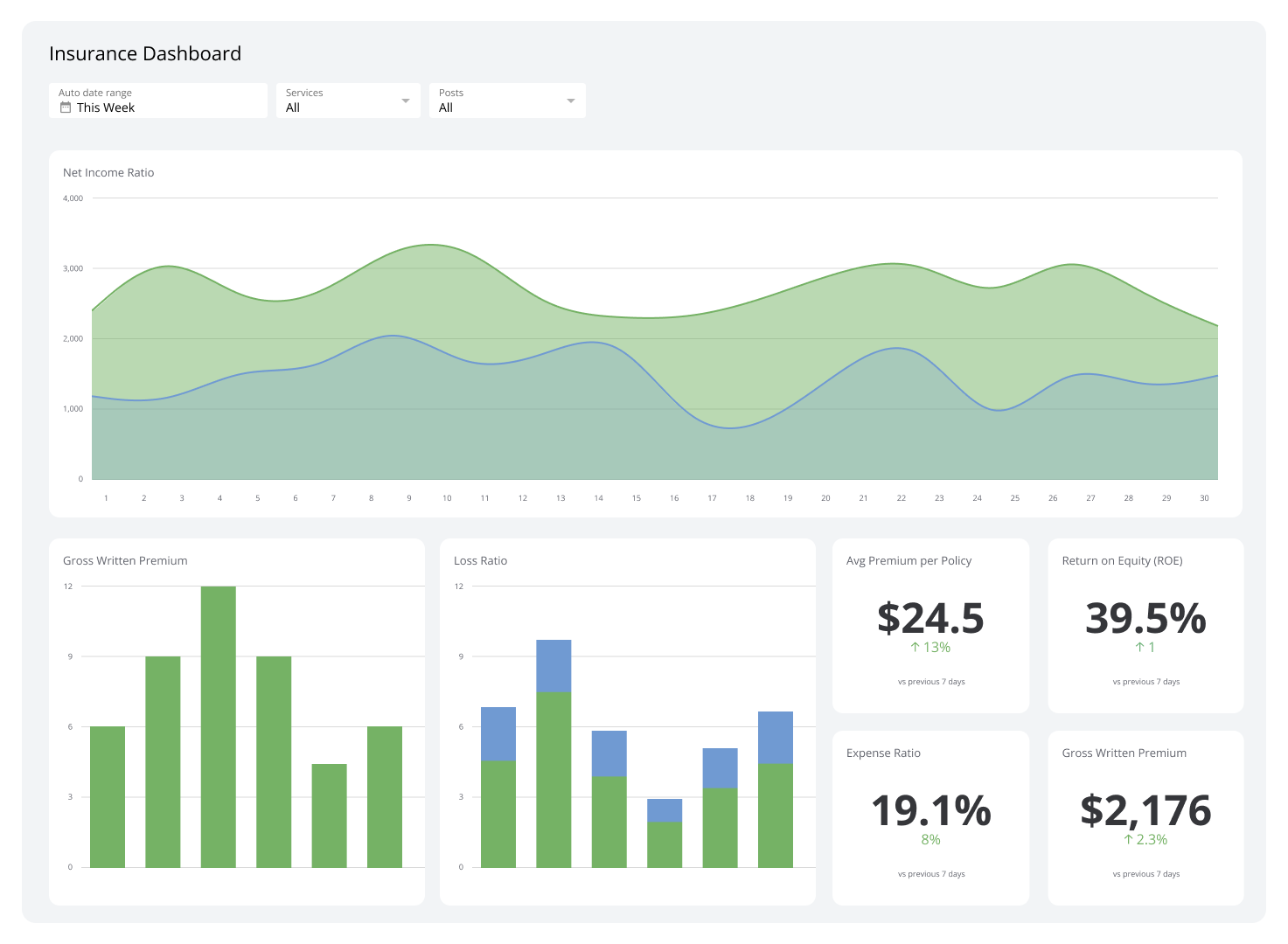

Insurance Dashboard

Insurance dashboards transform a wealth of data into metrics and KPIs that inform you about your insurance company's overall health and performance.

