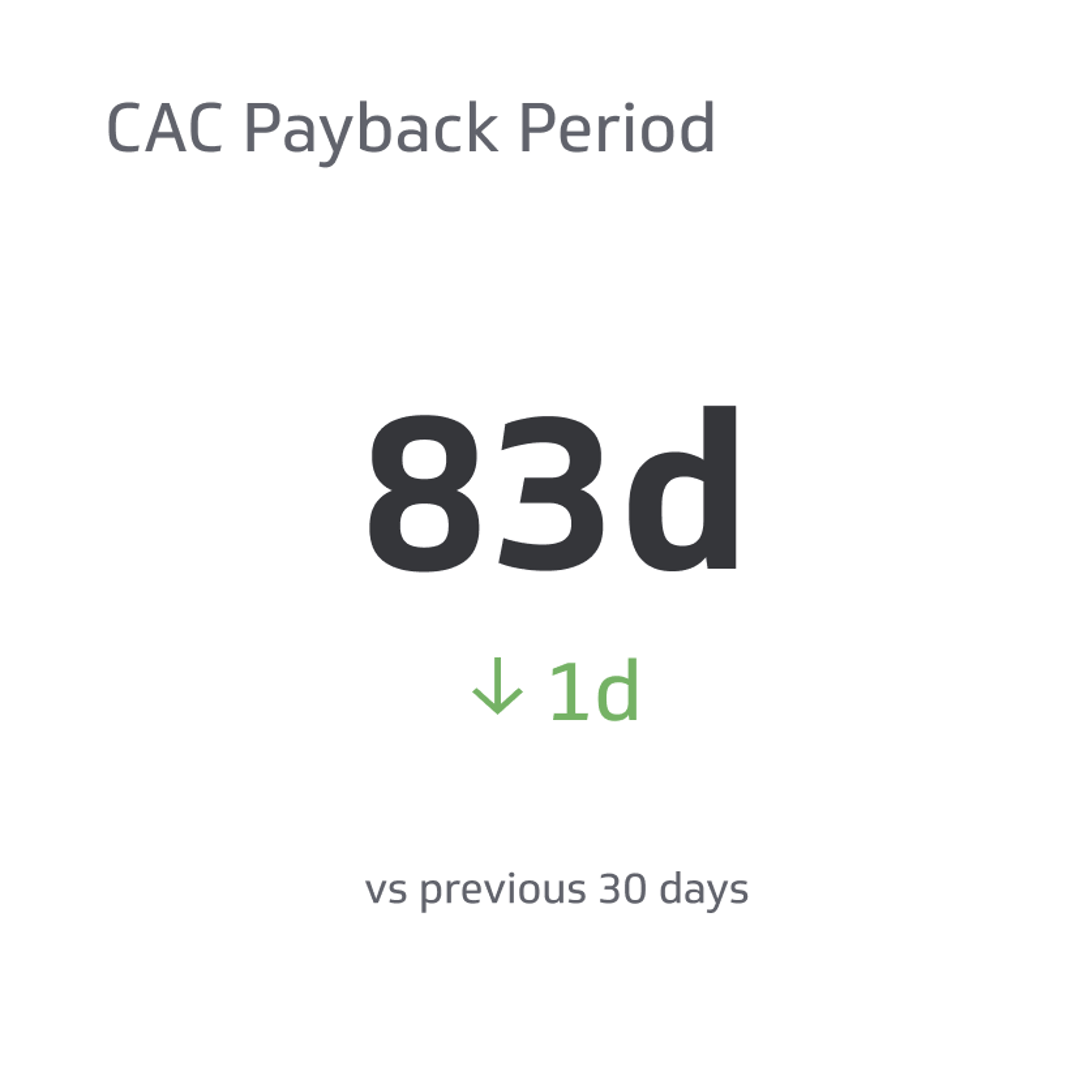

CAC Payback Period

The CAC payback period takes your Customer Acquisition Cost (CAC) and calculates it against how much marketing you had to do to bring that customer to your business.

