Non-Operating Expenses

A non-operating expense consists of an expense that is unrelated to regular operations.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Are you grappling with the complexities of managing your business finances? Non-operating expenses, often overlooked or misunderstood, can significantly impact your company's financial health. In this comprehensive guide, we will demystify non-operating expenses, helping you identify potential financial pitfalls and plan strategically to navigate them.

Stay ahead of the curve by understanding how these unique expenses affect your budget, and ensure your business operates smoothly and profitably."

What are Business Expenses?

Business expenses are expenses that businesses incur in their daily function.

They consist of operating expenses and non-operating expenses.

As we’ve seen, operating expenses are traditional expenses that businesses require to maintain their daily operations.

Non-operating expenses function a bit differently. They do not fit the traditional label, so you must factor them into your budget—and seek funding—in an inconsistent manner.

What is a Non-Operating Expense?

In business, a non-operating expense consists of an expense that is unrelated to regular operations.

There are many types of non-operating expenses. The most common consists of interest charges and losses on the disposition of assets.

While most accountants and budget managers do not account for non-operating expenses in their financial reports, business owners and professionals must understand the concept to avoid incurring unnecessary losses.

Why do Non-Operating Expenses Matter?

Understanding non-operating expenses is crucial to the smooth functioning of your business.

Regardless of their nature, non-operating expenses affect your business’s financial health.

Additionally, because they aren’t traditional expenses, non-operational expenses are often overlooked, causing additional financial problems.

Non-operating expenses are a natural part of running a business and a potential issue if addressed. While it is customary to incur non-operational expenses, companies must carefully plan and adjust their operations to account for them.

Lastly, understanding how operational and non-operational expenses work can help you better manage your budget in the future, optimizing your investments and spending over time.

Common Non-Operating Expenses

There are several significant non-operating expenses that you should know about to best contribute to your business.

Consider the following everyday non-operating expenses.

Monthly Interest Payments

Most companies—particularly public companies—finance their scaling capabilities with equity and debt.

Investments often require monthly interest payments, and these are considered non-operational expenses.

For example, a company that receives funding from a hedge fund will have to pay monthly interest to sustain the loan.

Sale of Assets

When companies sell their assets, they might incur non-operating expenses in the form of financial losses.

For example, if a candle company is scaling back its expenses and selling its brick-and-mortar shop—and they aren’t in the explicit business of buying and selling real estate—any losses on that sale will qualify as non-operational expenses.

Restructuring Costs

A restructuring cost or charge consists of a one-time expense the company incurs to reorganize operations.

For example, a coaching platform that must furlough or lay off its employees to maximize revenue is engaging in restructuring costs, incurring non-operating expenses.

Inventory Write-Offs

An inventory write-off occurs when the inventory value falls to zero, causing a company to lose fair market value.

When the company recognizes that its inventory no longer has value, they incur non-operational expenses.

For example, an organic food company with spoiled or damaged inventory must factor this loss into its non-operational expenses.

Lawsuit Costs

If a company faces a lawsuit and must pay for legal advice, fund court proceedings, or issue restitution, this constitutes non-operating expenses.

For example, a jewelry company facing a lawsuit for its appropriation of a third-party trademark will have to pay to address the situation, incurring non-operational expenses.

