6 key principles to leading practice management information

Published 2023-02-01

Summary - Turn data into information, and information into insight.

I recently gave a talk on How to be a Kick-Ass CFO at Accountex in London (Europe’s largest accounting conference). Most of my presentation circled around improving management information. As part of the talk, I walked through the power of heterogeneous data mashing and bringing together multiple data sources to make much better-informed decisions.

I also walked the audience through what I see as the way in which reporting matures as a business develops, along with some of the pitfalls of manual reporting.

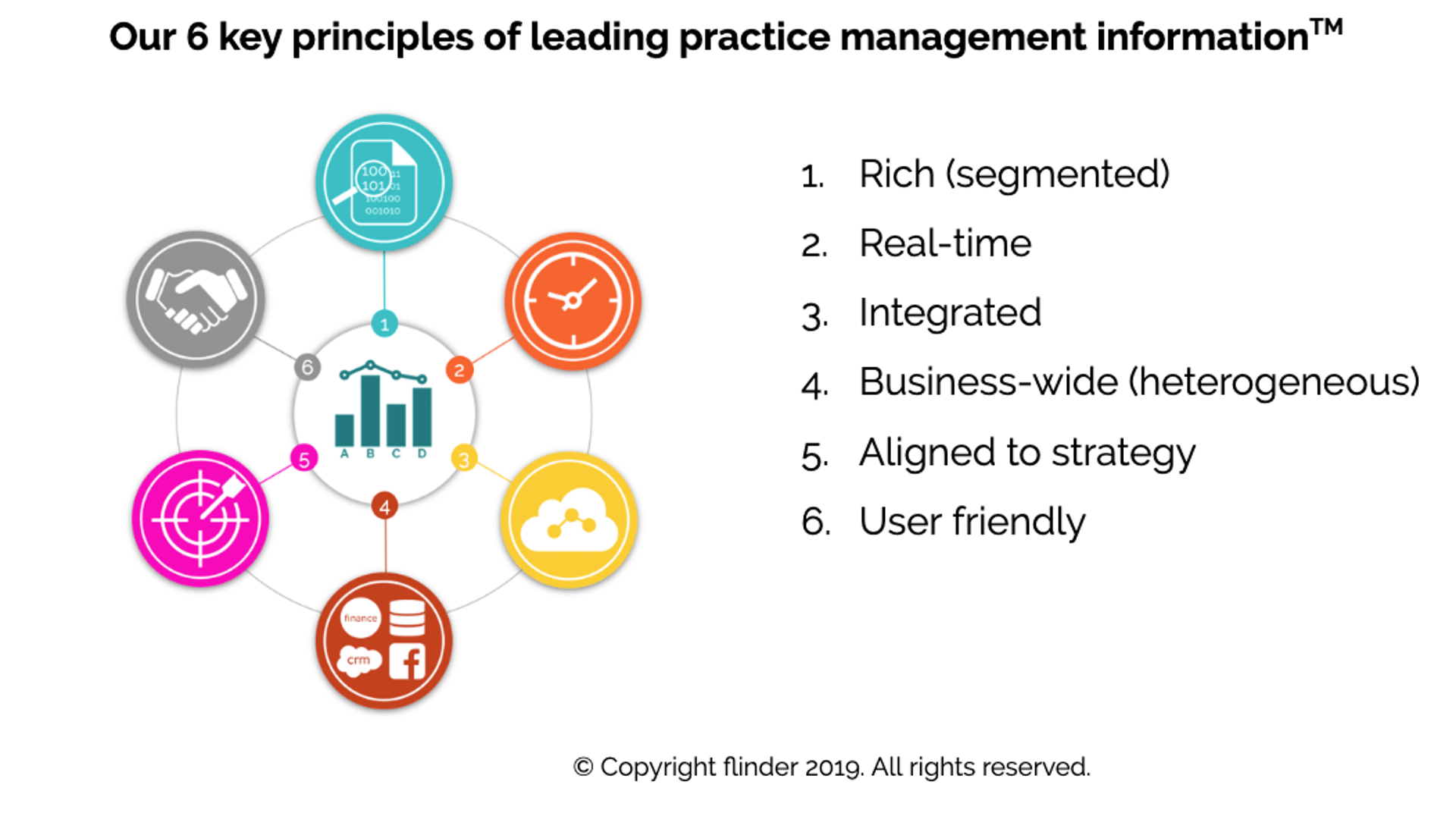

One of the most important areas I talked about was our 6 key principles of leading practice management information; get these right and you will be well on your way to the far right of our reporting maturity curve delivering rich, real-time, integrated, business-wide data analytics that are aligned to the business strategy and easy to use.

