Become a better CFO with these three metrics

Published 2024-02-16

Summary - If you want to become a better CFO, use the following metrics to help tell a story.

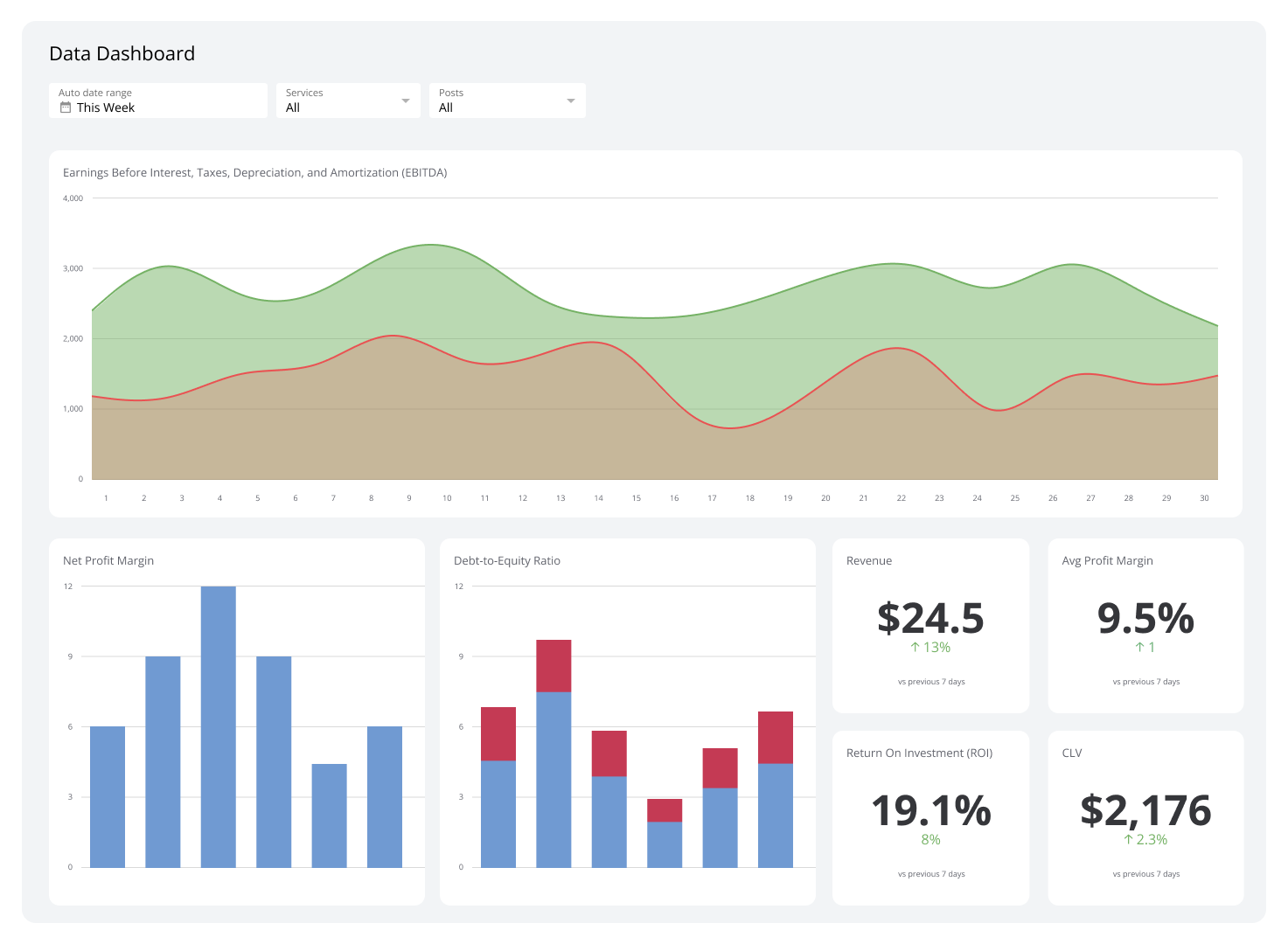

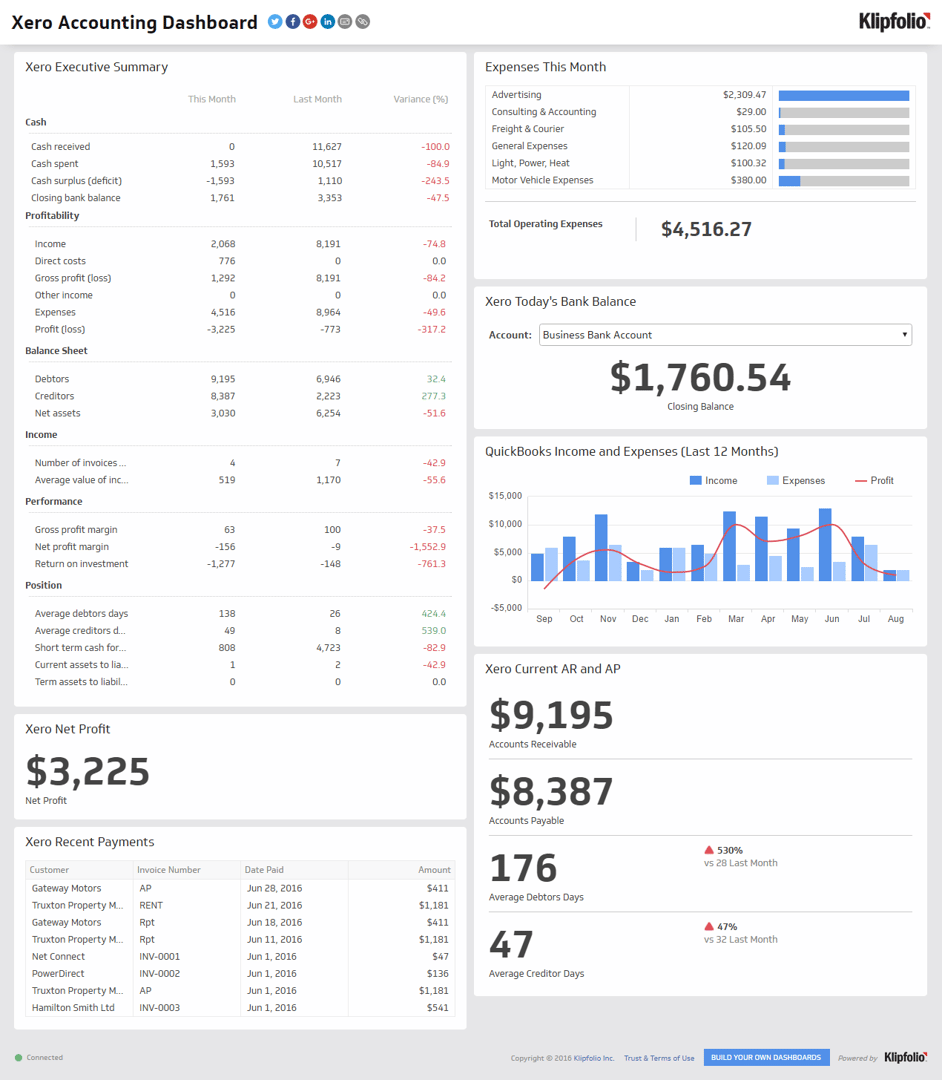

As a CFO, you’re probably very familiar with the popular accounting software programs that are out there and the metrics they provide. Typically, those metrics can offer helpful ratios, but in order to deliver a higher level of value to your company, you want to focus on the metrics you have the ability to influence, particularly when it comes to the financial health of the company.

If you want to become a better CFO, use the following metrics to help tell a story. Where is the company now and where is it going? What is our current cash position, future cash position, and pipeline?

