Are you spending too much money acquiring new customers?

Published 2023-09-11

Summary - Understanding how much a customer is worth to you over time is critically important to long-term success. If you spend too much money chasing customers, it affects your bottom line. If you spend too little, you are probably missing out on opportunities. Learn how to calculate your LTV:CAC ratio.

A few weeks ago, I explained why it’s important to understand and monitor how many of your prospects turn into paying clients.

This week, I want to go into detail about what, in business jargon, is called the LTV:CAC ratio. It’s the relationship between the lifetime value of a customer (the LTV for people who like acronyms) and the cost of acquiring that customer.

Don’t be put off by the jargon. This is an important metric. A business that doesn’t understand this ratio is missing crucial bits of information – information that is important not only to measure its success but also to direct its efforts.

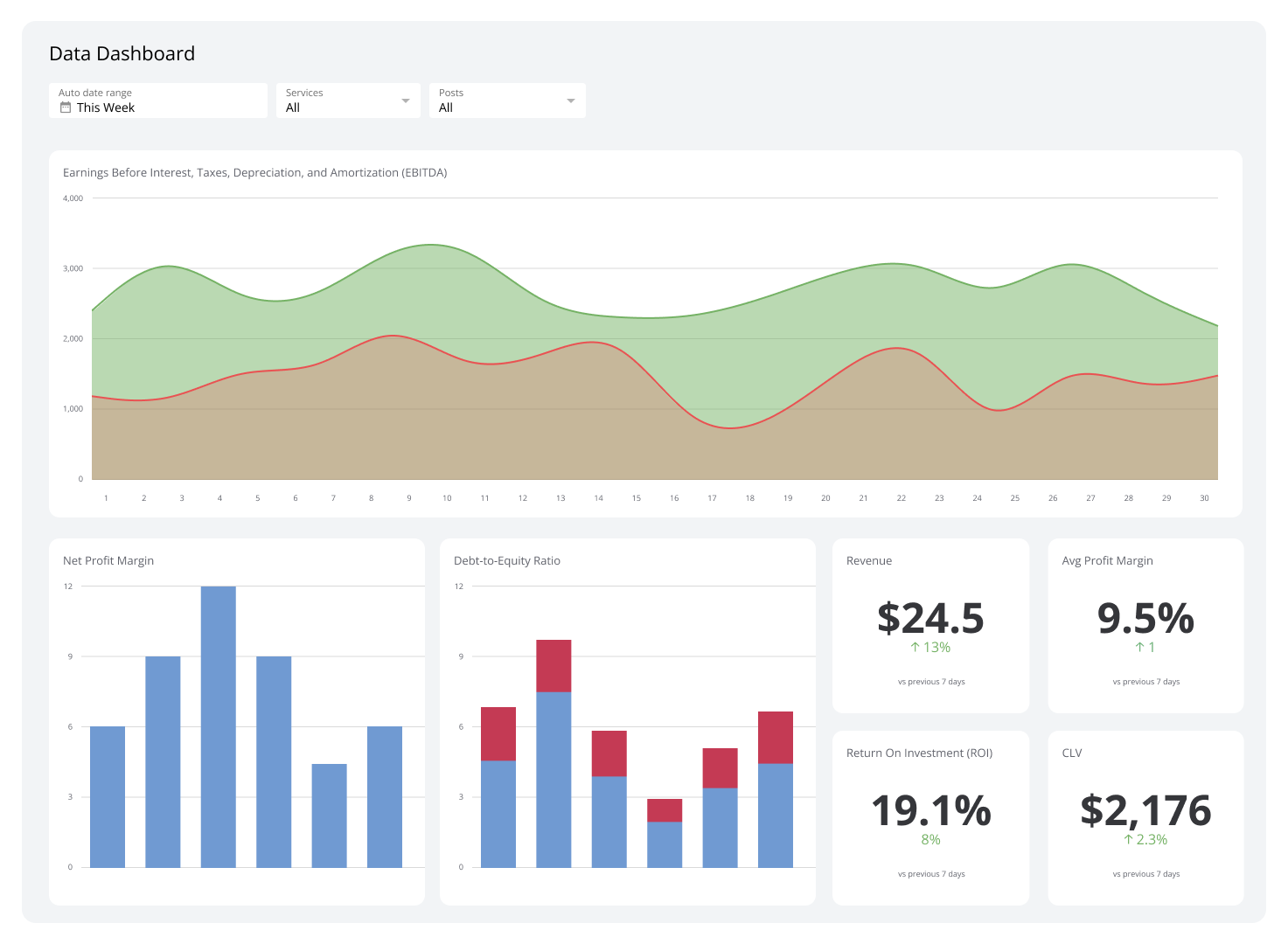

Very simply put, the ratio measures the difference between the money you spend acquiring a new customer (for most companies, this will be their sales and marketing budgets) and the amount of money a customer brings in over the entire time they do business with you.

This is a particularly crucial measure in a company like ours, which sells a subscription service. Because customers generally don’t stay forever, we are always looking for new customers.

In that respect, we are very much like a mobile phone company that signs customers up on a contract or a newspaper that gets people to subscribe to get the paper delivered for a set period of time.

If we spend too much money chasing customers, it affects our bottom line. If we spend too little, we’re missing out on opportunities.

So how do you know if you’re spending the right amount?

You need some numbers.

