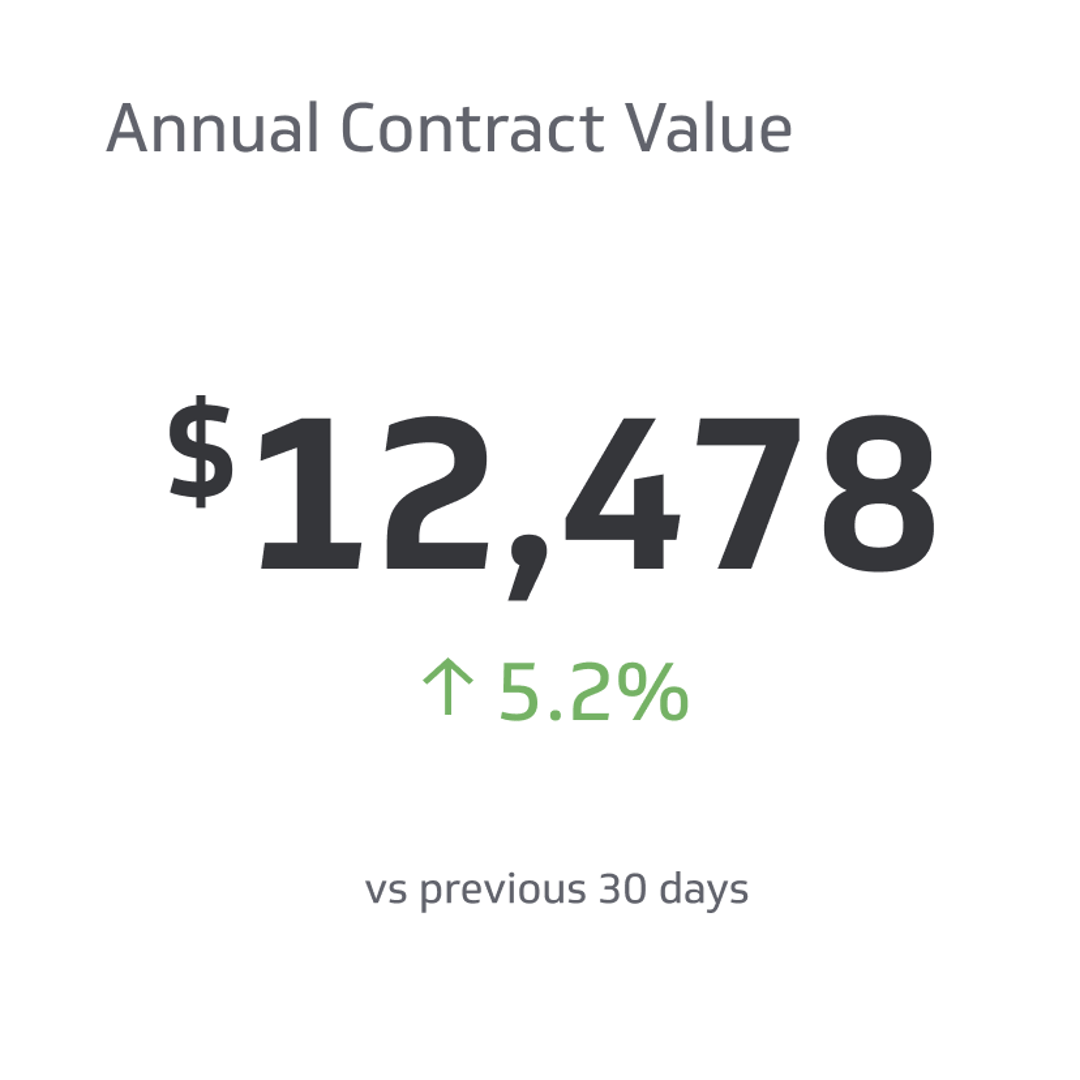

Annual Contract Value

At its core, ACV measures the value of a contract agreement over a single year.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

In business finance, metrics guide the path toward growth and success. One such measure is annual contract value (ACV).

ACV clarifies revenue projections, informs decision-making, and highlights the health of customer relationships. Yet, many enterprise leaders need to be made aware of this metric and how to leverage its capabilities.

We'll demystify the concept of the annual contract value, explain why it's crucial for your business, and guide you through calculating it effectively.

What Is Annual Contract Value?

At its core, ACV measures the value of a contract agreement over a single year. But there's a twist - it doesn't include one-time charges like setup or onboarding fees. Instead, ACV focuses exclusively on the recurring revenue a contract generates yearly.

For example, a three-year contract with a customer worth $300,000 doesn't have an ACV of $30,000. Instead, it's the value divided evenly each year, in this case, $100,000 annually.

The ACV metric aims to empower companies to understand the minimum yearly income they can expect from customers, providing a clearer picture of their baseline revenue stability.

How Does It Differ From Total Contract Value?

Total contract value (TCV) includes the total contractual revenue a client will pay the company, including recurring and non-recurring charges. It accounts for the overall value of a contract over its entire lifetime.

