17+ Key Metrics Every Successful Business Leader Should Know

Published 2024-03-18

Summary - Deciding which key metrics to focus on can be daunting. Here's a list, broken down by the stage of your business, of the most important metrics for modern business leaders.

As a business leader, you must stay on top of your company's health and progress. Metrics can provide a clear picture of where your business stands and where it's heading.

Understanding these metrics can help you steer your organization to where you want it to go. Some key metrics include sales revenue, customer satisfaction, and employee performance. Keeping an eye on these can help you make solid, data-driven decisions. As such, you can grow your business and make it thrive in the competitive market.

What is a metric?

A metric is a quantifiable measure that you can use to track, monitor, and assess the progress of your business activities. They provide concrete data that can help you understand how well your company, project, or specific processes are performing against your goals.

For instance, if your goal is to increase sales, metrics might include the number of sales completed or the number of new customers you made over a month or quarter. These numbers give you clear insights into where you stand in terms of achieving your sales goals.

Metrics refer to anything about your business, from customer satisfaction to employee performance. So, there can be hundreds of them, which isn’t really sustainable to track. As a business leader, you should know which metrics are the most important for your business and focus on monitoring those.

Key metrics are closely tied to your strategic goals and are essential for making informed decisions. If your strategic goal is to grow your market share, for example, key metrics could include market penetration rates or the number of new product users. As you can see, these metrics directly show you the impact and progress of your efforts.

What makes a metric important?

Metrics help you see whether your business is going the way you want it to. They provide measurable data that allows you to track, monitor, and assess the performance of your projects or specific processes. Let's delve into what makes a metric not just a number but a crucial part of strategic business planning.

Achieve your business goals

A metric becomes significant based on how well it aligns with your business goals. For example, when it comes to improving customer satisfaction, you’ll want to monitor the Net Promoter Score (NPS).

The NPS measures how likely your customers would recommend your products or services to others. A high NPS implies high satisfaction levels, which means that you’re on the right track toward achieving your organizational objectives.

Aligning your metrics with business goals makes sure that every data point you track and analyze has a purpose. It prevents you from getting lost in the sea of data and lets you focus on what truly matters for your business's success.

Drive action through data-driven decisions

Another way a metric is important is in its ability to propel your team to action. It's not just about having numbers on a dashboard. Rather, it's about understanding what those numbers mean for your business and what steps you should take in response.

Key metrics are those that highlight areas of success and pinpoint where improvements are needed. With these insights, your team can implement strategies that directly impact your organization's value proposition and operational excellence. This data-driven approach ensures that actions are informed, targeted, and effective in driving desired outcomes.

Make real-time insights more accessible

Having access to real-time data allows you to respond quickly to changes, whether it involves seizing opportunities or mitigating risks as they arise. And it doesn’t just empower you; metrics make it easier for your entire team to get a hold of these insights from your data assets.

This way, they can easily leverage the data that are relevant to their specific roles and responsibilities. Moreover, these enable them to stay one step ahead of the latest market dynamics and internal shifts.

Key metrics you should incorporate into your plans

Achieving your business goals isn’t about tracking all metrics in your organization. Instead, it’s more about staying on top of relevant ones that help you understand where your business stands and where it needs to go. Here are 17 key metrics that are instrumental for any business looking to track its performance and progress effectively.

1. Daily Active Users (DAU) / Monthly Active Users (MAU)

DAU and MAU are critical metrics for digital products and services as they offer insights into user engagement and the product/market fit. With these numbers, you get a clear picture of how often users interact with your service, which is key to understanding its value to them.

Comparing the DAU/MAU ratio is even more telling, as it reveals the level of engagement and retention of your users over time. These can reveal areas in product development, marketing strategies, and customer service that you need to enhance.

DAU/MAU ratio formula:

(# of DAU / # of MAU)100 = % DAU/MAU

2. Monthly MRR growth

Monthly recurring revenue (MRR) is a key sales metric that represents the predictable revenue generated from ongoing subscriptions on a monthly basis. Monitoring its growth provides insights into the success of your customer acquisition and retention efforts.