“The goal is to turn data into information, and information into insight.” - Carly Fiona, Former CEO of HP

1. Rich (segmented)

Aggregated information can easily masquerade the real story; an underperforming business unit or sales channel can easily be hidden when aggregated with a high-performing one. Without segmenting management information to the right level, this is much harder to identify and thus take corrective action.

Most organisations should segment their information, at least at a basic level. However, going deep on segmentation; by customer, by channel, by sales person or other dimensions depending on the business strategy, can really provide greater insight leading to better decision-making.

2. Real-time

To many this is a fairy-tale. To the wise, this is a reality. Businesses should always be striving for more timely information simply because this makes it more relevant.

Delivering management information in real-time with only 5-minute refreshes is a reality, but that largely depends on how real-time a process actually is. In the world of accounting, a payroll journal for example is typically posted monthly. This would mean the full profit & loss account is inaccurate during the month until this journal is posted. However, revenue could well be real-time and refreshed every 5 minutes if it’s being taken from an EPOS system, website or proprietary system.

Consider how real-time could change your view of the business, make better decisions and which parts could be sped up.

3. Integrated

In order to ensure your management information is constantly up to date and truly ‘hands free’ it’s important to link directly from the core application(s). By using an API (application programming interfaces) and dynamic data sources, the data will be pulled directly from the source systems. For many APIs, the requests can be customised to ensure you are getting only the data that you need, and in a consistent format that is ready to be engineered and interrogated.

Integrating applications is a huge enabler to real-time information – eliminating the human need to download, sort, cleanse, map and reupload data.

4. Business-wide (heterogeneous)

If you’ve never come across the term heterogeneous before, the English dictionary defines it pretty simply as ‘diverse in character or content’. In the realms of data, this can mean different things:

- Data sources i.e. applications

- Content i.e. customer numbers, revenue, orders

- Character or type i.e. XML, JSON, CSV

We want to mash these data sources together to give us some relatively. Essentially, it means we can better benchmark or make more sense of the information. When we make better sense of information, it most often leads to greater insight and helps to make better informed decisions.

One of my favourite phrases is; it’s not the what, but the why? What I mean by this is, it’s not what has happened that is important but why it has happened. We don’t just want to know what has changed but we want to know why it has changed. Evaluating what has happened across heterogeneous data sources most often uncovers that why.

5. Aligned to strategy

Too often management information is delivered the way it’s always been delivered, and with the same content it’s always had.

Stakeholders need information aligned to their strategy, and that strategy may evolve over time.

It’s so obvious when it's written down however, most businesses don’t align their management information to their business strategy and objectives. What is the point of the KPI if it's not helping to meet your strategic objectives?

6. User friendly

This is arguably the most important principle. Applying these other 5 principles is great but if the information is not designed with the audience in mind and their preferences then it’s just not going to get used.

It comes back to human behaviours; you can have all the best technology in the world but if people aren’t going to use it, it’s irrelevant. Focusing on how the user wants to look at and interact with the information is very under recognised.

The power of applying our 6 key principles

In the following example, you can see how we’ve brought financial and non-financial information from different sources (heterogeneous data) into the same (basic) dashboard to deepen our understanding of what’s going on in the business. We’ve brought financial information in from Xero (finance app), traffic in from Google Analytics and customer numbers from CIN7 (point of sale app).

Click here for our example dashboard.

1. In the top tile, you can easily see that revenue has been increasing month on month from January to April – in principle, this is great news!

2. If you click online customers and web traffic (additional heterogeneous data sources) on the right-hand side, you can see that there is a dip in both customer numbers and web traffic in February – possibly due to a shorter month, but either way this is something we should be conscious of and dig in deeper.

3. Bringing in online conversion (another data source) as another series, we can actually see that this has been reducing month on month since January – this is clearly not good!

If we bring in online AOV (average order value – blended data between two data sources), we can see that this has also fallen since February – again, not good.

