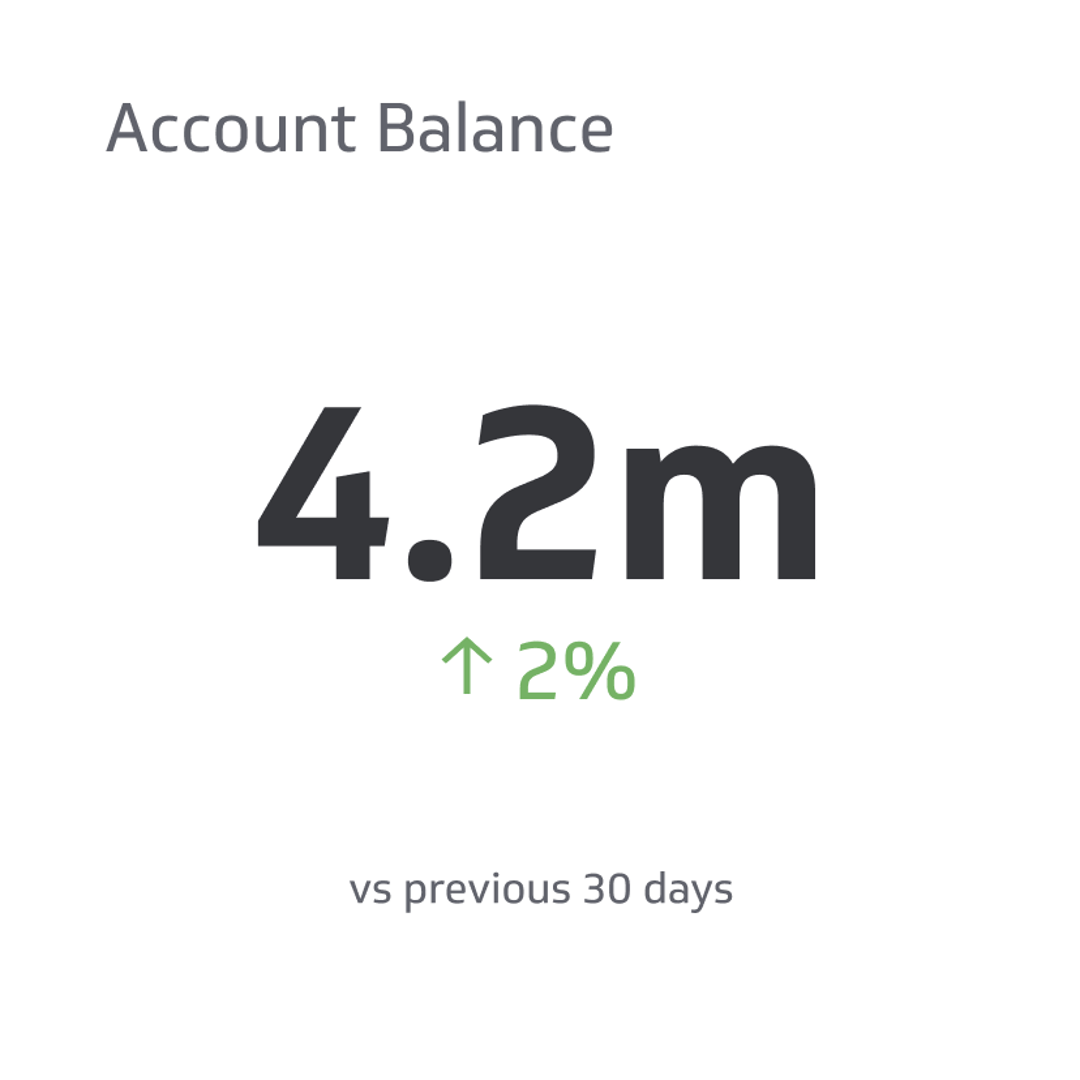

Account Balance

Account balance is the total amount of money held in a financial account at a specific time.

Track all your Financial KPIs in one place

Sign up for free and start making decisions for your business with confidence.

With the increasing importance of accurate financial tracking, knowing what goes into calculating your account balance and what factors can affect it is more important than ever.

In this article, we'll explore the definition, different types of accounts, and practical examples for setting up your accounts.

By understanding how powerful a proper accounting tool can be, you will better grasp matters such as forecasting potential profit gains or losses in any given month.

So let's dive in and find out exactly why staying on top of your business's finances with regular checks of your account balance makes a difference.

What Is Account Balance?

Account balance is the total amount of money held in a financial account at a specific time. The net amount is always the account balance, whether you have savings, checking, or investment account.

An account balance represents the available cash or current account value, including all debits and credits. So it's no wonder that financial institutions make the present value of account balances easily accessible to customers.

You can find your account balance through online platforms or readily available bank statements. While account balances may fluctuate throughout the day, it is a crucial metric for financial planning and management.

Available Credit vs. Account Balance

Regarding managing credit, there are two important figures to remember: available credit and account balance.