A consistent increase in MRR indicates a healthy business with a growing customer base. It provides a clear view of revenue trends and the effectiveness of your business model, which you can use to inform strategies on resource allocation, market expansion, and product investment to fuel further growth.

MRR formula:

MoM MRR Growth (%) = Net MRR (This Month) - Net MRR (Last Month) / Net MRR (Last Month)

3. Churn rate

The churn rate refers to the percentage of customers who discontinue their subscriptions within a given timeframe. It's a direct reflection of customer satisfaction and the perceived value of your service or product.

High churn rates can mean that your business is struggling to retain customers because of poor product quality or inadequate customer support. Keeping a close eye on your business’s churn rate allows you to identify areas for improvement in your business operations and take proactive measures to address customer dissatisfaction.

4. Net Promoter Score (NPS)

Speaking of customer dissatisfaction, the NPS provides insights into how buyers feel about your product or service. The metric is based on the willingness of your customers to recommend your business to others based on this question:

How likely is it that you would recommend (brand or product X) to a friend or colleague?

- Promoters = 10s and 9s

- Neutrals = 8s and 7s

- Detractors = responses below 7

The score itself is then calculated by subtracting the proportion of Promoter scores from the proportion of Detractor scores.

High NPS scores are often correlated with business growth. Loyal, satisfied customers are more likely to make repeat purchases and refer others. As a result, you get to increase your customer base and revenue without the high costs associated with acquiring new customers.

5. Lead conversion rate

The lead conversion rate indicates how well your sales and marketing teams turn potential leads into customers. It's a direct measure of the effectiveness of your sales funnel and marketing efforts.

If you have a low conversion rate, you may need to improve your sales process and marketing messages. Monitoring this metric also helps identify bottlenecks and opportunities for optimization to increase conversion rates.

6. Cost of Customer Acquisition (CAC)

CAC measures the total cost of acquiring a new customer, which highlights the efficiency of your marketing strategies and budget allocation. As a business leader, you must track this metric to evaluate the financial sustainability of your growth efforts.

Keeping CAC in check confirms that you're not spending more to acquire a customer than they're worth. Otherwise, you’d be wasting resources and potentially jeopardizing the financial health of your business. Use insights from this metric to optimize marketing spend and focus on high-performing channels to acquire customers more cost-effectively.

7. Customer Lifetime Value (CLV)

Aside from tracking how much from each customer, you must determine their long-term value to your business. The CLV estimates the total revenue your business can expect from a single customer account throughout your relationship.

Monitoring and understanding this metric helps justify investments in customer acquisition and retention strategies. It will show whether the cost of acquiring and serving customers outweighs the revenue they generate or not.

When you focus on increasing CLV, you can tailor your offerings and marketing efforts to meet customer needs more effectively. With this, you foster customer loyalty and value.

8. LTV:CAC ratio

Afterward, you can compare the CLV, or LTV in this case, and CAC for a more detailed analysis. The LTV:CAC ratio compares the lifetime value of a customer to the cost of acquiring them.

A healthy LTV:CAC ratio indicates that you’re deploying cost-effective marketing and sales strategies. Understanding this metric can help you refine your acquisition strategies and focus on channels and campaigns that yield the highest ROI.

LTV:CAC ratio formula:

Lifetime Value = Gross Margin % X ( 1 / Monthly Churn ) X Avg. Monthly Subscription Revenue per Customer

9. Quick ratio

The quick ratio assesses a company's ability to meet its short-term obligations with its most liquid assets, such as cash, cash equivalents, and accounts receivable. To calculate your quick ratio, you need:

- New MRR—how much new revenue you’ve added in your time window.

- Expansion MRR—the amount of existing revenue that has expanded, through upsells or upgrades, in your time window.

- Churned MRR—revenue lost from customers abandoning your product in your time window.

