3 Key Financial Reports to Understand as Your Business Grows

Published 2025-11-18

Summary - Looking to build financial reports? Here are the big three.

The 'P&L Report' vs. the 'Balance Sheet' vs. the 'Cash Flow Statement'.

The Profit & Loss Report

As your business grows from startup to about $1M in revenue, a Profit and Loss statement becomes a key resource for tracking performance. The P&L is straightforward. The P&L is fairly simple. It summarizes revenue, costs, and incurred expenses during a specific time period.

The Balance Sheet

Once annual revenue approaches the $1M mark, the balance sheet matters a lot. That is often when owners approach lenders for a line of credit or financing to buy equipment. The business is working, and you want to build on that momentum with more resources.

Lenders need a complete picture of the company’s health. While a P&L shows profit and loss over time, the balance sheet summarizes the company’s financial position at a point in time. It shows where the company stands today.

The balance sheet presents cash in bank accounts, fixed assets, accounts receivable (what customers owe you), inventory, and other assets. It also lists liabilities such as accounts payable (what you owe suppliers), the balance on any line of credit, and other debt. It is not a running total of transactions, it is the balance of those accounts on a specific date. For fixed assets, the balance sheet records the original cost less accumulated depreciation according to tax rules from authorities like the CRA or IRS.

Good accounting software helps once operations become more complex. Generate the balance sheet regularly so it is up to date whenever you need it.

The Cash Flow Statement

A cash flow statement shows how cash moves in and out over a period. It is similar to the P&L, but it includes everything that affects cash, including loan payments, owner distributions, capital investments, and other non-operating items.

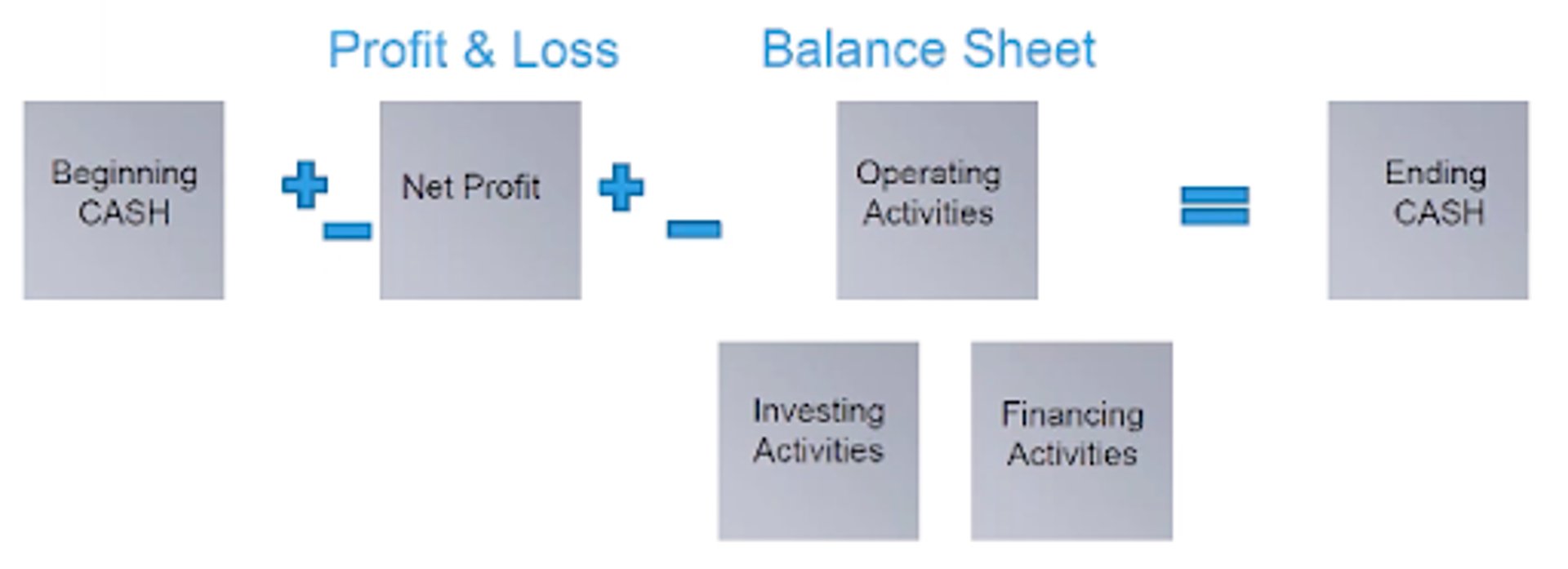

Cash flow statements can be tricky to prepare. Most owners work with an accountant. If you build one yourself, here is the basic logic:

Start with beginning cash, add or subtract profit and loss, then add or subtract changes in balance sheet items. That gives you operating cash. Add inve

These numbers are essential for the financial health of your company. To grow confidently, keep a close eye on cash flow. If you lack expertise, work with a professional, because small errors can have a big impact on the final result.