What is an Insurance Dashboard?

An insurance dashboard gathers live data from various sources to provide insurance-related metrics and KPIs, such as claims frequency, net earned premiums, expense ratios, and overall business growth. This dashboard helps you identify patterns, like the connection between customer demographics and claim frequencies, detect at-risk customers before they leave, create more accurate risk assessments, and refine pricing strategies.

In addition, this dashboard allows you to efficiently pinpoint fraud patterns and optimize resource allocation for claims processing in real time.

Examples of Insurance Dashboards

Insurance Performance Dashboard

An insurance performance dashboard gives you a detailed look at your company’s financial health, operational efficiency, and reputation. This broad tool showcases metrics related to policy sales, claims processing, risk assessments, and customer retention, allowing you to optimize your underwriting processes and improve claims management. It can also forecast company performance, uncover future markets, and pinpoint insurance packages or customer segments that are underperforming or showing growth potential.

Who’s it for | Insurance executives, underwriters, claims managers, actuaries, sales managers, customer service managers, risk analysts, financial officers |

How often it's needed | Daily, weekly, monthly, quarterly |

Covered KPIs | Gross written premium, net income ratio, loss ratio, combined ratio, expense ratio, policy retention rate, claims ratio, new business growth rate, average premium per policy, claims frequency, average claim settlement time, claims severity, underwriting profit margin, investment income, return on equity (ROE), solvency ratio, customer satisfaction score, policy lapse rate, cross-sell ratio, average policy duration, time to quote, quote-to-bind ratio, agent productivity, fraud detection rate, risk-adjusted return on capital (RAROC), reinsurance efficiency, reserve adequacy, premium collection ratio, customer acquisition cost (CAC), lifetime value of a policyholder, claims denial rate, policy renewal rate, underwriting expense ratio, loss adjustment expense ratio, net promoter score (NPS), digital adoption rate, speed of claims processing, policy servicing turnaround time, distribution channel effectiveness, risk exposure by line of business, regulatory compliance score, customer complaint ratio, market share by product line, actuarial accuracy, operational efficiency ratio |

Claims Overview Dashboard

Claims overview dashboards help you better visualize your insurance company's claims processing performance. They track the efficiency of claims handling, monitor settlement rates, and highlight hidden trends in claim types and frequencies. This lets you streamline the claims process, identify potential fraud, and improve overall customer satisfaction.

Who’s it for | Claims managers, claims adjusters, underwriters, actuaries, customer service representatives, fraud detection teams, insurance executives |

How often it's needed | Daily, weekly, monthly, quarterly |

Covered KPIs | Total number of claims, claims frequency rate, average claim processing time, claims settlement ratio, average cost per claim, claims by type, claims by region, claims approval rate, claims denial rate, claims in process, reopened claims rate, claim cycle time, loss ratio, expense ratio, combined ratio, claims reserves accuracy, subrogation recovery rate, fraudulent claims detected, customer satisfaction with claims process, claims adjuster productivity, time to first contact, claim severity, litigation rate for claims, claims paid within SLA, claims backlog, claims leakage rate, cost per claim, claims handled per adjuster, claims settlement accuracy, fast-track claims ratio, claims reported vs. claims settled, average time to assign adjuster, customer complaints related to claims, claim reserve development, claims expense ratio, total incurred losses, claim closure rate, claims paid to premium ratio, claims automation rate, third-party claims cost, claim escalation rate, NPS for claims process, claims-related customer retention rate |

Policy Administration Dashboard

A policy administration dashboard lets you better supervise the efficiency of issuing and renewing policies. It monitors collection rates and reveals policy trends among different customer demographics.

Regular observation of a policy administration dashboard allows you to make better choices in regard to policy administration. For example, you can quickly identify bottlenecks in the policy issuance process and make improvements for reduced turnaround times.

