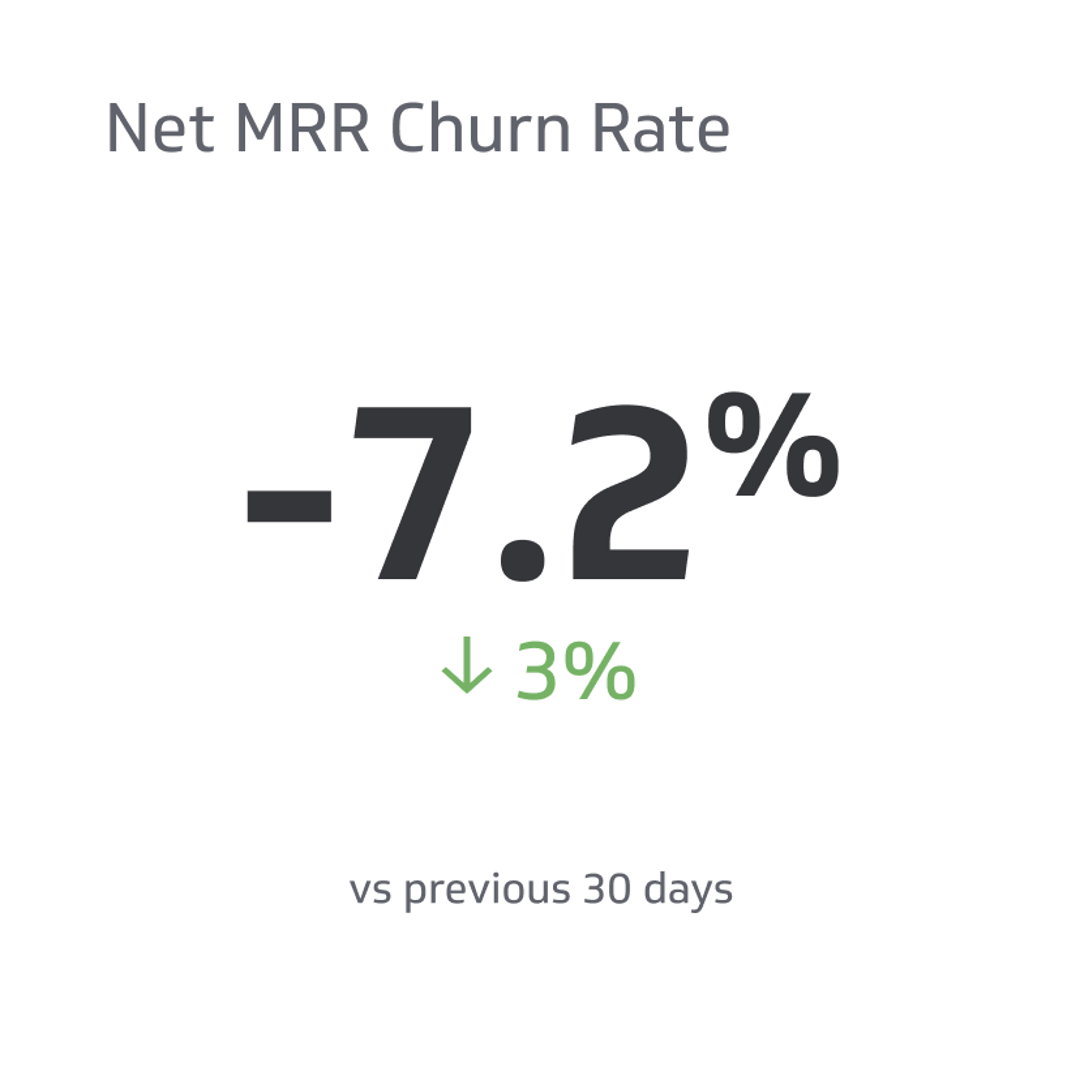

Net MRR Churn Rate

This metric helps evaluate how well a company is doing in terms of retaining existing customers and generating revenue.

Track all your SaaS KPIs in one place

Sign up for free and start making decisions for your business with confidence.

When running a subscription-based business, understanding metrics that measure your company's growth and success is crucial. One of the key metrics to keep an eye on is the Net Monthly Recurring Revenue (MRR) churn rate. It can help you evaluate how well your company is doing in terms of retaining your existing customers and generating revenue.

Let's take a deeper look at the MRR Net Churn Rate, how to calculate it, and why it's an important metric for your subscription-based business.

What is Net MRR Churn Rate?

Net Monthly Recurring Revenue (MRR) churn rate is a metric that measures the rate at which customers stop their subscription services, which negatively impacts monthly recurring revenue. Specifically, it measures the percentage difference between lost MRR and the new MRR generated by upselling, cross-selling, or new sign-ups during a given period.

It also checks the revenue from existing customers you are losing and your efforts to recover it. The net MRR churn rate calculation considers the total number of subscribers at the start of the period, the number of subscribers who churned during that period, and the amount of revenue lost due to those churned subscribers.

How To Interpret Net MRR Churn Rate

Interpreting this metric is crucial as it gives you insight into the health of your subscription-based business. The higher the net MRR churn rate, the more revenue you lose due to customer churn. This can imply that you need to review your customer retention strategy or find ways to improve your service to maintain your existing customers.