- Contraction MRR—revenue lost from downgrading customers in your time window.

Quick ratio formula:

Quick Ratio = (Last year's New + Upsell MRR) / (Last year's Lost + Downgrade MRR)

Having a good quick ratio means your business can cover its immediate liabilities easily. It’s a good metric to know if you want to attract investors and secure credit.

10. Current ratio

The current ratio is another liquidity metric that also evaluates a company's ability to meet its short-term obligations. However, unlike quick ratio, it takes into consideration the inventory, which provides a broader view of the company's overall liquidity position.

A strong current ratio suggests that a business can handle financial uncertainties and manage risks effectively. As such, it can reinforce the company’s financial resilience to stakeholders.

11. Sales growth rate

Sales growth rate measures the pace at which your company's sales revenue increases. It serves as a primary indicator of market demand and the effectiveness of your sales strategies.

Tracking sales growth lets you set realistic targets and provides a basis for incentivizing sales teams and matching sales efforts with business growth objectives.

12. Gross profit margin

Gross profit margin shows the percentage of total revenue that exceeds the cost of goods sold. Just like CAC, it provides insights into your business's financial health along with your products’ profitability.

By tracking this metric, you can improve your pricing strategies and cost management. You can also compare your gross margin with industry benchmarks to reveal competitive advantages or highlight areas for improvement in your production and sales processes.

13. Net profit margin

Net profit margin shows the percentage of revenue that translates into profit after all expenses. Like gross profit margin, it reveals your business's overall profitability and financial success.

A major difference between the two, though, is that net profit margin is a more comprehensive measure. This is because it takes into account all expenses, including operating costs, taxes, and interest payments. Gross profit margin only focuses on the revenue and cost of goods sold.

Use the insights you get from your organization’s net profit margin for strategic financial planning. This way, you can find opportunities to reduce costs, improve operational efficiency, and, ultimately, increase profitability.

14. Sales revenue

Sales revenue refers to the total income generated from sales of goods or services. It's a fundamental indicator of your company's market presence and demand for your offerings.

Unlike gross and net profit margin, sales revenue directly reflects the actual sales activity. An increasing trend in sales revenue signals business growth and market acceptance. You should regularly assess the sustainability of your business model and plan for future expansion.

15. Net revenue retention

Net revenue retention measures the percentage of revenue retained from existing customers over a specific period after accounting for upgrades, downgrades, and churn. It’s a particularly valuable metric for subscription-based businesses since it signals customer satisfaction and loyalty.

A high net revenue retention rate indicates that customers find ongoing value in your service. It implies good financial health and potential growth for your business by highlighting the success of retention strategies and the overall value of your offerings.

16. Annual revenue per employee

You should also consider the annual revenue per employee metric, which evaluates the productivity and efficiency of your workforce. Tracking how much employees contribute to your overall revenue can help you understand how your organization is making the most of your human resources.

Annual revenue per employee formula:

Revenue / # of employees

17. Employee satisfaction

More than returns on investment (ROI) and profit, employee satisfaction is another crucial factor to track for your organization. Happy and engaged employees tend to be more productive and contribute positively to the success of your company. Additionally, it leads to better talent retention and attraction while reducing turnover costs.

What is the difference between Key Metrics and Key Performance Indicators (KPIs)?

Key metrics and key performance indicators (KPIs) are often used interchangeably, which is understandable given they both help you gauge your company’s performance and progress. However, their applications and implications differ significantly.

Let's explore these differences to help you better leverage these tools for your business's growth and efficiency.

Function

Metrics refer to the various data points you collect across all areas of your business operations. Then, there are key metrics, which we’ve already established as these are closely tied to your strategic goals.

Key metrics like CAC, CLV, and profit margins help you understand how well different parts of your business are functioning. For instance, website traffic numbers can reveal how well your digital presence performs. However, since they’re a metric, they don’t directly indicate whether you're on track to meet your annual sales goals.