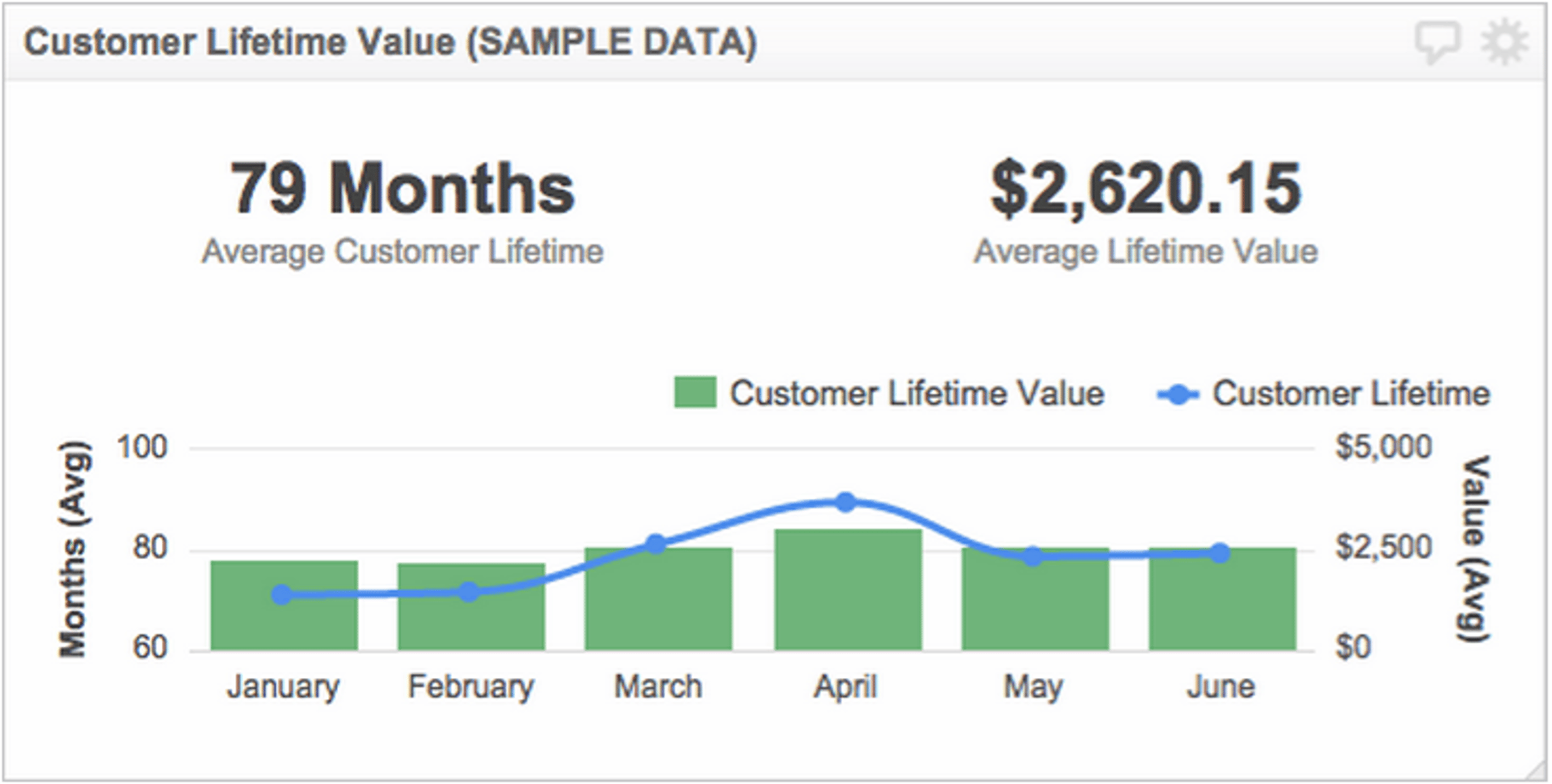

First, you need to know how long the average customer sticks with you before they cancel their service. Because, of course, the longer a customer sticks with you, the more valuable they are.

Start by looking at your churn rate – the number of people who cancel their subscription in any given month.

If you have 1,000 customers and every month 20 of them cancel, that works out to two percent monthly churn. By simply inverting this value ( 1 / Monthly Churn ), you can calculate how many months on average, your customers will stick around. At a 2% monthly churn, that works out to 50 months.

You will also need to know your Gross Margin % (the percentage of profit that remains after you have paid your costs for the product or service) and then how much money the average customer brings in each month.

Lifetime Value = Gross Margin % X ( 1 / Monthly Churn ) X Avg. Monthly Subscription Revenue per Customer

So, for example, if you had a gross margin of 75% and monthly customer churn of 2%, and each customer spent an average of $40 with you every month, the calculation would look like this:

75% X ( 1 / 2% ) X $40 = $1,500 LTV

Add this Klip to your Dashboard

Now that you have the lifetime value of a customer, you can turn your attention to calculating how much you spend acquiring a customer.

That’s usually the sales and marketing budgets together. The cost of acquiring a customer is the entire sales and marketing budget divided by the number of new customers acquired in a given period. This works really well if your sales cycle is short, where your sales and marketing costs can be tied to new customers in the same period. If it’s longer, you may want to stagger your costs and new customer wins to get a more accurate picture.

Cost to Acquire a Customer = Sales and Marketing Costs / New Customers Won

If you had total monthly sales and marketing expenses of $500K and you acquired 500 new customers in a given month, the calculation would look like this:

