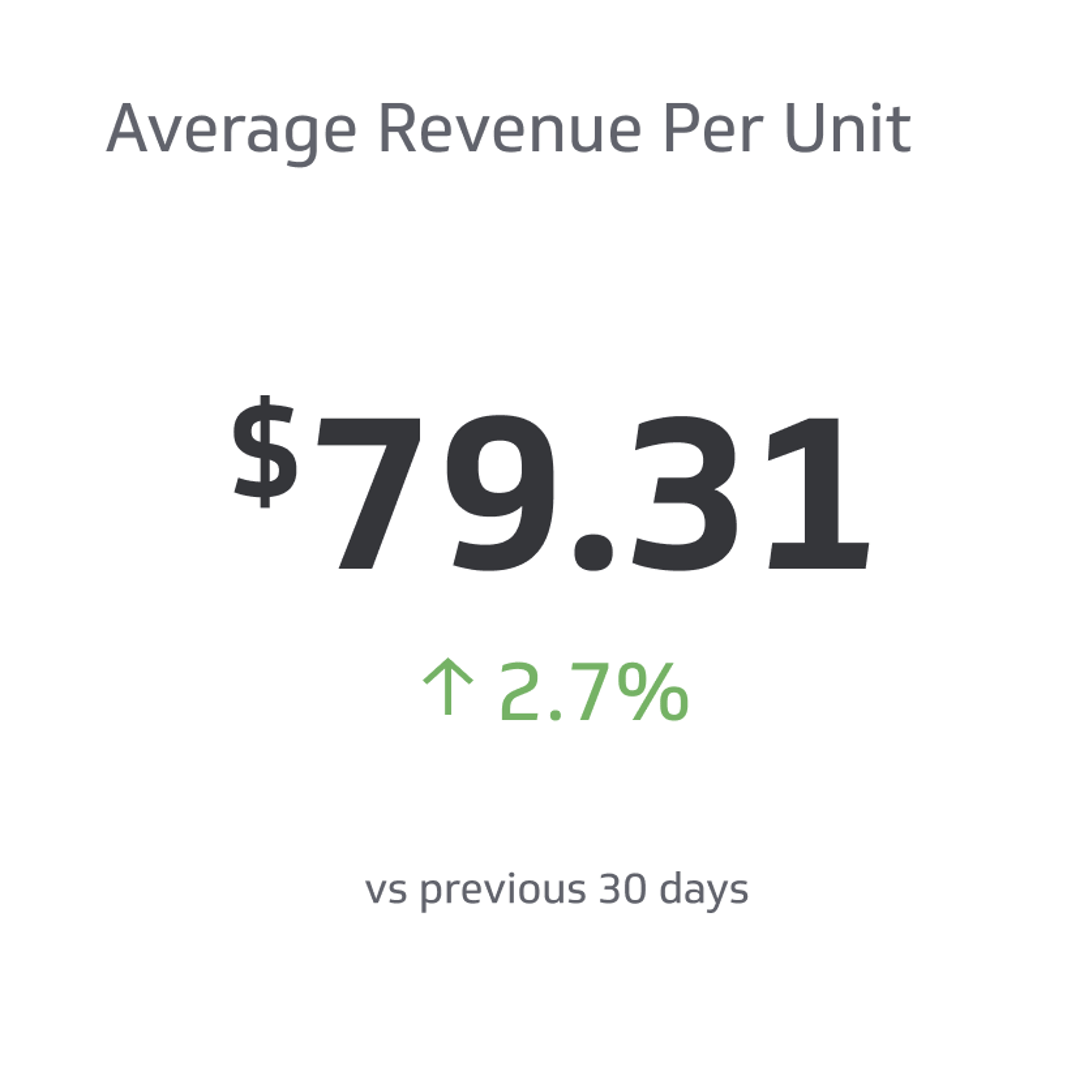

Average Revenue Per Unit (ARPU)

ARPU stands for Average Revenue Per Unit, and it measures the average revenue generated from a single customer or user.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

According to a recent survey, the US has been the leading country in Average Revenue Per User (ARPU) after recording a 49.13 US dollar ARPU in 2021. The figure indicates businesses' increasing demand and potential to capitalize on this metric. It also indicates that the importance of ARPU in business growth and success is undeniable.