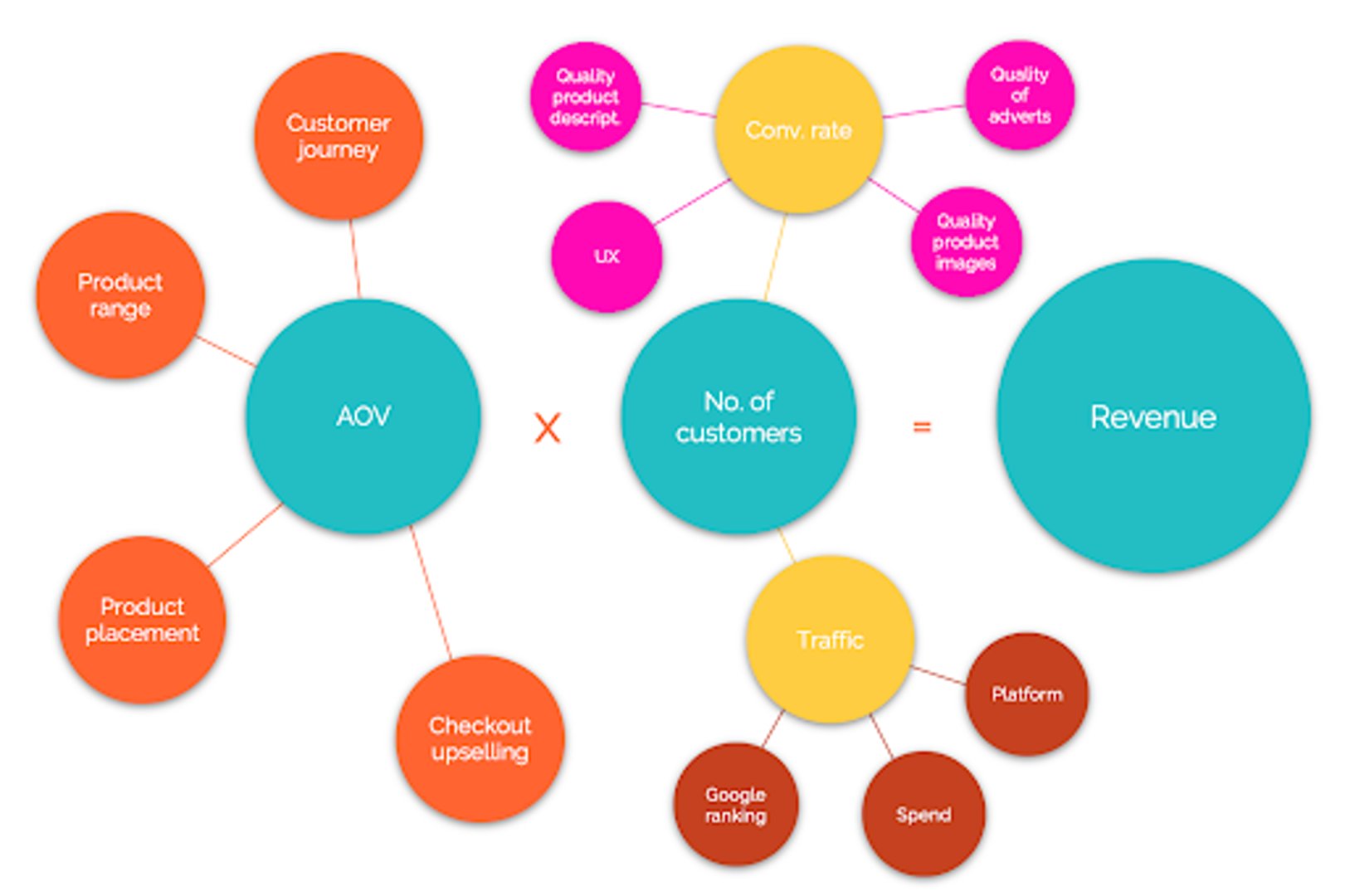

The below chart shows the components of revenue i.e. number of customers and average order value, and very importantly, potential drivers of each of these. These drivers are all aspects the business can try to improve on. But without going deeper on the data, and without bringing these additional (non-financial) data sources to mash together, we may not have identified these trends and at a financial information level, potentially been both satisfied with the numbers and blind to the reality of a reducing conversion and AOV. Both of which we can take action to try to increase.

The second tile in the dashboard is a clean version of the first one with the same initial revenue numbers. However, clicking to bring in the additional revenue series, it shows us what our revenue would be if we had both the highest conversion and highest AOV; over 10% more sales in April.

This relatively simple example goes to show the power of bringing in heterogeneous data to enrich our understanding of the business and to make better management decisions. In this case, focusing on both conversion and AOV.

You can see the full example and keynote talk here.