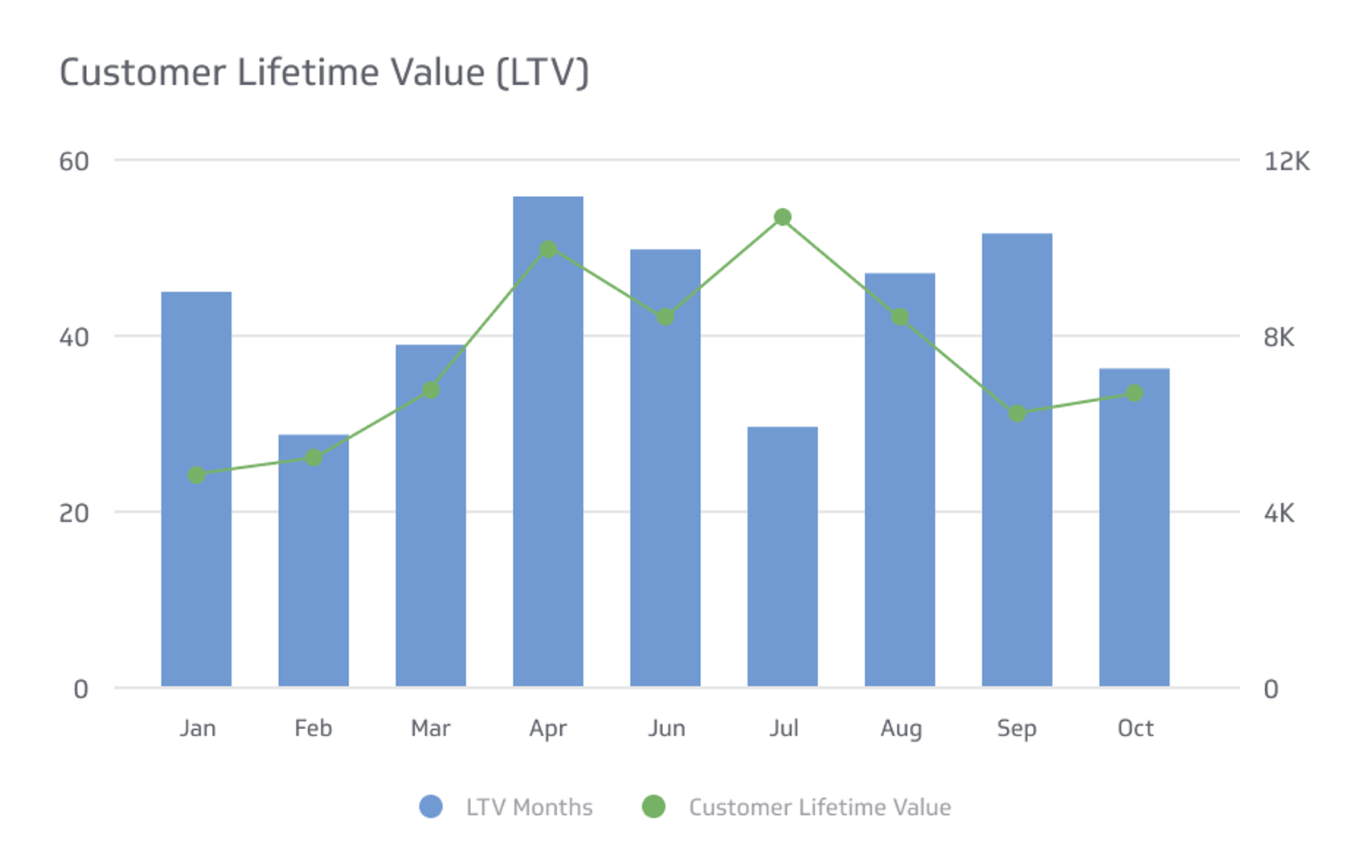

Customer Lifetime Value (LTV) KPI

Measure the amount of gross profit that is generated from a customer over the entire time they do business with a company.

Track all your Digital Marketing KPIs in one place

Sign up for free and start making decisions for your business with confidence.

.png)

Some customers might make just one purchase, but others may return, recommend your brand, and contribute significantly to its growth over time. Customer lifetime value (CLV) informs you of the difference between these and helps you focus on the customers who bring the most value to your business.

Examining how your customers engage with your brand can help you find ways to retain loyal customers and encourage repeat business.

Clear communication, loyalty programs, and personalized offers strengthen connections and cultivate lifetime value. Moreover, knowing each customer's long-term impact enables you to make more data-driven business decisions, grow relationships that drive success, and invest your resources effectively.

What is customer lifetime value?