On the other hand, a lower net MRR churn rate indicates your business is doing well in retaining customers and that customer acquisition is strong to offset revenue losses due to churn. Based on the calculated MRR churn rate, you can develop actionable insights to improve customer engagement and retention.

If you can not interpret the metric in this manner, it can cause you to miss out on opportunities to grow your subscription-based business. Therefore, keeping track of your net MRR churn rate regularly and adjusting your customer retention strategies is essential.

Calculating Net MRR Churn Rate

You'll need to know the formula to calculate the net MRR churn rate. The formula is pretty simple and is as follows:

- {(Churned MRR - Expansion MRR) ÷ Beginning MRR 30 days prior} x 100

Where:

- Churned MRR is the monthly recurring revenue lost from customers who stopped their subscription service during the measured period.

- Expansion MRR is the monthly recurring revenue generated by upselling, cross-selling or new sign-ups during the same period.

- Beginning MRR is the monthly recurring revenue at the start of the measured period.

You'll need to gather the data for the values above, plug them into the formula, and then get your net MRR churn rate. Hopefully, you have these values handy, but if you don't, you'll need to look for them before calculating the net MRR churn rate.

Example

Let's look at an example of calculating the net MRR churn rate.

For this example, let's say that a company has a total MRR of $100,000 with a churn of $4,000 and an account expansion of $1,600. You'll use these values to plug into the formula mentioned above. These numbers within the net MRR churn rate formula will look something like this:

- {($4,000 - $1,600) ÷ $100,000} x 100 = 2.4%

For a small business, a 3% to 5% churn rate is generally considered good, so the above example shows that the company this example applies to might need to do some work to improve its net MRR churn rate.

Advantages of Using Net MRR Churn Rate

There are several advantages to using a net MRR churn rate. Some of the main ones include:

- Being able to see a more accurate picture of how much revenue a company is losing.

- You can identify problem areas and where you can improve as a business.

- Net churn rate can help with business forecasting to adjust business strategies.

- You can benchmark your company's performance against competitors in your industry.

- It allows you to prioritize specific efforts that will help improve your business's performance.

Ensuring the calculations are accurate is essential, as wrong results can cause a misleading picture of the business’ state.

Limitations of Using Net MRR Churn Rate

Despite several advantages to using net MRR churn rate to learn more about your business's revenue, it's not without limitations. While you should still use the metric, here are the main limitations of it that you need to be aware of:

- It's a metric only for subscription-based companies.

- It doesn't factor in your revenue from new customers or subscribers.

- The churn rate can change as per price changes.

- You can't use it independently because it needs other metrics to comprehensively understand a business's financial situation.

- It doesn't capture customer sentiments that lead to churn rates like dissatisfaction and pressure from the competition.

How To Improve Your Net MRR Churn Rate

Once you learn your net MRR churn rate and why it's essential, you can determine if you need to improve it. If you do, these five tips can help you improve your churn rate.

Encourage Long-Term Contracts

Depending on your business type, this will look different, but this allows you to earn more income from existing customers and will increase the likelihood that they'll stick around and continue paying you. You'll want to provide options to your existing customers that allow them to upgrade to better plans with new features.

Long-term contracts can be for a year or as short as six months. Ideally, the longer, the better, so you'll want to avoid any month-to-month contracts because these can encourage customers to cancel at a moment's notice.

Find Ways to Upsell To Existing Customers

Finding ways to upsell to your customers can help your business stay relevant and sustainable. Not only will upselling earn your company more revenue, but it can allow you to build stronger relationships with your customers.

Whether you want to offer additional services, upgrades to current services, limited-time offers, or something else, these might appeal to your existing customer base and increase your net MRR churn rate.

The best part about upselling is that you don't necessarily need to develop 100% new ideas. You can see an increase in revenue by simply providing a coupon for specific services.

Increase Your Prices

If you're considering increasing your prices, consider giving current customers the price they started their subscription at for a specified amount before upping their price. Changing their price immediately can upset people and even have them cancel their subscription, which won't help your churn rate.

Develop Product Add-Ons and Other Features

You don't need to change your products entirely to see an improved churn rate. You can develop new products that fit with what your customers are using already to entice them to spend more money with your company rather than somewhere else.

You can even offer product add-ons and premium features that only those who add them to their current service can access. This will look different for every company depending on your services and products.

Monitor Your Customer Churn

When you can recognize trends and see patterns within your customer churn, you can better plan where your business plan or products needs tweaking.

Monitoring your customer churn can see how close you are to losing certain customers and if you can do anything to keep them with your services. You'll have more control over your business and can see how sustainable your business will be long-term.

Final Thoughts

Net MRR churn rate is an excellent metric for subscription-based business owners to see a better view of their company's performance. Calculating the churn rate is pretty simple as long as you can access the necessary values.

The results can help you determine if your company is experiencing revenue loss due to net churn, so you can develop actionable insights to improve customer engagement and retention. Although there are some limitations to using net MRR churn rates in isolation, it's still an important SaaS metric to consider alongside other financial and customer metrics.

Related Metrics & KPIs