On the other hand, KPIs are a specific subset of key metrics. They’re selected for their direct relevance to your company's success criteria for a certain project or process. Going back to the example above, website traffic can be a key metric, but the KPI might be the conversion rate of that traffic into actual sales since it directly measures the effectiveness of your digital marketing efforts.

Design

Key metrics, while crucial, don’t always align closely with specific business goals. They can indicate the health of various operations within your business, such as the efficiency of production or the effectiveness of a marketing campaign, without being directly tied to the overarching strategic objectives.

In contrast, KPIs are meticulously designed to measure progress towards achieving your company goals. They clearly indicate whether the organization is on the path to success by providing a measurable target that directly relates to the desired outcome.

Range

Key metrics can involve a broad range of business activities and offer general insights into performance and efficiency. Their level of specificity can vary, and while they are informative, they may not always suggest clear actions. These metrics help diagnose overall performance but may require additional analysis to translate into actionable strategies.

KPIs, on the other hand, are defined by their specificity and direct link to action. They highlight areas requiring attention or adjustment, which makes them powerful tools for instigating strategic action.

Purpose

Key metrics are useful for tracking trends and operational success but do not necessarily measure success in relation to strategic goals. Conversely, KPIs are established with clear targets in mind. As such, they directly correlate business activities and the desired outcomes.