$500,000 / 500 = $1,000 CAC

Add this Klip to your Dashboard

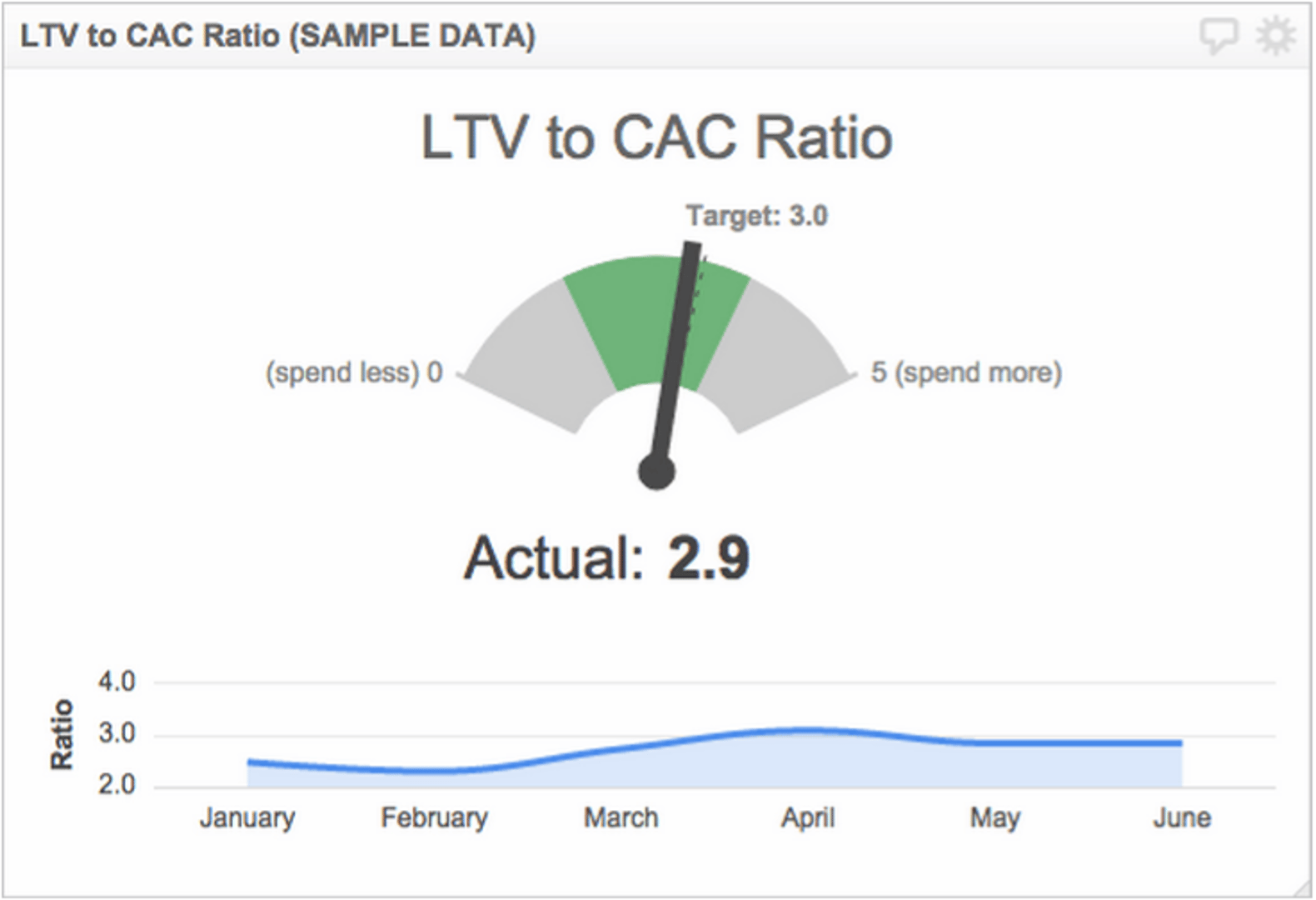

Ideally, you want to recover the cost of acquiring a customer within the first 12 months or so. In other words, if the average customer brings you $1,500 over 50 months, you should be spending about $360 to acquire customers.

To bring it back to acronyms and ratios, an ideal LTV:CAC ratio should be 3:1. The value of a customer should be three times more than the cost of acquiring them. If the ratio is close, i.e. 1:1, you are spending too much. If it’s 5:1, you are spending too little. In fact, you are probably missing out on business.

It sounds straightforward, and it is. But the fact remains you need to know these numbers. Because the more you understand what drives your business, the better the picture you will get of the levers you can pull to grow your business.

Allan Wille is a Co-Founder and Chief Innovation Officer of Klipfolio. He’s also a designer, a cyclist, a father, and a resolute optimist.