Who’s it for | Policy administrators, underwriters, customer service representatives, insurance agents, actuaries, product managers, insurance executives, compliance officers |

How often it's needed | Daily, weekly, monthly, quarterly |

Covered KPIs | Total number of active policies, new policy issuance rate, policy renewal rate, policy lapse rate, average premium per policy, policies by type, policies by region, policy modification rate, premium collection rate, time to policy issuance, underwriting accuracy, policy endorsement processing time, customer retention rate, policy cancellation rate, average policy duration, premium growth rate, policy administration expenses, straight-through processing rate, policy servicing turnaround time, cross-sell/upsell rate, policy accuracy rate, customer satisfaction with policy administration, agent productivity in policy management, time to quote, quote-to-bind ratio, policy document delivery time, policy-related customer inquiries, first contact resolution rate for policy queries, policy exception rate, policy backlog, paperless policy adoption rate, policy pricing accuracy, policy-related compliance violations, policy profitability by segment, average time for policy changes, policy-related customer complaints, policy reinstatement rate, policy-related fraud detection rate, policy administration system uptime, policy data quality score, policy-related customer self-service adoption rate, time to process policy claims, policy-related NPS |

Risk Assessment Dashboard

A risk assessment dashboard gives you a better sense of your risk exposure and underwriting performance across product lines, customer segments, and geographical regions. It tracks risk indicators (including risks) and highlights claims and loss ratio trends to aid you in maintaining a proper balance between risk and profitability. It’s particularly helpful if you want to change your risk models and introduce new policy exclusions.

Who’s it for | Underwriters, actuaries, risk managers, claims adjusters, insurance executives, portfolio managers, reinsurance specialists, compliance officers |

How often it's needed | Daily, weekly, monthly, quarterly |

Covered KPIs | Total risk exposure, loss ratio, combined ratio, risk-adjusted return on capital (RAROC), probability of default, loss frequency, loss severity, reserve adequacy, underwriting profit margin, claims frequency, average claim cost, policy lapse rate, premium adequacy, risk concentration by geography, risk concentration by line of business, catastrophe exposure, reinsurance utilization, risk-based capital ratio, solvency ratio, technical provisions, credit risk exposure, market risk exposure, operational risk metrics, stress test results, value at risk (VaR), expected shortfall, risk appetite utilization, risk limit breaches, emerging risk indicators, risk-adjusted pricing accuracy, underwriting exceptions rate, claims development patterns, large loss events, risk model performance, risk-based customer segmentation, fraud detection rate, policyholder risk score distribution, risk transfer efficiency, tail value at risk (TVaR), economic capital allocation, scenario analysis outcomes, risk correlation metrics, risk-adjusted profitability by product line, regulatory capital requirements compliance, risk diversification index, risk retention levels, risk mitigation effectiveness, underwriting guideline adherence, risk-based audit findings, risk data quality score, risk reporting timeliness, risk management maturity level, risk culture assessment score |

Fraud Detection Dashboard

Fraud detection dashboards provide a clear view of any suspicious activities within your insurance company. They showcase analytics regarding suspicious patterns, anomalies, and risk indicators across different transactions and customer behaviors. With these dashboards, you can quickly identify, investigate, and prevent fraud as it happens — which are all essential to maintaining trust with your customers and stakeholders.

Who’s it for | Fraud analysts, risk managers, compliance officers, security teams, financial controllers, customer service managers, IT security specialists, legal teams, senior management |

How often it's needed | Real-time, daily, weekly, monthly |

Covered KPIs | Total number of fraud attempts, fraud detection rate, false positive rate, fraud loss amount, fraud prevention savings, average time to detect fraud, average time to resolve fraud cases, number of high-risk transactions, fraud by transaction type, fraud by geographic location, fraud by customer segment, fraud by product/service, number of blocked accounts, number of suspicious activity reports (SARs) filed, fraud pattern identification rate, rule effectiveness score, machine learning model accuracy, fraud investigation backlog, customer fraud complaints, identity verification success rate, account takeover attempts, chargeback rate, fraud-related customer churn rate, fraud ring detection rate, emerging fraud trend indicators, cross-channel fraud correlation, employee fraud incidents, third-party fraud incidents, fraud loss recovery rate, fraud prevention ROI, compliance violation rate, anti-money laundering (AML) alerts, know your customer (KYC) compliance rate, fraud risk score distribution, behavioral biometrics anomalies, device fingerprinting matches, IP risk assessment, transaction velocity alerts, fraud detection system uptime, fraud analyst productivity, fraud case resolution time, fraud prevention training completion rate, fraud awareness campaign effectiveness, fraud policy violation incidents, fraud detection algorithm performance, fraud data quality score, fraud reporting accuracy, fraud risk assessment frequency, fraud control effectiveness, fraud mitigation strategy success rate |