ARPU is an important business metric, as it clearly explains how much revenue a company can generate from individual customers. To calculate ARPU, businesses need to understand the concept and then use a formula that considers their total revenue, the average number of customers, and other relevant factors.

Check out this article to discover what ARPU is and how to calculate it accurately. The guide will also look at why ARPU is an important financial metric and how businesses can increase their ARPU.

What is ARPU?

ARPU stands for Average Revenue Per Unit, and it measures the average revenue generated from a single customer or user. It is typically expressed in terms of money but can also be expressed in terms of usage (i.e., hours of usage or data consumed).

It is important to note that Average Revenue Per Unit is not part of the Generally Accepted Accounting Principles (GAAP). It means businesses don't need to report ARPU for their financial statements. However, tracking this metric is still essential to understanding the performance of a business.

The metric often compares a company’s revenue performance across different products, customer segments, or geographic regions. It can also set customer acquisition and retention goals. If not used properly, ARPU can be misleading and lead to incorrect conclusions.

How to Calculate ARPU?

To calculate ARPU, businesses need to understand the concept that acts as a variation factor when calculating the ARPU. Concepts such as total revenue, total customers, and the number of months need to be considered when calculating the ARPU. However, this concept may not be solid and may vary through the assessment period.

For instance, the total number of customers can vary as new customers are added to the company and old ones leave. The same applies to the total revenue, which can vary from month-to-month or period to period.

In this case, it's important to estimate these figures carefully before using the formula. Using exaggerated figures can make the ARPU calculation inaccurate and lead to incorrect conclusions.

You can mitigate this by averaging the variable concept to a relatively stable figure. In this manner, you can get accurate and reliable results. For instance, if in a month the total number of customers varied from 1,500 to 2,500, you can take the average of 2,000 giving the statistics a more stable value.

With this knowledge, they can easily calculate ARPU using the following formula:

ARPU = Total Revenue / Average Number of Customers or Users

Where:

- Total Revenue is the total amount of money the company earns over a given period.

- Average Number of Customers or Users is the average number of customers registered with the company over time.

It is important not to use the period's end date as the denomination, as it does not account for any variation within the period. Instead, you can average the start and end date for more accurate results.

Why Is ARPU Important?

ARPU is important because it allows companies to understand the overall performance of their business on an individual customer level. It allows them to gain insights into their offerings and optimize their strategies accordingly.

Here are reasons why ARPU is important for businesses:

• Understands customer value - It helps companies understand their customers' individual worth and identify which customers are the most valuable and which are not.

• Helps in setting customer acquisition goals - ARPU can provide insights into what goals companies need to set for customer acquisition and what kind of customers they should target.

• Helps evaluate marketing strategies - The metric can provide insights into which marketing campaigns are working and which are not.

• Helps in understanding customer lifetime value - It can help companies understand how much money a customer will likely generate over their lifetime.

• Helps in optimizing pricing - By tracking ARPU over time, companies can get an idea of what pricing strategy they should pursue. It can also help them identify potential areas for improvement.

The metric can help management make informed decisions and optimize strategies to ensure the ideal results. It is a valuable tool that provides insights into customer behavior and helps businesses understand whether their strategies are successful.

How Businesses Can Increase ARPU?

The value of the ARPU can be optimized by keeping customer lifetime value in mind. Here are a few tips to help businesses increase ARPU:

Offer Add-On Services

Companies can offer add-on services to existing customers to increase their value. It can be done by offering discounts, product upgrades, and other services. It can also be done by offering loyalty rewards to encourage customers to stay with the company.