How to Manage Non-Operating Expenses

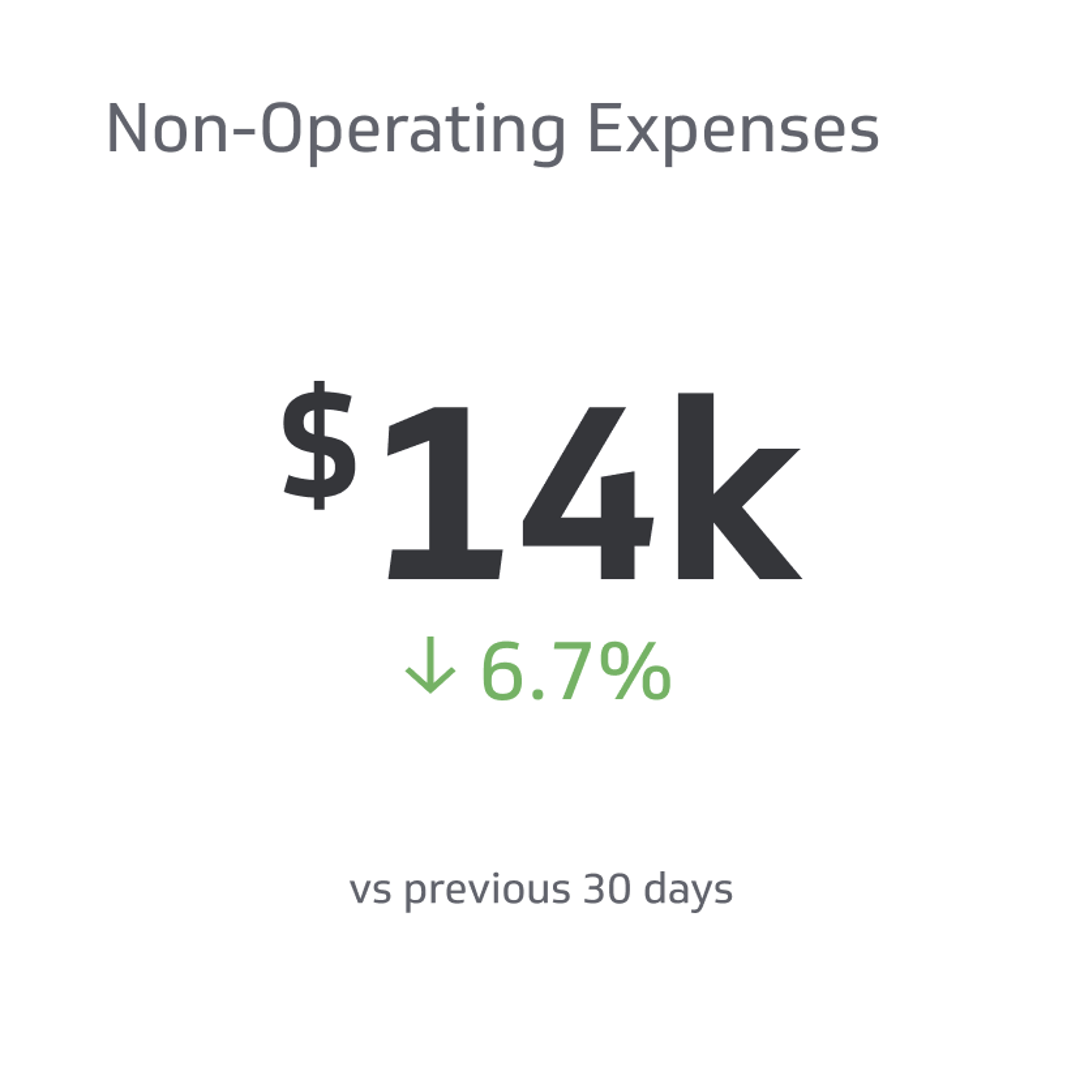

Non-operating expenses are outside of a business’s day-to-day operations or costs.

These expenses come from the above categories, including lawsuit costs, reorganizing charges, inventory write-offs, debts and interest payments, and more.

Most accountants record their non-operating expenses at the bottom of their income statements. This allows investors and key stakeholders to evaluate operational costs. As a result, non-operating payments may fall by the wayside.

Assessing Non-Operating Expenses

When reading a financial income statement, you’ll likely see operational costs first—right below revenue.