Customer lifetime value (CLV) measures the total revenue you can anticipate to earn from a customer throughout your relationship with them. It underlines how much wealth a customer introduces to your business over time, factoring in how often they buy, how much they spend, and most importantly, how long they remain loyal.

Knowing your customers’ lifetime value helps you concentrate on those who contribute the most to your growth. By recognizing your high-value customers, you can invest in strategies designed to keep them returning.

CLV also helps you decide how much to spend on acquiring new customers, making it a crucial factor when constructing marketing budgets. That’s because if you know a customer will bring significant long-term value, it makes a lot of sense to spend more upfront to win them over.

Lastly, CLV is a great way to predict future revenue.

By investigating customer behavior, you can gauge how much you’re likely to earn from your existing customers. You can use that data to make smarter business decisions and spot opportunities to strengthen customer retention or increase repeat purchases.

The key components of customer lifetime value

The key components of customer lifetime value (CLV) are essential factors that directly influence the revenue your business can expect to make from its customers.

Understanding these components helps you make data-driven decisions needed to optimize customer relationships, increase profitability, and sustain growth. Below are the main factors that contribute to customer lifetime value:

Average purchase value

Average purchase value is how much a customer typically spends per transaction. Determining the overall revenue you can expect from each customer is critical, and increasing this value significantly boosts customer lifetime value.

Use personalized recommendations based on past purchases to increase your average purchase value. Furthermore, providing product bundles that offer convenience or savings can encourage customers to spend more in one transaction, thereby increasing their average purchase value.

Purchase frequency

Purchase frequency measures how often a customer buys from your business. A higher frequency means customers are returning more often, which contributes to greater CLV.

Businesses that successfully increase purchase frequency benefit from more frequent customer interactions, creating a steady flow of revenue. Methods to increase this metric include sending reminders, offering loyalty programs, or creating subscription models where customers receive products automatically every month.

For instance, companies like Amazon use a combination of personalized recommendations and convenience (like Amazon Prime) to keep their customers coming back. The key is to engage consumers regularly with incentives or content that urges them to purchase sooner rather than later.

Customer lifespan

Customer lifespan is the length of time a customer continues to engage with your business and make purchases. The longer a customer stays, the more revenue they generate, and companies that offer subscription services like Hulu or Spotify build loyalty over time by continuously offering fresh content.

Reducing churn is imperative to increasing your customer lifespan. Providing ongoing value and addressing concerns rapidly helps prevent customers from switching to your competitors. Aside from that, regular check-ins, new products or services, and asking for feedback are simple ways to keep customers engaged over the long term.

Gross margin

Gross margin represents the profit your business makes after accounting for the cost of making the goods or services sold.

Higher gross margins mean that more of your revenue generated from each customer translates into profit. Improving your gross margin increases CLV since a higher margin allows you to reinvest your profits into customer retention strategies along with other growth efforts.

Optimizing production costs, reducing waste, or increasing the efficiency of your operations can improve gross margin. Besides that, offering premium products or services with higher margins can also help increase profitability per customer.

Customer acquisition cost (CAC)

Customer acquisition cost pertains to the expenses associated with acquiring a new customer, including marketing, advertising, and sales offers. If your LTV to CAC ratio is too high, your business will struggle to be profitable. Lowering CAC allows you to spend less to acquire customers while still seeing significant returns over their lifetime before they churn.

How do you calculate customer lifetime value?

To calculate customer lifetime value (CLV), you must consider average purchase value, purchase frequency, and customer lifespan.

- For a single customer: Add up the total revenue per month and multiply it by the number of months they've been a customer.

- For a business: Divide the average revenue per user (ARPU) by the company’s churn rate.

Alternatively, CLV can be calculated using the formula:

CLV = (Average Purchase Value) x (Purchase Frequency) x (Customer Lifespan)

If you're calculating for a business with a subscription model, you can also factor in gross margin to get a more accurate CLV, making sure the calculation reflects profitability.

Why is CLV important?

Customer lifetime value is important because it helps businesses identify where to focus their efforts to maximize profitability. Rather than treating all customers equally, CLV allows you to prioritize those who bring the most long-term value, making your investments more strategic.

One key reason customer lifetime value matters is its role in optimizing efforts. Research shows that depending on your industry, attaining a new customer always costs more than maintaining an old one. This makes it clear why retaining high-value customers should be your priority.

CLV aids in resource allocation across business operations.

For example, by specifying your highest-spending customers, you can improve service levels or offer personal discounts and rewards that increase their satisfaction and devotion to your brand. This is important to know since enhancing customer retention rates can lead to profit increases.