For instance, a company can offer a loyalty program where customers get points for each purchase they make. The points can then be used to redeem discounts or other special offers. Eventually, the tactic can lead to an increase in the customer's lifetime value.

Introduce Bundled services

Bundling multiple products or services together can help businesses increase their ARPU by encouraging customers to purchase more than one product or service at a time. It can be done by offering discounts when multiple services are purchased together.

For instance, a streaming service can offer discounts when customers purchase multiple subscriptions simultaneously.

The tactic can add value to customers' experience and encourage them to make multiple purchases. It can also help businesses increase their ARPU as their total revenues will increase with the additional purchases.

Increase Prices

Increasing prices can help increase ARPU by allowing you to earn more per customer. It is important to ensure the pricing does not become too high as it may lead to customers moving away from the company. You can contact a professional to analyze different competitors' prices, quality of products, and customer feedback to determine the optimal price for your services.

Cross-Sell and Upsell

Cross-selling is a tactic where you encourage customers to purchase related products or services from them. On the other hand, upselling is where you encourage customers to purchase higher-end versions of products or services.

Both tactics can help businesses increase ARPU by encouraging customers to make additional purchases. It is important to ensure the products or services offered are relevant and of good quality to give customers a positive experience.

Reduce Churn

Churn is when customers leave a company due to dissatisfaction or simply opting out of services. Reducing churn can help businesses increase ARPU by retaining customers and encouraging additional purchases.

You can reduce churn by providing customers with the ideal experience possible such as better customer service, timely responses to customer queries, and more.

By reducing churn, companies can ensure more customers stay with them and generate higher lifetime value. The reduction can help increase ARPU in the long run. It can also help businesses identify any issues and make necessary changes to provide a better experience.

Conclusion: Use ARPU to Maximize Business Performance

ARPU is an invaluable metric that can help businesses track their performance and maximize profits. It offers insights into how much revenue businesses generate from individual customers and allows them to set customer acquisition and retention goals.

To calculate ARPU, businesses need to understand the concept and then use a formula that considers their total revenue, the average number of customers, and other relevant factors. It is important to estimate these figures accurately to ensure that the ARPU calculation is reliable and accurate.

Contact us today to learn more about how ARPU can help you maximize your business performance.

FAQ's

When business owners want to maximize their performance, they often turn to ARPU as a valuable metric for measuring and tracking their success. However, getting accurate and reliable information about ARPU can be difficult. Here are some of the commonly asked questions about ARPU.

Which sectors benefit most from ARPU?

ARPU benefits any subscription-based sector, such as streaming services, gaming companies, and software companies. E-commerce companies and retailers can also use it to track customer spending. However, the business needs to understand the concept and formula well to calculate ARPU accurately.

When is the ideal time to use ARPU?

ARPU can be used at any time. Businesses should calculate their ARPU regularly, such as once a month or quarter, to track their performance and ensure their customer acquisition and retention goals are met. They can also measure the average time by which their customers place orders or make purchases to get a better understanding of their customer lifecycle.

Who is responsible for tracking ARPU?

Typically, a business's finance department or analytics team is responsible for tracking and calculating ARPU. They should monitor the customer acquisition and retention goals and spending trends regularly to ensure their ARPU calculations are accurate.

In some companies that don't have a finance department or analytics team, the business's senior management can be responsible for tracking and calculating ARPU. You can also outsource the calculation of ARPU to a professional firm.

What is the difference between ARPU and MRR?

ARPU and MRR are often confused because they measure customer spending. However, there is a key difference between them. ARPU (average revenue per user) measures the average spending of a single customer, while MRR (monthly recurring revenue) measures total customer spending across all customers over a period of time.

For example, if a company has 1000 customers and their average spending is $100 per month, the MRR would be $100,000 (1000 x $100). However, if one of the customers spends $500 per month, the ARPU for this customer alone would be $500.

Related Metrics & KPIs