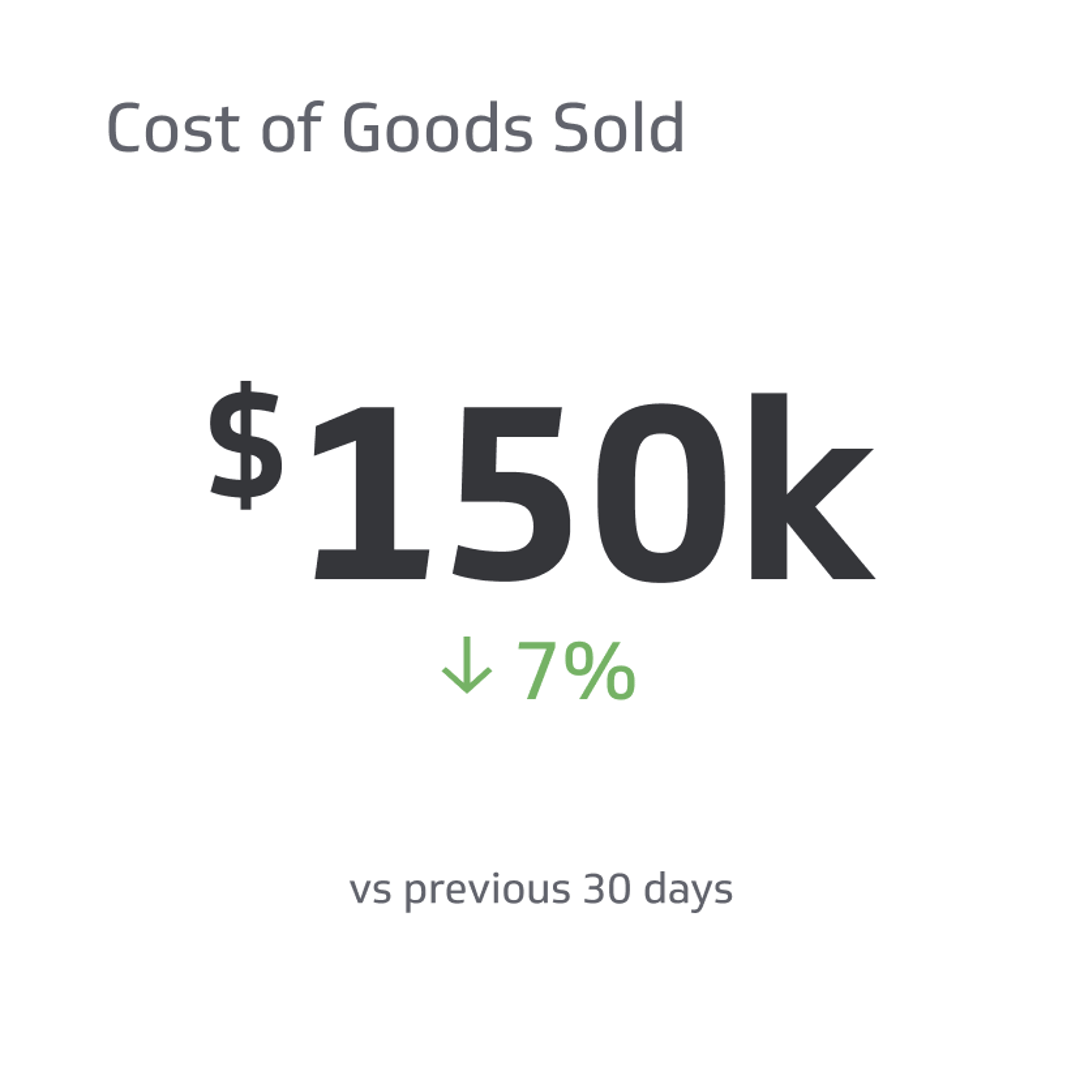

The costs of goods sold are removed from the revenue to arrive at gross income.