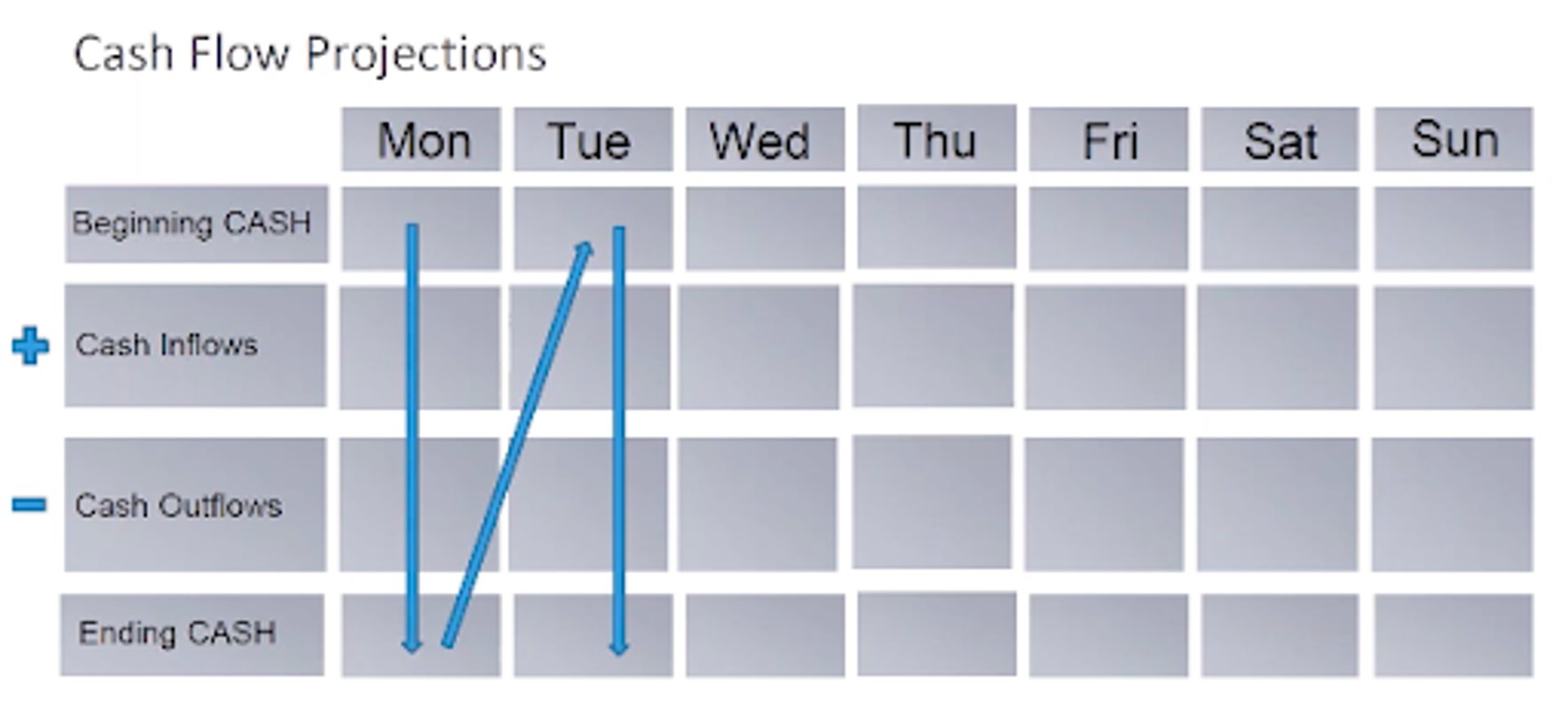

The next step is to build a cash flow projection:

You can create a table like this in Excel or Google Sheets. Put all columns together and extend the table to the end of the year. Start with beginning cash, the balance today. List cash inflows, any money coming into the company, such as amounts collected on invoices, refunds from vendors, and other receipts. Then list cash outflows, any money going out, including loan payments, distributions, and taxes. Finally, use a simple formula: beginning cash plus inflows minus outflows equals ending cash. Carry that formula through the rest of the table.

A practical cash flow projection helps you spot shortfalls early, decide when to hire, and plan pipeline targets.

If you want an easier way to monitor these numbers, Klipfolio Klips helps you build live financial dashboards and send scheduled reports so leaders stay aligned.

To Summarize...

All three reports become essential as a business grows. If payroll timing, taxes, hiring plans, or general confidence about the financial side ever feel uncertain, consider engaging a Virtual CFO to prepare these reports and guide strategic decisions. Clear reporting and regular discussions help owners move into the next stage with fewer surprises.

About Summit CPA

Summit CPA is a distributed accounting firm with a non-traditional approach to accounting. Their team of CPAs and accountants provides professional Virtual CFO Services and 401(k) audits for companies across the United States, many of which are remote. The firm also offers a CPA Firm Augmentation service, coaching other firms on how to deliver Virtual CFO services. Summit understands the bookkeeping, cash flow management, and business tax nuances that come with being distributed and helps clients navigate these challenges with proven practices.

Related Articles

Why Are KPIs Important?

By Danielle Poleski — August 5th, 2025

How smart businesses are making better decisions

By Alastair Barlow — November 22nd, 2023

Promoting data literacy with metrichq.org and the power of AI

By Allan Wille, Co-Founder — October 12th, 2023