Track all your SaaS KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Many startups think they’ll profit as soon as they pull in customers, but there’s more to it behind the scenes. SaaS businesses have to consider the competition so they price their goods and services correctly, making them enticing enough to win over new customers without cutting out all potential profit.

A new customer using your service isn’t an automatic profit, either. There’s a cost associated with taking on clients, so you have to weigh what the customers pay against how much you spend acquiring them. Any business looking for investors and stakeholders needs to understand this figure so they can present an accurate picture of the company’s finances.

When you understand your business’s CAC payback period, you’ll know how much profit you can make per customer, which helps you estimate your company’s potential growth.

What Is CAC Payback Period?

The CAC payback period takes your Customer Acquisition Cost (CAC) and calculates it against how much marketing you had to do to bring that customer to your business.

The basic foundation of this term is the classic idea of having to spend money before you can make money. You can’t expect a new customer to be pure profit because you need to draw them into your business with marketing and sales tactics, which cost money.

The CAC payback period is how long it takes your business to recoup the money you spent acquiring this customer. Many factors impact the CAC payback period, such as how much you spend on marketing, how much you charge for services, and how much your customer pays.

Some CAC payback periods are low due to organic leads or social media marketing, though there are still costs relating to your employees’ work reaching out to the contact list or posting content online. However, these costs are lower than a more involved marketing campaign that includes mailers and billboards.

Regardless of your marketing approach, there are always baseline costs for your employees’ salaries. Anyone who works in sales or marketing puts forth an effort to bring in new customers, so their costs count in the payback period. The other factors in the payback period vary based on your business practices.

Who Uses the CAC Payback Period Metric?

All businesses can use the CAC payback period metric to track their customer-based expenses and determine future growth. Knowing this amount is necessary so you can lower your advertising costs without losing potential clients and increase your business’s profits quickly.

Any company that calculates its CAC payback period amount will benefit from seeing a full picture of its business. They’ll get stark numbers relating to their advertising fees and how that money results in new business. If there’s a discrepancy between the marketing budget and customer acquisition, they can take steps to change that trajectory.

The sales and marketing teams can work together, using the current CAC payback period as their baseline, then strive to lower marketing costs while increasing the customer base. When the entire team comes together for this purpose, the business benefits from the collaboration.

SaaS companies use subscription services, so if a customer retains service for a certain period, the company will make back its acquisition funds. It’s up to you to ensure you price your services at a rate that pulls in customers instead of sending them to the competition while also ensuring you can pay back the acquisition costs within a specific period.

A shorter CAC payback period ensures you’ll get those funds back and start profiting from a customer’s subscription quickly, ideally within a few months. Keeping advertising costs low will also shorten the payback period.

Most SaaS businesses that perform well have a CAC payback period of five months to one year. Keeping a customer subscribed for this long isn’t difficult if you provide a necessary service, and offering a certain discount for an annual plan can ensure you reach that 12-month benchmark.

Why Is CAC Payback Period Important?

The CAC payback period is important because it helps you understand the status of your business. You’ll see clear terms of how much you spend on advertising and how that pays off. You wouldn’t want to pay $1,000 a month to a cleaning service that never came to your office, so likewise, you need to ensure your marketing department pulls its weight.

Tracks Expenses

Knowing the CAC payback period helps you track expenses. You’ll always have baseline costs relating to salaries, design software, and office space. But this amount also shows you how much you spend on ad publishing, content creation, and follow-up emails.

You’ll understand how these measures pay off so you can change your approach accordingly to eliminate unnecessary expenses.

Helps With Retention

Your CAC calculation may show that you routinely acquire thousands of new customers each quarter, but your current subscriptions are less than 5,000. This data shows you have an issue with retention. It’s good to get new customers, but if they’re not sticking around, you’re not making money from them.

At this point, you can check your customers’ longevity and see if they subscribe long enough to pay back the costs you put in for acquiring them in the first place. If they leave before you pay yourself back, you can assess the software and competition to see what you need to change.

Streamlines Pricing

If it takes two years for a customer to pay back your advertising expenses, you might spend too much on marketing. However, it might also show that your subscription fees are too low. You spend more than you make, so you could change your pricing to shorten the payback period.