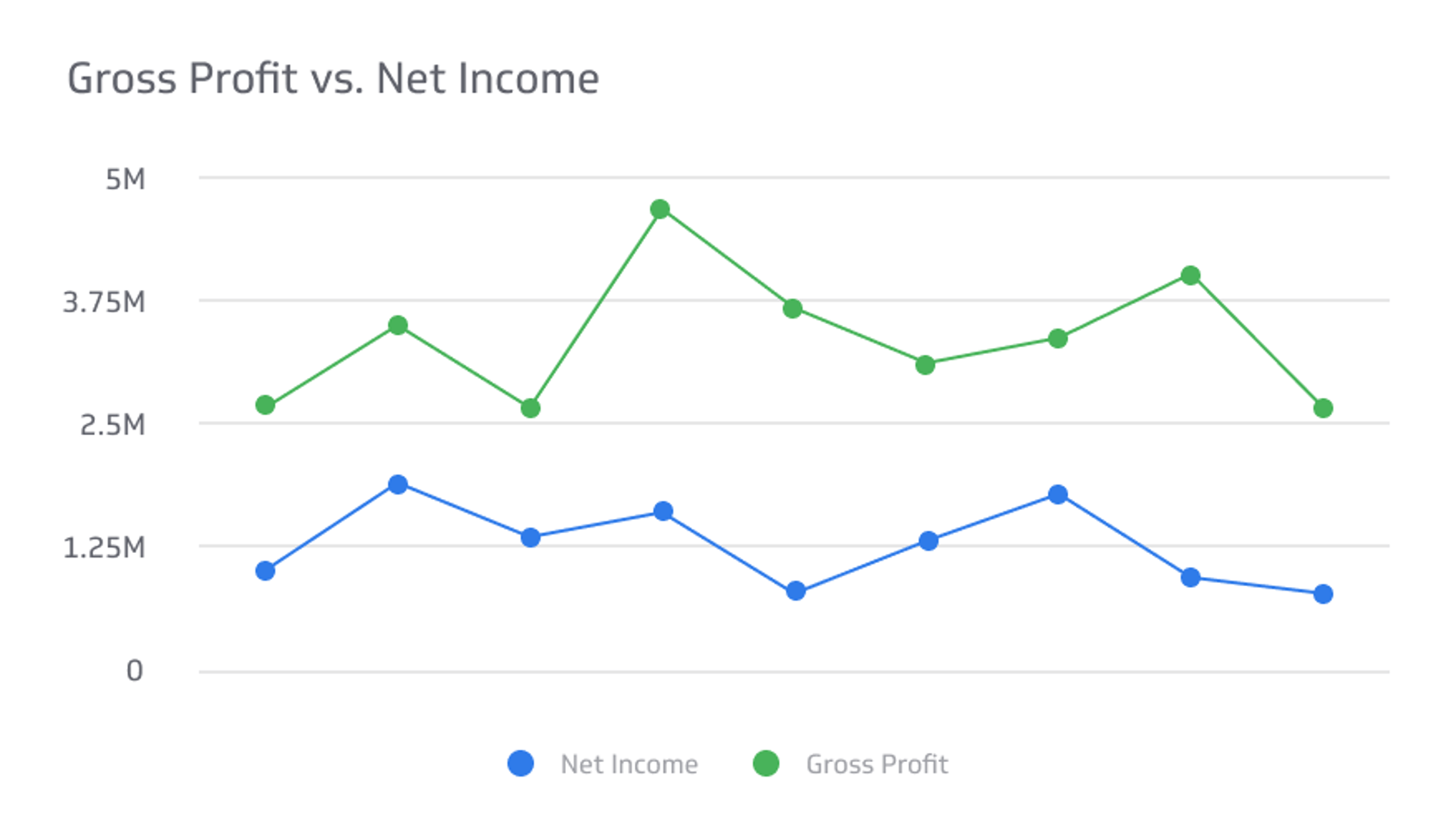

Once accountants have calculated gross income, they subtract operating costs to find an operating profit—revenue before interest and taxes.

Lastly, the accountant can finally determine non-operating expenses. Then, they will subtract non-operating expenses from operating profit to determine earnings before taxes.