Agent/Broker Performance Dashboard

An agent/broker performance dashboard provides a complete overview of how your agents and brokers are performing. It collects information from multiple sources to highlight its most effective sales strategies, such as cross-selling success rates, policy renewal percentages, and customer retention metrics. The dashboard also tracks revenue and policy progress by monitoring real-time sales data and comparing it with targets and past performance.

Who’s it for | Agency owners, branch managers, team leaders, individual agents/brokers, compliance officers, training and development teams, marketing managers |

How often it's needed | Daily, weekly, monthly, quarterly, annually |

Covered KPIs | Total premiums written, policy retention rate, new business acquisition, cross-selling success rate, average policy size, loss ratio, commission income, number of policies sold, customer satisfaction score, lead conversion rate, quote-to-bind ratio, average time to close, policy renewal rate, claims ratio, upsell rate, customer lifetime value, NPS, average revenue per customer, sales pipeline value, lead response time, policy accuracy rate, compliance score, continuing education credits earned, client contact frequency, referral generation rate, market share growth, profitability per client, average premium per policy, policy cancellation rate, time to first appointment, social media engagement metrics, website traffic from agent/broker efforts, customer onboarding time, underwriting submission quality, policy diversification index, client retention cost, time spent on administrative tasks vs. selling, number of cross-department collaborations, client education initiatives conducted, technology adoption rate, customer self-service usage rate, speed of claims processing involvement, number of high-value client acquisitions, client portfolio risk assessment accuracy, number of policy adjustments/endorsements, seasonal performance variations, performance relative to agency/brokerage goals, team collaboration effectiveness, client feedback implementation rate |

Overtime Report Dashboard

Overtime report dashboards let you accurately observe overtime activity within your insurance company. These dashboards keep tabs on the frequency, duration, and cost of overtime work across different departments and roles, allowing for immediate action and long-term planning regarding scheduling.

Who’s it for | Human resources managers, department heads, operations managers, finance teams, compliance officers, executive leadership, team supervisors, payroll managers |

How often it's needed | Daily, weekly, monthly, quarterly |

Covered KPIs | Total overtime hours, overtime costs, overtime percentage of total work hours, overtime by department, overtime by job role, overtime by employee, average overtime hours per employee, overtime trend analysis, overtime cost as a percentage of total labor cost, overtime hours distribution (weekday vs. weekend), seasonal overtime patterns, overtime approval rate, overtime reason categories, overtime impact on productivity, overtime-related errors or quality issues, compliance with labor laws and regulations, overtime budget variance, overtime vs. hiring new staff cost analysis, overtime impact on employee satisfaction, overtime correlation with absenteeism, overtime correlation with turnover rates, claims processing overtime, customer service overtime, underwriting overtime, IT support overtime, overtime during peak periods, overtime reduction initiatives effectiveness, overtime vs. regular time productivity comparison, overtime impact on employee health and safety, overtime forecasting accuracy, overtime policy adherence rate, overtime-related grievances or complaints, overtime impact on project timelines, overtime distribution equity among employees, overtime correlation with customer satisfaction scores, overtime-related training hours, overtime impact on employee work-life balance, overtime authorization process efficiency, overtime reporting accuracy and timeliness |