Impacts Marketing

Just as the CAC payback period will affect how you price your services, it can also impact your marketing. You might realize that a billboard is too expensive for the number of customers you pull in every quarter, so you cut that expense for a trial period to see how it changes your costs. You might also try more organic options to see if those expand into better leads.

Calculating CAC Payback Period

On average, companies spend over $200 to acquire new customers organically, but that amount rises to more than $340 if they use advertising methods. You can use this data as a baseline for your finances, but knowing the specific CAC payback period for your company will help you assess your current standing and what goals to set for the future.

To calculate the CAC payback period, take the total sales and marketing expenses for a set period. This includes the ad budget, content creation, costs of publishing ads on various platforms, and the department fees, like salaries, design software, and related supplies.

Divide that amount by the number of customers your business gained during the same time period. You can calculate this figure every month, quarter, billing cycle, or fiscal year. Just remember to use the same time period for both calculations.

To simplify the equation:

CAC = Total sales and marketing during a period / Customers acquired in the same period

Then, you take the CAC and divide it by your monthly recurring revenue (MMR) to determine how long it will take to earn money back and start turning a profit from that customer.

For example, if you spent $50,000 on sales and marketing last quarter and acquired 100 new customers, you spent $500 to acquire each customer. Your CAC is $500. You then have to calculate the costs of your service to determine how long it will take you to earn money back using the MMR.

If your monthly SaaS subscription fee is $25, it will take 20 months until you can earn a profit from that customer. Since that’s well above the ideal 12-month maximum, you’ll want to consider how you can lower your advertising costs and increase your subscription fees without losing customers.

Your customer can cancel their subscription after one year, meaning you’ve lost money because you still needed eight months to earn back the CAC. If your business offers a special two-year incentive, you could get away with the 20-month CAC payback period, but it’s not ideal. You don’t want to risk losing a customer and their money before you pay yourself back.

CAC Payback Period Goals

Your business’s CAC payback period goals should have certain measurable benchmarks that help you realize you’re on the right track. When you meet these goals, you’ll have more freedom to play around with the marketing funds and try different ways to attract customers.

However, you can’t get stagnant with your marketing or CAC payback period assessment. The industry frequently changes, and you need to ensure you’re offering a necessary product so customers continue to use your service. You need to keep your advertising fresh to attract new users. You need to continually research the competition to keep your prices relevant.

The lower the CAC payback period, the more likely you’ll retain the customer for as long as necessary to pay yourself back and then start making a profit. That’s why the five-month CAC payback period is the safest bet because you’ll likely keep customers that long without worry.

Once your business is established, you have more funds in the bank. You might not need to push your team to find a way to keep the payback period under 12 months because you don’t depend on that money to pay bills and salaries. Still, your business’s goal should be to reduce the payback period as much as possible.

Reducing CAC Payback Period

There are several ways you can reduce the CAC payback period. Once you get your calculation from the section above, check out the following tips to see what might help you make changes in your business.

Change Pricing

If you find that your CAC payback period is one year, you might want to offer an annual subscription that will cover your advertising expenses and then some. Your customers will want that deal to save money on their subscription, and you’ll have the security of knowing they’ll stay through the payback period.

Conversely, anyone who doesn’t choose the annual plan will pay more per month, decreasing the amount you lost to acquire them slowly but surely, so they’ll pay it off before that one-year mark.

Try Upselling

While the focus on the CAC payback period is the cost of bringing in new customers, you don’t want to overlook your existing clients. People who stay with you for a long period deserve some rewards, which you can afford since you already profit from them. You can try upselling various services with discounts since you don’t have the costs of bringing them into your client base.