On the other hand, ACV is more specific because it zeroes in on the annual recurring revenue but excludes one-time fees because they won't continually impact the enterprise's budget.

What Sectors Use Annual Contract Value?

ACV is not a metric restricted to a single industry or sector; it has broad applicability wherever recurring contracts exist.

That said, its usage is most applicable in businesses such as Software as a Service (SaaS), telecommunications, utilities, and any industry that relies on long-term, subscription-based, or recurring revenue contracts.

This business model is built upon subscription-based contracts, which generate recurring revenue. Tracking ACV helps these companies understand their predictable income streams and allows them to forecast future earnings more accurately.

How to Calculate Annual Contract Value?

Calculating ACV is a relatively straightforward process. Here are the steps to do so:

- Identify the total contract value (TCV): This includes identifying all recurring payments, like annual or monthly fees, over the contract's life.

- Subtract any one-time or setup fees: Subtract any subscriptions or one-time costs from the TCV.

- Determine the contract length: This is the total duration of the contract in years. For contracts not measured in years, convert the term into years (for example, a 24-month contract is two years).

- Divide the TCV by the contract length: This gives you the ACV. The result is the average revenue your company can expect to generate from this contract each year, not accounting for non-recurring payments.

Exemplary Scenarios

To illustrate the calculation of ACV, let's consider a few hypothetical scenarios.

Scenario 1: Multi-Year Contract

Let's suppose a software company sells a subscription CMS service. They have a customer who signs a 3-year contract with a yearly subscription fee of $5,000.

The ACV for this contract would be calculated as follows:

TCV ($5,000/year x 3 years) = $15,000

Contract length = 3 years

ACV = TCV ÷ Contract length = $15,000 ÷ 3 = $5,000

In this example, the ACV is the same as the yearly subscription fee since the customer pays the same amount each year.

Scenario 2: Biannual Payments Example

Suppose another customer signs a 2-year contract with a biannual (every six months) subscription fee of $2,000.

TCV ($2,000/payment x 4 payments) = $8,000

Contract length = 2 years

ACV = TCV ÷ Contract length = $8,000 ÷ 2 = $4,000

In this case, the ACV is the total yearly revenue from the contract, which is $4,000.

Scenario 3: Contract with Additional One-Time Fees

A SaaS company signs a contract with a customer for a one-year software subscription costing $10,000. In addition, the customer pays a one-time setup fee of $2,000 at the beginning of the contract.

When calculating the ACV, one-time fees are excluded because ACV aims to reflect the recurring revenue a company can expect to earn from a contract each year.

In this case, the ACV would be the TCV minus the setup fee.

ACV = TCV - Recurring Fees

ACV = $12,000-$2,0000

ACV = $10,000

Even though the customer pays a total of $12,000 in the first year of the contract, the ACV is only $10,000 because the $2,000 setup fee is a one-time charge and not a recurring source of revenue.

Common Misconceptions about ACV

Despite its straightforward calculation, a few common misconceptions about ACV can lead to misinterpretation of this critical metric.

- ACV includes one-time fees: ACV is calculated using only the recurring revenue from a contract, not one-time costs like setup or installation charges. These one-off payments are considered in the Total Contract Value (TCV), not the ACV.

- A larger ACV always means a better contract: While a high ACV generally indicates a more profitable agreement, it doesn't necessarily mean the contract is better for the business in the long run. Other factors, like customer acquisition cost (CAC) and the likelihood of contract renewal, should also be considered.

- ACV is the same as annual revenue: ACV only represents the yearly revenue from a specific contract, not the company's overall annual revenue. A company's total yearly revenue would include the ACV from all client contracts and other revenue streams.

Leveraging Data to Optimize ACV

Understanding and utilizing metrics effectively can be a game changer in optimizing your Annual Contract Value (ACV) in the era of big data.

Data-Driven Customer Segmentation

Customer segmentation is about dividing customers into distinct groups based on shared characteristics. A data-driven approach can provide richer insights, enabling businesses to create personalized strategies to increase ACV.

Case Study: SaaS Corp

SaaS Corp, a software company, utilized their customer usage data to segment their customers.

They discovered that users from the financial industry, who utilized a specific premium feature, had a significantly higher ACV. SaaS Corp responded by tailoring their marketing and product development efforts towards this segment, increasing their overall ACV.

Predictive Analytics for Churn Reduction

Predictive analytics uses historical data, machine learning, and statistical techniques to predict future outcomes.

Regarding ACV, you can use it to identify customers at risk of churning.

Case Study: StreamIt

StreamIt, a video streaming service, used predictive analytics to identify users who had decreased their streaming activity over the past month and were likelier to cancel their subscriptions.

By proactively reaching out to these users with personalized offers, StreamIt was able to reduce churn and protect their ACV.

Benchmarking ACV Against Industry Standards

Benchmarking involves comparing your business's ACV to industry standards to identify improvement areas and growth opportunities.

Case Study: Secure Net

Cybersecurity firm Secure Net noticed their ACV was lower than the industry average.