Customer lifetime value also provides invaluable insights fundamental for long-term planning. Enterprises with a straightforward understanding of their customer’s lifetime value can predict revenue more accurately and invest confidently in growth initiatives. This becomes particularly significant when acquisition costs rise, as customer acquisition costs have increased by nearly 50% in recent years.

Beyond that, CLV supports competitive advantage, and companies that emphasize long-term customer relationships commonly outperform those that focus only on short-term gains.

Through investing in the experience and loyalty of your most esteemed customers, you build a sound foundation of trust and satisfaction. This ultimately makes it harder for your competitors to win them over.

When is a lower CLV justifiable?

A lower CLV is justifiable in specific scenarios, primarily when businesses operate in industries with low margins, high competition, or a focus on short-term gains.

For instance, in industries like e-commerce or fast fashion, where customers tend to make infrequent or smaller purchases, a lower CLV may still be acceptable if the CAC is also fairly low. In these cases, businesses can rely on high-volume sales to compensate for the lower CLV.

Another situation when a lower CLV is justifiable is during a business's early stages or when launching new products.

New businesses often need to spend heavily on marketing and customer acquisition, which can temporarily inflate CAC and lower the overall CLV. However, if the business is in a growth phase, it may still be justified as an investment to build brand awareness and gain market share.

For companies offering low-cost, high-frequency products such as fast food chains—having a lower CLV can be justified as they focus on driving high volumes of repeat purchases. In these cases, businesses may not need high CLV but instead rely on customer churn as a natural part of their model, with plans to replace churned customers through consistent acquisition efforts.

Lastly, a lower CLV can also be justifiable if a business has high operational efficiency and can maintain profitability with a smaller customer base. However, if a company relies on continually acquiring new customers to compensate for lower CLV in the long term, it may face challenges in sustaining profitability.

What factors affect customer lifetime value?

Customer lifetime value is influenced by various factors that shape how much revenue each customer generates over their time with your business. Below is a more in-depth look at each of them.

1. Customer retention

Retention is one of the most influential factors in determining customer lifetime value. When customers remain loyal over time, they continue to generate revenue without the additional expense of accumulating new ones.

Loyal customers also tend to engage with your brand more deeply, purchasing more products or services and referring others, further amplifying their lifetime value.

Retention is even more important in industries like SaaS or subscription services. It has been shown that 80% of a business’s future revenue comes from just 20% of existing customers. Thus, you need to prioritize nurturing your current customer base to leverage this potential.

Personalized experiences, proactive support, and loyalty programs can strengthen retention and further enhance customer commitment. Ultimately, this will leave a positive impact on your CLV.

2. Purchase frequency

Purchase frequency directly impacts how much value a customer generates for your business. Customers who buy more often increase overall revenue, strengthening their connection to your brand. For example, major online retailers like Amazon have successfully increased purchase frequency through subscription services such as Prime, which encourages regular spending.

Targeted promotions and seasonal offers can also drive more frequent purchases, especially when paired with personalized recommendations. By tracking purchase patterns and using them to craft tailored campaigns, businesses can nudge customers to buy more often without appearing overly aggressive.

In addition, gamification techniques, such as offering discounts or rewards for making particular purchases, have been proven to increase purchase frequency. For example, evidence has even discovered that loyalty programs with gamified components result in a 22% increase in customer retention.

3. Average order value

The average amount customers spend per transaction plays a decisive role in CLV. Businesses that successfully increase their average order value (AOV) can see a dramatic peak in revenue without needing to gain new customers.

Strategies like upselling and cross-selling are particularly effective in increasing AOV. Amazon has even reported that its upselling and cross-selling efforts account for up to 35% of its total revenue. That means bundling complimentary products, offering free shipping methods, and creating personal product suggestions are proven tactics you should employ to encourage customers to spend more per transaction.

Furthermore, psychological pricing strategies play a part in boosting AOV.

Customers are likely to spend slightly more if they perceive they’re getting better value, such as opting for a premium package over a basic one.

Limited-time offers for higher-value bundles also drive larger deals and foster a strong sense of urgency. Implementing volume discounts, such as “buy two, get one free,” can further incentivize customers to increase their purchase size.

Additionally, offering post-purchase add-ons or exclusive upgrades at checkout can effectively encourage higher spending, which will boost customer lifetime value.

4. Customer experience

Customer experience strongly impacts satisfaction, sentiment, loyalty, and the likelihood of repeat purchases, making it a key factor in CLV.

68% of consumers are ready to spend more on brands that deliver good experiences. Smooth, personalized, and responsive interactions at every touch point are vital for cultivating a bright customer relationship. Meanwhile, fast response times, intuitive user interfaces, and proactive problem resolution can all contribute to a superior experience.