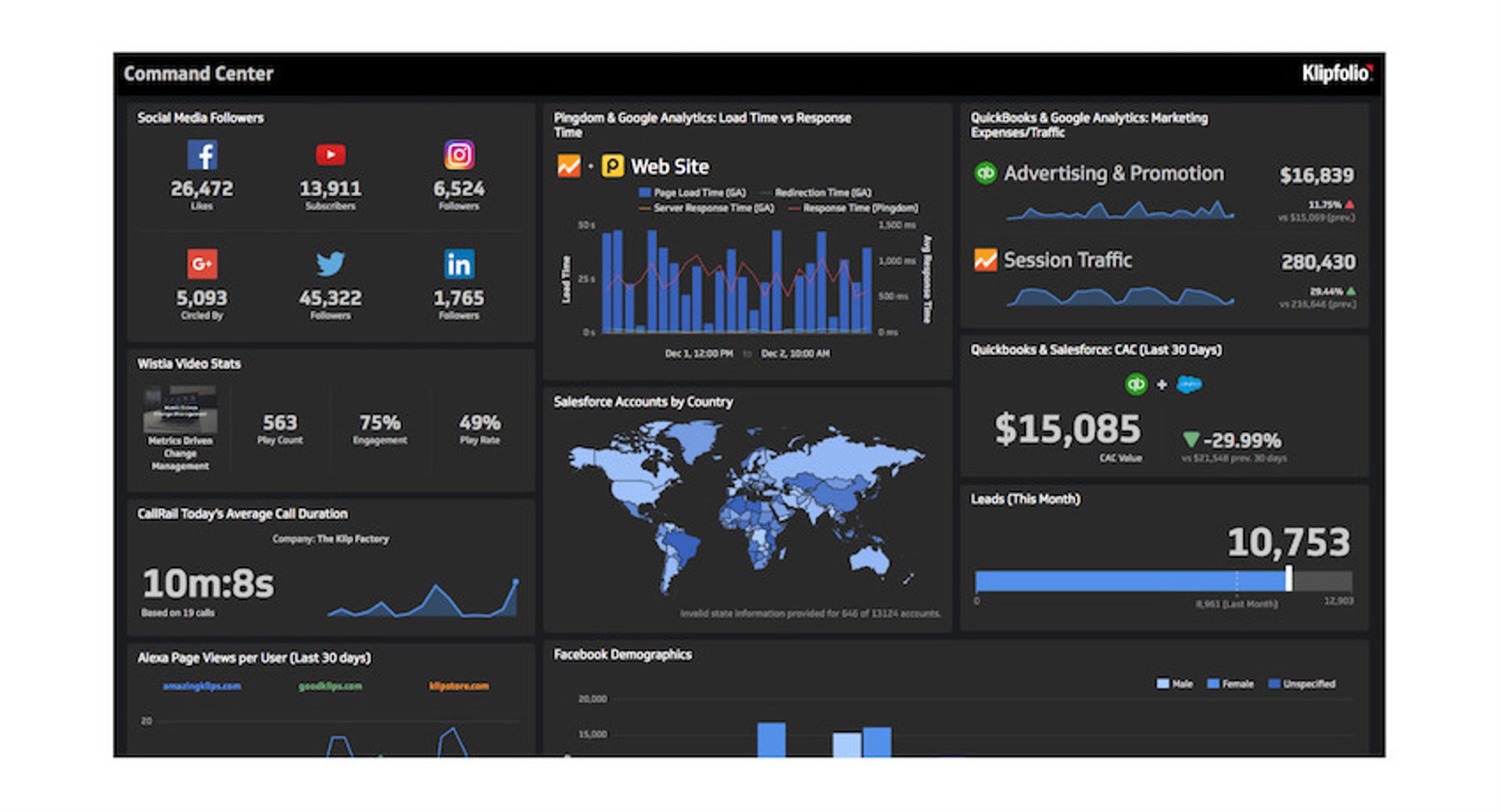

Foster data-driven leadership with Klipfolio

Knowing how to leverage key metrics and KPIs is crucial for effective business management. These quantitative measures work together to provide valuable insights into the performance and success of your organization. With the data you collect, you can identify areas of improvement and make informed business decisions to make your business scale.

Leverage data and lead the charge in growing your business with Klipfolio. Our low-code data visualization platform transforms insights from key metrics and KPIs into solid steps toward where you want your company to go. Start harnessing the power of your data and drive your team toward unprecedented success!

FAQs

Can a metric become a KPI?

Yes, a metric can become a KPI depending on its relevance and importance to the company's goals and objectives. A metric can act as a KPI when it's used to measure progress toward specific goals.

For example, while the number of website visitors is a metric, it becomes a KPI when your goal is to increase digital engagement. Identifying which metrics are most reflective of your strategic objectives is the first step in this process.

How do you determine metrics?

First, you need to define your goals and objectives. Once you have a clear understanding of what you want to achieve, you can identify the key areas that align with those goals. From there, you can determine the specific metrics that will help you measure progress in those areas.

Tools like PowerMetrics can help you analyze which metrics are most relevant to your goals and objectives. Then, you can display key metrics easily through its no-code data visualization capabilities.

How do you measure success with key metrics?

Success measurement begins with establishing clear, achievable benchmarks for each key metric. These benchmarks should be based on historical data, industry standards, or targeted goals set by your organization.

Then, provide context to your metrics within the broader scope of your business operations and market conditions. This involves looking at the numbers and digging deep to understand the stories they tell about customer behavior, market trends, and operational efficiency.

How do you use metrics to inform your strategy?

Metrics provide a foundation for making informed strategic decisions. You have too much at stake to rely on guesswork or gut feelings when it comes to your business strategy. By analyzing the data, you can identify areas of strength and opportunities for improvement to guide decisions on where to allocate resources and which initiatives to prioritize.

How often should I review metrics and KPIs?

Review frequency depends largely on your industry or business. Typically, most organizations do a monthly or quarterly review cycle, which helps them be responsive but avoid knee-jerk reactions to normal fluctuations.

If your business is going through rapid change or if you're implementing new strategies, you’ll want to review your metrics and KPIs more frequently so that you can make quick adjustments if needed.

Related Articles

2025 BI and Analytics Trends for Small and Mid-Sized Businesses

By Allan Wille, Co-Founder — December 18th, 2024

Promoting data literacy with metrichq.org and the power of AI

By Allan Wille, Co-Founder — October 12th, 2023

Let’s fix analytics so we can stop asking you for dashboards

By Cathrin Schneider — September 11th, 2023