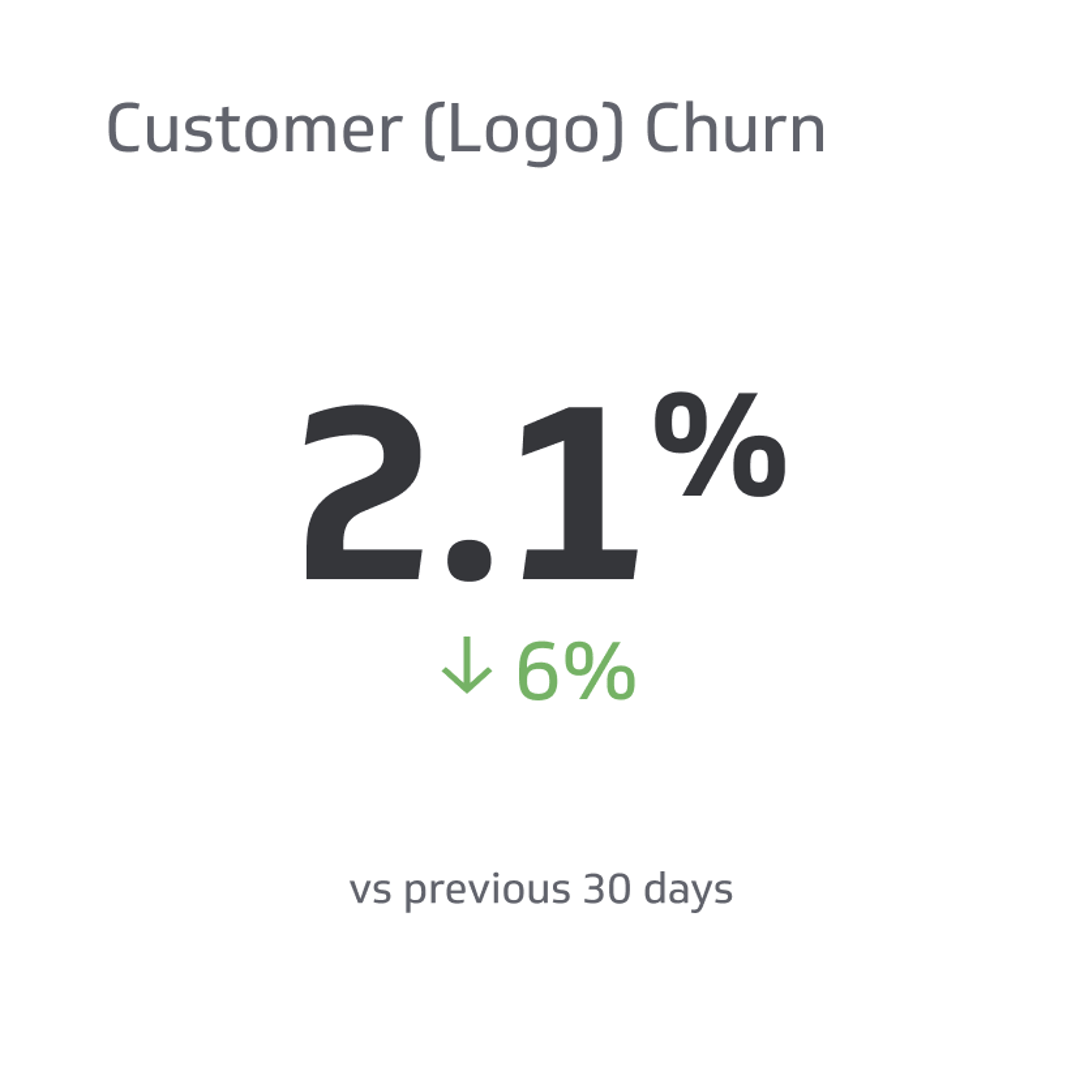

Decrease Churn

The bottom line when it comes to improving your CAC payback period is the need to decrease churn, which means customers leave before they pay back the acquisition cost. You’ll lose money on advertising and also lose a customer. Find out why customers leave and change your SaaS offerings.

Final Thoughts on CAC Payback Period

The CAC payback period can vary based on the age of your business, services offered, and competition in the marketplace. However, you can change this figure in many ways, so it’s worth calculating the amount to get the big picture. Then work with your team to lower the payback period and increase your business’s revenue.

Related Metrics & KPIs

Churn.png)