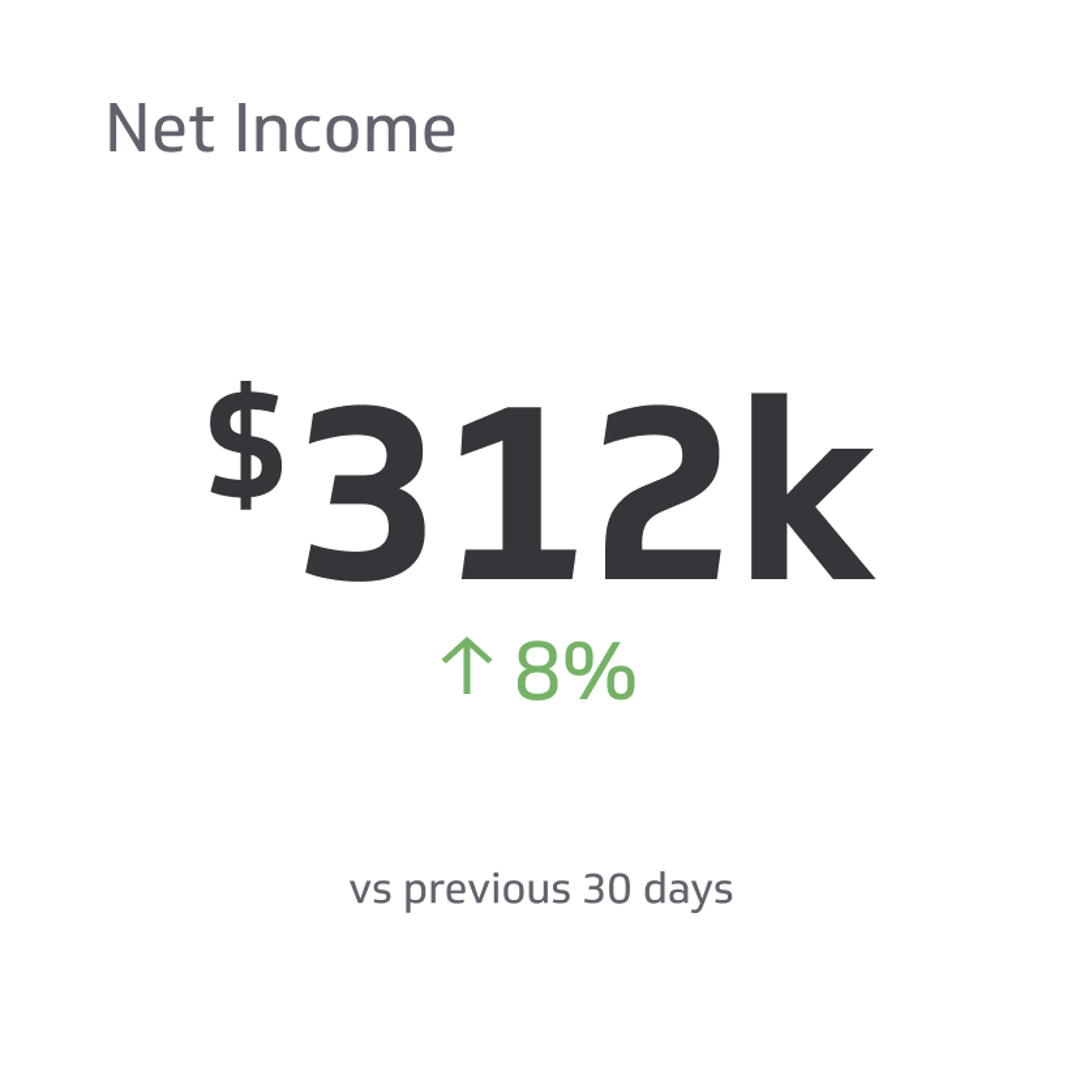

Most accountants then derive net income by adjusting for taxes and other miscellaneous costs.

Managing Non-Operating Expenses

There are several important considerations to remember when accounting for non-operating expenses.

First, it’s essential to separate non-operating expenses from total expenses. Consider keeping a separate budget, ledger, and business account to manage non-operating costs best.

Additionally, it’s important to consistently assess non-operating expenses to assess your company's financial health.

Lastly, consider saving a given amount of money each month to manage future non-operating expenses better since they are often unpredictable.

Minimizing Non-Operating Expenses

Most companies seek to minimize their expenses and maximize their revenue to continue scaling.

The best way to minimize non-operating expenses is to account for them and plan and save ahead of time.

You can also minimize non-operating expenses by:

- Keeping track of inventory integrity

- Maximizing efficiency

- Maintaining legal counsel to avoid legal proceedings

- Accounting for taxes

- They predict or track unpredictable disruptions in operations, including legislative developments, trademark issues, natural disasters, possible property sales or inventory write-offs, and more.

Frequently Asked Questions

Non-operating expenses may be difficult to understand and prepare for.

Consider the following answers to our most frequently asked questions for more information about non-operating expenses.

What Are Some Examples of Operating Expenses and Non-Operating Expenses?

Operating expenses include marketing, payroll, insurance, research and development, manufacturing, inventory, equipment, and more.

Non-operating expenses include inventory write-offs, debts, interest payments, lawsuit costs, etc.

What Do Rent and Utilities Count as Non-Operating Expenses?

Rent and utilities typically do not count as non-operating expenses, though they may qualify as indirect expenses.

What is Non-Operating Income?

Non-operating income is income derived from activities unrelated to business proceedings.

Non-operating income can include profits from investments, gains from foreign exchanges and tax write-offs, or dividend income.

How Does Non-Operating Income Relate to Non-Operating Expenses

Non-operating income is income derived from activities unrelated to business operations, while non-operating expenses are expenses unrelated to business activities.

Most companies use the non-operating income to fund non-operating expenses, while some may use the non-operating income to factor into profit.

Ultimately, non-operating income offers a perfect opportunity to prepare and account for non-operating expenses.

What is the Difference Between Non-Operating Expenses and Indirect Expenses?

Indirect expenses are expenses related to production, purchase, and sale. Non-operating expenses are expenses unrelated to business activities.

Indirect expenses count as operating expenses.

Wrapping Up: What is a Non-Operating Expense and Why Does it Matter?

Non-operating expenses are any expenses a business incurs that do not qualify as operational expenses.

These include inventory write-offs, debt, interest payments, cost restructuring, and more.

Understanding non-operating expenses is crucial to the smooth functioning of your company, and you must account for these costs if you want to maintain the integrity of your business and continue to grow and scale.

Remember that non-operating expenses are entirely natural, and most companies must, unfortunately, account for them.

If you plan and save accordingly, you can manage these expenses without issue!

Related Metrics & KPIs