Available credit refers to the amount still accessible on a credit account that is not being spent. This figure significantly impacts credit scores, directly affecting credit utilization rates.

Maintaining a low credit balance and controlling spending are critical to a healthy credit score. If credit is overspent and exceeds the available credit limit, transactions will be allowed if special arrangements have been made.

As well, exceeding the credit limit can result in costly over-the-limit fees. Keeping a close eye on available credit and account balances can help individuals make informed decisions about their credit usage and maintain a solid financial standing.

Types of Accounts and Examples

When managing money, it's essential to understand the various types of accounts available to you. Each account type has its own unique set of features and benefits that cater to specific financial needs.

Choosing the correct account can help you save money, earn interest, and achieve your financial goals.

In this section, we will provide in-depth explanations of different account types and their examples, so you can make informed decisions about managing your money effectively. So let's dive in and explore the world of account types together.

Checking Accounts

A checking account is a type of account that enables deposits and withdrawals, providing a convenient option for managing finances. Its flexibility to accept unlimited deposits and numerous withdrawals sets a checking account apart.

Imagine beginning with a balance of $750 and receiving a check for $3,000 or a $1,500 monthly payment. While the account balance may show $3,750 right away, it's important to note that it would be $2,250, depending on bank location.

When it comes to convenience and availability, a checking account is an excellent choice for those who need to access their funds regularly.

Money Market Account

A money market account perfectly fits a convenient and versatile banking option. With this type of account, you can enjoy the benefits of both a checking and savings account.

So whether you need to write a check, deposit cash, withdraw funds, or simply check your current balance, a money market account has covered you. Plus, you can make the most of your money with the added perk of earning interest on your savings.

Exemplary Scenario

Exploring some examples in figures helps us understand how a money market fund works fully. Imagine you have invested $5,000 in a money market fund with a 1% annual rate of return. After one year, your investment would earn $50 in interest, resulting in a total balance of $5,050.

Now, consider a scenario where the fund has a share price of $1, and you can purchase 5,000 shares with your $5,000 investment. If the share price increases to $1.01, your investment would be worth $5,050, resulting in a 1% return on investment.

Individual Retirement Accounts (IRAs)

Individual retirement accounts (IRAs) are a common investment strategy for individuals looking to save for retirement. IRAs enable individuals to make tax-free contributions into their account until age 59 and a half.

Once this age is reached, individuals can withdraw from their IRA, subject to specific tax requirements. These requirements and the potential earnings an individual may make on their investments make IRAs a powerful tool for long-term financial planning.

Individual Retirement Accounts, or IRAs, have become an increasingly popular option for long-term savings. They offer a range of benefits, such as tax advantages and flexibility in investment options.

It's essential to seek advice from a qualified accounting expert who can advise on the best approach to investing in low-risk, long-term assets. With the potential for growth in the stock market, an IRA offers an enticing opportunity for individuals seeking to invest in their future and secure their financial stability in retirement.

Certification of Deposit (CD)

In finance, various types of account balances accommodate different financial goals. One such balance is the Certification of Deposit (CD), which provides a no-risk option for individuals looking to invest a large sum of money and increase their interest.

Unlike a standard savings account, a CD requires dedicated, predetermined periods to maximize interest accumulation.

Although it may seem restrictive, CDs yield interest more quickly than traditional savings accounts and also come with the reassurance of no penalty for early withdrawal. For the financially-minded individual, a CD is a beneficial investment option.

One example of how a CD works is that an individual may invest $10,000 in a 5-year CD with a 2.5% interest rate. Over the five years, the individual would earn $1,266.84 in interest, bringing the total account balance to $11,266.84 at the end of the term. As a result, CDs are a secure investment option often offered by banks and credit unions.

Savings Account

A savings account is an excellent choice for new investors who seek a safe financial option that complements their checking account. While interest growth is typically slower than other account options, this account functions similarly to a checking account and offers hassle-free electronic money transfers between accounts.

Furthermore, it's much easier to begin and grow your funds in a savings account with peace of mind knowing that you'll be earning interest on your balance. Overall, a savings account is a stable choice for those seeking a secure, low-risk investment option.

For example, if you deposit $1,000 into a savings account with a 2% interest rate, you would earn an additional $20 in interest over a year. While this may seem insignificant, compounding interest can add up over time.

Whether saving for a specific short-term goal or simply looking to build a nest egg for the future, a savings account can effectively reach your financial targets.

Conclusion

In conclusion, individuals must manage their account balance by regularly checking for accuracy.

By understanding the various types of financial accounts, such as checking accounts, savings accounts, certificates of deposit (CD), money market accounts, and individual retirement accounts (IRA), people can make informed decisions on which type best suits their needs.

We encourage you to remain vigilant by tracking your financial situation regularly and staying up-to-date with your banks' policies on deposits and withdrawals in order to can protect and grow your finances.

Related Metrics & KPIs