Negative experiences, on the other hand, can have an outsized impact on CLV. A report by PwC found that 32% of customers would stop doing business with a brand they loved after just one bad experience. Investing in tools like customer relationship management (CRM) systems, chatbots, and training for customer-facing staff is a definite must-do for success.

Besides that, regularly collecting feedback through surveys and reviews can significantly help you improve customer satisfaction. That’s because they allow you to identify pain points and show the customers that their opinions are valuable and that you care about their expectations.

5. Loyalty and rewards programs

Loyalty and rewards programs enhance CLV by encouraging repeat purchases and deepening engagement. These programs provide incentives, like discounts, points, or exclusive perks, that motivate customers to keep buying from your brand. Statistics even show that 75% of consumers are more likely to stick with brands that offer loyalty programs.

However, the structuring of such programs should align with customer preferences to maximize participation and effectiveness.

Reward programs also create a feeling of exclusivity and belonging that strengthens customers' emotional connection to your brand. For example, Best Buy’s Rewards program has been credited with increasing average annual spending by 15% among loyal customers.

Loyalty programs' long-term benefits extend beyond retention because they encourage your customers to refer others. This creates a cycle of increased CLV and organic growth that will guarantee your business a lot of future revenue.

6. Pricing strategies

Pricing strategies influence customer lifetime value by shaping how much and how frequently they spend. Competitive and transparent pricing attracts customers, while strategies like tiered pricing or bulk discounts encourage higher spending. Moreover, numerous and flexible payment options, such as subscriptions and installment plans, can drive long-term loyalty.

Dynamic pricing, which adjusts based on demand or seasonality, can also increase revenue for your business. But, you must constantly balance affordability with perceived value to retain your customers without eroding profitability.

Lastly, you should remember that excessive discounting harms your margins and lowers the perceived quality of your offerings. Instead, focus on delivering exceptional value and experiences that justify your pricing and build long-term trust with your customers.

7. Product or service quality

The quality of your product or service is critical in determining whether customers return. High quality always fosters trust and guarantees satisfaction, leading to repeat purchases and positive referrals. Conversely, inconsistent or poor quality can damage your reputation.

Most customers stop buying from a brand after several instances of poor quality. As such, regular updates, quality control, and listening to customer feedback are essential if you want your business to outgrow its competitors and increase profits.

Businesses that consistently prioritize excellence build stronger relationships and stand out in modern competitive markets. Quality also supports lasting customer trust, increasing their willingness to engage and contribute more to your business over time.

8. Market trends and external factors

Market trends and external factors like economic shifts or evolving consumer preferences have a direct effect on CLV.

During times of economic uncertainty, customers will prioritize essential purchases over casual purchases. In 2024 alone, 80% of global consumers reported adjusting their daily spending habits due to inflation, with 40% reducing how much in total they buy.

Emerging trends, such as technology-driven convenience or sustainability, can also impact customer loyalty.

Brands that adapt to these shifts align better with customer values, deepening their connection and enhancing their lifetime value. Failing to evolve, however, risks alienating customers and guiding them toward more agile competitors who better meet their expectations.

9. Communication and engagement

Meaningful communication strengthens customer relationships, fosters loyalty, and increases lifetime value. Personalized messaging is fundamental in this regard, with most customers expecting it and some feeling frustrated when it’s unavailable.

Consistent touchpoints, such as email campaigns, social media engagement, and personalized product recommendations, help keep your brand at the top of consumers’ minds while nurturing lasting connections. These interactions must feel authentic and aligned with preferences so you can successfully cultivate a feeling of value and belonging.

Last but not least, immediate problem resolution, tailored solutions, and other types of proactive engagement build trust and enhance satisfaction.

10. Churn rate

Churn rate refers to the percentage of customers who stop engaging with your business.

This metric directly reduces CLV by shortening customer relationships. A high churn rate can be the result of poor product quality, a lack of engagement, or subpar support. Reducing churn rate by even a little can markedly increase your profits.

Addressing churn involves identifying and addressing common causes.

Steps like regularized feedback collection, incentives for continued engagement, and proactive issue resolution can each help retain customers. By keeping churn rates low, you ensure a stable, loyal customer base that contributes more to your business as time passes.

Use CLV insights to create valuable customer experiences

Understanding customer lifetime value equips you with the insights needed to build stronger relationships and drive long-term success. However, CLV isn’t just about numbers; it’s about shaping your strategies to deliver value to the customers who matter most while enhancing resource allocation and planning for the future.

As you refine your approach, leveraging tools to track and analyze CLV data becomes essential. Platforms like Klipfolio help simplify this process by providing real-time metrics and visualizations, empowering you to make informed, data-driven decisions.

Related Metrics & KPIs