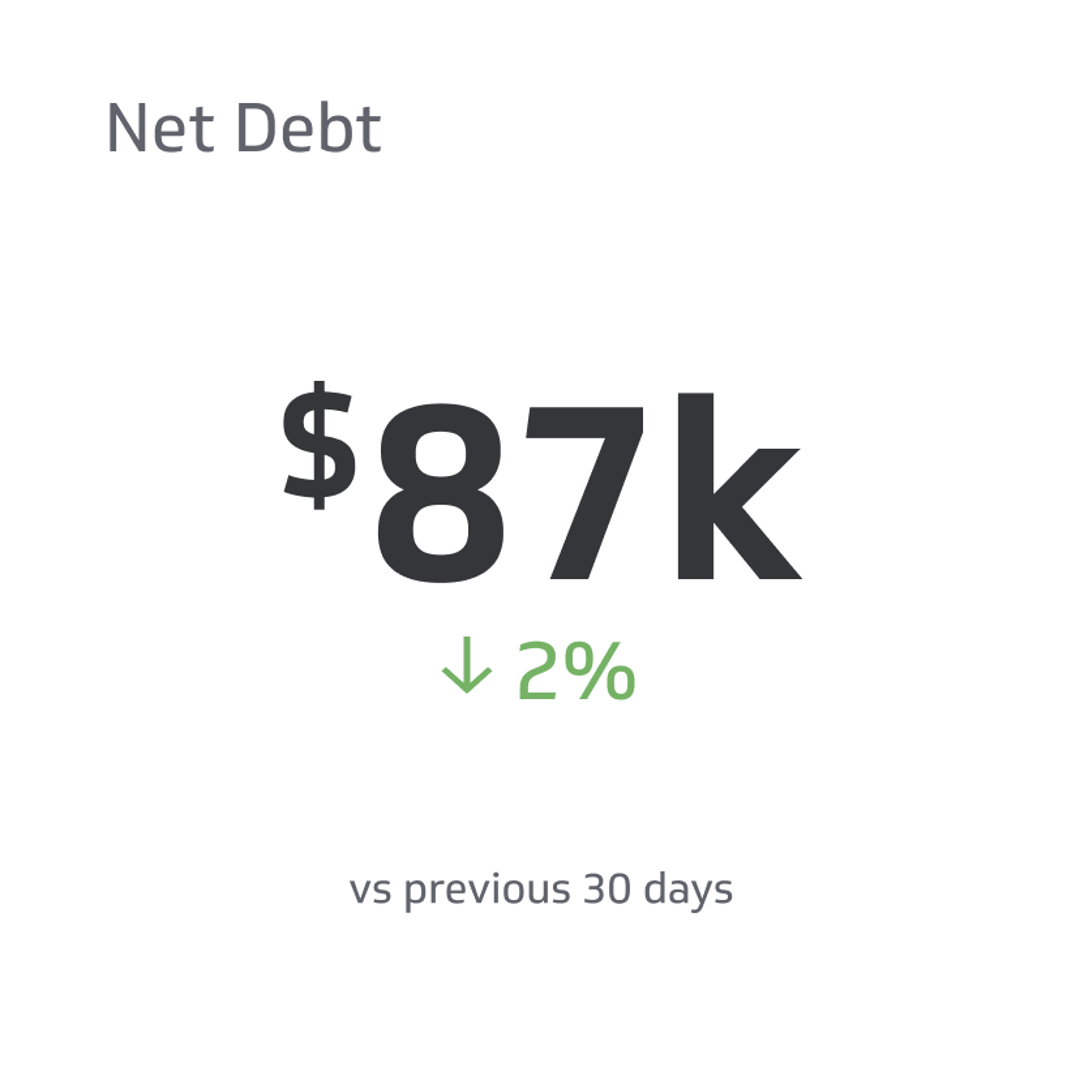

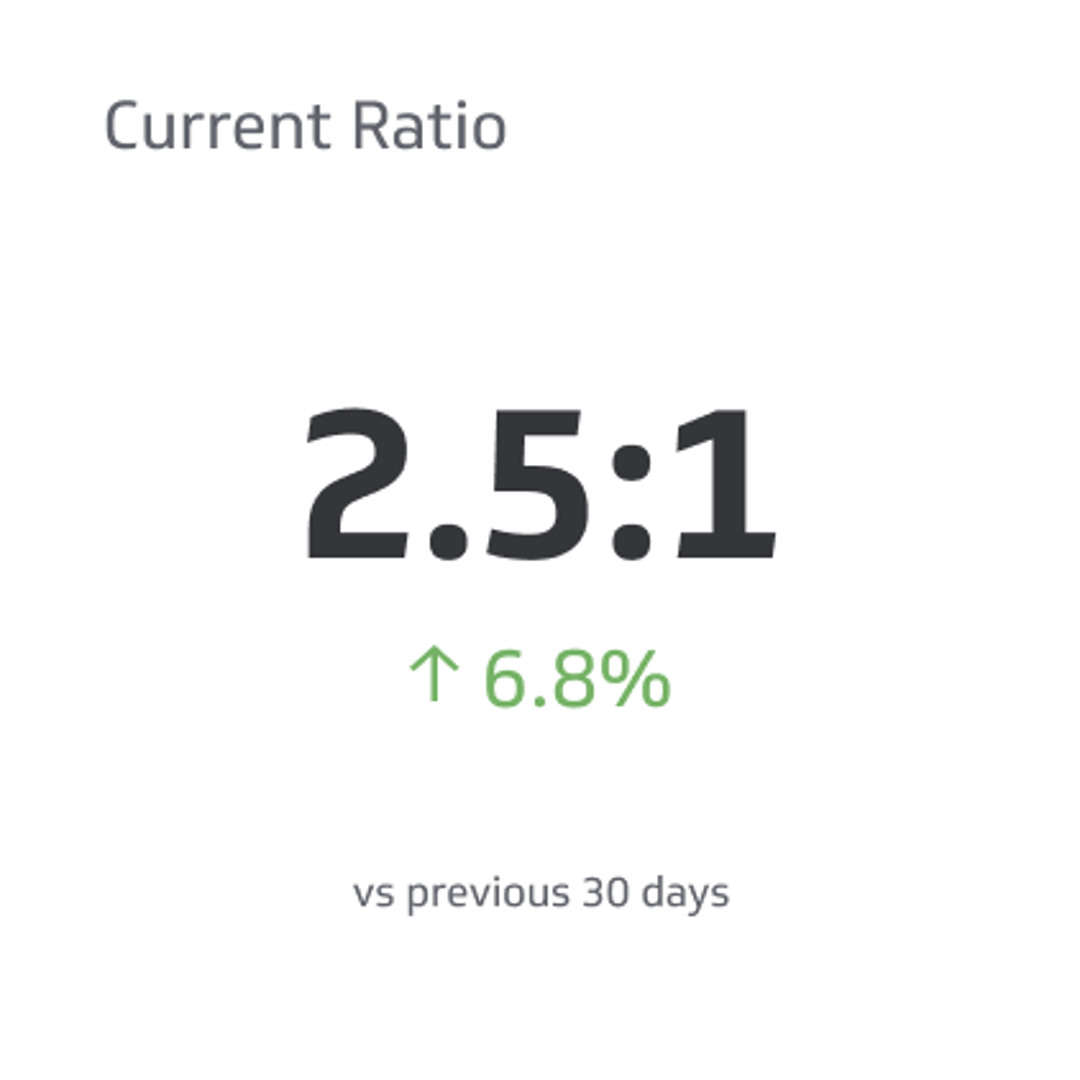

Current Ratio Metric

Measure the ability of your organization to pay all of your financial obligations within a year.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

Overview

Current Ratio measures your organization’s ability to meet your short-term financial obligations (short term refers to one year or less). This ratio is an indicator of your company’s liquidity and uses balance sheet accounts that fall under current assets (cash and cash equivalents, accounts receivable, etc) and current liabilities (accounts payable, short term debt, etc), to help you understand the solvency of your business. A ratio above 1 is favourable, and between 1.5 and 3 indicates strong financial performance. A ratio that is less than 1 implies greater reliance on operating cash flow and outside financing to meet short-term obligations.

Formula

Current ratio = Current assets / Current liabilities

Note: Both current assets and liabilities amounts can be found on the Balance Sheet.

Example of Current Ratio

A company has the following:

Current assets = $6,877,756

Current liabilities = $438,332

The current ratio is therefore calculated as follows: $6,877,756 / $438,332 = 15.69

This company is able to cover its current liabilities 15 times with their current assets showing a healthy Working Capital Ratio.

Key terms

- Assets: An economic resource that has cash value.

- Liability: A financial obligation that stems from previous transactions, such as a purchase order.

Success indicators

- A current ratio between 1.5 and 3.

- A current ratio that is greater than 1 and that is stable over the long term.

See also

Related Metrics & KPIs