1. Money in the Bank

How much money does your company need to have in the bank? We recommend that companies maintain 10 - 30% of their annualized revenue in the bank at all times, no matter what their size. A $3M company, for example, should have about $300K in the bank at any given time. This prevents minor issues from becoming major problems.

The company owner’s risk tolerance will determine where they need to be within that range.

While 10% may be sufficient for one business owner, another may need 15-20%. If, for example, the company’s revenue is heavily concentrated on one client and losing that client could be catastrophic, a higher percentage would be recommended. Risk can be determined by a wide range of factors, i.e. client concentration, the market, equipment needs, etc., so it’s important to determine how that applies to your company specifically.

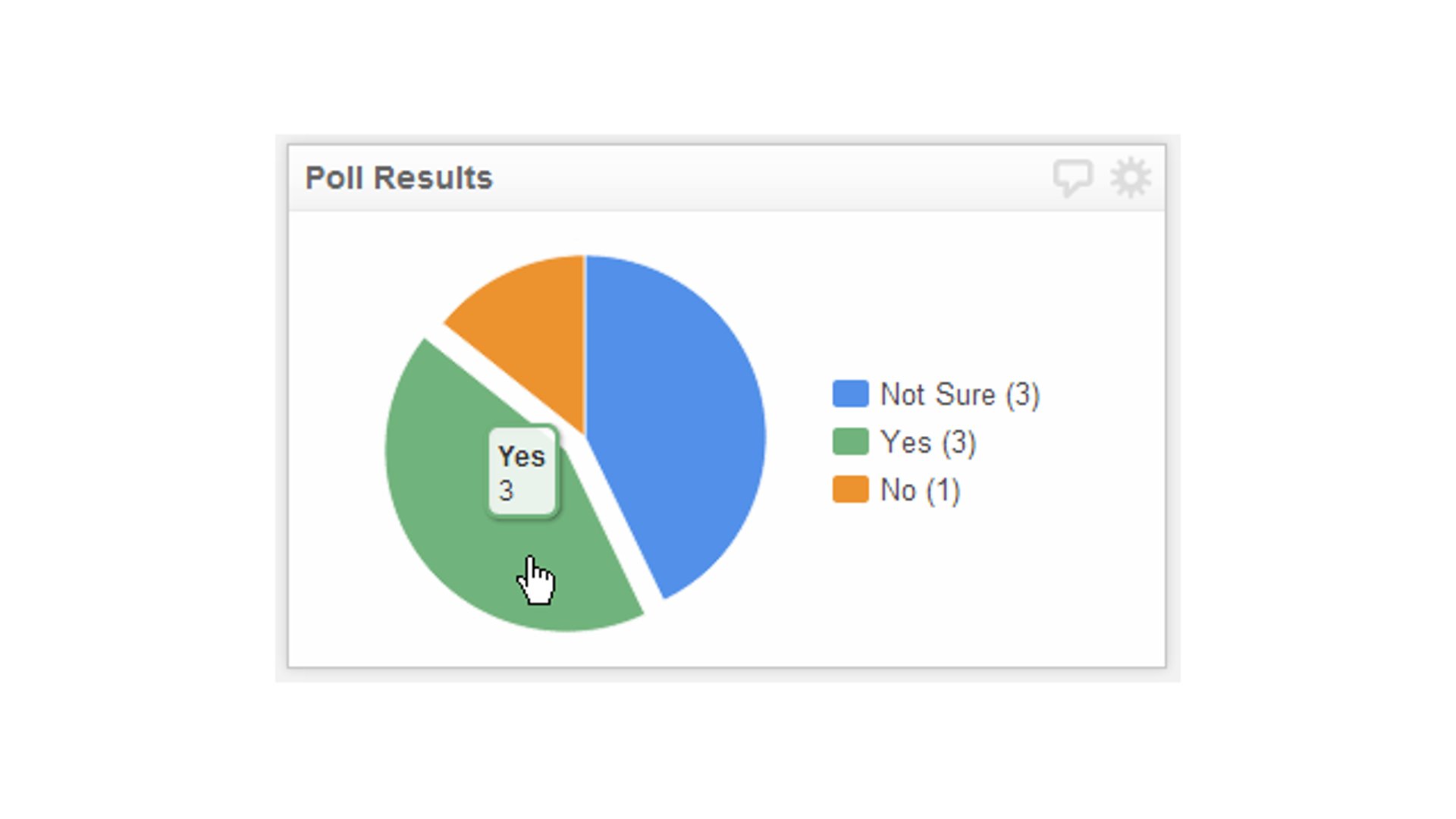

2. Non-Financial Metrics

How do you know where the company is going to be tomorrow and the next day? The key here is to come up with the non-financial metrics that the team can manage and monitor regularly. That means it can’t be revenue based.

If you tell the team you want them to increase the revenue by 10%, they don’t have anything tangible to control. Instead, you have to break it down to the non-financial metrics, i.e. we’re going to build five more widgets each month or we’re going to hire three new full-time employees and they’re each going to bill out $5K per month. With non-financial metrics like this, the team knows exactly what they need to do in order for the company to hit the overall revenue goal.

Non-financial metrics will differ depending on your type of business. For a service-based business, we look at production metrics: utilization, average bill rate, effective rate, and effective cost.

The Utilization Rate is the billable hours that you expect an employee to bill throughout the entire year.

You can calculate the Average Bill Rate by taking your revenue and dividing it by the billable hours.

The Effective Rate is calculated by multiplying the utilization rate and the average bill rate.

To calculate Effective Cost, take the producer’s salary and add their burden cost, which is typically about 25%. Then divide the total by the 2080 hours, which represents a 40-hour workweek, and that gives you the effective cost per hour for each employee.

3. Pipeline

Do you we have enough business in the pipeline to sustain both the current and future cash position? Even if your business is doing great, you’ve got cash in the bank, and your net income is impressive, you could be headed for trouble if you don’t have enough in the pipeline.