Simplify insurance metrics and KPI acquisition

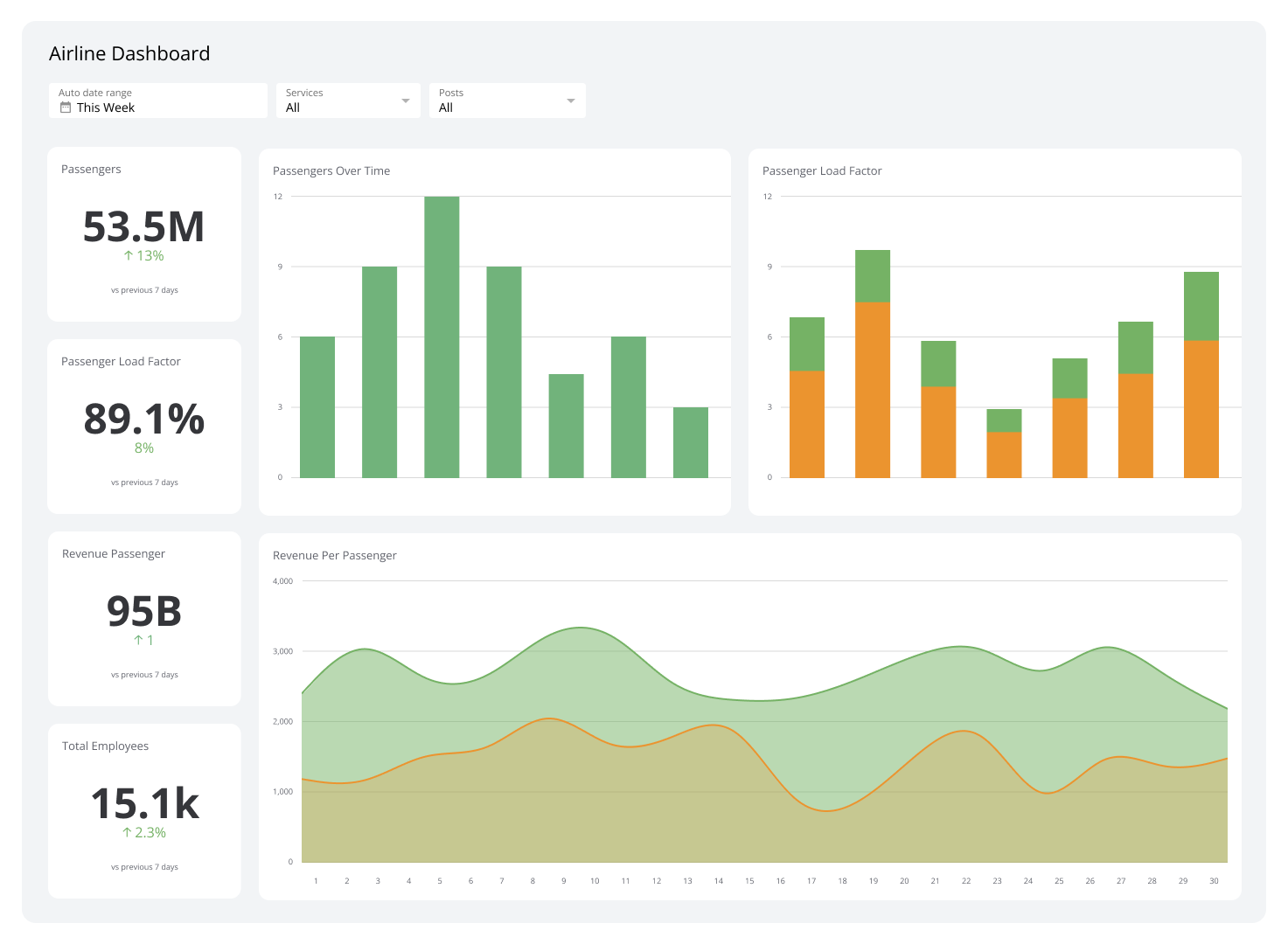

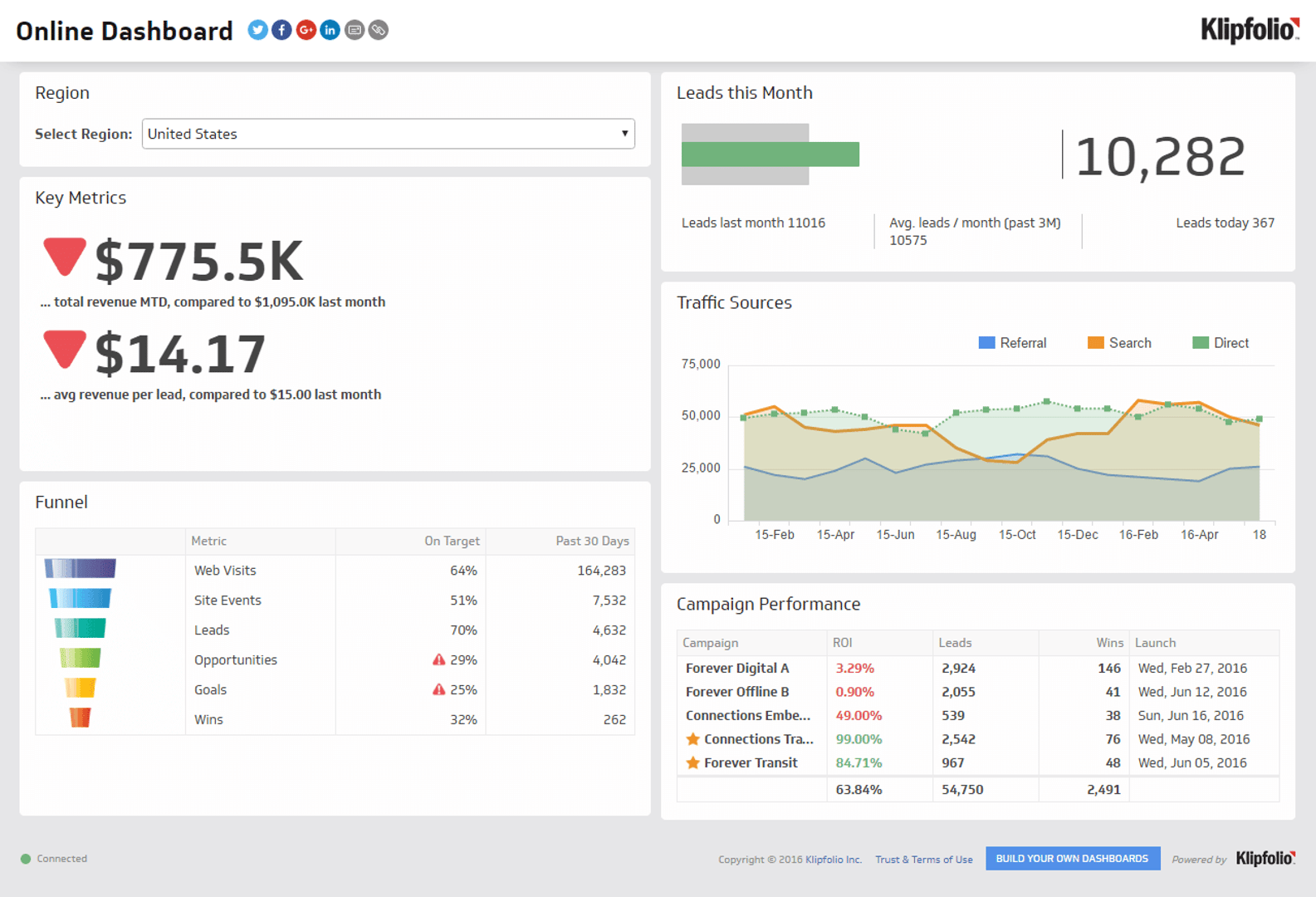

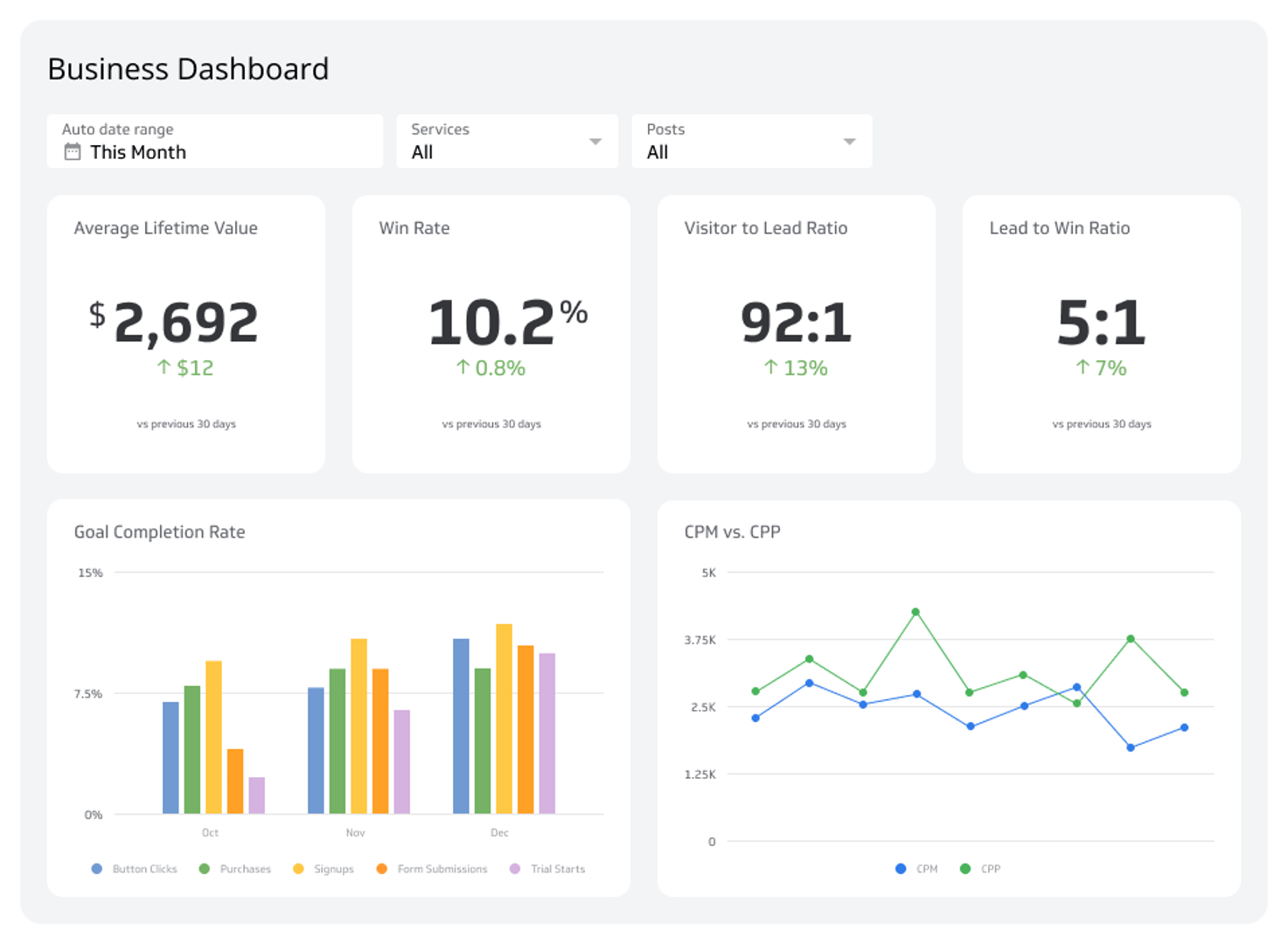

Insurance dashboards provide a clear picture of an insurance company's performance, risk levels, and operational efficiency. They give detailed insights into key areas of the business, including policy management, claims processing, fraud detection, and agent performance, allowing you to manage risks better and streamline company operations.

Klipfolio’s dashboards display all your essential insurance information in one convenient place. Try it for free today!

Related Dashboards

View all dashboards