By re-evaluating their pricing strategy and enhancing their product offering, they increased their ACV, resulting in higher revenue and improved market standing.

A/B Testing for Continuous Improvement

A/B testing compares two versions of a webpage, marketing campaign, or other business strategies to see which performs better.

Case Study: ShopNow

ShopNow conducted A/B testing on two pricing strategies and discovered that bundling led to a higher ACV than a la carte pricing. They decided to upsell their package deals to increase their ACV and overall revenue.

Strategies to Increase ACV

Increasing ACV can be a powerful lever for revenue growth, especially for businesses with subscription-based models where increasing the ACV of a contract directly translates into higher recurring revenue.

Below are some strategies that can help companies to increase their ACV:

Upselling and Cross-selling

Upselling and cross-selling to existing customers eliminates customer acquisition costs because you're focused on increasing your ACV within your current client portfolio rather than seeking new ones.

For example, a SaaS company might upsell customers from a basic to a premium subscription or cross-sell them an add-on service.

The key to successful upselling and cross-selling is understanding your customers' needs and demonstrating how the higher-end or additional product or service meets those needs better.

Target Larger Customers

In B2B sales, bigger enterprises have larger budgets and can afford higher-priced contracts, which can significantly increase your ACV.

While acquiring these customers can be more challenging and costly due to the longer sales cycles and more complex requirements, the potential increase in ACV can often justify the extra effort and cost.

Implementing an account-based marketing (ABM) strategy can be particularly effective in attracting larger customers. ABM involves identifying high-value prospects or accounts and developing personalized marketing strategies to engage and convert them.

Improve Product or Service Offering

Increasing the value you provide to your customers can justify a price increase, boosting your ACV.

In most cases, this optimization strategy involves improving the features of your product or offering superior customer service to your competitors, both of which increase your brand's perceived value and ease of use.

Adjust Pricing Structure

Sometimes, simply adjusting the pricing structure can increase the ACV.

This strategy could involve moving from a monthly to an annual subscription model, which can often lead to higher commitment and lower churn rates.

Alternatively, some businesses bundle products or services together at a discount, which could encourage customers to commit to longer contracts to lock in the savings.

Maintaining a Healthy ACV

While increasing ACV is essential, it's equally important to maintain a healthy ACV over time.

A healthy ACV is sustainable and consistent, which means more predictable revenue and financial stability.

Customer Retention

According to Forbes, increasing your customer retention rate by 5% can lead to 25-95% profit growth, depending on your industry, because keeping a loyal customer onboard is up to 5x cheaper than acquiring a new one.

High customer retention rates also contribute to a stable and predictable ACV, which is beneficial for forecasting and financial planning.

Effective customer retention strategies are varied and vast but could involve:

- Providing excellent customer service

- Developing solid relationships with customers

- Regularly checking in to ensure their needs are met

- Promptly addressing any customer service issues

Regularly Review Pricing Strategy:

Pricing strategy is not a "set it and forget it" element of your business; it's a dynamic component that should evolve with your business and market conditions.

Consider conducting a pricing audit at least once a year by:

- Analyzing your current pricing

- Researching competitor pricing

- Understanding your customers' perceived value of your product or service

- Assessing whether your pricing strategy is still effective

Based on your findings, you can adjust or completely change your pricing model to align with your business goals and market realities.

Customer Success Initiatives

Customers who achieve their desired outcomes using your product or service are more likely to consider additional purchases or upgrades, leading to a higher ACV.

Investing in customer success initiatives helps retain existing customers and increases the chance of upselling and cross-selling.

Customer success initiatives could involve:

- Onboarding programs to help customers get started

- Educational resources to help customers get the most out of your product or service

- Regular check-ins to understand customers' challenges and successes

Contract Renewals

ACV is not a one-time calculation; it's a financial metric that you should continually maintain and optimize over time. One way to do this is by focusing on contract renewals.

As contracts come up for renewal, take the opportunity to renegotiate the terms by:

- Offering new products or services

- Adjusting the price

- Extending the contract duration.

Any of these changes could increase the ACV.

Focus on Value Creation

Ultimately, the "secret" to maintaining a healthy ACV is continuously creating value for your customers. The more value your customers perceive in your product or service, the more they're willing to pay, and the higher your ACV will be.

Value creation can take many forms, some of which include:

- Improving your product features

- Offering superior customer service

- Understanding and anticipating your customers' needs

Regularly seek feedback from your customers about how you can create more value for them.

Maintain a Balanced Customer Portfolio

While targeting larger customers with the potential for higher ACVs is an excellent short-term strategy, you must maintain a balanced customer portfolio to survive in the long term.

Relying too heavily on a few large contracts can make your ACV - and thus your revenue - highly volatile and risky.

Aim to maintain a diverse portfolio of small, medium, and large contracts so that even if one contract ends, it won't significantly impact your overall ACV.

Final Thoughts

As you reflect on your business's ACV strategy, consider this: Are you merely following a number, or are you harnessing the power of ACV as a strategic tool to drive growth, create value, and achieve sustainable business success? As, the difference could be transformative.

Related Metrics & KPIs