To determine your pipeline metrics, you want to look at your contract overcapacity. The contract is what you currently have locked in�—your recurring revenue and any additional unbilled invoices you have out there. Divide that by what your team can actually produce and compare this to your trend over the last 3 months. If you typically pick up 15% and you’re at 85% capacity over the next 3 months, you’re in good shape. If you’re at 65%, then you’re not on track to hit your revenue goals.

Once you have a solid forecast in place, you can take the capacity of your team and adjust it based on the pipeline. Is the pipeline too heavy, too light, or is it just right? You may need to change your forecast based on that. Your forecast isn’t just revenue but your cash position at the end of a specific period of time – 3 months, 6 months, 12 months. You need to be able to predict that in order to manage the company well.

These are the metrics we focus on with our clients as they are the most important metrics for business owners to understand. The exact metrics you use will vary depending on the industry, but every business has a version of these metrics that you can help the owner focus on. Ultimately, you want to identify the key metrics specific to your company that will enable it to scale and achieve success. This goes beyond the standard financial reports that can be generated through any accounting software program.

These metrics can be used to tell business owners a story – where the company is now and where it’s going. When you help business owners fully understand these metrics, it helps them to make strategic decisions for the company, i.e. when it’s time to hire a new employee or invest in new equipment. It also helps them sleep better at night, and that is what makes you an invaluable member of the team.

For more on these metrics, download our free Forecasting with Metrics Guide.

ABOUT SUMMIT CPA:

Summit CPA is a distributed accounting firm with a non-traditional approach to accounting. We have an amazing team of CPAs and accountants who provide professional Virtual CFO Services and 401(k) Audits for companies all over the United States—many of which are remote companies as well. We also recently launched a CPA Firm Augmentation service, coaching other CPA Firms on how to successfully provide Virtual CFO services. We fully understand the accounting, bookkeeping, cash flow management, and business tax nuances that come with being distributed, and we love helping our clients overcome these challenges through our own experience and expertise.